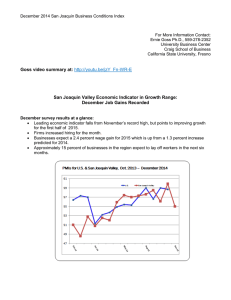

Document 13092162

advertisement

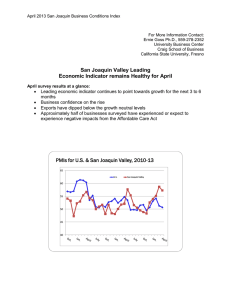

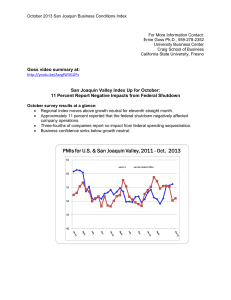

February 2013 San Joaquin Business Conditions Index For More Information Contact: Ernie Goss Ph.D., 559-278-2352 University Business Center Craig School of Business California State University, Fresno San Joaquin Valley Leading Economic Indicator Advances Again February survey results at a glance: Leading economic indicator expands for a third straight month. Export orders contract again. One-fourth of businesses expect that federal sequestration will have a negative impact on company sales. Approximately 42.9 percent of firms expanded sustainable purchasing programs over the past two years. PMIs for U.S. & San Joaquin Valley, 2010-13 65 U.S. San Joaquin Valley 60 55 50 45 40 For Immediate Release: March 1, 2013 Fresno, CA –The San Joaquin Valley Business Conditions Index advanced for a third straight month. The index is a leading economic indicator from a survey of individuals making company purchasing decisions in firms in the counties of Fresno, Madera, Kings and Tulare. San Joaquin Business Conditions Index – p. 2 of 4 The index is produced using the same methodology as that of the national Institute for Supply Management (www.ism.ws). Overall Index: The index, produced by Ernie Goss Ph.D., Research Associate with the Craig School of Business at California State University, Fresno, expanded to 55.2 from 54.0 in January and 52.6 in December. An index greater than 50 indicates an expansionary economy over the course of the next three to six months. Survey results for the last two months and one year ago are listed in the accompanying table. “ “Improvements in the area’s housing sector along with manufacturing growth pushed the overall index higher for the month. The February reading was slightly higher than the national ISM reading of 54.1. Both readings point to a slowly expanding economy,” said Goss. Employment: For a fourth straight month, the hiring gauge moved above the growth neutral threshold. However, the job index slumped to a tepid 51.1 from expanded slightly to 56.3 in January. The February 2013 index is well above the February 2012 reading of 44.8. “Readings over the past several months indicate that the job market has been expanding and will continue to improve, albeit at a slow pace,” said Goss. Wholesale Prices: The prices-paid index, which tracks the cost of raw materials and supplies, expanded to 66.0 from January’s 63.9. “The Federal Reserve Open Market Committee, which sets U.S. interest rate policy remains committed to their current aggressive ‘cheap’ money policy. While it has not sparked any significant inflationary pressures for U.S. consumers, this policy is boosting our wholesale inflation gauge and is pushing U.S. asset prices up at a pace that is causing disruptions in certain sectors of the economy such as agriculture,” said Goss. Business Confidence: Looking ahead six months, economic optimism, captured by the business confidence index, rose to a level that still indicates pessimism regarding the area’s economic outlook. The February business confidence index increased to 43.6 from January’s 41.2 and December’s much weaker 37.0. “Uncertainty surrounding sequestration and healthcare reform continue to lower business confidence. This month we asked survey member how the upcoming sequestration would affect their company’s sales. One-fourth expect the cut in federal spending to result in a reduction in unit sales for their company. It is clear that this weighed on the economic outlook this month,” said Goss. ”Inventories: Businesses contracted inventories for the month. The February index rose to 51.3 from January’s much weaker 42.6. “Sluggish growth in inventories are yet another indicator of weak business confidence,” reported Goss. San Joaquin Business Conditions Index – p. 3 of 4 Companies in the region continue to expand “sustainable” procurement policies. This month approximately 42.9 percent of firms indicated that they had expanded sustainable purchases of raw materials and supplies over the past two years. On the other hand, 33.2 percent reported no change and 23.9 reported a reduction in sustainable buying over the two year period. . Trade: New export orders weakened for February with a reading of 44.2 which was down from January’s 46.1. At the same time, December imports expanded for the moneth with an import index of 51.9, up markedly from January’s 42.3. “As our overall regional gauge moved above growth neutral for February, so did purchasing from abroad. On the other hand, economic weakness among the region’s important trading partners weighed on exports,” said Goss. Other components: Other components of the February Business Conditions Index were new orders at 58.1, up from 55.4 in January; production or sales at 55.6, down from 57.2 in January; and delivery lead time at 59.6, up from January’s 58.7, Table 1 details survey results for February 2012, January 2013 and February 2013. March survey results will be released on the first business day of next month, April 1. San Joaquin Business Conditions Index – p. 4 of 4 Table 1: Overall and component indices for last 2 months and one year ago (above 50.0 indicates expansion) San Joaquin Valley February 2012 January 2013 February 2013 Leading economic indicator 50.1 54.0 55.2 New orders 50.3 55.4 58.1 Production or sales 50.8 57.2 55.6 Employment 44.8 56.3 51.1 Inventories 49.5 42.6 51.3 Delivery lead time 55.9 58.7 59.6 Wholesale prices 62.4 63.9 66.0 Imports 48.6 42.3 51.9 Export orders 58.9 46.1 44.2 Business confidence 47.3 41.2 43.6 Craig School of Business: http://www.craig.csufresno.edu/ Follow Goss: Twitter at http://twitter.com/erniegoss or www.ernestgoss.com