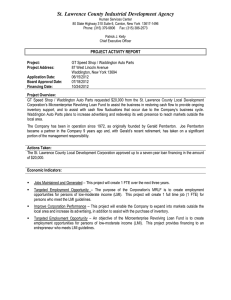

W O R K I N G Business Cycle

advertisement