MEMORANDUM

advertisement

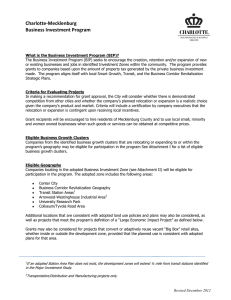

MEMORANDUM TO: Kelly Setzer, Corporate Communications FROM: Brad Richardson, Economic Development Manager DATE: September 26, 2013 RE: Business Investment Program Report (FY12 & FY13) The Business Investment Program was created in 1998 in partnership with Mecklenburg County to encourage the creation, retention and/or expansion of new or existing businesses and jobs in identified investment zones within the community. The program provides grants, paid over multiple years, based upon the amount of new property tax generated by the business. Businesses are required to meet and maintain thresholds for capital investment, new jobs and wages throughout the term of the grant. BIP grants are often used to provide a match to State incentives. Council policy includes provisions that no payments will be made unless investment and hiring targets are met, as well as provisions that obligate a business to repay a portion of the grant if it removes its investment from Charlotte within a certain period of time after the end of the grant term. As illustrated in the attached Activity Report, the City has approved fifty (50) BIP grants since the program began. Of these, twenty-seven (27) are currently active; eight (8) are complete; and fifteen (15) have been withdrawn for non-compliance. Please find attached the following two documents: 1) Activity Report, highlighting payments made in F12 and FY13. 2) BIP Policy (updated December, 2012). Please contact me if you have additional questions at 704-336-3857. Working to make Charlotte neighborhoods and businesses healthy and vibrant 600 E. Trade Street • Charlotte, NC • 28202• 704-336-3380 www.CharlotteNC.gov Charlotte-Mecklenburg Business Investment Program What is the Business Investment Program (BIP)? The Business Investment Program (BIP) seeks to encourage the creation, retention and/or expansion of new or existing businesses and jobs in identified Investment Zones within the community. The program provides grants to companies based upon the amount of property tax generated by the private business investment made. The program aligns itself with local Smart Growth, Transit, and the Business Corridor Revitalization Strategic Plans. Criteria for Evaluating Projects In making a recommendation for grant approval, the City will consider whether there is demonstrated competition from other cities and whether the company’s planned relocation or expansion is a realistic choice given the company’s product and market. Criteria will include a certification by company executives that the relocation or expansion is contingent upon receiving local incentives. Grant recipients will be encouraged to hire residents of Mecklenburg County and to use local small, minority and women owned businesses when such goods or services can be obtained at competitive prices. Eligible Business Growth Clusters Companies from the identified business growth clusters that are relocating or expanding to or within the program’s geography may be eligible for participation in the program See Attachment I for a list of eligible business growth clusters. Eligible Geography Companies locating in the adopted Business Investment Zone (see Attachment II) will be eligible for participation in the program. The adopted zone includes the following areas: Center City Business Corridor Revitalization Geography Transit Station Areas1 Arrowood-Westinghouse Industrial Area2 University Research Park Coliseum/Tyvola Road Area Additional locations that are consistent with adopted land use policies and plans may also be considered, as well as projects that meet the program’s definition of a “Large Economic Impact Project” as defined below. Grants may also be considered for projects that convert or adaptively reuse vacant “Big Box” retail sites, whether inside or outside the development zone, provided that the planned use is consistent with adopted plans for that area. 1 If an adopted Station Area Plan does not exist, the development zones will extend ¼ mile from transit stations identified in the Major Investment Study. 