Market Power in Mortgage Lending and the Transmission of Monetary... David Scharfstein

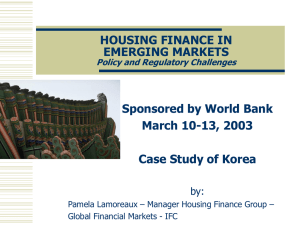

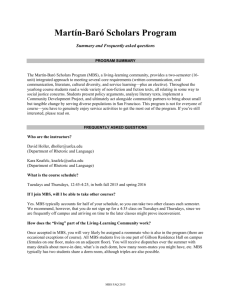

advertisement