Frequently Asked Questions (FAQ) - Annual October Vacation Payout

advertisement

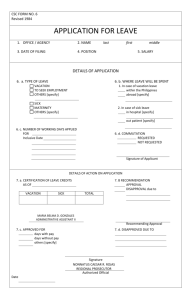

Frequently Asked Questions (FAQ) - Annual October Vacation Payout What is the annual October vacation payout? The annual vacation payout is a payout of the vacation hours that are above the established maximum accrual limits, per CCEU Article 13.9 and 13.11 “Vacation Carry-Over.” How do I know if the annual October vacation payout applies to me? In order to trigger the annual October vacation payout, you must meet the criteria of: (1) your vacation hours as of September 30th are above the maximum accrual limits per CCEU Article 13.9 Vacation Carry-Over and (2) you must have 100 hours of sick leave available after any September absences have been reported and posted by Payroll. CCEU Article 13.9 Vacation Carry-Over addresses years of service and days, however it does not specify if a day is equal to 8 hours. Can you please clarify? CCEU Article 13.9 Vacation Carry-Over is calculated using 8 hours as a day. For example if you have worked 1 to 4 years, that is equal to 19 days and 19 days x 8 hours per day = 152 maximum carry-over hours. Can you clarify the years of service in CCEU Article 13.9 Vacation Carry-Over? The years of service are based on the service months you have worked which means you must work 12 service months to move up to the next accrual rate tier. For example, a 10 month employee will work 10 months in one fiscal year and 2 months in the following before they are eligible to move to the next accrual rate which is reflected in the years of service. Example 1 - 4 years includes the first day of work through the last working day of the 4th year, 5 years includes the first day into your 5th year through the last working day of your 5th year, etc. When is the annual October vacation payout going to be paid? The annual October vacation payout will be paid on the same check as your regular payroll check the last working day in October. Is the annual vacation payout taxed the same as my regular check? The annual vacation payout in considered a "lump sum payout" and is taxed differently than your regular payroll check and will be taxed as follows: Federal - flat 25%, State - taxed the same as your regular paycheck, FICA - taxed the same at 6.2% and Medicare (MC) - taxed the same at 1.45%. Can I adjust my tax status to lessen the tax rate on the vacation payout? You can change your taxes using the W4 form (Federal form), used to make tax changes for Federal taxes only or State and Federal as the same) and DE4 (State tax form if you want your State tax to be different than Federal). Since the vacation payout is a lump sum payout, the only change that will make a difference to your Federal taxes is achieved by claiming "exempt" which is NO taxes. Please note: when changing to “exempt” status, it will not only affect your vacation payout, but your regular paycheck as well since it is all combined on one check for the month. (September, 2013)