Frontiers of Finance 2012 Conference Programme 13-15 September 2012 Finance Group

advertisement

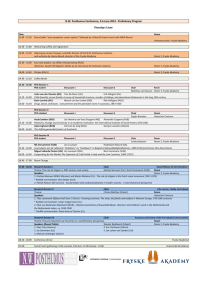

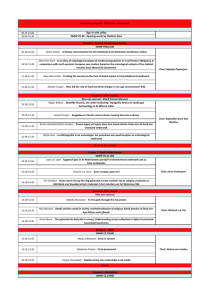

Frontiers of Finance 2012 Conference Programme 13-15 September 2012 Finance Group Warwick Business School University of Warwick Coventry CV4 7AL For wireless internet access please contact the Registration Desk If you are visiting from another academic institution which participates in the eduroam service then this service is available across the Warwick campus. Users log-in using their normal IT account as issued by their home institution Access code for main doors to Warwick Business School Scarman Road Building: Please note that access is available from 1 hour prior to registration until 30 minutes after the last scheduled session finishes Programme Overview: Thursday 13 September 2012 8:30-8:55 Registration and Coffee 8:55-9:00 Opening Remarks – Room B0.12 Mark Taylor (Dean, Warwick Business School) 9:00-9:45 Keynote Talk – Room B0.12 Asger Lunde (Aarhus University) “Econometric Analysis of Vast Covariance Matrices Using Composite Realized Kernels” 9:45-10:00 Refreshment Break - Atrium 10:00-11:30 Session A Session B Contributed Sessions 1 High Frequency Finance & Risk Management – Room B0.12 Transparency – Room B0.01 11:30-11:45 Refreshment Break - Atrium 11:45-12:30 Keynote Talk – Room B0.12 Marcelo Fernandes (Queen Mary, University of London) “Testing for Jump Spillovers Without Testing for Jumps” 12:30-13:45 Lunch - Lounge 13:45-14:30 Keynote Talk – Room B0.12 Neil Shephard (University of Oxford) “Econometric Analysis of Multivariate Realised QML: Efficient Positive Semi-definite Estimators of the Covariation of Equity Prices” 14:30-14:45 Refreshment Break - Atrium 14:45-15:45 Session A Session B Contributed Sessions 2 Volatility & Jumps – Room B0.12 Market Microstructure – Room B0.01 15:45-16:00 Refreshment Break - Atrium 16:00-17:30 Session A Session B Contributed Sessions 3 High Frequency Finance – Room B0.12 Macro Liquidity – Room B0.01 17:30-17:45 Refreshment Break - Atrium 17:45-18:30 Keynote Talk – Room B0.12 Nikolaus Hautsch (Humboldt-Universität zu Berlin) “On The Dark Side of the Market: Identifying and Analyzing Hidden Order Placements” 19:30 Dinner, Scarman Conference Centre Programme Overview: Friday 14 September 2012 8:00-8:30 Registration and Coffee 8.30-10.00 Session A Session B Session C Contributed Sessions 4 Options & Volatility – Room B0.01 Order Choice in Order Driven Markets – Room B0.12 Boards – Room B1.19 10:00-10:15 Refreshment Break 10:15-11:00 Keynote Talk – Room B0.12 Thierry Foucault (HEC Paris) “Learning from Peer Stock Prices and Corporate Investment” 11:00-11:15 Refreshment Break 11:15-12:45 Session A Session B Session C Contributed Sessions 5 Volatility Room B0.01 High-Frequency Trading – Room B0.12 Ownership – Room B1.19 12:45-14:15 Lunch and Poster Session – Lounge 14:15-15:00 Keynote Talk – Room B0.12 Terrence Hendershott (University of California, Berkeley) “High-Frequency Trading and Price Discovery” 15:00-15:15 Refreshment Break 15:15-16:45 Session A Session B Session C Contributed Sessions 6 Macro Liquidity – Room B0.01 Flash Crash – Room B0.12 Bankruptcy – Room B1.19 16:45-17:00 Refreshment Break 17:00-18:30 Session A Session B Contributed Sessions 7 Market Frictions and Liquidity – Room B0.12 Corporate Finance 1 – Room B0.01 19:30 Dinner, Scarman Conference Centre Programme Overview: Saturday 15 September 2012 8:00-8:30 Registration and Coffee 8:30-10:00 Session A Session B Contributed Sessions 8 M&A and Hedge Funds – Room B0.12 Corporate Finance 2 – Room B0.01 10:00-10:15 Refreshment Break - Atrium 10:15-11:00 Keynote Talk – Room B0.12 Rui Albuquerque (Boston University) “Corporate Social Responsibility and Asset Pricing in Industry Equilibrium” 11:00-11:15 Refreshment Break - Atrium 11:15-12:45 Session A Session B Contributed Sessions 9 Banking 1 – Room B0.01 IPOs – Room B0.12 12:45-14:15 Lunch - Lounge 14:15-15:00 Keynote Talk – Room B0.12 Ulrich Hege (HEC Paris) “Levered Blockholders and Payout Policy” 15:00-15:15 Refreshment Break - Atrium 15:15-16:45 Session A Session B Contributed Sessions 10 Banking 2 – Room B0.01 PE and VC – Room B0.12 19:30 Dinner, Scarman Conference Centre Programme: Thursday 13 September 2012 8:30-8:55 Registration and Coffee 8:55-9:00 Opening Remarks – Room B0.12 Mark Taylor (Dean, Warwick Business