2 Transportation/Distribution and Manufacturing projects only. Revised December 2012 Charlotte-Mecklenburg Business Investment Program Program Guidelines and Requirements Investment $3 million Investment is broadly defined as improvements to land and/or buildings, or the purchase or lease of new equipment, or buildings constructed for the qualifying company. Where circumstances warrant, however, Grant calculations may give consideration to the value of leasehold improvements in existing buildings when it can be reasonably demonstrated that the lease will cause additional investment to replace the leased space, or that the lease results in a higher value for the building. Job Creation 20 new jobs; however, manufacturers creating less than 20 new jobs, but at least 10 may be considered for the program with a minimum investment of $6 million within the Investment Zone. Wage Rate Grant recipients must pay an average wage rate for all employees at the investment site equal to or greater than 100% of the average annual wage rate for the Charlotte-Gastonia-Rock Hill M.S.A. Should the projected annual average wage rate be less than the M.S.A. average, the City and County may consider the industry-specific annual average wage rate in making a determination regarding eligibility. The required average annual wage rate may be lowered by up to 20% for those companies that pledge to employ Work First participants and/or residents of the development zone itself in 25% or more of the new job positions. Terms and Amounts Grants last for three years and are based upon 90% of new property taxes generated by the investment. Existing businesses within Mecklenburg County are eligible for an additional two year term. Clawback Provisions Required investment and employment standards will be set forth in a contractual agreement between the City, County and Grantee. These standards must be maintained throughout the term of the Grant in order for payments to continue. Failure to maintain these levels during the Grant term will result in suspension of Grant payments until such time as the levels are once again met and maintained. Grant recipients that relocate outside of Charlotte during the term of the Grant – or within 3 years after receipt of the final Grant installment – will be required to repay a proportional amount of the Grant. 3 All wages are defined by the U.S. Bureau of Labor Statistics Area Occupational Employment and Wage Estimates. 2 Charlotte-Mecklenburg Business Investment Program Large Economic Impact Projects Investment $30 million Investment is broadly defined as improvements to land and/or buildings, or the purchase or lease of new equipment, or buildings constructed for the qualifying company. Where circumstances warrant, however, Grant calculations may give consideration to the value of leasehold improvements in existing buildings when it can be reasonably demonstrated that the lease will cause additional investment to replace the leased space, or that the lease results in a higher value for the building. Job Creation 150 new jobs; however, some projects may create fewer jobs yet more investment, or higher paying jobs with less investment, or a higher number of jobs with lower average wages, etc. For this reason, such projects could still be considered as a “large economic impact” project. Wage Rate Grant recipients must pay an average wage rate for all employees at the investment site equal to or greater than 125% of the average annual wage rate for the Charlotte-Gastonia-Rock Hill M.S.A.3 Should the projected annual average wage rate be less than 125% the M.S.A. average, the City and County may consider the industry-specific annual average wage rate in making a determination regarding eligibility. The required average annual wage rate may be lowered by up to 20% for those companies that pledge to employ Work First participants and/or residents of the development zone itself in 25% or more of the new job positions. Terms and Amounts Grants last for five years and are based upon either 50% or 90% of new property taxes generated by the investment, dependent upon whether the project locates in the investment zone. Existing businesses within Mecklenburg County are eligible for an additional two year term. Clawback Provisions Same provisions as general programs guideline; however, clawback term will be five years instead of three. Major Headquarters Projects Major Headquarters Projects are defined as “a corporate, divisional or regional headquarters of a Fortune 1000 company with an annual average wage that exceeds 200% of the regional average wage3, (currently $89,200). Grants for such projects will be considered on an individual basis. 3 All wages are defined by the U.S. Bureau of Labor Statistics Area Occupational Employment and Wage Estimates. 