CGA Accrual Validation Guidance

advertisement

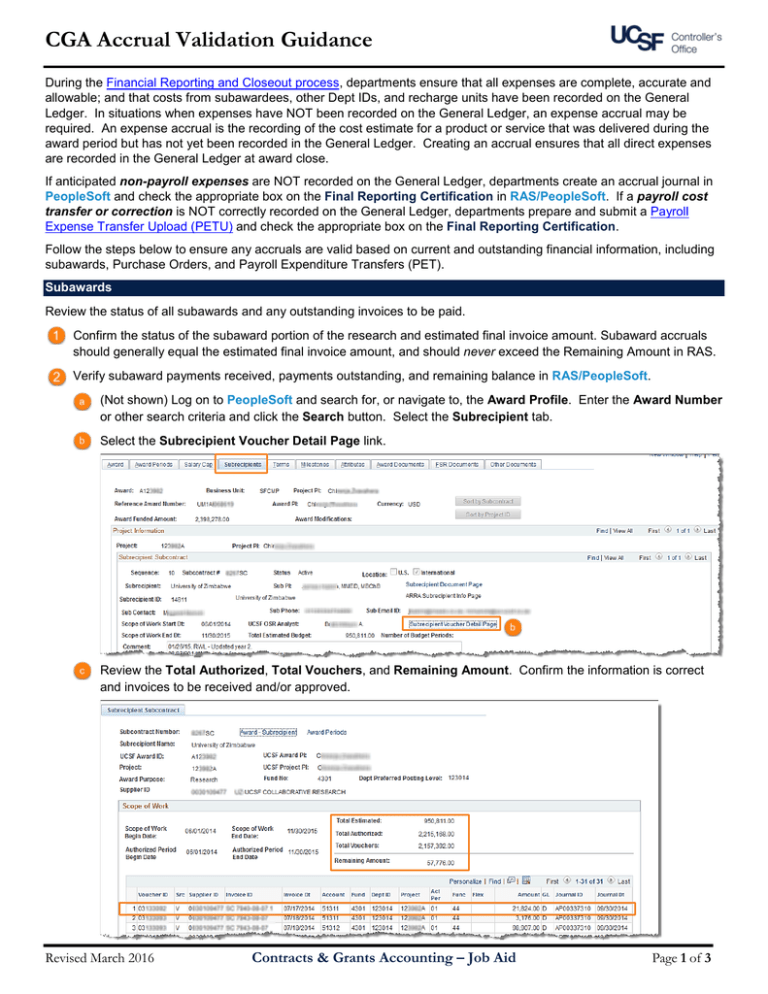

CGA Accrual Validation Guidance During the Financial Reporting and Closeout process, departments ensure that all expenses are complete, accurate and allowable; and that costs from subawardees, other Dept IDs, and recharge units have been recorded on the General Ledger. In situations when expenses have NOT been recorded on the General Ledger, an expense accrual may be required. An expense accrual is the recording of the cost estimate for a product or service that was delivered during the award period but has not yet been recorded in the General Ledger. Creating an accrual ensures that all direct expenses are recorded in the General Ledger at award close. If anticipated non-payroll expenses are NOT recorded on the General Ledger, departments create an accrual journal in PeopleSoft and check the appropriate box on the Final Reporting Certification in RAS/PeopleSoft. If a payroll cost transfer or correction is NOT correctly recorded on the General Ledger, departments prepare and submit a Payroll Expense Transfer Upload (PETU) and check the appropriate box on the Final Reporting Certification. Follow the steps below to ensure any accruals are valid based on current and outstanding financial information, including subawards, Purchase Orders, and Payroll Expenditure Transfers (PET). Subawards Review the status of all subawards and any outstanding invoices to be paid. Confirm the status of the subaward portion of the research and estimated final invoice amount. Subaward accruals should generally equal the estimated final invoice amount, and should never exceed the Remaining Amount in RAS. Verify subaward payments received, payments outstanding, and remaining balance in RAS/PeopleSoft. (Not shown) Log on to PeopleSoft and search for, or navigate to, the Award Profile. Enter the Award Number or other search criteria and click the Search button. Select the Subrecipient tab. Select the Subrecipient Voucher Detail Page link. Review the Total Authorized, Total Vouchers, and Remaining Amount. Confirm the information is correct and invoices to be received and/or approved. Revised March 2016 Contracts & Grants Accounting – Job Aid Page 1 of 3 CGA Accrual Validation Guidance Purchase Orders Verify the status of open Purchase Orders (POs) and the allowable/allocable amount to be encumbered or posted using BearBuy. Run the MyReports “Purchase Order Lien Balance Report.” See the job aid PO Lien Balance Report for details on running a report. Review POs in BearBuy Navigate to BearBuy. From the document search page, enter the PO number and click Go. Click on the PO No hyperlink Click on the Invoices tab to view invoice details. The invoice statuses will be displayed. Validate and determine the outstanding purchases to be processed. Ensure the requested accrual amount falls within the budget period and pertains to the award. Page 2 of 3 Contracts & Grants Accounting – Job Aid Revised March 2016 CGA Accrual Validation Guidance Payroll Expenditure Transfers (PETs) Review the status of all payroll, both posted and pending, to determine if adjustments are needed based on allowable effort expended within the period. Run the MyReports “Distribution of Payroll Expense (DPE) Report” by payroll period to validate posted and pending payroll. See the job aid Distribution of Payroll Expense (DPE) Report for details on running the report. Examples of pending payroll include vacation accruals and payroll in suspense. Examples of posted payroll that should be adjusted would be payroll not appropriate for the award reporting period. Compare the “DPE” to the MyReports “Transaction Detail Report” (TDR) for the award to identify any payroll transactions in suspense. Payroll transactions which appear on the DPE but not on the TDR are “in suspense”. See the job aid Transaction Detail Report for details on running the report and the job aid Understanding Payroll Transaction on the TDR and DPE Reports for guidance on clearing payroll in suspense. For more information on the Financial Reporting and Closeout Process and other Contracts and Grants training and job aids, see the Controller’s Office website. Revised March 2016 Contracts & Grants Accounting – Job Aid Page 3 of 3