The Tata Power Company Limited Investors’ Meet - February 2009 1

advertisement

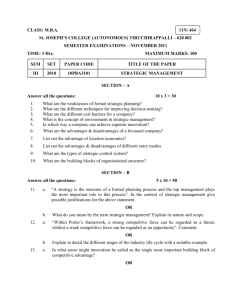

The Tata Power Company Limited Investors’ Meet - February 2009 1 Disclaimer Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited’s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited’s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited’s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. The information contained in this presentation, unless otherwise specified is only current as of the date of this presentation. Unless otherwise stated in this document, the information contained herein is based on management information and estimates. The information contained herein is subject to change without notice and past performance is not indicative of future results. The Tata Power Company Limited may alter, modify or otherwise change in any manner the content of this presentation, without obligation to notify any person of such revision or changes. This presentation may not be copied and disseminated in any manner. THE INFORMATION PRESENTED HERE IS NOT AN OFFER FOR SALE OF ANY EQUITY SHARES OR ANY OTHER SECURITY OF THE TATA POWER COMPANY LIMITED. 2 Agenda • Part A: Overview of Tata Power • Part B: Power Business – Section 1: Generation – Section 2: Fuel & Logistics – Section 3: T & D – Section 4: Power Trading • Part C: Other Businesses • Part D: Financial Performance • Part E: Sustainability 3 Part A: Overview of Tata Power 4 A Tata Company 5 Tata Power: Introduction • Largest private, integrated utility company in India today with presence across the value chain in fuel, generation, T&D and trading • Founded in 1906, to supply hydro-electric power to Mumbai. Set-up thermal generation in Trombay in 1960s • • • Expanded outside Mumbai with IPP (Belgaum) and CPP (Tata Steel) in 1990’s Thrust on renewables including wind, hydro and solar Successful Public Private Partnerships in generation, transmission and distribution 6 Pioneer in Power Sector First 800 MW thermal unit First pump storage unit in the country of 150 MW Capacity First to Introduce SCADA and Fibre Optic ground wire communication Flue Gas De-sulphurisation plant using sea water 220 kV Cable Transmission 220 kV Network transmission Computerized lines in grid control First four circuit and energy gas towers management First insulated system 500 MW switch First 150 MW thermal gear thermal unit unit 7 Existing Presence in Power Sector Tala Transmission NDPL Jojobera 428 MW Samana 29 MW Trombay 1330 MW Mumbai Distribution Mumbai Transmission Hydro 447 MW Supa 17 MW Haldia 90 / 120 MW Khandke 51 MW Bramanvel 11 MW Thermal (1839 MW) Belgaum 81 MW Gadag 16 MW Hydro (471 MW) Wind (124 MW) Transmission Other Projects: 1. Indonesian Coal Mines: 30% stake 2. Geodynamics: 10% stake 3. Exergen: 5% stake Distribution 8 Tata Power Group – Major Companies Tata Power Subsidiaries 100% 100% 100% 74% Joint Ventures Coastal Gujarat Power Ltd 49% Tata Power Trading Company Ltd` 40% Trust Energy Resources Pte Ltd 33% Tata BP Solar Ltd Tubed Coal Mine Ltd Mandakini Coal Mine Ltd Maithon Power Ltd 74% Industrial Energy Ltd 51% North Delhi Power Ltd 51% Powerlinks Transmission Ltd 50% Nelco Ltd Associates 30% KPC 30% Arutmin 40% 9 • • • • • • • • • • • Trombay 14, 25 Hydro 14, 32 Jojobera 23 Belgaum 14 Haldia 27 Wind Farm 33-35,60 Solar PV 49 Mundra Maithon Tata Steel JV (IEL) Tata BP Solar Transmission • • Mumbai Tala 42 Distribution • • Mumbai Delhi 42 • Tata Power Trading • • • • • Indonesian Coal Mines Coal Bed Methane Mandakini Tubed TPC Asia Businesses Generation Division Other Entities Power Business Tata Power Trading Fuel & Logistics Other Business • SED • NELCO 48 Refer to page numbers in black, for details 10 Part B: Power Business – Section 1: Generation – Section 2: Fuel & Logistics – Section 3: T & D – Section 4: Power