3 Charlotte-Mecklenburg Business Investment Program ATTACHMENT I ELIGIBLE BUSINESS CLUSTERS Manufacturing o Includes: Automotive/Transportation Equipment Energy Medical Devices Plastics Metalworking Industrial Machinery Defense & National Security Aerospace Consumer Products and Food Processing Research & Development Facilities Headquarters o Includes: Corporate, Divisional & Regional Transportation/Distribution (Logistics) o Includes: Truck transportation Support activities for transportation Warehousing and storage Financial, Insurance & Professional Services o Includes: Financial investment & related activity Credit intermediation & related activity Insurance carriers & related activity Funds, trusts & other financial vehicles Professional & technical services Software development Back Office Operations o Excludes: Law Firms or Accounting Firms, or other professional service companies that predominantly serve the Charlotte region. Emerging Technologies/Industries o Includes: Opto-Electronics Fuel Cells/Alternative Energy Bio-Informatics Film/Video Production Facilities Industries which create synergy with programs of focus at the Charlotte Research Institute or local colleges and universities. 4 ´ Attachment II Rd o John st n -Oe rR d Rd Rd Sta tesville r eek ar C ug WS N I-77 Hwy S I-77 Hwy St n Tr yo N l Fr e dD A Mo rr Rd al Rd or d Co R d Old ve The P laza i gl Se d kR ee Br i a Rd d lR el w as C S Am i ty ar on S Kings Dr Sh N r Qu een sR d ve Dr Rd d R ce la W al re t M ar ga M a r ga r e t W ac No Idlewild Rd e Rd Dr ou th V iew en North Sardis Rd d R ov M atth n de r Rd kw l Rd s hip y Pkw E Mat thews St o St S Tr a de C ar St Rd ce me ew s Tow n hn en Park i wy d le R ng Rea R d Rd City of Charlotte W I-4 85 ne In rH w y ee Mc K P nt ws a as tth e W ed d i evil St Rd Transit Stations: 1/4 Mile Buffer P le d y lk S t Elm Ln ton R S Po Outer Hw h ns Jo E I-485 Ma hn d P v i ll eine t on Jo Business Investment Zone E D ow ns R Pin P d WJ Pr Rd Ol e xa Al d d Rd R n G le e a g l e s w o ll o il H rH ne lk S t e t is as St Sh a r o n R d W e st N Po Nor th rd vd Sa Bl R ce S ha ro R d kS ar y nd on pe ny de o lo In S ha r n Pkw ua on r th ea st E F a i rv i ew Rd Rd e br In Rd r en nfe Co Ln oe P od Rd 85 ns F ord ce a R am e Av yn d d I- 4 Natio ll s e Av o Sc t nS Tr yo S E a st w a y D r Ln W W S e lw R ity M is sion H i a ll South Blvd ne e C re vo O l d S te e l la e Ty or Dr d eA Beatt ies Fo rd Rd SH Rd Edgewood e Boye iel Blv d nc Gr N i er e Rd vill od d r St Litt le Ro ck R d S I-485 Ou ter Hwy Rd o r is We st Am M o nr k Rd on r on y er sR d Rd ar ha d e Cre e St am ah os NH Rd vis Ho N I-485 Inn er Hwy Rd on il s d rR ve Ri Di ar G Id e d e Ln d vd is B l Law Rd SS ym R do en ld wi un n h Al b em arle Rd le t ar r es H n son Ch u r c Q Ste el E Ro bi T W W R E on Mi Dr r d d w i nd s Blvd Neighborhood & Business Services, December 3, 2012 d e Dr rC R E Arrowo EH Ma in St nR Kilbo rn R W est in gh o u se B l vd W ck A rc h dale D r d er re NW C rR dR S Rd Sh la R r rC r te oo Rd ug a Po ro w R iv ES y nd Sa C aro Ar he Rd Ar c hd a le D r W h t N ew r Rd 7t Rd Brown-G rie th nc e pt Tyv o ro vide E W o odlawn Rd w Ha Pro d ho d t cky Ro d H ic k o r y Gr o ve R Rd d mR nR l to S ham h tt A ve odl a w Rd Wo rk B ea wy W ba Pk St o lp d S on Dr d Ave l A ve nd am R d Ave E Gr a h s on w oo Ra St ak 4t h d eO Bill y St P a r k n so Cen t ra ea Blv Kenilw o r th Pin r sD id av eh st d ey r nR al sD nt o Sc D o u g la Rd vd Bl ty d at wy n B elk Fr E or d n ive Ci t Jo h M Ea tR mo nt e xi Un te r ty rs i S E E d D Belk F rwy St R R ek th i nt St 36 N W Jo hn M th E d St S rk wy B lv pi ng Ce n e St t ou n lvd st B Ex 30 M th hea d Yo Pk op Av Dalton Ave 12 kR St W W Wilkinson Blvd F 4t h W are Fr em c e N eel Rd M s e wy W alla y i or r MD S r h N US Hwy 29 Bypass e St Mo re a kw W Rd d gh P Rd ve Av h r ks h ir 5t D wn Br e oo W g r ift in Oa kla W se e Th s h B ir m l any St m yR Jo Rd Al do cka e x gh Av e Sta te sville Sa mW Dr Fr ee Tu Cla op Sh IB Ne Belm eade Dr ke e e ge R d e ee k d pea as y es a Tuc k r wy Hw er In n Ch 5H od D I-8 os hle wd yS We en E is Cr te D r st a Rd T m Ga rd vi n R d ar d G n A t a do A As Do Hw Rd d sR ki n o nw Old -8 5 a ll Ln ki n s R d G le NI el l M rr y s zz Fe re Ro es oo G rove Rd d M Rd el C h ap dy C in E hR Rd Ne Gr iers ch n lv Rd rch u rc bo d Au te n R d lly t Ho C hu Ch Gi b Ci ty n Mo u ek 85 vd h C re I- 4 Bl ac lla rd S re d Pe R e tre Ma Rd B R hur W Br n n ol ly eC P et e h ave Mt H lom d Sa s B lv y hi d Hw a rr i t er H ow ks R T Rd oo Br ll Be et Ou Rd ns W w Rd vi e lvd 85 ake I-4 r ry Su E Rd Fe a ex Rd e lle s k da l zz e L rB nde y Hw y er C r ch d ut W R ille ers v 5O Oa Ro M t Holl y-Hu n t 8 W I- 4 d l oo Hw hu ch r ne yC s RdHucks Rd Relocation Hucks Rd e ll S Od d R E I-4 k 85 e re In erit Ext Metromont Pkwy H u ck d P r o sp Rd nR ge R d hle Rd ks mo R id Ext lla r e ar De H uc Rd Ma y i dg e Loganville Dr Rd ld n er Hw E I-485 Inn Ea ie stf w Bro n R Rd E xt xa A le ra n a Rd de Miles Pro s pe Ham brig ht Rd 1 rity R idge Rd e Old State s v ill d ce R Va n McCoy Rd Business Investment Zone la Rd ins R e cK d M e Rd Ex t y