School) 9:00-9:45 Keynote Talk – Room B0.12 Asger Lunde (Aarhus University) “Econometric Analysis of Vast Covariance Matrices Using Composite Realized Kernels” 9:45-10:00 Refreshment Break - Atrium 10:00-11:30 Session A Contributed Sessions 1 High Frequency Finance & Risk Management – Room B0.12 Chair: Harald Lohre (Deka Investment GmbH) Gregor Weiss (TU Dortmund) “Liquidity Commonality and Risk Management” (with Hendrick Supper, TU Dortmund) Discussant: Harald Lohre (Deka Investment GmbH) Katarzyna Bien-Barkowska (National Bank of Poland) “Capturing Order Book Dynamics in the Interbank EUR/PLN Spot Market” Discussant: Gregor Weiss (TU Dortmund) Harald Lohre (Deka Investment GmbH) “Diversified Risk Parity Strategies for Equity Portfolio Selection” (with Ulrich Neugebauer and Carsten Zimmer, Deka Investment GmbH) Discussant: Katarzyna Bien-Barkowska (National Bank of Poland) Transparency – Room B0.01 Chair: Anthony Neuberger (University of Warwick) Arze Karam (Queen’s University Belfast) “The Value of the Non-anonymity on the NASDAQ” Discussant: Vincent van Kervel (Tilburg University) Vincent van Kervel (Tilburg University) “Liquidity: What You See Is What You Get?” Discussant: Arie Gozluklu (University of Warwick) Arie Gozluklu (University of Warwick) “Pre-Trade Transparency and Informed Trading: An Experimental Approach to Hidden Liquidity” Discussant: Arze Karam (Queen’s University Belfast) Session B 11:30-11:45 Refreshment Break - Atrium 11:45-12:30 Keynote Talk – Room B0.12 Marcelo Fernandes (Queen Mary, University of London) “Testing for Jump Spillovers Without Testing for Jumps” 12:30-13:45 Lunch - Lounge 13:45-14:30 Keynote Talk – Room B0.12 Neil Shephard (University of Oxford) “Econometric Analysis of Multivariate Realised QML: Efficient Positive Semi-definite Estimators of the Covariation of Equity Prices” 14:30-14:45 Refreshment Break - Atrium 14:45-15:45 Session A Contributed Sessions 2 Volatility & Jumps – Room B0.12 Chair: Ingmar Nolte (University of Warwick) Alessandro Palandri (University of Warwick) "Up and Down Volatilities and Their Dynamics" (with Matteo Sandri, University of Warwick) Discussant: Jan Novotný (City University London) Jan Novotný (City University London) “The Identification of Price Jumps: Stock Market Indices During the Crisis” (with Jan Hanousek and Evzen Kocenda, Charles University) Discussant: Qi Xu (University of Warwick) Market Microstructure – Room B0.01 Chair: Arie Gozluklu (University of Warwick) Corey Garriott (Bank of Canada) “Front-running and Post-trade Transparency” Discussant: Sunny X Li (VU University Amsterdam) Sunny X Li (VU University Amsterdam) “Dynamic Inventory Control with Endogenous Information Acquisition” Discussant: Corey Garriott (Bank of Canada) Session B 15:45-16:00 Refreshment Break - Atrium 16:00-17:30 Session A Contributed Sessions 3 High Frequency Finance – Room B0.12 Chair: Thomas Dimpfl (University of Tübingen) Gabriel G Velo (University of Padova) “A Tick of Haven: Stylized Facts and Dynamic Modelling of Nano-frequency Data on Precious Metals” (with Massimiliano Caporin, University of Padova and Angelo Ranaldo, St Gallen University) Discussant: Thomas Dimpfl (University of Tübingen) Alvaro Cartea (University College London) “Buy Low Sell High: A High Frequency Trading Perspective” (with Sebastian Jaimungal, University of Toronto and Jason Ricci, University of Toronto) Discussant: Gabriel G Velo (University of Padova) Thomas Dimpfl (University of Tübingen) ”Can Internet Search Queries Help to Predict Stock Market Volatility?” (with Stephan Jank, University of Tübingen) Discussant: Alvaro Cartea (University College London) Macro Liquidity – Room B0.01 Chair: Anthony Neuberger (University of Warwick) Thomas Katzschner (University of Jena) “The Contribution of Multilateral Trading Facilities to Price Discovery” (with Robert Jung, University of Hohenheim) Discussant: David Brown (University of Colorado at Boulder) David Brown (University of Colorado at Boulder) “Dark Pool Exclusivity Matters” (with Leslie Boni, University of New Mexico and J Chris Leach, University of Colorado at Boulder) Discussant: Thomas Katzschner (University of Jena) Session B Miriam Marra (University of Warwick) “Illiquidity Commonality Across Equity and Credit Markets” Discussant: Kees Bouwman (Erasmus University) 17:30-17:45 Refreshment Break - Atrium 17:45-18:30 Keynote Talk – Room B0.12 Nikolaus Hautsch (Humboldt-Universität