2009 Transaction Highlights Corporate Practice

advertisement

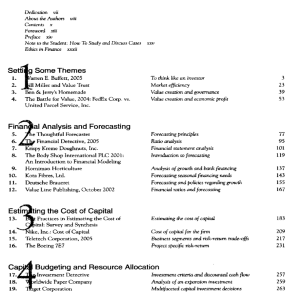

Corporate Practice 2009 Transaction Highlights Global legal counsel in 36 cities on three continents. United States Europe Anchorage, Austin, Boston, Charlotte, Chicago, Dallas, Berlin, Frankfurt, London, Moscow, Paris, Warsaw Fort Worth, Harrisburg, Los Angeles, Miami, Newark, New York, Orange County, Palo Alto, Pittsburgh, Portland, Raleigh, Research Triangle Park, San Diego, San Francisco, Middle East Dubai Seattle, Spokane/Coeur d’Alene, Washington, D.C. Asia Beijing, Hong Kong, Shanghai, Singapore, Taipei, Tokyo Corporate Practice 2009 Transaction Highlights The Corporate practice at K&L Gates, composed of 500 lawyers, provides fullservice corporate counsel to facilitate the structuring, financing and successful completion of acquisitions, divestitures, mergers, joint ventures/strategic alliances and recapitalizations, and public and private debt and equity offerings. We serve as counsel to publicly traded companies, privately held and venture-backed companies, partnerships, private equity firms and other investment funds, management groups and entrepreneurs. Our lawyers in the United States, Europe, Asia, and the Middle East are highly experienced in cross-border M&A, securities, regulatory and financing transactions and maintain a balance between company side and capital markets clients in virtually every industry. K&L Gates 2009 Corporate Practice Transaction Highlights Mergers & Acquisitions The Barbarian Group Merger with Cheil Worldwide Carousel Capital Partners and AGDATA, LP Beam Global Spirits & Wine, Inc. Dissolution of a four-way joint venture and formation of a two-way strategic alliance Carrier Commercial Refrigeration, Inc. Betfair Group Limited (UK) Acquisition of ODS Technologies Ahnu, Inc. Artificial Life, Inc. Acquisition by Deckers Outdoor Corporation Strategic alliance with 3M Company Bridgewater Savings Bank Merger with East Bridgewater Savings Bank Carousel Capital Partners Acquisition of COPAC, Inc. Conesys, Inc. Continental AG Covance Inc. Sale of Jerrick, Inc. subsidiary to Carlisle Companies Incorporated Sale of global public transit solutions business Sale of Interactive Voice & Web Response Services business EPCOR Power L.P. EPCOR Utilities Inc. Halliburton Company Acquisition of Merrimac Industries, Inc. Sale of EPCOR Power (Castleton) LLC Transfer of power generation assets and operations to Capital Power Fuqing Guanwei Plastic Industry Co. Ltd. Halliburton Company Jettainer GmbH JMP Group, Inc. Acquisition of Wellbore Energy Solutions, Inc. Acquisition of own shares from Trenstar Inc. Acquisition of Cratos Capital Partners, Inc. Lance, Inc. Liberty Tire Services Liberty Tire Services Liberty Tire Services Acquisition of certain assets of Stella D’oro Biscuit Co., Inc. Acquisition of Utah Tire Recyclers, Inc. Acquisition of Ridge Recyclers Incorporated Acquisition of Florida Tire Recycling, Inc. Acquisition of certain assets from Merck subsidiary Rosetta Inpharmatics LLC Microsoft Corporation Novozymes Biologicals, Inc. The Odom Corporation The Odom Corporation Otis Elevator Company Joint venture with Southern Wine & Spirits of America Acquisition of Lonsdale Elevator, Inc. Sale of equity interests in MedData Health, LLC Sale of certain assets of the Tyler Refrigeration Division Crane Co. Acquisition of Interactive Supercomputing, Inc. Sale of turf and landscapes applications business Purchase of certain Alaska Distributors Co. beer, wine and spirits distribution businesses Reverse takeover of MD Holdings Corp. John Wagner Associates, Inc. Split-off and corporate reorganization Acquisition of DeepBlue Technologies, LLC LKQ Corporation Acquisition of Greenleaf Auto Recyclers, LLC Microsoft Corporation K&L Gates 2009 Corporate Practice Transaction Highlights Par Pharmaceutical, Inc. PA SportsTicker, Inc. Acquisition of the worldwide ® rights of Nascobal Nasal Spray Sale of all of the issued and outstanding capital stock of PA SportsTicker, Inc. Residential Credit Solutions The Robinson Media Group Joint