Cabinet 06 February 2012 Full Council 22 February 2012

advertisement

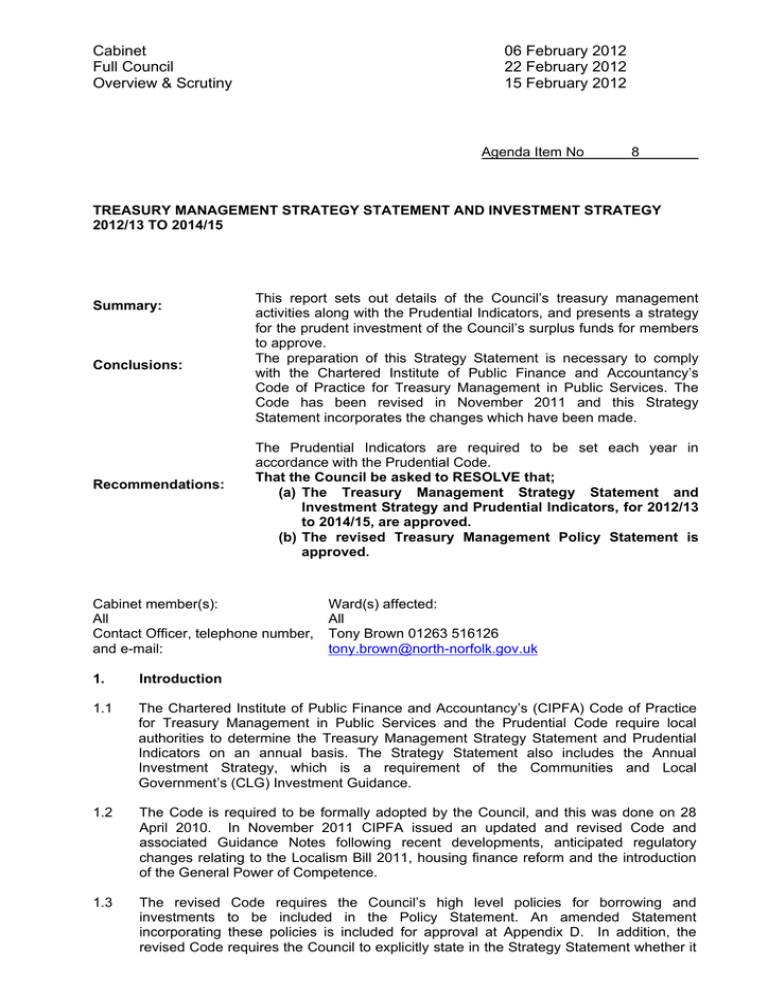

Cabinet Full Council Overview & Scrutiny 06 February 2012 22 February 2012 15 February 2012 Agenda Item No______8_______ TREASURY MANAGEMENT STRATEGY STATEMENT AND INVESTMENT STRATEGY 2012/13 TO 2014/15 Summary: Conclusions: Recommendations: This report sets out details of the Council’s treasury management activities along with the Prudential Indicators, and presents a strategy for the prudent investment of the Council’s surplus funds for members to approve. The preparation of this Strategy Statement is necessary to comply with the Chartered Institute of Public Finance and Accountancy’s Code of Practice for Treasury Management in Public Services. The Code has been revised in November 2011 and this Strategy Statement incorporates the changes which have been made. The Prudential Indicators are required to be set each year in accordance with the Prudential Code. That the Council be asked to RESOLVE that; (a) The Treasury Management Strategy Statement and Investment Strategy and Prudential Indicators, for 2012/13 to 2014/15, are approved. (b) The revised Treasury Management Policy Statement is approved. Cabinet member(s): All Contact Officer, telephone number, and e-mail: Ward(s) affected: All Tony Brown 01263 516126 tony.brown@north-norfolk.gov.uk 1. Introduction 1.1 The Chartered Institute of Public Finance and Accountancy’s (CIPFA) Code of Practice for Treasury Management in Public Services and the Prudential Code require local authorities to determine the Treasury Management Strategy Statement and Prudential Indicators on an annual basis. The Strategy Statement also includes the Annual Investment Strategy, which is a requirement of the Communities and Local Government’s (CLG) Investment Guidance. 1.2 The Code is required to be formally adopted by the Council, and this was done on 28 April 2010. In November 2011 CIPFA issued an updated and revised Code and associated Guidance Notes following recent developments, anticipated regulatory changes relating to the Localism Bill 2011, housing finance reform and the introduction of the General Power of Competence. 1.3 The revised Code requires the Council’s high level policies for borrowing and investments to be included in the Policy Statement. An amended Statement incorporating these policies is included for approval at Appendix D. In addition, the revised Code requires the Council to explicitly state in the Strategy Statement whether it Cabinet Full Council Overview & Scrutiny plans to use derivative instruments to manage risk. derivatives is included in section 6 of this report. 06 February 2012 22 February 2012 15 February 2012 The Council’s position on 1.4 Treasury Management is about the management of risk. The Council is responsible for its treasury decisions and activity, recognising that no treasury management activity is without risk. All activities will comply with relevant statute, guidance and accounting standards. 1.5 The Council is required to have regard to the Prudential Code and to set Prudential Indicators for the next three years to ensure that the Council’s capital investment plans are affordable, prudent and sustainable. These indicators, along with those to which the Council should have regard to when determining the Council’s treasury management strategy are included within Appendix E. 2. Interest Rate Forecast 2.1 The economic and interest rate forecast provided by the Council’s treasury management advisor, Arlingclose Ltd, is attached at Appendix C. The Council will keep its Treasury Strategy under review and realign it in response to evolving economic, political and financial events. 3. Borrowing Strategy 3.1 The Council is currently debt free and its capital expenditure and financing plans do not currently imply any external borrowing requirement in 2012/13. 4. Annual Investment Strategy 4.1 In accordance with Investment Guidance issued by the CLG and best practice the Council’s primary investment objective remains the security of capital. The liquidity or accessibility of the investments followed by the yields earned are important, but are secondary considerations. 4.2 The Credit Markets are where governments and companies raise funds and these remain in a state of distress as a result of the excessive and the high cost of debt. In some cases, Greece and Italy being the most notable examples, the extent and implications of the debt which has been built up have led to a sovereign debt crisis and banking crisis with the outcome still largely unknown. It is against this backdrop of uncertainty that the Council’s investment strategy is framed. 