zu Berlin) “On The Dark Side of the Market: Identifying and Analyzing Hidden Order Placements” 19:30 Dinner, Scarman Conference Centre Programme: Friday 14 September 2012 8:00-8:30 Registration and Coffee 8.30-10.00 Session A Contributed Sessions 4 Options & Volatility – Room B0.01 Chair: Paul Schneider (University of Warwick) Stylianos Perrakis (Concordia University) “Microstructure Noise and Price Discovery in Options Markets: Theory and Empirical Evidence” Discussant: Martin Wallmeier (University of Fribourg) Clemens Volkert (Westfälische Wilhelms-Universität Münster) “The Fine Structure of Variance: Consistent Pricing of VIX Derivatives” Discussant: Stylianos Perrakis (Concordia University) Martin Wallmeier (University of Fribourg) “Smile in Motion: An Intraday Analysis of Asymmetric Implied Volatility” Discussant: Clemens Volkert (Westfälische Wilhelms-Universität Münster) Order Choice in Order Driven Markets – Room B0.12 Chair: Arie Gozluklu (University of Warwick) Jerome Dugast (HEC Paris) “Limited Attention and News Arrival in Limit Order Markets” Discussant: Michael Moore (Queen's University Belfast) Richard Payne (City University London) “Market Order Flows, Limit Order Flows and Exchange Rate Dynamics” Discussant: Sarah Draus (University of Naples Federico II) Lars Norden (Stockholm University Business School) “Components of the Bid-Ask Spread and Variance: A Unified Approach” Discussant: Jerome Dugast (HEC Paris) Boards – Room B1.19 Chair: Grzegorz Trojanowski (University of Exeter) Bang Dang Nguyen (University of Cambridge) “Sugar and Spice and Everything Nice: What Are Good Directors Made Of?” Discussant: Grzegorz Trojanowski (University of Exeter) Linus Siming (Bocconi University) “Orders of Merit and CEO Compensation: Evidence form a Natural Experiment” Discussant: Bang Dang Nguyen (University of Cambridge) Session B Session C 10:00-10:15 Refreshment Break 10:15-11:00 Keynote Talk – Room B0.12 Thierry Foucault (HEC Paris) “Learning from Peer Stock Prices and Corporate Investment” 11:00-11:15 Refreshment Break 11:15-12:45 Session A Session B Session C 12:45-14:15 Contributed Sessions 5 Volatility – Room B0.01 Chair: Tony Lawrance (University of Warwick) Michalis Vasios (University of Warwick) “A Least Squares Regression Realised Covariation Estimation: A Comprehensive Simulation Study” Discussant: Tony Lawrance (University of Warwick) Tony Lawrance (University of Warwick) “Exploratory Graphics for Financial Time Series Volatility” Discussant: Michalis Vasios (University of Warwick) High-Frequency Trading – Room B0.12 Chair: Michael Moore (Queen's University Belfast) Peter Hoffman (ECB) “A Dynamic Limit Order Market with Fast and Slow Traders” Discussant: Richard Payne (City University London) Ian Marsh (City University London) “Computer-based Trading in the Cross-Section” Discussant: Peter Hoffman (ECB) Sarah Draus (University of Naples Federico II) “Circuit Breakers and Market Runs” Discussant: Anthony Neuberger (University of Warwick) Ownership - Room B1.19 Chair: Chendi Zhang (University of Warwick) Edward Lee (University of Manchester) “Impact of Split Share Structure Reform in China on CEO Accountability to Corporate Fraud” Discussant: Hannes F Wagner (Bocconi University) Hannes F Wagner (Bocconi University) “Does Family Control Matter? International Evidence from the 2009-2009 Financial Crisis” Discussant: Chendi Zhang (University of Warwick) Lunch and Poster Session – Lounge Diama K Abulabn (Birzeit University Palestine) “Managing of Treasury in the Banking System Within a Multi Currency Economy” (with Nidal Rashid Sabri and Dima W Hanyia, Birzeit University Palestine) Panagiotis Couzoff (Lancaster University) “External Monitoring, Managerial Entrenchment and Corporate Cash Holdings” (with Shantanu Banerjee and Grzegorz Pawlina, Lancaster University) Cândida Ferreira (Technical University of Lisbon) “European Banking Efficiency: A Panel Cost Frontier Approach” Andrej Gill (Goethe University Frankfurt) “Basel III and CEO Compensation in Banks: A New Regulatory Approach After the Crisis” (with Christian Eufinger, Goethe University Frankfurt) Olga Lebedeva (University of Mannheim) “Trading Aggressiveness and Its Implications for Market Efficiency” Vitor Leone (Nottingham Trent University) “Multiple Changes in Persistence vs. Explosive Behaviour: The Dotcom Bubble” (with Otavia Ribeiro de Medeiros, Universidad de Brasilia) Vladimir