Dynamic Airline Slot Exchange during Ground Delay Programs Thomas Vossen

advertisement

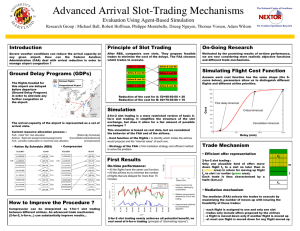

Dynamic Airline Slot Exchange during Ground Delay Programs Thomas Vossen, University of Colorado, Boulder Michael Ball, Philippe Montebello University of Maryland, College Park Ground Delay Programs: Motivation: airline schedules “assume” good weather SFO: Scheduled Arrivals 18 Number of Arrivals 16 VMC airport acceptance rate 14 12 10 8 IMC airport acceptance rate 6 4 2 0 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Ground Delay Programs delayed departures delayed departures delayed arrivals/ no airborne holding delayed departures GDPs under CDM Resource Allocation Process: • FAA: initial “fair” slot allocation [Ration-by-schedule] • Airlines: flight-slot assignments/reassignments [Cancellations and substitutions] • FAA: periodic reallocation to maximize slot utilization [Compression] Compression Example Slot released by canceled/ 4:05 delayed flight 4:05 4:20 USA 51 UAL 234 USA 345 4:50 AAL 672 4:50 AAL 672 5:10 AAL 95 5:10 AAL 95 Earliest time of arrival = 4:20 Slot Exchange Alternatives • Compression as Reallocation – Dynamic changes to airline “demand profiles” necessitate (re)rationing • Compression as Slot Trading – e.g., Slot Credit Substitutions: “I am willing to cancel flight f1 if I can move up flight f2”. Slot Trading Opportunities 160 40 140 35 Cum. cnx (% of flts in gdp) Cum. Subs (% of flts in gdp) Airline Substitution/Cancellation Patterns 120 100 80 60 40 20 0 1 75 149 223 297 371 445 519 593 667 741 815 Cumulative minutes (from start of program) 30 25 20 15 10 5 0 1 51 101 151 201 251 301 351 401 451 501 551 601 651 701 751 Cum ulative m inutes (from start of program ) Consider potential benefits of extending slot trading framework – e.g., Increase offers submitted by airlines From 1-for-1 to 2-for-2 trades • Compression and/or slot credit substitution can be interpreted as a 1-for-1 trading system, i.e. offers involve giving up one slot and getting one in return (many offers are processed simultaneously) • What about k-for-k or k-for-n offers, e.g. 2-for-2: Trade?? Value proposition for compression & SCS Value(slot) = $0 unusable because of cancellation or flight delay usable slot Value(slot) > $0 SCS/Compression “trades” are always driven by the exchange of a slot with value 0 and a slot with value > 0!! 2-for-2 trades enable airlines to profit by exchanging pairs of usable slots that result in an increase in overall value to the carrier. Airline B Airline A B20 (low priority) A25 (high priority) s3 s1 s2 A10 (low priority) s4 B35 (high priority) A’s value proposition: valA(s3) – valA(s1) + valA(s4) – valA(s2) = 2000 - 1500 + 300 - 500 = $300 B’s value proposition: valB(s1) – valB(s3) + valB(s2) – valB(s4) = 500 - 800 + 2500 - 1800 = $400 Another view of 2-for-2 trading: generalized substitutions Normal Substitution Generalized Substitution Issues • System Design: – How do airlines represent and generate offers? – Formulation and solution of FAA mediation problem • System Evaluation: – Airline objectives and strategies – Performance Measurement: • comparison with optimal centralized solution (system efficiency) % improvement 30 25 20 15 %Improvement Compression Benefits 2-for-2 Trading Model • • compression executed after flts with excessive delay (>2hrs) are canceled Global Max. 35 10 5 5 0 0 GDP bo s0 106 -0 1 bo s0 115 -0 1 bo s0 119 -0 bo 1 s0 130 -0 1 bo s0 208 -0 1 bo s0 214 -0 bo 1 s0 221 -0 1 bo s0 226 -0 1 bo s0 310 -0 bo 1 s0 313 -0 1 bo s0 321 -0 1 bo s0 323 -0 bo 1 s0 330 -0 1 bo s0 408 -0 1 bo s0 418 -0 1 bo s0 106 -0 1 bo s0 115 -0 1 bo s0 119 -0 1 bo s0 130 -0 1 bo s0 208 -0 1 bo s0 214 -0 1 bo s0 221 -0 1 bo s0 226 -0 1 bo s0 310 -0 1 bo s0 313 -0 1 bo s0 321 -0 1 bo s0 323 -0 1 bo s0 330 -0 1 bo s0 408 -0 1 bo s0 418 -0 1 Initial Results • Airline Objective: On-time Performance proposed offers: all at-least, atmost pairs that improve on-time performance Compression Global Max GDP Trading Model 40 40 35 30 25 20 15 10 Initial Results • Airline Objectives: Passenger Delay Costs Objective Function 1 Objective Function 2 • • Imposed “Staircase” structure 80 70 70 60 60 % Im p ro v em e n t 80 50 40 30 50 40 30 20 20 10 10 0 0 1/ 6/ 20 0 1/ 13 1 /2 00 1/ 20 1 /2 00 1/ 27 1 /2 00 1 2/ 3/ 20 0 2/ 10 1 /2 00 2/ 17 1 /2 00 2/ 24 1 /2 00 1 3/ 3/ 20 0 3/ 10 1 /2 00 3/ 17 1 /2 00 3/ 24 1 /2 00 3/ 31 1 /2 00 1 4/ 7/ 20 0 4/ 14 1 /2 00 4/ 21 1 /2 00 1 % Im p ro v e m e n t “Standard” Passenger Delays GDP 0 1 0 0 1 0 0 1 0 0 1 00 1 0 0 1 0 0 1 0 0 1 00 1 0 0 1 0 0 1 0 0 1 0 0 1 00 1 0 0 1 0 0 1 20 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 /2 6/ 1 0 /1 7 /2 4 1 7 /2 4 3 /3 1 3 /2 0 /2 7 2 /3 /1 0 3 1 4 /7 /1 4 21 1/ 3/ 2 2/ 2 1 1/ 3 3 1 3/ 4 4/ GDP Towards a practical system: offer structure high priority flights “move up” range low priority flights current position “move down” range current position Offers: • Airlines willing to accept high priority moves up in exchange for low priority moves down Data Requirements: • 1 new data item per flight -- LET: latest exchange time Towards a practical system: mediation problem • IP formulation that assigns flights to slots in a manner consistent with offers – Allows airlines to express relative per unit value of upmoves vs down-moves • Objective Function – Efficiency: maximize total distance or number of up moves – Equity: aims to distribute benefits in proportion to offers submitted Towards a Practical System: Airline Cost Function for Simulation 3.5 cancellation cost x 10 4 3 2.5 2 1.5 1 0.5 0 0 20 40 60 80 100 120 Time (delay) 140 160 180 2 to 3 hrs Towards a Practical System: Initial Results Objective: • • Maximize total distance of Up moves Maximize total distance of Up moves + sum of equity components 80% 60% 70% % Improvement 70% 50% 40% 30% 20% 60% 50% 40% 30% 20% 10% 0% 0% 0 00 01 00 00 00 00 00 -0 00 00 00 00 01 0 0 01 1- 09- 21- -03 - -21 - 21- 17- 21- 04- 21- -2 1 21- 29- 04- 031 6 6 1 6 11 6 6 1 11 1 6 1 6 -0 -0 -0 -0 -0 -0 K -0 A-0 A-0 P-0 L-0 A-0 O-0 L-0 -0 G OS OS W R W R AD AH S F H T F E V G G J I I P S M S S L B L B E E C GDP Compression VG -0 BO 1-1 S- 1-0 0 BO 1-0 0 S- 9-0 EW 06- 1 2 R 1-0 EW 01 - 0 03 R -0 -00 6 IA D 21 -0 6- 00 IA 21 H -0 -00 1 JF -1 7 K -0 -0 LG 6 -2 1 A- 1-0 0 LG 1-0 0 A- 4-0 0 M 6-2 0 S P- 1-0 0 0 PH 6-2 1L00 SE 06A- 210 0 SF 1-2 0 9O 01 -0 ST 1 -0 4 L01 -00 -0 300 10% C % Improvement Objective: GDP Trading Model Summary and Conclusions • Results illustrate potential benefits of slot trading framework • Trading benefits may be limited by carriers which operate smaller aircraft – Introducing side payments may “induce” small carriers to accept delays • Results depend significantly on airline bid generation strategies. – Best airline approach depends on internal schedule and cost structure, attitude toward risk and strategy of competitors. – Competitive simulations currently being constructed.