Agenda Item No_____9________ Summary:

Agenda Item No_____9________

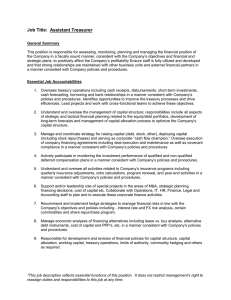

Treasury Management Annual Report 2012/13

Summary:

Options Considered:

Conclusions:

Recommendation:

This report sets out the Treasury Management activities actually undertaken during 2012/13 compared with the Treasury Management

Strategy for the year.

This report must be prepared to ensure the Council complies with the

CIPFA Treasury Management and Prudential Codes.

Treasury activities for the year have been carried out in accordance with the CIPFA Code and the Council’s Treasury Strategy.

That the Council be asked to RESOLVE that The Treasury

Management Annual Report and Prudential Indicators for 2012/13 are approved.

Approval by Council demonstrates compliance with the Codes. Reasons for

Recommendation:

Cabinet Member(s)

Cllr W Northam

Ward(s) affected: All

Contact Officer, telephone number and email: Tony Brown, 01263 516126, tony.brown@northnorfolk.gov.uk

1. Introduction

1.1 The Chartered Institute of Public Finance and Accountancy (CIPFA) defines treasury management as “the management of the Council’s investments and cash flows, its banking and its capital market transactions; the effective control of the risks associated with those activities and the pursuit of optimum performance consistent with those risks”.

1.2 The Council’s treasury management activities are undertaken in accordance with the

CIPFA Code of Practice on Treasury Management. The Code requires local authorities to produce annually Prudential Indicators and a Treasury Management Strategy

Statement on the likely financing and investment activity. The Code also recommends that members are informed of treasury management activities at least twice a year.

1.3 This report sets out details of investment transactions; reports on the risk implications of treasury decisions and transactions; gives details of the actual results for the year and confirms the position on compliance with treasury limits and Prudential Indicators.

2. Economic Background

2.1 The UK economy shrank in the first, second and fourth quarters of 2012. Growth of

0.9% in the third quarter however, aided by the Olympic Games, enabled growth to register 0.2% over the year.

2.2

The growth in wages at 1.2% was below inflation and constrained household spending power. The rate of inflation as measured by the Consumer Prices Index (CPI) dipped below 3%, falling to 2.4% in June before rising to 2.8% in February 2013. Higher food and energy prices and higher transport costs contributed to inflation remaining above the

Bank of England’s 2% target for CPI.

2.3

The lack of growth and fall in inflation persuaded the Bank of England to maintain the

Bank Rate at 0.5% The government’s Funding for Lending initiative commenced in

August and gave banks access to cheaper funding on the basis they would pass this advantage on to the wider economy to aid growth. The result was an improvement in the flow of credit to mortgagees, but lending to small and medium-s ized enterprises (SME’s) was still below expectations.

2.4

A direct consequence of the Funding for Lending Scheme was a sharp drop in the rates at which local authorities could lend to banks. At the beginning of the year the investment rates for 3, 6 and 12 month deposits were 1%, 1.33% and 1.84%. By the end of the year they had fallen to 0.44%, 0.51% and 0.75% respectively.

3. Long Term Borrowing

3.1 The Council has no long-term debt. The strategy has been to remain debt-free and not to borrow long-term monies to finance its capital spending, relying instead on usable capital receipts, government grants and revenue contributions. Any decision to borrow in the future will need to have regard to the treasury implications, including taking account of the additional credit risk of holding both investments and borrowing.

4. Investment Activity

4.1

The Department for Communities and Local Government’s (DCLG) Guidance on Local

Government Investments requires the Council to focus on security and liquidity, rather than yield when undertaking its treasury activities

4.2 The table below gives Members an appreciation of the investment activity undertaken in

2012/13, showing the position at the start and end of the year, together with the transactions during the year. The percentages show the average investment return achieved for each investment category for 2012/13, and the average life of the investments to maturity, weighted to investment value.

