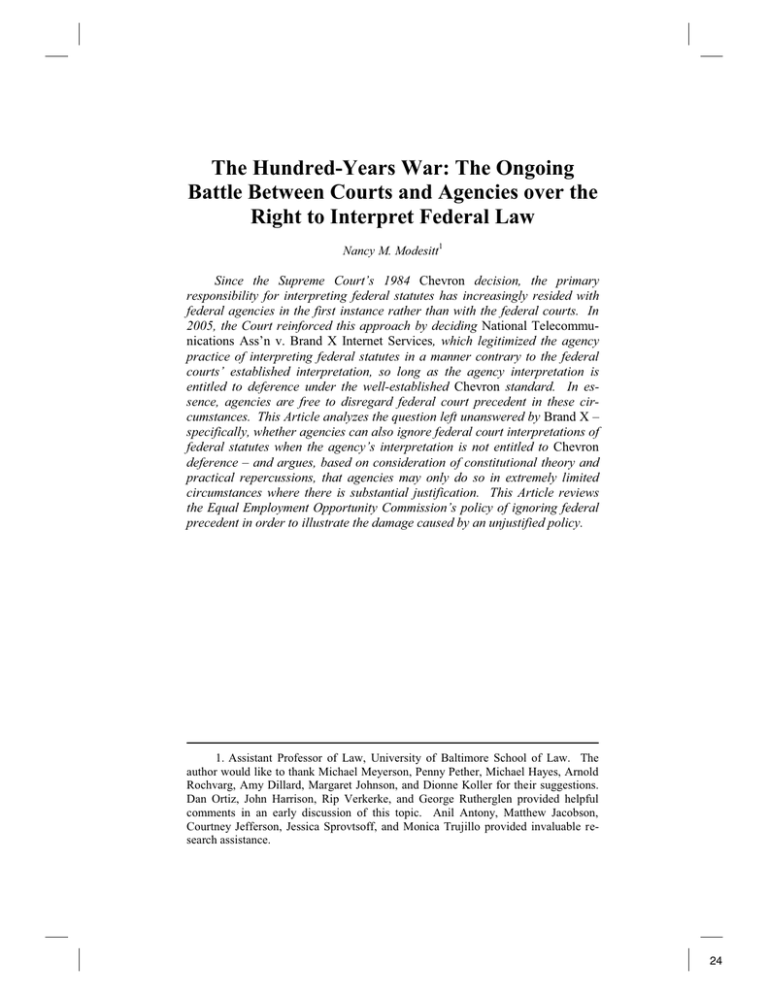

The Hundred-Years War: The Ongoing Right to Interpret Federal Law

advertisement