Proceedings of 7th Asia-Pacific Business Research Conference

advertisement

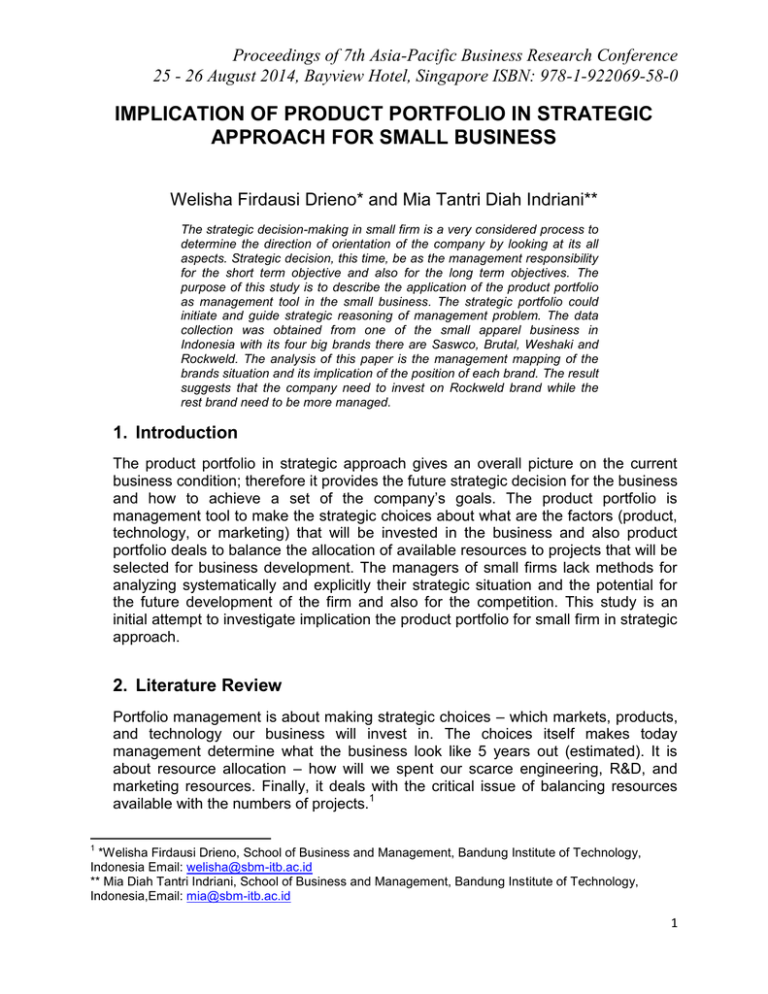

Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 IMPLICATION OF PRODUCT PORTFOLIO IN STRATEGIC APPROACH FOR SMALL BUSINESS Welisha Firdausi Drieno* and Mia Tantri Diah Indriani** The strategic decision-making in small firm is a very considered process to determine the direction of orientation of the company by looking at its all aspects. Strategic decision, this time, be as the management responsibility for the short term objective and also for the long term objectives. The purpose of this study is to describe the application of the product portfolio as management tool in the small business. The strategic portfolio could initiate and guide strategic reasoning of management problem. The data collection was obtained from one of the small apparel business in Indonesia with its four big brands there are Saswco, Brutal, Weshaki and Rockweld. The analysis of this paper is the management mapping of the brands situation and its implication of the position of each brand. The result suggests that the company need to invest on Rockweld brand while the rest brand need to be more managed. 1. Introduction The product portfolio in strategic approach gives an overall picture on the current business condition; therefore it provides the future strategic decision for the business and how to achieve a set of the company’s goals. The product portfolio is management tool to make the strategic choices about what are the factors (product, technology, or marketing) that will be invested in the business and also product portfolio deals to balance the allocation of available resources to projects that will be selected for business development. The managers of small firms lack methods for analyzing systematically and explicitly their strategic situation and the potential for the future development of the firm and also for the competition. This study is an initial attempt to investigate implication the product portfolio for small firm in strategic approach. 2. Literature Review Portfolio management is about making strategic choices – which markets, products, and technology our business will invest in. The choices itself makes today management determine what the business look like 5 years out (estimated). It is about resource allocation – how will we spent our scarce engineering, R&D, and marketing resources. Finally, it deals with the critical issue of balancing resources available with the numbers of projects.1 1 *Welisha Firdausi Drieno, School of Business and Management, Bandung Institute of Technology, Indonesia Email: welisha@sbm-itb.ac.id ** Mia Diah Tantri Indriani, School of Business and Management, Bandung Institute of Technology, Indonesia,Email: mia@sbm-itb.ac.id 1 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 There are many of product portfolio methods. One of the methods is using the strategic approaches. Strategic Approaches shows that the portfolio of project is largely driven by the strategy of business. The business strategy decides the spit of resources across different categories – for example, by types of project, markets, or product lines – to create strategic buckets. And strategic consideration dominate the decision to do (or not do) certain R&D and new product project. GE/Mc Kinsey Product Portfolio Model Figure 2. 1 GE/Mc Kinsey Product Portfolio Model The GE matrix generalizes the axes as ‘Market Attractiveness’ and ‘Business Unit Strength’ whereas the BCG , matrix uses the market growth rate as a proxy for industry attractiveness and relative market share as a proxy of the strength of business unit. The difference is that the GE/Mc Kinsey matrix has nine cells diagram while BCG matrix has four cells diagram. Market Attractiveness and business unit strength are calculated by first identifying criteria for each, determining the value of each parameter in the criteria, and multiplying that value by weighting a factor. The market attractiveness is determined by Market Growth Rate (Sales Growth Rate) Market size Demand variability Industry profitability Growth Industry rivalry Global opportunity Macro environmental (PEST) Factors Some factors that can be used to determine business unit strength include: Market share Brand equity (Net Promoter Score) Growth in market share 2 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Distribution channel accessed Production capacity Profit margins competitors relative to The result is a quantitative measure of industry attractiveness and the business unit’s relative performance in that industry. Net Promoter Score The Net Promoter Score (NPS) is a simple and powerful tool to measure client satisfaction with one single question, an indication of the growth potential of the company or product. The most successful companies using Net Promoter build out a complete operational model with NPS as its centerpiece. Real breakthroughs in performance are achieved only when companies move from a research model to an operational model embedded in their company culture. Strategic Implication of Product Portfolio Matrix Resource allocation recommendation can be made to grow, hold, or harvest a strategic business based on the its position on the matrix as follows Figure 2. 