Nowhere to go, no way to pay

advertisement

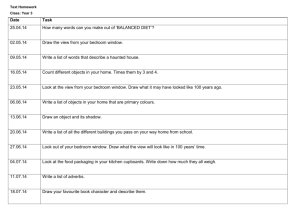

Nowhere to go, no way to pay Applying the bedroom tax with discretion Foreword For disabled people and their families, a spare bedroom to store medical equipment or get some respite is not a luxury. It supports them to live independently and, ultimately, it saves the taxpayer money. We believe the under occupation penalty, or ‘bedroom tax’, will cost the state money rather than saving it. It takes no account of the cost of adapting disabled people’s homes, and may force them to leave a home that has been specifically adapted to meet their needs. If Local Authorities and social landlords don’t have alternative homes available for people to downsize to, people already struggling on a low income will have no choice but to face cuts to their Housing Benefit. As a disability charity and registered social landlord, Papworth Trust specialises in building and adapting wheelchair accessible homes for life. We are increasingly concerned by the stories from our tenants and other disabled people about how the under occupation penalty is affecting them. We recognise and support the intention behind the policy to free up larger homes for families living in over crowded accommodation. We disagree, however, with the blanket application of the policy. Nowhere to Go, No Way to Pay presents real stories from 5 disabled families to show how the policy is affecting them. We are appealing to Local Authorities to apply the bedroom tax with discretion so that disabled people do not lose out if they have a genuine need for an extra bedroom, or if they have nowhere suitable to downsize to. Adrian Bagg Chief Executive Papworth Trust 1 What is the under occupation penalty? From 1 April 2013 the Government reduced Housing Benefit for working age social housing tenants with one or more ‘spare’ bedrooms. The aim of this under occupation penalty, also known as the bedroom tax, is to encourage working age families living in homes too big for them to move to smaller properties, freeing up larger homes for over crowded households. As a result of this policy, 670,000 households have lost on average £14 a week from their Housing Benefit. Just under two thirds of those are households with a disabled family member. 100,000 families affected are living in adapted properties.1 The rules allow one bedroom each for: • an adult couple • any other person aged 16 or over • 2 children of the same sex under 16 • 2 children under 10 regardless of their sex • any other child under 16 • a paid carer who regularly stays overnight. The new rules apply to people living in adapted accommodation and people whose partner or family member cares for them. They also affect people with fluctuating conditions who occasionally need overnight care. The new size criteria mean that working age social tenants with a ‘spare’ bedroom need to pay for under occupying or move to a smaller property. What the public think... 9 in10 2 think that sick and disabled people should be exempt from the under occupation penalty 2 2in3 think that no one should have their Housing Benefit reduced unless they refuse to move into suitable, smaller accommodation 3 What people told us: “We’re considering moving to a one bedroom property because of the bedroom tax, but it would mean my husband having to sleep on the sofa.” “If we had to move miles away for an adapted house, my wife would lose her job.” “I can’t move to a smaller house, as I wouldn’t have the support I get here and there would be nowhere for my daughters to sleep.” 3 Why exempt disabled people who need a spare room? The ‘spare’ bedroom is often essential “We use it to store our disability equipment which we don’t have room for anywhere else” - Phil and Trish As a result of their illness or impairment, many disabled people have a genuine need for their ‘spare’ bedroom. For example, some couples cannot share a bedroom because their disability makes it impossible or difficult to sleep in the same bed. A large hospital bed may take up the bedroom, meaning one partner has to sleep in another room. Sometimes the ‘spare’ bedroom is used to store disability equipment like wheelchairs and hoists which would otherwise block access for wheelchairs to the corridors or living rooms. Adaptations made to a property may also make a bedroom unusable, such as a through floor lift into the room. As a specialist provider of accessible accommodation, we build homes that our tenants can stay in for life. These homes often include a spare bedroom that can be used by a live in carer or overnight carer if our tenant’s health condition or impairment is likely to deteriorate. This helps our tenants to live independently for longer and reduces their need for residential care, which would cost the state much more, as their condition worsens. 