Prelov (Russian Academy of Sciences) “Tick-by-Tick Analysis and the Return Efficiency Theory for Financial Markets” Thanos Verousis (Bangor University) “Liquidity and Trading Activity of Equity Options: Time Series and Hedging Cost Effects” (with Owain ap Gwilym, Bangor University) Gregor Weiss (TU Dortmund) “Systemic Risk and Bank Consolidation: International Evidence” (with Sascha Neumann and Denefa Bostandzic, Ruhr-Universität Bochum) Vladimir Yankov (Boston University and the Federal Reserve Bank of Boston) “In Search of a Risk-free Asset” 14:15-15:00 Keynote Talk – Room B0.12 Terrence Hendershott (University of California, Berkeley) “High-Frequency Trading and Price Discovery” 15:00-15:15 Refreshment Break 15:15-16:45 Session A Contributed Sessions 6 Macro Liquidity – Room B0.01 Chair: Vikas Raman (University of Warwick) Kees E Bouwman (Erasmus University) “Aggregate Stock Market Illiquidity and Bond Risk Premia” Discussant: Gennaro Bernile (University of Miami) Gennaro Bernile (University of Miami) “Local Business Cycles and Local Liquidity” Discussant: Mathijs A. van Dijk (Erasmus University) Mathijs A. van Dijk (Erasmus University) “Commonality in Market Efficiency” Discussant: Vikas Raman (University of Warwick) Flash Crash – Room B0.12 Chair: Roman Kozhan (University of Warwick) Martin Haferkorn (Goethe-University Frankfurt) “Single Stock Circuit Breakers – Issues in Fragmented Markets” Discussant: Ian Marsh (City University London) Bart Zhou Yueshen (VU University Amsterdam) “Too Many Middlemen? Impaired Learning from Trades” Discussant: Giovanni Cespa (City University London) Giovanni Cespa (City University London) “Illiquidity Contagion and Liquidity Crashes” Discussant: Bart Zhou Yueshen (VU University Amsterdam) Bankruptcy – Room B1.19 Chair: Navin Chopra (Northwestern University) Mascia Bedendo (Bocconi University) “In- and Out-of-Court Debt Restructuring in the Presence of Credit Default Swaps” Discussant: Shantanu Banerjee (Lancaster University) Shantanu Banerjee (Lancaster University) “Understanding the Investment Behaviour of Distressed Firms” Discussant: Navin Chopra (Northwestern University) Emanuele Tarantino (University of Bologna and TILEC) “The Casual Effect of Bankruptcy Law on the Cost of Finance” Discussant: Mascia Bedendo (Bocconi University) Session B Session C 16:45-17:00 Refreshment Break 17:00-18:30 Session A Session B 19:30 Contributed Sessions 7 Market Frictions and Liquidity – Room B0.12 Chair: Roman Kozhan (University of Warwick) Johannes A Skjeltorp (Norges Bank) “Identifying Cross-sided Liquidity Externalities” Discussant: Lars Norden (Stockholm University Business School) Dale Rosenthal (University of Illinois at Chicago) “Transaction Taxes in a Price Maker/Taker Market” Discussant: Johannes Skjeltorp (Norges Bank) Aditya Kaul (University of Alberta) “Order Characteristics, Uncertainty and Price Formation in the Foreign Exchange Market” Discussant: Martin Haferkorn (Goethe-University Frankfurt) Corporate Finance 1 – Room B0.01 Chair: Albert Banal-Estanol (Universitat Pompeu Fabra) Sigitas Karpavicius (Flinders University) “Dividends: Relevance, Rigidity and Signaling” Discussant: Vito Gala (London Business School) Daniel Ludwig Urban (Technische Universität München) “The Value of Financial Flexibility and Payout Policy” Discussant: Sigitias Karpavicius (Flinders University) Vito Gala (London Business School) “Beyond the Q: Estimating Investment Without Asset Prices” Discussant: Daniel Ludwig Urban (Technische Universität München) Dinner, Scarman Conference Centre Programme: Saturday 15 September 2012 8:00-8:30 Registration and Coffee 8:30-10:00 Session A Session B Contributed Sessions 8 M&A and Hedge Funds – Room B0.12 Chair: Tereza Tykvová (Universität Hohenheim) François Derrien (HEC Paris) “The Perverse Effects of Investment Bank Rankings: Evidence from M&A League Tables” (with Olivier Dessaint, HEC Paris) Discussant: Stefan Rostek (University of Tübingen) Stefan Rostek (University of Tübingen) “The Valuation of M&A Targets by Relative Indifference Prices” (with Carolin Mauch, University of Tübingen) Discussant: Petri Jylha (Aalto University) Petri Jylha (Aalto University) “Do Hedge Funds Supply or Demand Immediacy?” (with Kalle Rinne and Matti Suomin, Aalto University) Discussant: François Derrien (HEC Paris) Corporate Finance 2 – Room B0.01 Chair: Elizabeth Whalley (University of Warwick) Mathijs A van Dijk (Erasmus University) “Do Firms Issue More Equity when Markets are More Liquid?” (with René M Stulz, Ohio State University and Dimitrios Vagias, Erasmus University) Discussant: Andrew Caverhill (University of Hong Kong) Andrew Caverhill (University of Hong Kong) “An Empirical Study of Corporate Liquidity Dynamics, with Conditioning on Earnings” Discussant: Elizabeth Whalley (University of Warwick) Albert Banal-Estañol (Universitat Pompeu Fabra) “The Simple Economics of Capital Structure, Corporate Structure and Project Selection” (with Marco Ottaviani, Northwestern University) Discussant: Mathijs van Dijk (Erasmus University) 10:00-10:15 Refreshment Break - Atrium 10:15-11:00 Keynote Talk – Room B0.12 Rui Albuquerque (Boston University) “Corporate Social Responsibility and Asset Pricing in Industry Equilibrium” 11:00-11:15 Refreshment Break - Atrium 11:15-12:45 Session A Contributed Sessions 9 Banking 1 – Room B0.01 Chair: Bo Larsson (Stockholm University) Tianxi Wang (University of Essex) “Put Your Money Where Your Mouth Is: An Equilibrium Model Relating Bank Scale to Bank Quality” Discussant: Lei Mao (University of Warwick) Stefano Puddu (University of Lausanne) “TAF Effect on Liquidity Risk Exposures” (with Andreas Wälchli, University of Lausanne) Discussant: Tianxi Wang (University of Essex) Session B IPOs – Room B0.12 Chair: Maia Gejadze (Université Catholique de Louvain) M Martin Boyer (HEC Montreal) “Insurer Information, Insiders and Initial Public Offering” Discussant: Hugh Colaco (Aston University) Grzegorz Pawlina (Lancaster University Management School) “Leaders and Followers in Hot IPO Markets” (with Shantanu Banerjee, Lancaster University Management School and Ismail Ufuk Güçbilmez, University of Edinburgh Business School) Discussant: M Martin Boyer (HEC Montreal) Hugh M J Colaco (Aston University) “Do Firms That Go Public Quickly Perform Better?” (with Shantaram P Hegde, University of Connecticut) Discussant: Grzegorz Pawlina (Lancaster University Management School) 12:45-14:15 14:15-15:00 Lunch - Lounge Keynote Talk – Room B0.12 Ulrich Hege (HEC Paris) “Levered Blockholders and Payout Policy” 15:00-15:15 Refreshment Break - Atrium 15:15-16:45 Session A Contributed Sessions 10 Banking 2 – Room B0.01 Chair: Tianxi Wang (University of Essex) Bo Larsson (Stockholm University) “Banking on Regulations?” (with Hans Wijkander, Stockholm University) Discussant: Stefano Puddu (University of Lausanne) Enrique Schroth (University of Amsterdam) “Dynamic Debt Runs and Financial Fragility: Evidence from the 2007 ABCP Crisis” (with Gustavo Suarez, Federal Reserve Board and Lucian A Taylor, University of Pennsylvania) Discussant: Bo Larsson (Stockholm University) PE and VC – Room B0.12 Chair: Jana Fidrmuc (University of Warwick) Maia Gejadze (Université Catholique de Louvain) “Private Equity Fundraising, Fund Performance and Firm Specialization” (with Pierre Giot, University of Namur and Armin Schwienbacher, Université Lille Nord de France) Discussant: Tereza Tykvova, (Universität Hohenheim) Andrej Gill (Goethe University-Frankfurt) “Going Public – Going Private. The Case of VC-backed Firms” (with Uwe Walz, Goethe University-Frankfurt) Discussant: Jana Fidrmuc (University of Warwick) Tereza Tykvová (Universität Hohenheim) “Does Syndication with Local Venture Capitalists Moderate the Effects of Geographical and Institutional Distances and Experience?” (with Andrea Schertler) Discussant: Andrej Gill (Goethe University-Frankfurt) Session B 19:30 Dinner, Scarman Conference Centre Keynote Speakers Rui Albuquerque Boston University Rui Albuquerque is Associate Professor of Finance at the School of Management of Boston University and Visiting Full Professor of Finance at the Portuguese Catholic University in Lisbon. He is also affiliated with the Center for Economic and Policy Research and the European Corporate Governance Institute. Professor Albuquerque’s research was awarded the 2011 Broderick Prize for Excellence in Research Scholarship, the 2008 Smith Breeden Distinguished Paper Prize, the 2003 Lamfalussy Fellowship by the European Central Bank, along with several other prizes from KPMG, BSI and ECGI. He is currently a Dean’s Research Fellow at Boston University. His research has appeared in the top academic journals including The Journal of Finance, The Journal of Financial Economics, The Review of Economic Studies, and The Review of Financial Studies. Professor