2Product Portfolio Strategic Implications Grow strong business in attractive industry, average business unit’s attractive industry, and strong business units in average industry. Hold/Earnings average business in average industry, strong business unit is weak industry and weak business in attractive industry. Harvest weak business units in unattractive industry, average business unit in unattractive industry, and weak business units in average industry. 3 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Figure 2. 3 Product Portfolio Implication of The Strategy While the GE business screen represents an improvement over simpler BCG growth-share matrix, it still presents a somewhat limited view by not considered interaction among the business units and by neglecting to address the core competencies leading to value creation. Rather than serving as the primary tool for resources allocation, portfolio matrices are better suited to displaying a quick synopsis of the strategic business units 3. The Methodology and Model Descriptive Research The descriptive research attempts to describe, explain and interpret conditions of the present i.e. “what is’. The purpose of a descriptive research is to examine a phenomenon that is occurring at a specific place(s) and time. A descriptive research is concerned with conditions, practices, structures, differences or relationships that exist, opinions held processes that are going on or trends that are evident. This research is the one of the method of the qualitative research. The company object of this research is one of the small apparel businesses in Indonesia that is CV Saswco Perdana. CV. Saswco Perdana is one of the entrepreneurship companies that established since 1993 in Bandung, Indonesia. The company produces the product that is focused for low to mid economic as the target market for the business. CV 4 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Saswco Perdana has four big brands that give impact to the company; there are Saswco, Brutal, Weshaki, and Rockweld. Those brands will be as the point of the product portfolio analysis that can give strategic association of the company management. Data Collection The data were collected from interview, observation and also from the company business data. The interview object is the customer of the company that already purchased the product in the store for each brand of the company. The objective is to know the perspective of the brand in consumer mind. The observation data is the framework of current condition in the company. The company business data include the financial performance and business unit quantitative data that help the author to measure the company. Data Analysis The product portfolio analysis for this research is used the GE/Mc Kinsey Model in strategic approach. The purpose is to map the condition of CV Saswco Perdana’s brand in current market conditions. The result of this analysis will be the strategic implication for the company strategy formulation. In GE/Mc Kinsey Model of product portfolio, there are two main axes which will be the necessary reference to make the strategic implication. The axes are the market attractiveness and the business strength units. In this research, the author picks two variables of each axis as the materials to make the product portfolio analysis. Those variables will be as decider factor to be plotted in the matrix and it resulted from the calculation of the final scores. Below is shown the framework of construction of product portfolio for this research. Determine The Product Portfolio Model Perform a Review of The Straregic Implication of The Product Portfolio Determine The Factor of The Variable of the Axes Sum All Up and Intepret to The Matrix Find The Data Resource to Support The Variable Multiply The Weight and Variable Score Assign The Weight of Each Variable based on The Company 's Necessity Calculate The Variable to Make Score Figure 3. 1 Product Portfolio Analysis Making Process 5 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Market Attractiveness The market attractiveness factors that are used are the sales growth rate and profitability growth. These factors determine the attractiveness of market and to understand its evolving opportunity and threats as they relate to the strength and weaknesses of the firm. This is caused by the data availability of the company that can be easier to be proceeded and those variables are represented the market attractiveness in general. Those factors represented the favorability of the brands in the market condition from 2011 until 2013. 