4 There is a chronic shortage of adapted housing nationally “There seem to be a few one or two bedroom properties available but none of them are adapted” - Mr and Mrs Harman For disabled people who live in adapted properties, there is very little chance of moving locally to a smaller and similarly adapted property. Of the 1.8 million council owned properties, just 0.4% (7,200) have all the accessible features listed in the current Building Regulations.4 In some areas, waiting times for a council owned adapted property are over 5 years. 371,000 disabled people live in properties that are unsuitable for their needs.5 Disabled people who want to downsize could be forced to move into unadapted properties. Local Authorities will need to pay for hundreds of thousands of pounds in adaptations to their social housing stock through Disabled Facilities Grants (DFGs). The average cost of adaptations funded by DFGs in 2010 was £6,396.6 Installing a wet room can cost between £3,500 and £5,000. Building a ramp for level access to a home costs up to £8,000. It is a waste of public money to spend thousands on new adaptations in order to save a few hundred pounds from the under occupation penalty. Greater social care costs “We’re eligible for a full time carer, but I care for my wife myself. I’m saving the council £900 a week” - Jim The care given by unpaid carers, such as family and friends, is worth an estimated £119 billion per year,7 a huge saving for the NHS and social services. Two thirds of those affected by the under occupation penalty are households with a disabled family member, many of whom receive care from their relatives. The rules do not allow a separate bedroom for informal overnight carers who often provide care for free, despite the family being eligible for care from their local council. If families ask social services to provide the care in order to avoid the under occupation penalty, this will greatly increase social care costs for Local Authorities. 5 Discretionary Housing Payments are not a robust solution “I’m going to have to find over £100 a month to pay for the bedroom tax” - Annaliese People affected by the under occupation penalty can apply to their Local Authority for a Discretionary Housing Payment (DHP) to help cover the cost. The Government has allocated £25 million to support disabled people affected by the under occupation penalty in 2013/14. We believe this will not be enough – dividing the funding equally among only tenants receiving Disability Living Allowance would give each household just £2.07 a week, compared to an average loss of £14 per week.8 The Government insists that DHPs mean disabled people will not lose out because of the under occupation penalty. But in the Government’s guidance to Local Authorities, it recognises that the money will not cover everyone in need of a DHP, and therefore other groups should not be excluded from receiving the DHP funding intended for disabled people.9 6 DHPs are a purely discretionary grant, with Local Authorities deciding on a case by case basis. There is no guarantee that specific groups, or people living in particular types of accommodation, will receive them. DHPs are a short term, time limited fix. Once a Local Authority’s DHP funding for the year runs out, no more payments can be made. As DHPs are discretionary grants, applicants have no right to appeal if they are turned down. 7 Case studies Annaliese and Kevin Annaliese and Kevin have lived in their two bedroom flat for 8 years. As they are both wheelchair users, the flat has adaptations throughout, such as a wet room, lowered worktops and sink in the kitchen, and wide manoeuvring space for their wheelchairs. “My health has definitely gone down, and we may need a live in carer at some point in time,” says Annaliese, “If we moved into a one bedroom house, we’d only have to move back into a two bedroom flat again if I started needing a live in carer.” Although Annaliese and Kevin have carers coming in during the day, the carers do not stay overnight at the moment. Annaliese and Kevin have lost £26.85 a week from their Housing Benefit because they have one spare bedroom. The spare bedroom is there for a carer to stay overnight when they need it. “I’m going to have to find over £100 a month to pay for the bedroom tax. Food is going up in price - I’m only buying the things we need, and extras when they’re on special offer.” “There aren’t any one bedroom adapted houses around here for us to move to” 8 Trish and Phil Trish and Phil have lived in their two bedroom bungalow for 29 years. Trish has spina bifida and Phil has cerebral palsy. Both use large electric wheelchairs, which need space to manoeuvre and to be stored. Trish and Phil have carers supporting them six times a day. Trish has a hospital airbed on permanent loan. It takes up a lot of space, so Phil uses a single bed beside it so they can sleep in the same room. This means that there isn’t much room for them or their carers to get around the beds, so they use the second bedroom to store their wardrobes, bulky medical supplies and Phil’s mobile hoist. These items can’t be stored in the hallway or living room as they would block access, meaning Trish and Phil wouldn’t be able to move around the house in their wheelchairs. Trish and Phil’s benefit has been cut by £11.61 a week. “Although no one sleeps in our spare room, it isn’t a luxury. We use it to store our disability equipment which we don’t have room for anywhere else.” “We couldn’t have our equipment or boxes in the living area of a one bedroom house, as we wouldn’t be able to get around.” 