Trading 11 Generation: Business Models 12 Impact of New CERC Norms 13 Tata Power: Existing Operations Mumbai Licence Area (1777 MW) Trombay - Thermal Hydro Power Generation Unit 4 150 MW Oil & Gas Khopoli 72 MW Unit 5 500 MW Oil, Coal & Gas Bhivpuri 75 MW Unit 6 500 MW Oil & Gas Bhira 300 MW Unit 7 180 MW Gas Total 447 MW Total 1330 MW Wind 124 MW Jojobera 428 MW Belgaum Haldia 90 MW 81 MW CPP IPP 14 CPP Thermal Projects Under Implementation Maithon1050 MW Jojobera/Jamshedpur 240 MW Mundra 4000 MW Haldia 30 / 120 MW Trombay 250 MW Thermal (5570 MW) 15 Project Capacity • 4000 MW (5 x 800 MW) Ownership Structure • 100% subsidiary: Coastal Gujarat Power Limited Business Model • Case 2 Customers • Gujarat (1805 MW), Maharashtra (760 MW), Punjab (475 MW), Haryana (380 MW), Rajasthan (380 MW) Funding • Project Cost: Rs 17,000 Crore (D/E: 75:25) • Financial closure completed in April 08 – lenders such as IFC, ADB Completion • Targeted by 2012 vs 2014 as per bid conditions Project Description • Fuel: 10 mtpa offtake agreement with KPC/Arutmin - 50% for Mundra. Pricing part fixed and part linked to CERC index Mundra UMPP 16 Project Milestone • Over 13% work already completed Construction Activities • Structural erection is in progress for two boiler units and civil work is progressing well at site On-site • Over 2500 people already located on site Funding • CGPL completed all pre-disbursement conditions and received its first disbursement of loans in this quarter on contracted terms Mundra UMPP 17 Mundra - Boiler and TG Building 18 Mundra - Cooling Water Conduits below TG Rafts 19 Project Capacity • 1050 MW (2 x 525MW) Ownership Structure • Maithon Power Limited 74: 26 JV of Tata Power and Damodar Valley Corporation Business Model • Regulated Customers • DVC (300 MW), NDPL (300 MW), WBSEB (150 MW), PSEB (300 MW) Funding • Project Cost: Rs 4450 Crores • (D/E: 70:30) • Debt syndication completed Completion • Unit 1: 2010, Unit 2: 2011 Project Description • Fuel: Linkage Coal, initial supply by DVC Maithon 20 Project Milestone • Over 21% of work completed Ordering • Ordering for all packages completed Construction Activity • Column erection completed for Boiler Unit-1 • Foundation completed for Boiler Unit-2 Fuel Supply • Coal linkage sanctioned. Active discussions on to sign Fuel Supply Agreements with coal mines 400 KV Switchyard Column Casting 21 Unit 1- Erection of column & roof girder Unit 1- Column casting in progress for TG deck slab. Unit - 2 Foundation work Unit 1- Mill Bunker 22 JAMSHEDPUR (PH #6) Project Capacity • 120 MW JOJOBERA (Unit #5) • 120 MW Ownership Structure • IEL (74:26 JV of Tata Power and Tata Steel) • IEL Business Model • CPP • CPP Funding • Project Cost: Rs 490 Crores • Project Cost: Rs 620 Crores • D/E 70:30 • D/E 70:30 Completion • March 2009 • December 2009 Project Description • • Fuel: Coke oven gases of Tata Steel Fuel: Linkage from West Bokaro and Mahanadi Coal field. Captive Power Plants 23 Jamshedpur (PH #6) – Site Photographs TG Rotor erection IDCT Commissioned 24 Project Capacity • 250 MW Ownership Structure • Tata Power Division Business Model • Regulated + Merchant Funding • Project Cost: Rs 1066 Crore • D/E 70:30 Completion • Synchronized in January 2009 • Commissioning by March 2009 Project Description • Fuel: Imported coal Trombay Unit 8 25 Trombay (Unit 8) – Site Photographs 26 Project Capacity • 120 MW (2 x 45 MW + 30MW) Ownership Structure • Tata Power Division Business Model • Merchant and Regulated Customers • Hoogly Metcoke, PPA with Tata Power Trading and WBSEDCL Funding • Project Cost Rs 605 Crores • D/E 70:30 Completion • 1st two 45MW units commissioned in August ‘08 and December ‘08 • 3rd unit expected to commission in March ‘09 (30MW) Project Description • Fuel: Hot flue gases from Hoogly Metcoke Haldia 27 Haldia – Site Photographs 2 1 TG Unit # 1 & 2 in operation