PLEASE NOTE this is a 2014-15 reading list—the precise content...

advertisement

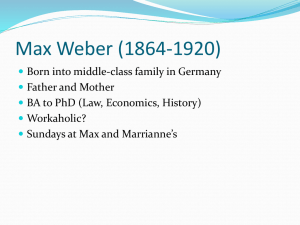

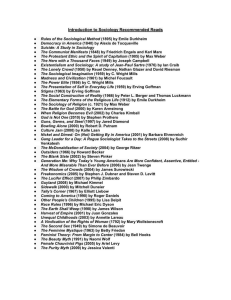

PLEASE NOTE this is a 2014-15 reading list—the precise content may change in future years. Part One: What is Economic Sociology: Classical Resources Week 2. The Classical Tradition I: What is a Market? This is the first of two weeks in which we will look at what the classical tradition of sociology has to offer economic sociology today. There is a lot of material we could cover here – including the work of figures such as Marx, Durkheim, Spencer, Veblen and others – but we will start with perhaps the most important of all: Max Weber. Most students know Weber through his writings on the Protestant Ethic, but this week we will look in detail at his economic sociology (which is the focus of Chapter 2 of his life’s work Economy and Society – note the title of this book!). In particular we will read key excerpts from this work which address the relation of economic action to social action, the basis of what constitutes ‘a market’, and the what a ‘market economy’ is in distinction to one that is ‘centrally planned’. Although some of this material may seem a little dry, this is foundational work that we will build upon in coming weeks. For a very clear introduction to the field of economic sociology (although it is now a little dated), see Smelser, N.J. and Swedberg, R. (2005) ‘Introducing Economic Sociology’ in their Handbook of Economic Sociology. Princeton: Princeton University Press. For an excellent collection of interviews with major economists/economic sociologist which will be useful background reading for the module, see Swedberg, R. (1990). Economics and Sociology. Princeton: Princeton University Press. Key Reading: Weber, M. (1978). Economy and Society Volume One. Berkeley: University of California Press. The following sections from Chapter 2, ’Sociological Categories of Economic Action’: 1. ‘The Concept of Economic Action’, pp.63-8. 8. ‘The Market’, pp.82-5. 14. ‘Market Economies and Planned Economies’, pp.109-11. 31. ‘The Principle Modes of Capitalistic Orientation of Profit-Making’, pp.164-6. 41. ‘The Mainspring of Economic Activity’, pp.202-6. And also Chapter 7, ‘The Market: Its Impersonality and Ethic’, pp.635-40. This book is in the short-loan section of the library as we are not allowed to reproduce this text via a scan because of copyright law. However, a free download of the PDF of this book can be found here. Further Reading: Weber also wrote two popular pamphlets on markets. It would be useful if you could look at one or the other of these: ‘Stock and Commodity Exchanges’. Theory and Society, 29, 3, June, pp.305-38. ‘Commerce on the Stock and Commodity Exchanges’, 29, 3, June, pp.339-71. For an excellent introduction to the work of Weber on this subject, see Swedberg, R. (1998). Max Weber and the Idea of Economic Sociology. Princeton: Princeton University Press. Another text that might be useful is Gane, N. (2012). Max Weber and Contemporary Capitalism. Basingstoke. In particular Chapter 4, ‘Markets’, pp.50-71. [This is available from the library as an ebook]. Week 3. The Classical Tradition II: The Sociology of Competition One word that goes hand-in-hand with Weber’s theory of the market is ‘competition’. Weber argues that markets are not just sites of exchange (a term that is foundational for much social science) but competition within and between buyers and seller over price. But what exactly is competition? Today, under so-called ‘neo-liberal’ conditions (a term we will address in further weeks), competition and competitiveness is said to be a good thing: it can stimulate growth and, paradoxically, lead to social cohesiveness. These are ideas that we will place into question. But, first, we will explore the social dynamics of competition itself. To do this, we will turn back to a brilliant but neglected piece by Georg Simmel that dates from 1903: ‘The Sociology of Competition’. We will ask what a sociology of competition is and why it is potentially important today. Key Reading: Simmel, G. (2008). ‘The Sociology of Competition’. Canadian Journal of Sociology, 33, 4, pp.957-78 Further Readings: Davies, W. (2014). The Limits of Neoliberalism. London: Sage. Chapter 2. Duina, F. (2011). Winning: Reflections on an American Obsession. Princeton: Princeton University Press. Mannheim, Karl (1971). ‘Competition as a Cultural Phenomenon’ in Kurt H. Wolff (ed.), From Karl Mannheim. Oxford: Oxford University Press, pp.223-61. Simmel, G. (1964). Conflict: The Web of Group Affiliations. New York: The Free Press. See Chapters 1 and 3. Weber, M. (1978). Economy and Society Volume One. Berkeley: University of California Press. See the section on ‘Conflict, Competition, Selection’, pp.38-40. For an introduction to Simmel’s writings see: Frisby, D. (1992). Simmel and Since: Essays on Georg Simmel's Social Theory. London: Routledge. For neoliberal writings that celebrate the value of competition, see: Hayek, F. (1948). Individualism and Economic Order. Chicago: Chicago University Press. Chapters 5 and 6. Kirzner, I. (1973). Competition and Entrepreneurship. Chapter 3. Part Two: Market Society and Its Limits Week 4. The Powers of Markets: Early Neoliberal Thought Max Weber’s writings on markets did not go unnoticed by economists – particularly by those with an Austrian background. Friedrich Hayek (who won the Nobel Prize in Economic Sciences) and his mentor, Ludwig von Mises, were particularly interested in Weber’s work and both were well-versed in the classical sociological tradition. Indeed, Hayek was the first person to attempt to translate Chapter One of Weber’s Economy and Society into English. This week we will read one of Hayek’s key essays from the mid-1940s: ‘The Use of Knowledge in Society’. As the title of this essay suggests, Hayek has a particular view not only of society but of the relation of the economy to society, and this is quite different from that advanced by Weber. For Hayek, the market is a ‘marvel’ that acts as a great coordinating force – one that brings together fragments of lay knowledge held by dispersed individuals, often through acts of competition. Hayek’s view is that the market is the greatest information processor known to humankind, and is unrivalled by all other social forms (including the state). Today, this view is more popular than ever and ‘economic’ and ‘market-based’ (or what we might call neoliberal ideas) are, increasingly, in the ascendency. We will ask why this is, while at the same time identifying the strengths and weakness of Hayek’s position. Even if you don’t agree with Hayek’s argument, why has it proved to be so influential? Key Reading: Hayek, F.A. (1948). Individualism and Economic Order, Chapter 4, ‘The Use of Knowledge in Society’, pp.77-91. Chicago: Chicago University Press. Please read further into this book if you have time. Download it for free. Further Readings: Burgin, A. (2012). The Great Persuasion: Reinventing Free Markets. Cambridge: Harvard University Press. Chapter 1. Caldwell, B. (2005). Hayek’s Challenge: An Intellectual Biography of F.A. Hayek. Chicago: Chicago University Press. Gamble, A. (1996). Hayek: The Iron Cage of Liberty. Cambridge: Polity. Gane, N. (2014). ‘Sociology and Neoliberalism: A Missing History’. Sociology. Hayek, F. (1944). The Road to Serfdom. London: Routledge. Hayek, F. (1960). The Constitution of Liberty. London: Routledge. Wapshott, N. (2012). Keynes Hayek: The Clash That Defined Modern Economics. New York: Norton. For the methodological statement that frames much of Hayek’s work, even if the latter departs from it in important ways, see Max Weber, Economy and Society, Chapter 1. Berkeley: University of California Press. For a brilliant overview of the activities and reach of the neoliberal think-tank that Hayek established in 1947 – The Mont Pelerin Society – see Mirowski, P. and Plehwe, D. (eds.) (2009). The Road from Mont Pelerin The Making of the Neoliberal Thought Collective. Cambridge: Harvard University Press. Week 5. In Critique of Neoliberalism: Is Market Society Pathological? One of the main critics of the type of market society advocated by Friedrich Hayek is Karl Polyani. Polanyi would have known Hayek’s work well as his brother – Michael Polayni - worked closely with Hayek and was an early member of the neoliberal think-tank, The Mont Pelerin Society (which was founded by Hayek in 1947 and is still very much in existence). We will read an extract from Karl Polayni’s most famous work The Great Transformation (first published in 1944 – the same year as Hayek’s best-selling