venture with FDIC with respect to Franklin Bank Assets Acquisition of 11 Connecticut School of Broadcasting locations Unanimis Holdings Limited Unify Corporation Sale to France Telecom/ Orange Mobile Acquisition of AXS-One, Inc. Pike Electric Corp. Acquisition of assets from Facilities Planning & Siting, PLLC Rotunda Corporation Sale of Dutch subsidiary EzGov, B.V., including EzGov UK, Ltd. United Rentals (North America), Inc. Acquisition of Leasco Equipment Services, Inc. Senior secured loan to Hibernia Atlantic U.S. LLC ConnectEDU, Inc. Series C preferred stock financing BIA Digital Partners II LP Acquisition of Principle Capital Investment Trust plc Salem Press Inc. Acquisition of EBSCO Publishing XMLaw, Inc. Sale to Thomson Reuters (Legal) Inc. ProEquine Group, Inc. Acquisition of RHE Hatco, Inc. Sterling Partners Purchase of controlling interest in School of Rock LLC YGM Trading Limited Acquisition of Asian intellectual property rights for the Aquascutum brand Aqua Resources Fund Limited Private Equity, Venture Capital, and Other Non-Public Financings BIA Digital Partners SBIC II LP Principle Capital Holdings S.A. Aqua Resources Fund Limited Purchase of Series C convertible preferred shares in China Hydroelectric Corporation BIA Digital Partners II LP Mezzanine financing of Cross MediaWorks, Inc. Secured note and warrant financing of Manifest Solutions, LLC Essex Woodlands Health Ventures Essex Woodlands Health Ventures Series D convertible preferred stock financing of Entellus Series A preferred stock financing of Victory Pharma, Inc. Bridge Semiconductor Corporation Convertible note bridge financings Banc of America Strategic Investments Corporation Investment in Invenergy Wind LLC Cognitive Match Ltd Series A preferred stock financing Halosource, Inc. HomePipe Networks, Inc. Series D preferred stock financing Convertible note financing K&L Gates 2009 Corporate Practice Transaction Highlights ITA Partners, Inc. Series A-2 common stock offering MediQuest Therapeutics, Inc. Series B preferred stock financing Pharmaca Integrative Pharmacy Series G preferred stock financing Plexus Fund I, L.P. JSK Therapeutics, Inc. Convertible note and warrant seed financing Navigation Capital Partners Recapitalization of Quantapoint, Inc. KBI Biopharma, Inc. Series B preferred stock financing New Leaf Paper Co. Series A preferred stock financing PitchBook Data Inc. Plexus Fund I, L.P. Series A preferred stock financing Investment in Saf-T-Net, Inc. Sabey Data Centers LLC Schedulicity, Inc. Investment in Web Products, Inc. Formation and financing of LLC for operating data centers Series A preferred stock financing TRA Global, Inc. Telecom Transport Management, Inc. TaiGen Biopharmaceuticals Holdings Limited Series B preferred stock financing Series B-1 preferred stock financing Triangle Capital Corporation Triangle Capital Corporation Investment in NewZoom, Inc. Investment in Cecilware Series C preferred stock financing Washington Research Foundation Investment in Series B preferred stock of MicroGREEN Polymers, Inc. Laird Norton Company LLC Investment in Class A Units of American Education Group LLC Matrix Corporate Capital LLP Secondary fundraising by Patagonia Gold plc, acted for broker Pacific Bioscience Laboratories, Inc. Pharmaca Integrative Pharmacy Private placement Series F-4 preferred stock financing Plexus Fund I, L.P. Plexus Fund I, L.P. Investment in QualaWash Holdings LLC Investment in MPD Chemicals, LLC/Silar Labs Sittercity, Inc. Series A preferred stock follow-on financing Triangle Capital Corporation Thomas Raymond & Co. Seed financing Triangle Capital Corporation Triangle Mezzanine Fund, LLP investment in Frozen Specialties, Inc. Investment in Technology Crops, LLC Zones, Inc. ZST Digital Networks, Inc. Convertible note financing Private placement K&L Gates 2009 Corporate Practice Transaction Highlights Public Offerings, PIPEs, and Other Institutional Financings Allegheny Energy Supply Company LLC Rule 144A offering Allegheny Technologies Incorporated Public offerings of senior notes and convertible notes and cash tender offer for notes