Boiler # 3 – 2 under erection 28 Projects in Pipeline Total Planning & development activities initiated 29 5670 Captive Coal Blocks Mandakini Coal Block • 7.5 MTPA (jointly allotted with Jindal Photo Film and Monnet Ispat & Energy - each JV Partner having a share of 2.5 MTPA) at Dist. Angul, Orissa • Submission of EIA Report: Jan / Feb ‘09 • Approval of mining plan by MoC: Jan / Feb ‘09 • Start of Production: July 2011 Tubed Coal Block • 5.75 MTPA [Jointly allocated with Hindalco at Latehar, Jharkhand – Hindalco (60%) 3.45 MTPA & Tata Power (40%) 2.30 MTPA] • Submission of application for Environmental Clearance: Mar 2009 • Submission of Draft Mining Plan to MoC: Jan 2009 • Start of Production: Sep. 2011 30 Generation Capacity (Tata Power Group) Tata Power - Capacity 14000 12000 5200 10000 Capacity in MW 8000 3075 6000 4000 2000 0 2365 2008 613 2365 2009 7398 1125 220 2978 3198 2010 2011 Year Ended Mar 31 31 4323 2012 2013 Added in the Year Opening Capacity Hydro Electric Power • Oldest and one of the largest private sector players with capacity of 447 MW • Several awards and recognitions – Bhira Pump Storage Scheme received the CEA Silver Shield • Agreed to take 26% equity stake in 114 MW Dagachhu Hydro Electric Power Project being developed by The Royal Government of Bhutan • MoU with a European firm to jointly develop hydro opportunities in India and Nepal • Actively exploring additional 1000 MW in large hydel projects including India, Nepal, Bhutan etc – final stages of negotiations for 120MW, with import of power 32 Initiatives In Renewables • 124 MW operational • 72 MW to be commissioned – 52 MW by March ’09, 20 MW by April ‘09 • 300 MW being additionally explored • Developing a 3 MW grid connected solar PV farm in Maharashtra • Evaluating potential for concentrated solar thermal (CST) generation • Signed MoU with Govt. of Gujarat for 5 MW solar plant Renewable / Clean Coal Other Initiatives • Acquired 10% stake in Geodynamics Limited, Australia • Acquired 5% stake in Exergen, Australia • Signed MoU with Govt. of Gujarat for 5 MW geothermal plant • Exploring micro hydel opportunities • Actively looking for fuel cell technology partners to pursue opportunities in the Indian market • Exploring feasibility of standalone biomass based power plants • Exploring possibilities of large scale geothermal generation 33 Installed Capacity • 124 MW Project Under Implementation • 73 MW (35 MW Karnataka, 21 MW Gujarat, 17 MW Maharashtra) Ownership Structure • Tata Power division Business Model • Regulated Funding • Project Cost: Rs 633 Crores Completion • March - April 2009 Project Description • Turnkey projects by Enercon Wind Farms 34 Wind Projects Under Implementation Samana 21 MW Sadawaghapur 17 MW Gadag 35 MW Wind (73 MW) 35 Part B: Power Business – Section 1: Generation – Section 2: Fuel & Logistics – Section 3: T & D – Section 4: Power Trading 36 Fuel Fuel supplies fo r new projects fo 37 25 0 r2 rs a e y Indonesian Coal Mines Deal Highlights Performance • Acquired 30% equity stake in KPC and Arutmin from PT Bumi Resources, Indonesia • Quantity mined in Jan-Sep 2008 ~ 37MT • Acquisition value of USD 1.1 bn • Average realised price per tonne (FOB) – US$70.5 (Jan-Sep 2008) • Off-take contract with KPC for 10.5 mtpa ± 20% (at Tata Power’s option) • EBITDA from Operations – US$792 millions (Jan-Sep 2008) Source – Bumi Resources Loading port – all weather, capable of handling cape size vessels Mining operations are efficient – Rio Tinto and BHP practices followed Loading portLoading at KPC port at KPC Coal conveyor belt at KPC 38 Coal conveyor belt at KPC Trust Energy Asia Pte Limited • SPV incorporated in Singapore for owning ships to meet shipping requirements and trading in fuels • Present shipping requirements of 8-9 vessels for Mundra • To be met through a combination of long term charters and out