4.3 Investments are categorised as “Specified” or “Non-Specified” within the investment guidance issued by the CLG. Specified investments are sterling denominated investments with a maximum maturity of one year. They also meet the “high credit quality” as determined by the council and are not deemed capital expenditure investments under statute. All other investments are classified as non-specified. 4.4 The types of investments that may be used by the Council and whether they are specified or non-specified are as follows: Investment Specified NonSpecified Term deposits with banks and building societies 3 3 Term deposits with other UK local authorities 3 3 Certificates of deposit with banks and building societies 3 3 Cabinet Full Council Overview & Scrutiny 06 February 2012 22 February 2012 15 February 2012 Gilts 3 3 Treasury Bills (T-Bills) 3 2 Bonds issued by Multilateral Development Banks 3 3 Local Authority Bills 3 2 Commercial Paper 3 2 Corporate Bonds 3 3 AAA rated Money Market Funds 3 2 Other Money Market and Collective Investment Schemes 3 3 Debt Management Account Deposit Facility 3 2 4.5 Corporate bonds are now included as available investment instrument; CLG has indicated they will become an eligible non-capital investment from 1 April 2012. In response to evolving conditions in financial markets, the Council amended in December 2011 the minimum credit criteria for individual institutions to which the Council is prepared to lend its funds. The criteria in the next paragraph are a continuation of that policy. 4.6 The Council and its advisors, Arlingclose Ltd, select countries and financial institutions after analysis and ongoing monitoring of: • • • • • • • Published credit ratings for financial institutions (minimum long term rating of Aor equivalent for counterparties; AA+ or equivalent for non-UK countries. Credit Default Swaps (where quoted) Economic fundamentals (for example Net Debt as a percentage of GDP) Sovereign Support Mechanisms Share Prices Corporate developments, news and articles, market sentiment and momentum. Subjective judgement (or put more simply – common sense) 4.7 The countries and institutions which currently meet the criteria for term deposits, Certificates of Deposit (CDs) and call accounts are included on the recommended Sovereign and Counterparty List included at Appendix C Institutions can be temporarily suspended or removed from the list should any of the factors identified above give rise to concern. Institutions which meet the minimum criteria and which are judged appropriate investment counterparties by the Council’s treasury advisors can be added to the list in the future. 4.8 The Council’s policy is to make exceptions to the counterparty policy established around credit ratings in appropriate circumstances. Institutions which meet the credit criteria may be suspended from the lending list, but institutions which do not meet the criteria cannot be added. 4.9 The Council banks with the Co-operative Bank plc. At the current time the bank does not meet the minimum credit criteria of a long term rating of A- (or equivalent). Despite this the Bank will continue to be used for short term liquidity requirements (overnight and weekend investments) for a maximum sum which can be placed in the Public Sector Reserve Account of £500,000. Cabinet Full Council Overview & Scrutiny 06 February 2012 22 February 2012 15 February 2012 4.10 Short-term interest rates are forecast to remain low for a long period, Arlingclose Ltd think that it could be 2016 before the official bank rate begins to rise. It would be usual in such an interest rate environment to lengthen investment periods, where cash flow requirements permit, in order to lock in higher rates of return with acceptable levels of risk. However, the problem currently is finding investment counterparties which provide acceptable levels of counterparty risk. 4.11 Investments will be placed with a range of approved investment counterparties in order to achieve a diversified portfolio of prudent counterparties, investment periods and rates of return. Maximum investment levels will be set for individual counterparties to ensure prudent diversification is achieved. 4.12 Money market funds (MMFs) will be utilised. These funds do provide good diversification, but the Council will seek to further diversify its exposure by utilising several MMFs. The Council will also restrict its exposure to MMFs with lower levels of funds under management by limiting investments to 0.5% of the net asset value of the Fund. 5 Collective Investment Schemes (Pooled Funds) 5.1 The Council will continue to evaluate the use of Pooled Funds to determine the appropriateness of their use within the investment portfolio. Pooled funds enable the authority to diversify the assets and the underlying risk in the investment portfolio and provide the potential for enhanced returns. 