Balance Invested Matured Balance Weighted

01/4/2012

£000s £000s £000s

31/3/2013

£000s

Return

%

Average

Life

(days)

19,110 93,300 (99,295) 13,115 0.82 70 Short-term

Bonds issued by

Multilateral

Development

Banks

Pooled Funds

All investments

1,000

0

20,110

0

5,000

98,300

0

0

(99,295)

1,000

5,000

19,115

0.80

-

0.82

352

-

90

4.3 Security of the capital sum invested remained the Council’s main investment objective.

This was maintained by following the Council’s counterparty policy as set out in its

Treasury Management Strategy Statement for 2012/13. New investments were placed with the Debt Management Office, AAA-rated Stable Net Asset Value Money Market

Funds, appropriate UK banks and building societies which are systemically important to the banking system. In addition, on the 31 March 2013, an investment of £5m was made in the CCLA Local Authorities Property Fund (LAMIT) in accordance with the decision by Council in September 2012 to invest a proportion of the investment portfolio in pooled property funds.

4.4 Credit Risk

Counterparty credit quality was assessed and monitored with reference to the following;

1. Credit ratings (The minimum long-term counterparty credit rating determined for the 2012/13 treasury strategy was A- (or equivalent) across the rating agencies

Fitch, S&P and Moody ’s).

2. The price of credit default swaps (this is similar to an insurance policy which pays out the value of an investment should a counterparty fail to repay an investment), where quoted.

3. Gross Domestic Product (GDP) of the country in which the institution operates.

4. The country’s net debt as a percentage of GDP

5. Any potential support mechanisms and share price (where quoted).

4.5 In June Moody’s downgraded a number of banks including the UK banks on the

Council’s lending list - Barclays, HSBC, Royal Bank of Scotland/Natwest, Lloyds TSB

Bank/Bank of Scotland and Santander. However, none of the ratings fell below the

Council’s minimum credit rating threshold of A- (or equivalent).

.4.6 All investment counterparties are given a credit score based on this information in 4.4.

Weighted average scores are then calculated for both value and time. The value weighted average reflects the credit quality of investments compared to the size of the deposit. The time weighted average reflects the credit quality of investments compared to the number of days to maturity of the deposit.

4.7 Appendix F shows the different credit scores which apply to the long-term credit ratings of an institution (The final score will also take the other factors listed above into account).

The Council aims to achieve a score of 7 or lower (A- or better), to reflect the Council’s overriding priority of security of monies invested and a minimum credit rating threshold of

A- fo r investment counterparties, as set out in the Council’s Treasury Management

Strategy Statement.

4.8 The table below shows how the scores and ratings have changed over the financial year. The more investments the Council has with counterparties with higher credit ratings, the lower the score will be. Over the year the value weighted scores have increased but remained well below the minimum level of 7 which represents the lowest credit rating the Council will accept.

4.9 An ideal scenario would show a lower time weighted average credit score than the value weighted credit score. This would indicate that where a longer term investment decision is taken, a higher credit quality counterparty had been selected.

Date

31/03/2012

30/06/2012

30/09/2012

31/12/2012

Value

Weighted

Average

Credit Risk

Score

4.59

4.61

4.49

4.96

Value

Weighted

Average

Credit

Rating

A+

A+

AA-

A+

Time

Weighted

Average

Credit Risk

Score

3.39

3.06

2.98

3.33

Time

Weighted

Average

Credit

Rating

AA

AA

AA

AA

Average

Life (days)

97

59

49

57

31/03/2013 5.3 A+ 3.07 AA 61

4.10 The graphs at Appendix G shows the Council’s position at 31 March 2013 and compares how the Council has performed in relation to other clients of the Council’s treasury advisors, Arlingclose Limited.

4.11 The first graph shows that at the 31 March 2012 the rate of interest on the Council’s investments was 0.7% with a value weighted credit score of 5.3. The average credit score for all Arlingclose clients was 5.09 with an average interest rate of 0.85%, indicating that the investment return on the portfolio is just below the average for the client group, but is achieved with an above average credit score.

4.12 The second graph shows that the Council is achieving a better than average credit score of 3.07 on a time weighted basis compared to the client group average of 4.75.

4.13 Liquidity

In accordance with the D CLG’s Guidance on Investments, the Council maintained sufficient level of liquidity through the use of Money Market Funds, overnight deposits and call accounts with banks.

4.14 Yield

The Council sought to optimise returns commensurate with its objectives of security and liquidity. The UK Bank Rate was maintained at 0.5% through the year and short term money market rates remained at very low levels which had a significant impact on investment income. In response to uncertain and deteriorating credit conditions in

Europe, the Council considered an appropriate risk management response was to shorten maturities for new investments.