right purchases – 3 LT charters signed and 2 Korean build vessels purchased for delivery in 2011 • Spare capacity may be used commercially 39 Part B: Power Business – Section 1: Generation – Section 2: Fuel & Logistics – Section 3: T & D – Section 4: Power Trading 40 Distribution Opportunities • Second License – parallel licensing unlikely to happen soon • Privatization – not much progress in replicating Delhi model • Outsourcing – opportunity for marginal players • Franchisee Opportunity – window is open for private participation 41 Mumbai: Transmission and Distribution • 23,000 customers with 2500 MUs of sales (mostly to high value bulk consumers) • 17 receiving and distribution stations, 318 consumer substations and 1335 Kms of HT & LT Cable network. Total asset base over Rs 1400 crores • MERC regulated tariff with 16% RoE on distribution and 14% on transmission. Incentive on reducing ATC losses • Supreme Court has held that Tata Power was entitled to effect supply of electrical energy in retail directly to consumers 42 North Delhi Power Limited (NDPL) • 51:49 JV of Tata Power and Delhi Vidyut Praday Nigam (Govt. of Delhi) • Over 1 million consumers with 5000 MUs consumption and net asset base of over Rs 1800 Crores • Assured returns upto 16%, plus incentives on loss reduction YTD FY09: Sales – Rs 18.14 billion, PAT Rs 1.17 billion Dividend – 12% on enhanced capital, after 1:2 bonus AT&C Losses 43 Powerlinks Transmission Limited • • • 51:49 JV of Tata Power and Power Grid Corporation of India • • Total investment of Rs 1560 Crores (D/E 70:30) 1200 km 400 kV double-circuit transmission lines Transmits power from Tala Hydroelectric Project and Eastern/North-Eastern region to New Delhi and adjoining areas. CERC based tariff (14% ROE) with incentive of 10% (pre-tax) as majoration charges YTD FY09: Operating Income – Rs 1.67 billion, PAT – Rs 0.32 billion, Dividend – 8% 44 Part B: Power Business – Section 1: Generation – Section 2: Fuel & Logistics – Section 3: T & D – Section 4: Power Trading 45 Tata Power Trading Company Limited TPTCL Sales (MU) Role 6750 7000 • 6000 MUs • 4500 5000 4000 3000 • 3000 2000 1000 0 1205 1711 674 • 76 '04-05 '05-06 '06-07 '07-08 '08-09 (E) '09-10 (E) '10-11 (E) • • • Identify and tap surplus power source in the country Locate a customer who is ready to pay in cash the for power at its landed cost inclusive of transmission losses Settle commercial terms on both sides such that trader’s open positions are minimized Organize and ensure physical delivery (RTC control room operation) Ensure payment security on both ends Balance the risk within regulated trading margin of 4 paisa Develop the power trading market YTD FY09: Operating Income – Rs 13.97 billion, PAT – Rs 0.04 billion, Dividend – 20% 46 Part C: Other Businesses 47 Strategic Electronics Division (SED) • • Revenues of Rs.59 crores (Mar 08) against Rs.51 crores during the previous year. • • • Future revenue to come from MBRL Pinaka production order and Air Defence System. • Current revenue contributors include electronics system for the Rocket Launchers, Fire Control Computers for Arjun Tank and Command and Control systems. Defence spend over Rs. 400 bn, 40% indigenous. Expected growth ~ 15%. SED expected to be granted Raksha Udyog Ratna status which will provide access to technology, prequalification benefits and defence R&D budgets 7 manufacturing licenses of SED to provide access to foreign vendors under domestic offset obligation 48 Tata BP Solar • • • • 51:49 JV between BP Solar and Tata Power • Growth plans include expansion of its module manufacturing facility and thrust on domestic sales Market leader in Solar Photovoltaic technology in India with turnover of Rs 660 Crores Nearly 75% of sales from exports largely to Europe and USA India’s first Polycrystalline Solar cell manufacturing plant and 45 MW module manufacturing