1. Sales Growth Rate Methodology To find the sales growth rate score, the author collect the resource directly from the company document. The data resource was collected from the company’s financial statement from 2011 to 2013. Formula To make the final score, we have to know the formula to calculate the variable and make the average of the variable calculation of the sales growth rate. The average value will be as the input for the scoring method. - Sales Growth Rate Formula There are many ways to calculate the sales growth rate of the brand and most of the calculation uses the annual sales as the input of the formula. Below is shown the calculation of the sales growth rate: Sales Growth Rate = - Average Rate After know the result of the sales growth rate calculation, we calculate the average of sales growth rate from 2011 until 2013. Below is shown the calculation of the average of sales growth rate: Average Rate = ( ) ( ) - Scoring Method To make the score we make the table of scale that integrated with the range of the result of the average sales growth rate. The score range is from 1 to 5. Calculation The following table is the sales revenue data of CV Saswco Perdana’s brands from 2011 to 2013. 6 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Brand Saswco Weshaki Brutal Rockweld Sales Revenue 2011 Rp4,465,203,000 Rp893,040,600 Rp2,083,761,400 Rp481,626,926 Sales Revenue 2012 Rp5,369,520,000 Rp1,073,904,000 Rp2,505,776,000 Rp633,719,640 Sales Revenue 2013 Rp4,926,784,200 Rp985,356,840 Rp2,299,165,960 Rp792,149,550 Table 3. 1 CV Saswco Perdana’s Brands Sales Revenue After know the sales revenue data, we can calculate the sales growth rate by using the previous formula. Below is shown the result calculation of the sales growth rate of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld Sales Growth Rate 20112012 0.2 0.21 0.02 0.32 Sales Growth Rate 20122013 (0.08) (0.08) (0.08) 0.25 Sales Growth Rate Average 0.06 0.065 0.06 0.285 Table 3. 2 Calculation Result of Sales Growth Rate After know the result of the sales growth rate average, we can make the score range of the sales growth rate average. The following table is the sales growth rate range scores. Average Sales Growth Rate Range Scale 0.01-0.06 0.07-0.12 0.12-0.18 0.19-0.24 0.25-0.30 Score 1 2 3 4 5 Table 3. 3 Average Sales Growth Rate Range Scale Score 2. Profitability Growth Methodology To find the profitability growth score, the author collect the resource directly from the company document. The data resource was collected from the company’s financial statement from 2011 to 2013 Formula To make the final score, we have to know the formula to calculate the variable and make the average of the variable calculation of profitability growth. The average value will be as the input for the scoring method. 7 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 - Profitability Growth Formula The calculation of profitability growth has the same calculation with the sales growth rate. Below is shown the calculation of the profitability growth: Profitability Growth = - Average Profitability Growth The average profitability growth calculation has the same method with the sales growth rate. Below is hsown the formula of the average of average profitability growth: Average Rate = - ( ) ( ) Scoring Method To make the score we make the table of scale that integrated with the range of the result of the average sales growth rate. The score range is from1 to 5 Calculation The following table is the profitability data of CV Saswco Perdana’s brands from 2011 to 2013 Brand Saswco Profitability 2011 Rp,952,023,316.4 Weshaki Rp390,404,663.2 8 Rp910,944,214.3 2 Rp(152,348,000) Brutal Rockweld Profitability 2012 Profitability 2013 Rp1,760,316,518 Rp1,265,438,563 .2 Rp352,063,304 Rp253,087,712.6 4 Rp821,481,042 Rp2,299,165,960 Rp(109,569,320) Rp(76,840,000) Table 3. 4 CV Saswco Perdana’s Brands Profitability After know the sales revenue data, we can calculate the sales growth rate by using the previous formula. Below is shown the result calculation of the sales growth rate of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld Profitability 20112012 (0.98) (0.1) (0.99) (1.72) Profitability 20122013 (0.28) (0.3) (0.28) (1.7) Profitability Average (0.63) (0.2) (0.635) 1.71 Table 3. 5 Calculation Result of Profitability Growth 8 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 After know the result of the sales growth rate average, we can make the score range of the sales growth rate average. The following table is the sales growth rate range scores. Average Profitability Range Scale (1)-(0.2) (0.1)-0.6 0.7-1.4 1.5-2.2 2.3-3.0 Score 1 2 3 4 5 Table 3. 