5.2 Investments in pooled funds will be undertaken with advice from Arlingclose Ltd. The performance and continued suitability in meeting the Council’s investment objectives of any investment in these funds will be regularly monitored. 6 The Use of Financial Instruments for the Management of Risks 6.1 The CIPFA Code requires authorities to explicitly state in their Strategy whether they plan to use derivative instruments to manage risks (such as interest rate swaps to manage interest rate risks), and to ensure they have the legal power to do so. 6.2 The legal power under which local authorities may use derivatives instruments remains unclear. The General Power of Competence in the Localism Bill is not sufficiently explicit and consequently the Council does not intend to use derivatives. 6.3 Should this position change, the Council would develop a detailed and robust risk management framework governing the use of derivatives, but this change in strategy will require approval of Full Council. 7 2011/12 Minimum Revenue Provision (MRP) Statement 7.1 The Local Authorities (Capital Finance and Accounting)(England)(Amendment) Regulations 2008 (SI2008/414) place a duty on local authorities to make a prudent provision for debt redemption. Guidance on Minimum Revenue Provision (MRP) has been issued by the Secretary of State and local authorities are required to “have regard” to such guidance under section 21 (1A) of the Local Government Act 2003. 7.2 There are four alternative methods available and the Council will apply the CFR (Capital Financing Requirement) Method. The CFR at 31 March 2013 is estimated to be £Nil and as such, under this calculation method, there will be no requirement to charge MRP in 2012/13. Cabinet Full Council Overview & Scrutiny 06 February 2012 22 February 2012 15 February 2012 8. Monitoring and Reporting on the Treasury Outturn and Prudential Indicators 8.1 The Technical Accountant will report to Cabinet on treasury management activity and performance as follows: • • The treasury management position is monitored during the year against the approved strategy for the year. A mid-year review is prepared and quarterly reports are prepared as part of the budget monitoring process. The Council will produce an outturn report on its treasury activity no later than 30 September after the financial year end. The Overview and Scrutiny Committee will be responsible for the scrutiny of treasury management activity and practices. 9. Training 9.1 In accordance with CIPFA’s Code of Practice, the “responsible officer” ensures that all members tasked with treasury management responsibilities, including scrutiny of the treasury management function, receive appropriate training relevant to their needs and understands fully their roles and responsibilities. 10. Investment Consultants 10.1 The Council employs a Treasury Management Advisor, Arlingclose Limited, to provide advice and information on counterparty credit worthiness, treasury strategy, economic updates and technical support on all treasury matters. The Treasury Advisory Service is periodically subject to tender to ensure the Council receives a quality service and Arlingclose successfully tendered for a new contract commencing 1 April 2011 for a period of 3 years, with the option to extend for a further year. 11. Risks to the Council 11.1 This strategy ensures that the identification, monitoring and control of risk are the prime criteria by which the effectiveness of treasury management activities is measured. 12. Financial Implications 12.1 The effectiveness of the Treasury Strategy will have a significant impact on the budget and finances of the Council. Investment decisions will be made based on the Council’s forecast of interest rate movements. If actual rate movements prove to be very different, there will be implications for the investment return achieved. 12.2 It is not possible to predict with certainty the future movements in interest rates. The Strategy must therefore be flexible enough to allow the Council to respond to changing market conditions. It must also enable the Council to respond to future changes in legislation. 12.3 The security of the Council’s investments is of prime concern, and the Strategy must ensure that, as far as possible, the Council’s investments are repaid in full, with interest earned, on the due date.