facility (largest in the region) 49 Part D: Financial Performance 50 Financials - Year Ended March 31, 2008 Year Ended 31-Mar-08 31-Mar-07 59.16 47.15 (49.79) (39.92) 9.37 7.23 Interest & Finance charges (1.42) (1.89) Depreciation (2.91) (2.92) Other Income 4.66 3.44 Profit Before Tax 9.70 5.86 Provision for Taxes (1.00) 1.11 Statutory Appropriations (0.59) (0.23) 8.11 6.74 Rupees in Billions Operating Income Operating Expenditure Operating Profit Profit After Tax Dividend: Mar 2008 – 105%, Mar 2007 – 95%, Equity Share Capital – Rs.2.21 billion 51 Financials – Nine Months ended December 31, 2008 Quarter Ended Nine Months Ended 31-Dec- 08 31-Dec-07 31-Dec-08 31-Dec-07 17.77 14.19 57.62 42.81 (15.17) (11.51) (49.21) (34.98) 2.60 2.69 8.41 7.84 Interest & Finance charges (0.78) (0.44) (0.95) (0.99) Depreciation (0.81) (0.70) (2.30) (2.13) Other Income 0.25 0.41 1.85 2.41 Profit Before Tax 1.26 1.96 7.02 7.13 Provision for Taxes (0.11) 0.01 (1.34) (0.68) Statutory Appropriations (0.14) - (0.51) - 1.01 1.97 5.17 6.45 Rupees in Billions Operating Income Operating Expenditure Operating Profit PAT after Statutory Appropriations 52 Financials - Consolidated Year Ended March 31, 2008 Year Ended 31-Mar-08 31-Mar-07 Operating Income 108.91 64.76 Operating Expenditure (87.70) (53.85) Operating Profit 21.21 10.91 Interest & Finance charges 4.88 2.83 Depreciation 5.59 4.15 Other Income 4.79 2.67 Profit Before Tax 15.53 6.60 Provision for Taxes (3.76) 0.99 Profit Before Minority Interest 11.77 7.59 Minority Interest/Associates (1.22) 0.01 Profit After Minority Interest 10.55 7.60 Statutory Appropriations (0.59) (0.23) 9.96 7.37 Rupees in Billions Profit after Statutory Appropriations 53 Tata Power – Financials (Standalone) Annual Sales (MU) Profit After Tax (In Billion Rs.) EPS (in Rs.) Net Worth (In Billion Rs.) 54 Dividend History Earnings (Rs.) 40 40 Dividends (Rs.) Payout ratio (%) 30 30 Rs. 20 20 10 10 0 0 2003 2004 2005 55 2006 2007 2008 % Funding by Tata Power - Projects under Implementation Own Funds (Rs.5,100 Crores) Debt (Rs.18,000 Crores) • Internal accruals: Rs.2800 Crores • Domestic loans through domestic financial institutions, banks and capital markets • Remainder – Disinvestment of various holdings or assets • Foreign loans through external Credit Agencies and Multilateral Agencies: ADB, IFC – Equity dilution through warrants, preferential issue and/or rights if required • Of the required debt, Rs. 15,700 Crores will be drawn from debt already arranged Total Fund Requirement (From Jan 2009 to March 2012): Rs.23,100 Crores 56 Part E: Sustainability 57 Climate Change • Trombay SO2 emission of 24TPD (1330MW) - one of the most stringent • Forum of 46 global companies: New policy framework on Combating Climate Change (3C) • Carbon Footprint for the Company completed • Sustainability Council formed - 17 CDM Projects Identified • Utilization of waste hot gases from steel plants for power generation Renewable and Clean Coal Technology • Solar Concentrated Thermal (SCT) • Geo Thermal energy • Coal Bed Methane (CBM) • Coal beneficiation technologies Wind Farms • Existing installed Renewable plants • CDM host country approval received for the 62 MW of the new wind farms • 73 MW of wind power projects under implementation • 17 MW in Maharashtra, 21 MW in Gujarat, 35 MW in Karnataka. Demand Side Management • DSM Workshop conducted for all utilities in Maharashtra • Energy conservation awareness campaigns for Customers & School • Launched “I will, Mumbai will” (joint Adv. campaign with other Dist. Lic.) • Tata Power Energy Club formed for curbing energy wastage Human Resource Management • Long Term Settlement with the Union signed • Succession Planning process implemented • Competency Development exercise in progress • Organization Transformation Initiatives are being implemented Thank you We take pride in 56