The Road to Serfdom). This is an extraordinary book which questions both the assumption that market society is natural and the idea that markets are able to regulate themselves (a question that returned to the fore after the recent financial crisis). We will use Polayni’s text to question the limits of markets and to think about the two social dynamics that are not purely economic in basis: reciprocity and redistribution. This will lead to further questioning of the normative relationship between the economy and society. One of the questions here is who, exactly are markets good for, and what are there 'social costs'. This feeds into recent political debates over the value of proposed organizations such as the Transatlantic Trade Investment Partnership (TTIP) - see https://www.youtube.com/watch?v=Y4OQeekSD6s&feature=youtu.be Key Reading: Polanyi, K. (1944). The Great Transformation, Chapter 4, ‘Societies and Economic Systems’, pp.45-58. Boston: Beacon Press. Please read further into this book if you have time. Further Readings: Block, F. (2003). ‘Karl Polanyi and the Writing of the Great Transformation’. Theory and Society, 32, 3, pp.275-306. Block, F. and Somers, M. (2014). The Power of Market Fundamentalism: Karl Polanyi's Critique. Cambridge: Harvard University Press. Dale, G. (2013). Karl Polanyi: The Limits of the Market. New York: Wiley. [Available from the library as an e-book]. Lacher, H. (1999). ‘The Politics of the Market: Re-Reading Karl Polanyi’. Global Society, 13, 3, pp.313-26. Levitt, K. (2013). From the Great Transformation to the Great Financialization: On Karl Polanyi and Other Essays. London: Zed Books. Mendell, M. and Salée, D. (eds.) (1991). The Legacy of Karl Polanyi: Market, State and Society at the End of the Twentieth Century. Basingstoke: MacMillan. Week 6. Political Economics: Neoliberalism as a Form of Governance In the previous week, we considered the argument that Polanyi’s argument that markets are limited in power because they are never ultimately able to regulate themselves. This week we will return to this question by looking at the post-War intervention of the ordoliberals – a group of economists (many of whom also considered themselves to be sociologists) clustered around the journal Ordo in post-War Germany. The importance of this group of thinkers is outlined by Michel Foucault in his lectures on biopolitics. The key point is that they argue for a state, and ultimately a vision of the social, that is founded upon principles that come from the market. For if markets are unable to regulate themselves then it should be the role of state and government to make sure that they operate as best they can – and this means injecting dynamics of competition into all forms of social and cultural life. This might sounds far-fetched, but many have argued that the state has acted in exactly this way through and following the recent crisis: it has acted as guarantor (to use Foucault’s word) of market capitalism. We will think critically about this situation, while at the same time seeking to identify contemporary examples where market-led principles of competition and competitiveness are at play. Key Reading: Foucault, M. (2008). The Birth of Biopolitics, lecture from the 14 February, 1979, pp.128-57. Basingstoke: Palgrave. [Available from the library as an e-book]. Further Readings: Bonefeld, W. (2013). ‘Adam Smith and Ordoliberalism: On the Political Form of Market Liberty’. Review of International Studies, 39, 2, April, pp.233-50. Bonefeld, W. (2012). ‘Freedom and the Strong State: On German Ordoliberalism’. New Political Economy, 17, 5, pp.633-56. Burrows, R. (2012). ‘Living with the h-index? Metric Assemblages in the Contemporary Academy’. Sociological Review, 60, 2, May, pp.355-72. Dardot, P. and Laval, C. (2013). The New Way of the World: On Neoliberal Society. In particular Chapters 3 (pp.75-100) and 7 (pp.193-214). London: Verso. Gane, N. (2012). ‘The Governmentalities of Neoliberalism: Panopticism, Post-panopticism and Beyond’. Sociological Review, 60, 4, November, pp.611-34. Gane, N. (2014). ‘The Emergence of Neoliberalism: Thinking Through and Beyond Michel Foucault’s Lectures on Biopolitics’. Theory, Culture and Society, 31, 4, July, pp.3-27. Ptak, R. (2009). ‘Neoliberalism in Germany: Revisiting the Ordoliberal Foundations of the Social Market