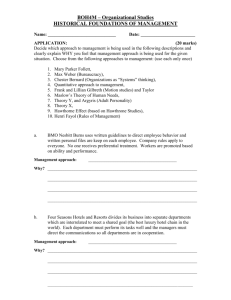

STATE OF NEW JERSEY SENATE, No. 12 214th LEGISLATURE [Fourth Reprint]

advertisement

![STATE OF NEW JERSEY SENATE, No. 12 214th LEGISLATURE [Fourth Reprint]](http://s2.studylib.net/store/data/012978520_1-01203bb63cb68046d1e1e19203aadf14-768x994.png)