4.15 The Co uncil’s investment income for the year was £206,481 which compares to the revised budget of £269,900. The anticipated rate of return on investments in the revised budget was 1.1% and a rate of 0.82% was actually achieved. The average balance available for investment in the year was £25.1m compared to a revised budget of

£24.6m

5. Compliance

5.1 All investments made during the year complied with the Council’s agreed Treasury

Management Strategy, Prudential Indicators, Policy Statement, Practices and prescribed limits. Maturing investments were repaid in full on the due date.

5.2 The Council has a limit of £500,000 which can be left overnight with its bankers, The Cooperative Bank plc. On the 27 March 2013 an unexpected payment for £663,503.54 was received after the cut-off time for treasury dealing. Consequently the funds remained with the bank overnight leaving a total balance of £816,940.98, and the limit was exceeded. The organisation concerned has been contacted and they have undertaken to advise the Council in advance when such large payments are made in future.

5.3 The Council can confirm that it has complied with its Prudential Indicators for 2012/13, which were approved on 22 February 2012 as part of the Council’s Treasury

Management Strategy Statement. Details can be found in Appendix H.

5.4 In compliance with the requirements of the CIPFA Code of Practice this report provides members with a summary report of the treasury management activity during 2012/13.

None of the Prudential Indicators have been breached and a prudent approach has been taking in relation to investment activity with priority being given to security and liquidity over yield.

6. Conclusion

6.1 The treasury activities for 2012/13 have been carried out in accordance with the CIPFA

Code and the Council’s Treasury Management Strategy.

7. Financial Implications and Risks

7.1 The financial impact of implementing the Council’s treasury strategy for 2012/13 has been set out in this report.

8. Sustainability – None as a direct consequence of this report.

9. Equality and Diversity – None as a direct consequence of this report.

10. Section 17 Crime and Disorder considerations – None as a direct consequence of this report.

Credit Score Analysis

Long-Term

Credit Rating

AAA

AA+

AA

AA-

A+

A

A-

BBB+

BBB

BBB-

Not rated

BB

CCC

C

D

Score

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Appendix F

Appendix G

Appendix H

1.

Prudential Indicators 2012/13

Gross Debt and the Capital Financing Requirement:

1.1 In order to ensure that over the medium term debt will only be for a capital purpose, the

Council should ensure that debt does not, except in the short term, exceed the total of the capital financing requirement (CFR) in the preceding year plus the estimates of any additional capital financing requirement for the current and next two financial years. The

Council met this requirement as only £3.5m of short term borrowing for cash flow purposes was undertaken in the year which was below the CFR shown at 4.1.

2. Estimates of Capital Expenditure:

2.1 This indicator is set to ensure that the level of proposed capital expenditure remains within sustainable limits and, in particular, to consider the impact on Council Tax.

Capital Expenditure 2012/13

Updated

Total

Estimate

£000s

11,650

2012/13

Outturn

£000s

4,546

2.2 Capital expenditure will be financed or funded as follows:

Capital Financing

Capital receipts

2012/13

Updated

Estimate

£000s

4,840

2012/13

Outturn

£000s

2,951

Government Grants

Revenue contributions and Reserves

6,352

458

1,148

447

Total Financing 11,650 4,546

This table shows that capital expenditure was funded entirely from sources other than external borrowing.

3. Ratio of Financing Costs to Net Revenue Stream:

3.1 This is an indicator of affordability and highlights the revenue implications of existing and proposed capital expenditure by identifying the proportion of the revenue budget required to meet financing costs. The definition of financing costs is set out in the

Prudential Code.

3.2 The ratio is based on costs net of investment income.

Ratio of Financing

Costs to Net

Revenue Stream

2012/13

Estimate

%

2012/13

Outturn

%

Total (1.95) (1.49)

The indicator is negative because the Council has interest receivable and no financing costs. The change in the ratio is a result of the actual investment income being lower than budget.

4. Capital Financing Requirement:

4.1 The Capital Financing Requirement (CFR) measures the Council’s underlying need to borrow for a capital purpose. The calculation of the CFR is taken from the amounts held in the Balance Sheet relating to capital expenditure and financing.

Capital Financing

Requirement

2012/13

Estimate

£000s

2012/13

Outturn

£000s

2013/14

Estimate

£000s

2014/15

Estimate

£000s

Total CFR 1,916 1,916 1,634 1,328

4.2

The total CFR indicated in the table relates to vehicles and equipment used on the

Council’s refuse and car park management contracts. These are recognised under

IFRS accounting regulations which require equipment on an embedded finance lease to be recognised on the balance sheet.