Albuquerque holds a B.A. (magna cum laude) in Economics from the Portuguese Catholic University, and M.A. and Ph.D. degrees in Economics from the University of Rochester. Marcelo Fernandes Queen Mary, University of London Marcelo Fernandes holds a PhD in Management Science from the Solvay Business School of the Universite Libre de Bruxelles since 1999. He is a professor at Queen Mary's School of Economics and Finance int he UK and at the Sao Paulo School of Economics of the Getulio Vargas Foundation in Brazil. Past appointments include a Jean Monnet Fellowship at the European University Instutite in Fiesole, Italy and an assistant professorship at the Graduate School of Economics of the Getulio Vargas Foundation in Rio de Janeiro, Brazil. His research interests are mainly in financial econometrics, empirical finance and nonparametric theory. Thierry Foucault HEC Paris Thierry Foucault is Professor of Finance at HEC, Paris and a research fellow of the Centre for Economic Policy (CEPR). His research focuses on the determinants of financial markets liquidity and the industrial organization of the securities industry. His work has been published in top-tier scientific journals, including the Journal of Finance, the Journal of Financial Economics, and the Review of Financial Studies. He acts as co-editor of the Review of Finance since 2009 and he is an Associate Editor of the Journal of Finance and the Review of Asset Pricing Studies. He received research awards from the Europlace Institute of Finance in 2005 and 2009, the annual research prize of the HEC Foundation in 2006 and 2009, and the 2009 Analysis Group award for the best paper on Financial Markets. Nikolaus Hautsch Humboldt-Universität Nikolaus Hautsch is Professor of Economics at HumboldtUniversität zu Berlin. He received his PhD in Economictrics in 2003 from the University of Konstanz. From 2004-2007 he joined the Department of Economics of the University of Copenhagen. He is deputy director of the Center for Applied Statistics and Economics (CASE) at HumboldtUniversität zu Berlin and is project head within the Collaborative Research Center 649 "Economic Risk" at Humboldt-Universität zu Berlin funded by the German Science Foundation. Moreover, he is research fellow of the Center for Financial Studies (CFS) Frankfurt and member of the Danish Center for Accounting and Finance. His research focuses on the econometrics of high-frequency financial data, market microstructure analysis, the modelling of volatility, covariances and liquidity, information processing on financial markets, term structure modeling as well as dynamic factor models. He publishes in well-established journals in the area of finance and econometrics. Hautsch had visiting positions a the University of Technology, Sydney, the University of Melbourne and the Université Catholique de Louvain. Ulrich Hege HEC Paris Ulrich Hege is Professor and holder of the FBF Chair in Corporate Finance at HEC Paris. Previously, he has held positions at Tilburg University (Netherlands) and ESSEC (Paris), and was also a visiting professor at London Business School and New York University. A native of Germany, he holds a master’s degree from the University of Frankfurt and a Ph.D. from Princeton University. He has extensively published on topics such as acquisitions and divestitures, private equity, venture capital, joint ventures, corporate governance, debt restructuring, and bankruptcy. His research has been published in the Review of Financial Studies, Journal of Business, Review of Finance, Rand Journal of Economics, Harvard Business Review, and other international journals. Asger Lunde Aarhus University Asger Lunde holds a Ph.D. in economics (Aarhus University). He is Professor, at the Department of Economics and Business, Aarhus University, Denmark. He is research fellow at the Center for Research in Econometric Analysis of Time Series (CREATES) in Aarhus, Denmark and a member of the Oxford-Man institute for Quantitative Finance, Oxford, UK. His current research interest addresses several aspects concerning volatility measurement and modeling. In a parallel research agenda, he investigates the effect of data mining on model evaluation and model selection. Neil Shephard University of Oxford Neil Shephard has been a statutory Professor of Economics at Oxford University since 2006. He served as the founding director of Oxford-Man Institute from 2007-11. He