Economy’ in Mirowski, P. and Plehwe, D. (eds.) The Road to Mont Pelerin. Cambridge: Harvard University Press. Part Three: Contemporary Challenges Week 7. Embeddedness and ‘the Economy’ From the 1980s onwards, new forms of economic sociology have emerged that question many of the core arguments and assumptions of the classical tradition. In these two weeks of the module, we will look at the work of three thinkers that have been central to this (re-)development of economic sociology: Mark Grenovetter, Karin Knorr Cetina and Timothy Mitchell (there are many others but we cannot cover everyone here! See the further readings for a flavour of the work, for example, of Donald MacKenzie or Harrison White). One of the key themes of this week is whether the economy, and economic life, exists as something separate from what might be called ‘the social’ – the question of ‘embeddedness’. Max Weber believed that with the passage to the modern world a number of different ‘life-orders’ separated out from one another and ultimately entered into conflict. Weber argues that one of these spheres is the ‘economic’. This week we will ask exactly what an ‘economy’ is and how it is related to social life: is it something relatively autonomous in its own right, or is it inextricably bound up or ‘embedded’ in sets of social relations. This question, which becomes even more complex with the technologisation of market forms (something we will consider next week), will lead us to reflect critically on much of the material we have covered so far, in particular the work of Weber, Hayek and Polanyi. Key Readings: Granovetter, M. (1985). ‘Economic Action and Social Structure: The Problem of Embeddedness’. American Journal of Sociology, 91, 3, November, pp. 481-510. Mitchell, T. (2008). ‘Rethinking Economy’. Geoforum, 39, 3, pp.1116-21. Further Readings: Mitchell, T. (2005). ‘The Work of Economics: How a Discipline Makes Its World’. European Journal of Sociology, 46, 2, August, pp.297-320. Mitchell, T. (2005). ‘Economists and the Economy in the Twentieth Century’ in Steinmetz, G. (ed.) The Politics of Method in the Human Sciences: Positivism and its Epistemological Others. Duke University Press. Sassen, S. (2005). ‘The Embeddedness of Financial Markets’, pp. 17–37 in K. Knorr Cetina and A. Preda (eds.) The Sociology of Finance. Oxford: University of Oxford Press. Uzzi, B. (1996). ‘The Sources and Consequences of Embeddedness for the Economic Performance of Organizations: The Network Effect’. American Sociological Review, 61, 4, pp.67498. Week 8. Markets Today: Globalization and Technology While the underlying analyses and arguments of Weber and Simmel (along with other classical sociologists) remain useful for exploring the dynamics of contemporary capitalist society, markets today are quite different in form from those of the late-19th Century and early-20th Century. This week we will look at two aspects of contemporary markets that have attracted recent sociological attention: their global reach and, increasingly, their highly technologized form. No longer are markets simply local or national in basis (as they were at the time Weber wrote his economic sociology), they are now transnational, networked forms that work out of and between key global centres (London, New York, Chicago, Tokyo etc). With the emergence of new digital technologies, the question of time has become ever more significant as markets have become ever faster (in terms, for example, of the speed at which trades can be executed, or algorithmic ‘bots’ can react to market-related news). Markets have become more like machines or even media. The aim of this week is to consider the challenges these developments present to economic sociology. Key Reading: Cetina, K.K. (2006). ‘How are Global Markets Global?’, in Cetina, K.K. and Preda, A. (eds.) The Sociology of Financial Markets. Oxford: Blackwell. Further Readings: Gane, N. (2006). ‘Speed Up or Slow: Social Theory in the Information Age’. Information, Communication and Society, 9, 1, pp.20-38. Giddens, A. (1990). The Consequences of Modernity. Cambridge: Polity. Giddens, A. (1991). Modernity and Self-Identity. Cambridge: Polity. Lenglet, M. (2011). ‘Conflicting Codes and Codings: How Algorithmic Trading Is Reshaping Financial Regulation’. Theory, Culture and Society, 28, 