6 Average Sales Growth Rate Range Scale Score Business Strength Unit The business strength factors that are used are the brand equity that focuses in calculating customer loyalty by using the net promoter score and the distribution channel. These factors determine the competitiveness of the business units the market to understand its evolving opportunity and threats as they relate to the strength and weaknesses of the firm. This is caused by the data availability of the company that can be easier to be proceeded and those variables are represented the business strength unit in general. Those factors represented the favorability of the brands in the market condition from 2011 until 2013. 1. Net Promoter Score To know the net promoter score, at the beginning of the research, the author conducted the interview of the customer that actually bought the product for each brand. The sample size is 50 respondents of each brand by asking a single question of the willingness of the customer to promote the product p their colleagues. From the prior question, the respondents answer from the range number scale from 1 to 10. The answer of the question could be categorized onto three group people, there are: o o o Promoters = respondents giving a 9 or 10 score Passives = respondents giving a 7 or 8 score Detractors = respondents giving a 0 to 6 score Formula After know the answer from the respondents, the author classified the response into the group of people. Then the percentage of the group of people was made to make the calculation easier. - Net Promoter Score Formula As the basis of the score making, below is shown the formula of the net promoter score 9 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 - Scoring Method To make the score we make the table of scale that integrated with the range of the result of the average sales growth rate. The score range is from 1 to 5 Calculation The following table is the result of net promoter score of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld NPS 6,37 3,65 5,12 5,26 Table 3. 7 Calculation Result of Net Promoter Score After know the result of the net promoter score for each brand, we can make the score range of the net promoter score. The following table is the sales growth rate range scores. NPS Range Scale 1-2 3-4 5-6 7-8 9-10 Score 1 2 3 4 5 Table 3. 8 Net Promoter Score Range Scale Score 2. Distribution Channel Access To know the measurement of the distribution channel access, at the beginning of the research, the author conducts the interview to gather the information about the distribution system for each brand. Then, the author collected the data resource of the number of the store for ach brand from the company documents. After that, the author categorized the type of store and also the role of store and makes the weight scoring for each role. Below is shown the store category and its supply chain process 10 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 a. Private store/flagship The private store is the distribution channel that owned by the company itself. The selling system is controlled by the marketing of the company and it gives the fastest response of the product service to the customers. b. Collaboration flagship The collaboration flagship is the distribution channel that is not owned by the company. The distribution channel is owned by the client that commonly only sell the CV Saswco Perdana’s product. The price that been offered is almost the same with the private store. c. Made by Order (general product and custom product) The made by order system is exclusively based on special order demand. The product can be as the general product of the company or it can be custom product. The selling activities are directly handled by the company (not the flagship). The term and conditions is applied for this distribution system. Formula In this analysis, the author valuing the distribution channel based on the function of the channel to make the score weight. For distribution channel/store which have a function as distribution point (has two roles as wholesaler and Retailer) the value for each distribution channel is two, then for wholesaler, retailer, and made by order function has the value one for each. - Distribution Channel Access Weight Formula After know the value of each distribution channel access, we can calculate the total distribution weight for each type of the store. Below is shown the calculation of the total weight of distribution channel access: For Private Store and Collaboration Store Total Weight = (2xnumber of distribution point) + (1xnumber of wholesaler) + (1xnumber of retail) For the Made by Order System Total