is a Council Member of the Society of Financial Econometrics and has been an Associate Editor of Econometrica since 2002. Neil is a member of the advisory boards or research associate of econometric research centres at Aarhus University, New York University and Singapore Management University. With Colin Mayer he founded Oxford University’s masters’ degree in Financial Economics and from 2006-07 chaired the Oxford Financial Research Centre. His research interests are mainly focused on econometrics with particular interests in financial volatility, dependence, high frequency financial data and simulation based inference. He received his doctorate from LSE and was elected a Fellow of the Econometric Society in 2004, a Fellow of the British Academy in 2006 and was awarded an honourary doctorate by Aarhus University in 2009. Diama Abulaban Waqar Ahmed Rui Albuquerque Birzeit University Palestine University of Warwick Boston University dlaban@birzeit.edu phd11wa@mail.wbs.ac.uk ralbuque@bu.edu Afeez Aziz Albert Banal-Estanol Shantanu Banerjee University of Warwick University Pompeu Fabra, Spain Lancaster University M.A.Abdul-Aziz@University of Warwick.ac.uk albert.banalestanol@upf.edu s.banerjee@lancaster.ac.uk Sohnke Bartram Mascia Bedendo Gennaro Bernile University of Warwick Bocconi University University of Miami sohnke.bartram@wbs.ac.uk mascia.bedendo@unibocconi.it g.bernile@miami.edu Katarzyna Bien-Barkowska Kees Bouwman Martin Boyer National Bank of Poland Econometric Institute, Rotterdam HEC Montreal katarzyna.bien@sgh.waw.pl kbouwman@ese.eur.nl martin.boyer@hec.ca David Brown Alvaro Cartea Andrew Caverhill University of Colorado University College London Hong Kong University dcbrown@colorado.edu alvaro.cartea@gmail.com carverhill@business.hku.hk Giovanni Cespa Linquan Chen Navin Chopra City University London University of Warwick Northwestern University giovanni.cespa@gmail.com phd11lc@mail.wbs.ac.uk n-chopra@kellogg.northwestern.edu Hugh Colaco Peter Corvi Panagiotis Couzoff Aston University University of Warwick Lancaster University h.colaco@aston.ac.uk peter.corvi@wbs.ac.uk p.couzoff1@lancaster.ac.uk Francois Derrien Amogh Deshpande Alexandra Dias HEC Paris University of Warwick University of Leicester derrien@hec.fr amogh.deshpande@University of Warwick.ac.uk ad313@l@leicester.ac.uk Thomas Dimpfl Sarah Draus Jerome Dugast University of Tuebingen University of Mannheim Haas Business School thomas.dimpfl@uni-tuebingen.de draus.sarah@unina.it jerome.dugast@gmail.com Marcelo Fernandes Candida Ferreira Jana Fidrmuc Queen Mary University London UECE University of Warwick m.fernandes@qmul.ac.uk candidaf@iseg.utl.pt jana.fidrmuc@wbs.ac.uk Ilias Filippou Thierry Foucault Hung Ying Fung University of Warwick HEC Paris University of Warwick phd10if@mail.wbs.ac.uk foucault@hec.fr phd11yh@mail.wbs.ac.uk Vito Gala Andrea Gamba Corey Garriott London Business School University of Warwick University of California vgala@london.edu andrea.gamba@wbs.ac.uk cgarriott@bankofcanada.ca Maia Gejadze Osman Ghani Dudley Gilder Louvain, Belgium University of Warwick Aston University Maia.Gejadze@uclouvain.be phd10og@mail.wbs.ac.uk d.gilder@aston.ac.uk Andrej Gill Arie Gozluklu Martin Haferkorn Goethe University University of Warwick Goethe University Frankfurt gill@econ.uni-frankfurt.de arie.gozluklu@wbs.ac.uk haferkorn@wiwi.uni-frankfurt.de Gustav Haitz Nikolaus Hautsch Ulrich Hege Humboldt University Berlin Humboldt University Berlin HEC Paris haitzgus@hu-berlin.de nikolaus.hautsch@wiwi.hu-berlin.de hege@hec.fr Terrence Hendershott Peter Hoffmann Kentaro Iwatsubo University of California, Berkley ECB Kobe University hender@haas.berkeley.edu Peter.Hoffmann@ecb.int iwatsubo@econ.kobe-u.ac.jp Petri Jhyla Xing Jin Arze Karam Aalto University University of Warwick Queen's University Belfast ptjylha@gmail.com xing.jin@wbs.ac.uk a.karam@qub.ac.uk Sigitas Karpavicius Thomas Katzschner Aditya Kaul Flinders University Australia University of Jena University of Alberta sigitas.karpavicius@flinders.edu.au thomas.katzschner@uni-jena.de akaul@ualberta.ca Gi Kim Kostas Koufopoulos Roman Kozhan University of Warwick University of Warwick University of Warwick gi.kim@wbs.ac.uk kostas.koufopoulos@wbs.ac.uk roman.kozhan@wbs.ac.uk Bo Larsson Tony Lawrance Olga Lebedeva Stockholm University University of Warwick University of Mannheim bo.larsson@ne.su.se A.J.Lawrance@University of Warwick.ac.uk