6, pp.44-66. MacKenzie, D. (2008). Material Markets: How Economic Agents Are Constructed. Oxford: Oxford University Press. MacKenzie, D. (2011). ‘How to Make Money in Microseconds’. London Review of Books, 33, 10, 19th May, pp.16-18. Sassen, S. (2000). ‘Digital Networks and the State: Some Governance Questions’. Theory, Culture and Society, 17, 4, pp.19-33. Week 9. Crowds in Markets One of the major questions to be addressed by economic sociologists in recent years is whether market participants are deliberative, rational actors or rather whether markets are made up of crowds that are barely rational because they are made up of people following or ‘imitating’ each other (especially in times of crisis – a theme we will turn to in the final lecture of this module). This week we will look closely at this question by reading between a classic text (part of Weber’s Chapter 1 of Economy and Society) and a more recent article by Jakob Arnoldi and Christian Borch. We will ask exactly what a ‘crowd’ is and will question where the dividing line falls between crowd behaviour and what Weber calls ‘social action’. Key Readings: Weber, M. (1978). Economy and Society Volume One. Berkeley: University of California Press. Read pp.22-6 closely (from the beginning of section B on Social Action). Arnoldi, J. and Borch, C. (2007). ‘Market Crowds Between Imitation and Control’. Theory, Culture and Society, 24, 7-8, pp.164-80. Further Readings: Borch, C. (2007). ‘Crowds and Economic Life: Bringing an Old Figure Back In’. Economy and Society, 36, 4, pp.549–73. Borch, C. (2012) .The Politics of Crowds: An Alternative History of Sociology. Cambridge: Cambridge University Press. Canetti, E. (1984). Crowds and Power. New York: Farrar. Easley, D. and Kleinberg, J. (2010). Networks, Crowds and Markets: Reasoning About a Highly Connected World. Cambridge: Cambridge University Press. Gane, N. (2012). Max Weber and Contemporary Capitalism. Basingstoke: Palgrave. Look in particular at Chapter 4. Le Bon, G. (2002). The Crowd: A Study of the Popular Mind. New York: Dover Publications. Tarde, G. (2003). The Laws of Imitation. Ann Arbor: University of Michigan Press. White, H.C. (1981) ‘Where Do Markets Come From?’. American Journal of Sociology, 87, 3, pp.517–47. Week 10. The Sociology of Crisis. Until recently it would be rare to find the topic of crisis covered on an economic sociology module. But things have changed. In the autumn of 2007, market capitalism plunged into a state of acute crisis. In the UK, there was the first run on a high street bank (Northern Rock) for nearly 100 years, and the following year the British Government rescued the Royal Bank of Scotland by becoming a majority shareholder. The US, meanwhile was gripped by a sub-prime crisis that led, among other things, to the bankruptcy of Lehman Brothers, which was at the time the fourth largest investment bank in America. Through this period the foundations of global capitalism were shaken to their core, and, for a moment at least, the previous confidence in the powers of markets disappeared. We will consider three main things: 1). what constitutes a ‘crisis’; 2). whether the economic sociology we have study on this module can be used to understand the events that played out from 2007 onwards; and 3). whether economic sociology itself needs to learn from these events. For a very good popular text on this topic, see John Cassidy’s How Markets Fail: The Logic of Economic Calamities. London: Penguin Key Reading: Gamble, A. (2009). Spectre at the Feast: Capitalist Crisis and the Politics of Recession. Chapter 1, ‘Crises of Capitalism’, pp.13-35 (and also Chapter 2 if possible). Basingstoke: Palgrave. Further Reading: Davies, W. (2014). The Limits of Neoliberalism, in particular Chapter 5 ‘Contingent Neoliberalism: Financial Crisis and Beyond’, pp. 148-87. London: Sage. Gamble, A. (2014). Crisis Without End?: The Unravelling of Western Prosperity. Basingstoke: Palgrave. Mirowski, P. (2013). Never Let a Serious Crisis Go To Waste. London: Verso. Roitman, J. (2013). Anti-Crisis. Durham: Duke University Press. Streeck, W. (2014). Buying Time: The Delayed Crisis of Democratic Capitalism. London: Verso. Žižek, S. (2009). First as Tragedy, Then as Farce. Chapter 1, ‘It’s Ideology Stupid!’, pp.9-85. London: Verso. Žižek, S. (2010). Living in the End Times. London: Verso.