Weight = (1xnumber of made by order) - Average Distribution Weight After know the total weight of the distribution channel, we can calculate the average of distribution weight. Below is shown the calculation of the average distribution channel access weight: 11 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Calculation The following table is the calculation of the total weight of each distribution channel and its average: 12 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Brand Saswco Score Weshaki Score Brutal Score Rockweld Score Private Store Distribution Point Wholesale (Wholesale and Retail) 4 0 8 0 1 0 2 0 0 0 0 0 2 0 4 0 Retai l 6 6 2 2 0 0 0 0 Total Weight 14 4 0 4 Collaboration Store Distribution Point Wholesal Retai (Wholesale e l and Retail) 2 0 5 4 0 5 0 1 3 0 1 3 1 0 3 2 0 3 0 2 3 0 2 3 Total Weight 9 4 5 5 Made by Order 1 1 1 1 0 0 1 1 Average Distribution Weight 8 3 1.67 3.3 Table 3. 9The Calculation of Distribution Channel Weight After know the result of the average distribution weight for each brand, we can make the score range of the distribution channel access. The following table is the sales growth rate range scores. Average Distribution Weight Range Scale 1-2 3-4 5-6 7-8 9-10 Score 1 2 3 4 5 Table 3.10The average Distribution Weight Range Scale 13 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4. The Findings The product portfolio is the tools to know the position of the brands of CV. Saswco Perdana consider the market attractiveness and the capabilities of the business units’ itself. We can decide and continue the next analysis after plotting the factors of the market attractiveness and business strength into the nine cells matrix. Market Attractiveness The market attractiveness which is becomes the factor for this analysis is sales growth rate and profitability growth for each brand of CV Saswco Perdana. The following is the result of the analysis of market attractiveness factors. A. Sales Growth Rate After know the range scale of the score for the sales growth rate, we can summarize the score of CV Saswco Perdana’s brands. Below is shown the table of the score of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld Score 1 2 1 5 Figure 4. 1Sales Growth Rate Score From the table above, we can know that Rockweld has the highest score of the sales growth for the last three years compared with the other brands. Therefore, Rockweld has the opportunity to keep the position to be more attractive. B. Profitability Growth After know the range scale of the score for the profitability growth, we can summarize the score of CV Saswco Perdana’s brands. Below is shown the table of the score of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld Score 1 1 1 5 Figure 4. 2Profitability Growth Score From the table above, we can know that Rockweld has the highest score of the profitability growth for the last three years compared with the other brands. Therefore, Rockweld has the opportunity to keep the position to be more attractive. 14 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Business Strength Unit The business strength unit which is becomes the factor for this analysis is net promoter score and distribution channels access for each brand of CV Saswco Perdana. The following is the result of the analysis of market attractiveness factors 1. Net Promoter Scores After know the range scale of the score for the net promoter score, we can conclude the score of CV Saswco Perdana’s brands. Below is shown the table of the score of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld Score 3 2 3 3 Figure 4. 3 Net Promoter Scores’ Score From the table above, we can know that Weshaki has the highest score of the sales growth for the last three years compared with the other brands. Therefore, Weshaki has to concern about maintaining the business unit strength. 2. Distribution Channel Access After know the range scale of the score for the distribution channel access, we can conclude the score of CV Saswco Perdana’s brands. Below is shown the table of the score of CV Saswco Perdana’s brands. Brand Saswco Weshaki Brutal Rockweld Score 4 2 1 2 Figure 4. 4Distribution Channel Access Scores From the table above, we can know that Saswco has the highest score of the distribution channel access for the last three years compared with the other brands. Therefore, Saswco has the opportunity to keep the position to maintain the strength Plotting the Product Portfolio After know the score for the elements of market attractiveness and business strength unit, we calculate the total attractiveness and strength for each brand. 