lebedeva@corporate-financemannheim.de Edward Lee Zicheng Lei Zicheng Lei University of Manchester University of Warwick University of Warwick Edward.Lee@manchester.ac.uk phd11zl@mail.wbs.ac.uk phd11zl@mail.wbs.ac.uk Rong Leng Vitor Leone Xiaoyue Li University of Warwick Nottingham Trent University VU University Amsterdam rong.leng@associate.wbs.ac.uk Vitor.Leone@ntu.ac.uk xysunnyli@gmail.com Junjie Liu Harald Lohre Asger Lunde University of Warwick Deka Investment GmbH Aarhus University Phd11jl@mail.wbs.ac.uk harald.lohre@deka.de alunde@econ.au.dk Lei Mao Miriam Marra Ian Marsh University of Warwick University of Warwick City University lei.mao@wbs.ac.uk miriam.marra@wbs.ac.uk I.Marsh@city.ac.uk Jonathan Mascie-Taylor Eberhard Mayerhofer Afrasiab Mirza University of Warwick Dublin City University Queen's University, Canada j.mascie-taylor@University of Warwick.ac.uk Eberhard.mayerhofer@gmail.com afmirza@gmail.com Michael Moore Anthony Neuberger Bang Dang Nguyen Queen's University Belfast University of Warwick Judge Business School m.moore@qub.ac.uk anthony.neuberger@wbs.ac.uk B.Nguyen@jbs.cam.ac.uk Ingmar Nolte Sandra Nolte Lars Norden University of Warwick University of Leicester Stockholm University ingmar.nolte@wbs.ac.uk sandra.nolte@leicester.ac.uk ln@fek.su.se Jan Novotny Marcus Ong Alessandro Palandri City University London University of Warwick University of Warwick jan.novotny@mbs.ac.uk marcus.ong@mac.com alessandro.palandri@wbs.ac.uk Grzegorz Pawlina Richard Payne Stylianos Perrakis Lancaster University City University London Concordia University, Canada g.pawlina@lancaster.ac.uk Richard.Payne.1@city.ac.uk sperrakis@jmsb.concordia.ca Vladimir Prelov Stefano Puddu Vikas Raman Russian Academy of Science Université de Neuchatel University of Warwick V.V.Prelov [prelov@iitp.ru] stefano.puddu@unine.ch vikas.raman@wbs.ac.uk Dale Rosenthal Stefan Rostek Nidal Sabri University of Wisconsin - La Crosse University of Tuebingen Birzeit University Palestine daler@uic.edu stefan.rostek@uni-tuebingen.de nsabri@birzeit.edu Paul Schneider Enrique Schroth Neil Shephard University of Warwick City University London University of Oxford paul.schneider@wbs.ac.uk E.J.SchrothDeLaPiedra@uva.nl neil.shephard@economics.ox.ac.uk Linus Per Siming Johannes Skjeltrop Przemyslaw Stan Stilger Bocconi University Norges Bank, Norway University of Manchester linus.siming@unibocconi.it johannes-a.skjeltorp@norgesbank.no p.stilger@gmail.com Alex Stremme Richard Taffler Emanuele Tarantino University of Warwick University of Warwick University of Bologna alex.stremme@wbs.ac.uk richard.taffler@wbs.ac.uk emanuele.tarantino@unibo.it Mark Taylor Spyridon Terovitis Grzegorz Trojanowski University of Warwick University of Warwick University of Exeter mark.taylor@wbs.ac.uk S.Terovitis@University of Warwick.ac.uk g.trojanowski@ex.ac.uk Leonidas Tsiaras Alistair Tucker Tereza Tykvova Aston Business School University of Warwick University of Hohenheim l.tsiaras@aston.ac.uk AGJF.Tucker@University of Warwick.ac.uk tereza.tykvova@uni-hohenheim.de Daniel Urban Mathijs van Dijk Vincent van Kervel Technische Universität München Erasmus University Tilburg University daniel.urban@ifm.wi.tumuenchen.de madijk@rsm.nl v.l.vankervel@uvt.nl Michalis Vasios Gabriel Velo Thanos Verousis University of Warwick University of Padova Bangor University michalis.vasios.09@mail.wbs.ac.uk velo.gabriel@gmail.com t.verousis@bangor.ac.uk Matija Vidmar Clemens Volkert Georgios Voulgaris University of Warwick Muenster University University of Warwick m.vidmar@University of Warwick.ac.uk 01clvo@wiwi.uni-muenster.de georgios.voulgaris@wbs.ac.uk Hannes Wagner Martin Wallmeier Boromeus Wanengkirtyo Bocconi University University of Fribourg University of Warwick hannes.wagner@unibocconi.it martin.wallmeier@unifr.ch b.w.wanengkirtyo@University of Warwick.ac.uk Tianxi Wang Sarah Qian Wang Gregor Weiss Essex University University of Warwick TU Dortmund University wangt@essex.ac.uk qian.wang@wbs.ac.uk gregor.weiss@tu-dortmund.de Elizabeth Whalley Chungling Xia Qi Xu University of Warwick University of Warwick University of Warwick elizabeth.whalley@wbs.ac.uk phd11cx@mail.wbs.ac.uk phd11qx@mail.wbs.ac.uk Vladimir Yankov Yan Zhang Chendi Zhang Boston University University of Warwick University of Warwick vladimir.yankov@gmail.com zjwufei@gmail.com chendi.zhang@wbs.ac.uk Bart Yueshen Zhou VU University Amsterdam yueshenbartzhou@gmail.com