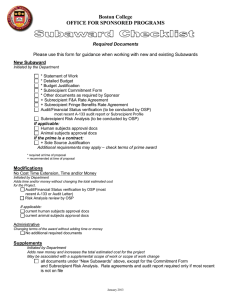

UNIFORM GUIDANCE AT K-STATE SUBAWARDS & SUBRECIPIENT

advertisement

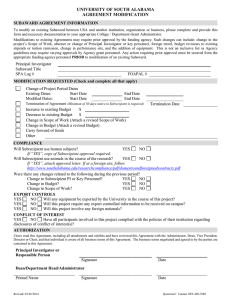

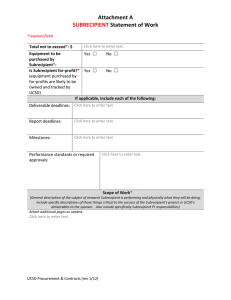

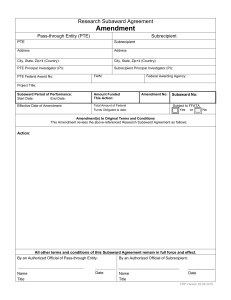

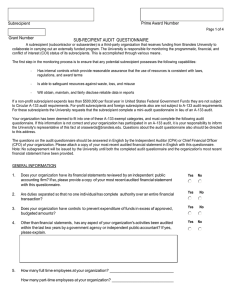

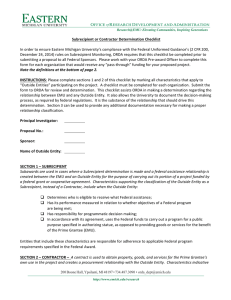

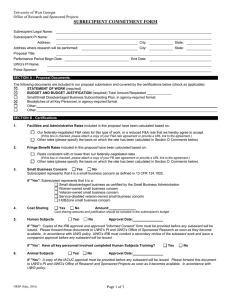

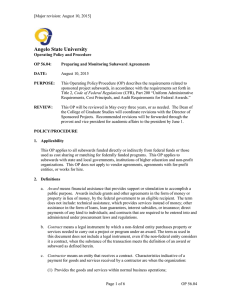

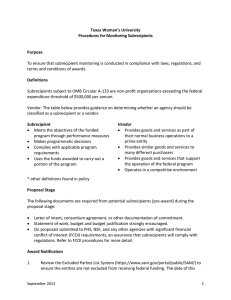

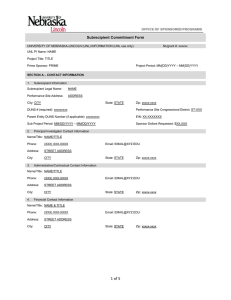

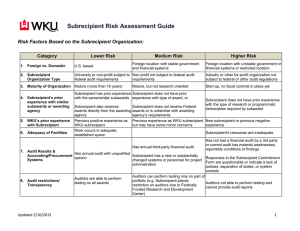

UNIFORM GUIDANCE AT K-STATE SUBAWARDS & SUBRECIPIENT MONITORING 2 CFR Part 200 – Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards 200.332 Fixed Price Subawards • • • • • • Prior written approval from Federal awarding agency Limited to the federal Simplified Acquisition Threshold, currently $150,000. Per COFAR FAQs: It is allowable to have multiple subs to same subrecipient that total more than $150K if they have distinct statement of work. All subs have to have prior written approval. Section 200.201(b)(1) states that fixed amount awards and subawards “if the project scope is specific and if adequate cost, historical, or unit pricing data is available to establish a fixed amount award based on a reasonable estimate of actual cost. . . . Accountability is based on performance and results.” Section 200.201(b)(2) states that a fixed price award cannot require mandatory cost share or matching. Section 200.201(c)(2) states that the subrecipient must certify in writing to pass-through entity at the end that project was completed. If the required level of activity was not carried out, the amount of the subaward must be adjusted. 200.330 Subrecipient & contractor determinations Basically the same guidelines as before . . . Subrecipients: • Performance measured against objectives of Federal program • Programmatic decision making • Adherence to Federal program requirements Contractors: • Provides goods/services within normal business operations • Provides similar goods and services to many different purchasers • Operates in a competitive environment • Not subject to compliance requirements of the Federal program as a result of the agreement. 200.311 Pass-through Entities - IDC • All pass-through entities must . . . • (a)(4) Indirect cost rate • • If the subrecipient has a federally recognized, negotiated rate, use it. If not: • Negotiate a rate with the subrecipient or • Use the de minimus rate of 10% MTDC 200.331 Pass-through Entity - Risk 200.331 (b) Evaluate each subrecipient's risk of noncompliance with Federal statutes, regulations, and the terms and conditions of the subaward . . . PreAwards Check suspension and debarment Check restricted parties list database Subrecipient Commitment Form on PreAwards website SPA Is subrecipient subject to Single Audit (Subpart F—Audit Requirements formerly A-133 Audit)? If not, we will monitor invoices and expenditures more closely. 200.331 Pass-through Entity - Monitoring (d)(1) Reviewing financial and performance reports required by the pass-through entity. SPA & business offices review financial reports. PIs receive and review performance reports: You should have the PI approve invoices before payments are issued to subrecipients so that PI can alert us if we need to hold payments for lack of performance. PI certification forms required before final payment will be approved by SPA.