BNP Paribas Securities Corp. Amherst Securities Group Arch Coal, Inc. Array Networks, Inc. Multiple Fannie Mae mortgagebacked securities offerings Follow-on public offering and Rule 144A offering Admission to Taiwan Emerging Stock Market Various Ginnie Mae reverse mortgage REMIC securities offerings Boise Inc. Capital Power Corporation Chimera Investment Corporation Chimera Investment Corporation Rule 144A offering Follow-on public offerings Rule 144A offerings Follow-on public offering of common stock PT Delta Dunia Makmur Tbk Education Management Corporation Secondary public offering Coca-Cola Bottling Co. Consolidated Underwritten offer and sale of 7% senior notes CT Holdings (International) Limited Acting for the sponsor, Optima Capital Limited, on admission to the Hong Kong Stock Exchange Education Management Corporation Flow International Corporation Initial public offering Follow-on public offering ICBC International Capital Ltd. Modern Media Holdings Limited Initial public offering of Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Limited, acting for the global coordinators, sponsors, and the underwriters Initial public offering, acted for sponsor, ICBC International Capital Ltd. DARA BioSciences, Inc. Registered direct offerings Bank of America Sale of 3,580,000,000 ordinary shares Hecla Mining Company Hecla Mining Company Follow-on public offering Common stock PIPE New Enterprise Associates PT Bukit Makmur Mandiri Utama Common stock PIPE 11.75% guaranteed senior notes Multiple Fannie Mae, Freddie Mac and Ginnie Mae mortgage-backed securities offerings China-Biotics, Inc. Cash tender offer for senior subordinated notes Horizon Securities Acting for the lead manager to Cowealth Medical’s admission to Taiwan Emerging Stock Market Seaspan, Inc. Represented Dennis Washington interests in $200 million Series A preferred stock issuance For more information on the Corporate Practice 2009 Transaction Highlights, please contact: Christopher M. Carletti +1.206.370.8314 chris.carletti@klgates.com D. Mark McMillan +1.312.807.4383 mark.mcmillan@klgates.com Martin Lane +44.20.7360.8117 martin.lane@klgates.com Robert P. Zinn +1.212.536.4887 +1.412.355.8687 robert.zinn@klgates.com Anchorage Los Angeles San Diego Austin Miami Beijing Berlin Moscow San Francisco Boston Newark Seattle Charlotte New York Shanghai Chicago Dallas Orange County Singapore Dubai Palo Alto Fort Worth Paris Spokane/Coeur d’Alene Frankfurt Pittsburgh Taipei Tokyo Harrisburg Portland Raleigh Hong Kong London Research Triangle Park Warsaw Washington, D.C. K&L Gates is comprised of multiple affiliated entities: a limited liability partnership with the full name K&L Gates LLP qualified in Delaware and maintaining offices throughout the United States, in Berlin and Frankfurt, Germany, in Beijing (K&L Gates LLP Beijing Representative Office), in Dubai, U.A.E., in Shanghai (K&L Gates LLP Shanghai Representative Office), in Tokyo, and in Singapore; a limited liability partnership (also named K&L Gates LLP) incorporated in England and maintaining offices in London and Paris; a Taiwan general partnership (K&L Gates) maintaining an office in Taipei; a Hong Kong general partnership (K&L Gates, Solicitors) maintaining an office in Hong Kong; a Polish limited partnership (K&L Gates Jamka sp.k.) maintaining an office in Warsaw; and a Delaware limited liability company (K&L Gates Holdings, LLC) maintaining an office in Moscow. K&L Gates maintains appropriate registrations in the jurisdictions in which its offices are located. A list of the partners or members in each entity is available for inspection at any K&L Gates office. This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. ©2010 K&L Gates LLP. All Rights Reserved. 91110_3443 K&L Gates includes lawyers practicing out of 36 offices located in North America, Europe, Asia and the Middle East, and represents numerous GLOBAL 500, FORTUNE 100, and FTSE 100 corporations, in addition to growth and middle market companies, entrepreneurs, capital market participants and public sector entities. For more information, visit www.klgates.com.