15 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Then, the result of the attractiveness and strength will be plotted in the nine cell matrix. Saswco Market Attractiveness Factor Market Growth Rate Profitability Weshaki Market Growth Rate Profitability 0.6 0.4 Brutal Market Growth Rate Profitability 0.6 0.4 Market Growth Rate Rockweld Profitability 0.6 0.4 Brand Weight 0.6 0.4 Saswco Business Strength Factor Net Promoter Score Distribution Weshaki Net Promoter Score Distribution 0.6 0.4 Brutal Net Promoter Score Distribution 0.6 0.4 Net Promoter Score Rockweld Distribution 0.6 0.4 Brand Weight 0.6 0.4 Score 1 1 Total 2 1 Total 1 1 Total 5 5 Total The Attractiveness 0.6 0.4 1 1.2 0.4 1.6 0.6 0.4 1 3 2 5 Score The Strength 3 1.8 4 1.6 Total 3.4 2 1.2 2 0.8 Total 2 3 1.8 1 0.4 Total 2.2 3 1.8 2 0.4 Total 2.2 After know the final total score of each element of the market attractiveness and the business strength unit, we plot the point of the brand to the nine cell matrix. The information of the market attractiveness as the Y-axis and the business unit strength as the X-axis. 16 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Market Saswco Brutal Weshaki Rockweld From the product portfolio matrix, we can conclude the condition of CV. Saswco Perdana’s brand position: Saswco The plot of product portfolio of Saswco (almost 60% part of the pie chart) is tend to has low market attractiveness with high business strength. The position shows that Saswco have to protect the position and re focus the business strategy. It means that CV Saswco Perdana should to: a. Manage the current earnings to be more efficient and productive which will resulting an improvement performance of financial condition for further development b. Concentrate on attractive segments to be focused on the niche market and to make the business settle and keep continue for longer time c. Defend the brand’s strength and it will be better if there is an innovation during maintain the brand itself. Weshaki 17 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 The plot of product portfolio for Weshaki (almost 60% part of pie chart) is tend to has low market attractiveness with medium business strength. The position shows that Weshaki is have to manage their self to keep gain earnings. It means that CV Saswco Perdana should to: a. Protect position in most profitable segment for Weshaki product that hopefully could be the concentration of the market b. Upgrade product line for Weshaki product to make the customer more attractive to purchase the product c. Minimize investment in Weshaki product to balance out the waste expense with the expected earning Brutal The plot of product portfolio for Brutal has low market attractiveness with medium business strength. The position shows that Brutal is have to manage their self to keep gain earnings. It means that CV Saswco Perdana should to: a. Protect position in most profitable segment for Weshaki product that hopefully could be the concentration of the market b. Upgrade product line for Brutal product to make the customer more attractive to purchase the product c. Minimize investment in Brutal product to balance out the waste expense with the expected earning Rockweld The plot of product portfolio of Rockweld has high market attractiveness with low business strength. The position shows that Rockweld is have to invest to build for further development. It means that CV Saswco Perdana should to: a. Challenge for leadership that will make Rockweld be a leader for its market segments and keep developing the brand b. Build selectively on strength that can increase the attractiveness of Rockweld in its market segments c. Reinforce vulnerable areas that can makes declining for Rockweld attractiveness in its market 5. Summary and Conclusions The product portfolio in strategic approach application is the efficient tools for management in small business to see the position of the state of the products and also to see the direction of the strategic decision to be taken. In this study, the object company suggested to grow or invest on Rockweld brand while the other brand 18 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 commonly tend to be more managed to increase the company development. Rockweld decision point is to challenge for leadership, build selectively on strength, and reinforce vulnerable areas. Saswco decision point is to manage current earnings, concentrate on attractive market and defend the brand strength while for the rest brand, they suggested protecting position in most profitable segment, upgrading product line and minimizing investment. End Notes References Bamberger, I 1982, Portfolio Analysis for the Small Firm, Long Range Planning, Vol 15, No, 6, pp.49-57. Linneman, RE and Thomas, MJ 1982 A Commonsense Approach to Portfolio Planning, Long Range Planning, Vol 15, No. 2, pp.77-92. Cooper, RG and Edgett, SJ 1999, New Product Portfolio Management: Practices and Performance, J Prod Innov Manag, Vol. 16, pp. 333-351. 19