9 Lisa and Brett Couple Lisa and Brett have lived together in a specially adapted two bedroom bungalow for the past three and a half years. Lisa has Spastic Quadriplegia Cerebral Palsy and is a full time wheelchair user. She needs 24 hour care. As well as being her partner, Brett is also Lisa’s full time carer, saving their Local Authority around £1,400 a month (nearly £17,000 a year). Lisa’s condition means that Brett needs to sleep in their second bedroom 5 or 6 nights a week. Brett has arthritis, and he finds it incredibly painful when Lisa accidentally kicks him in bed (her condition means that she regularly has such spasms). As Lisa’s full time carer, it’s vital that Brett can get some rest so he can care for her properly. “We’re being penalised when Brett saves so much money for the Government” 10 Lisa and Brett’s Housing Benefit has been cut by £14 a week. Moving house would be difficult and costly for both them and their Local Authority. Their home has been specially adapted for Lisa’s specific needs. Finding anything smaller that would meet Lisa’s needs is nearly impossible, and adapting a new smaller home would cost their Local Authority tens of thousands of pounds and could take years under the current funding system. Lisa and Brett don’t want to move out of the area, as they get support from nearby family and friends, which means they are less reliant on the NHS and social services. Looking ahead to the future, if Brett’s health gets worse and Lisa needs a full time carer, they will need a second bedroom for the carer to live and sleep in. “I think it should be looked at properly, not just one size fits all,” says Lisa, “If there’s a genuine need for the room, it should be disregarded. The Government is penalising the people who do what they do out of love.” 11 “I’m saving the council £900 a week by caring for my wife” Jim and Sue Jim and Sue have lived in their two bedroom bungalow for 13 years. Sue has cerebral palsy so she uses a bariatric bed, which leaves her with just enough space to manoeuvre her electric wheelchair. Jim and Sue are not allowed to move because their Local Authority paid to fit tracking hoists in the bedroom and living room. They had to sign an agreement to stay in their home for the next 5 years. Despite this, their benefit has been cut by £25.30 a week. 12 Jim provides overnight care for Sue but if she received overnight care from social services, they would be exempt from the under occupation penalty. “It makes me think ‘Fine, I won’t care for my wife’. They can pay for carers to come in overnight,” says Jim. “We’re eligible for a live in carer and the council said that would cost them £900 a week. That’s how much I’m saving them.” Mr and Mrs Harman “We would need an adapted house with a living room big enough to put in a bed” Mr and Mrs Harman live in a two bedroom house which has been adapted for Mr Harman, who has mobility difficulties following a stroke. The house features a wet room, through floor lift, handrails and level access, and the couple has lived there for the past four and a half years. “We’ve got to downsize because we can’t afford the bedroom tax,” says Mrs Harman. “There seem to be a few one or two bedroom properties available but none of them are adapted.” 13 Nowhere to go, no way to pay is published by Papworth Trust. We would like to thank the people who have contributed to this report, especially those who allowed us to share their stories as case studies. About Papworth Trust Papworth Trust is a leading disability charity. We support over 20,000 people each year through a wide range of services. We also work with disabled people to campaign about issues that affect them. References 1 DWP, 2012, Impact Assessment: Housing Benefit: Under occupation of social housing 2 ComRes, April 2013, The People: Bedroom Tax Poll 3 ComRes, April 2013, The People: Bedroom Tax Poll To find out more, please contact our Policy and Campaigns team: 4 DCLG, 2009, English House Condition Survey 2007 – Annual Report 01480 357200 5 DCLG, 2008, English House Condition Survey 2006 – Annual Report policy@papworth.org.uk www.papworth.org.uk/campaigns 6 Foundations, 2010, Adapting for a lifetime: The key role of home improvement agencies in adaptations delivery Papworth Trust Bernard Sunley Centre Papworth Everard Cambridge CB23 3RG 7 Carers UK and the University of Leeds, 2011, Valuing Carers 2011: Calculating the value of carers’ support 8 DCLG, 2009, English House Condition Survey 2007 – Annual Report 9 National Housing Federation, 2013, The Bedroom Tax: Some home truths 10 DCLG, 2008, English House Condition Survey 2006 – Annual Report © Copyright Papworth Trust, April 2013. Registered Charity number 211234. If you would like a copy of this report in another format or language, please ask us using the contact details above.