5. Incremental Impact of Capital Investment Decisions:

5.1 This is an indicator of affordability that shows the impact of capital investment decisions on Council Tax levels. The incremental impact is calculated by comparing the total revenue budget requirement of the current approved capital programme with an equivalent calculation of the revenue budget requirement arising from the proposed capital programme.

Incremental Impact of

Capital Investment

Decisions

2012/13

Estimate

£

2012/13

Outturn

£

Increase in Band D

Council Tax

Nil Nil

5.2

The Council’s capital plans, as estimated in forthcoming financial years, have a neutral impact on council tax. This reflects the fact that capital expenditure is predominantly financed from internal resources (grants, contributions, and revenue and capital receipts), and there is no increase in the underlying need to borrow.

6. Authorised Limit and Operational Boundary for External Debt:

6.1 Section 3(1) of The Local Government Act 2003 requires the Council to set an Affordable

Borrowing Limit (referred to in the Code as the Authorised Limit), regardless of its indebted status. It is a statutory limit which should not be breached.

6.2 The Operational Boundary is based on the same estimates as the Authorised Limit reflecting the most likely, prudent but not worst case scenario, and without the additional headroom included within the Authorised Limit for unusual cash movements.

6.3 The Head of Finance confirms that there were no breaches to the Authorised Limit and the Operational Boundary during the year. The maximum amount borrowed during the year was £3.5m

2012/13

Estimate

£000s

Outturn as at

31/3/13

£000s

3,500 Authorised Limit for

Borrowing

Authorised Limit for Other

Long-term Liabilities

Authorised Limit for

External Debt

Operational Boundary for

Borrowing

Operational Boundary for

Other Long-term Liabilities

9,556

1,916

11,472

5,458

1,916

1,916

5,416

3,500

1,916

Operational Boundary for External Debt

7,092 5,416

7. Adoption of the CIPFA Treasury Management Code:

7.1 This indicator demonstrates that the Council has adopted the principles of best practice.

Adoption of the CIPFA Code of Practice in Treasury Management

The Council approved the adoption of the CIPFA Treasury Management Code at Full

Council on 28 April 2010.

8. Upper Limits for Fixed Interest Rate Exposure and Variable Interest Rate Exposure:

8.1 These indicators allow the Council to manage the extent to which it is exposed to changes in interest rates. The Council calculates these limits on net principal sums outstanding (i.e. fixed rate debt net of fixed rate investments).

8.2 The purpose of the limit is to ensure that the Council is not exposed to interest rate rises on any borrowing which could adversely impact the revenue budget. Variable rate borrowing can be used to offset exposure to changes in short term rates on investments.

The limit therefore allowed maximum flexibility for fixed or variable rate investments and investment decisions were ultimately made on expectations of interest rate movements.

2012/13

Estimate

%

Compliance with

Limits

Upper Limit for Fixed Interest Rate Exposure (100%) Yes

Upper Limit for Variable Interest Rate

Exposure

(100%) Yes

8.3 As the Council’s investments exceed its borrowing, these calculations have resulted in a negative figure.

9. Maturity Structure of Fixed Rate borrowing:

9.1 This indicator is to limit large concentrations of fixed rate debt needing to be replaced at times of uncertainty over interest rates. The limits were set to give maximum flexibility should any borrowing be required for cash flow purposes therefore the limits have been complied with.

9.2 It is calculated as the amount of projected borrowing that is fixed rate maturing in each period as a percentage of total projected borrowing that is fixed rate. The Council does not anticipate entering into any borrowing therefore the limits have been set to allow the

Council maximum flexibility should any borrowing be required (potentially for cash flow purposes).

Maturity structure of fixed rate borrowing

Lower

Limit for

2012/13

%

Upper

Limit for

2012/13

%

Actual

Fixed rate

% Fixed

Rate

Borrowing Borrowing at 31/3/13

£m at 31/3/13 under 12 months 0 100 3.5 100

12 months and within 24 months 0 100

24 months and within 5 years

5 years and within 10 years

10 years and within 20 years

20 years and within 30 years

0

0

0

0

100

100

100

100

30 years and within 40 years

40 years and within 50 years

0

0

100

100

50 years and above 0 100

10. Upper Limit for total principal sums invested over 364 days:

10.1 The purpose of this indicator is to limit exposure to the possibility of loss which may arise as a result of the Council having to seek early repayment of the sums invested.

Upper Limit for total principal

2012/13

Estimate

Outturn

31/3/13 sums invested

£m £m over 364 days

Total 15 6