AN ABSTRACT OF THE THESIS OF James H. Matzat Master of Science

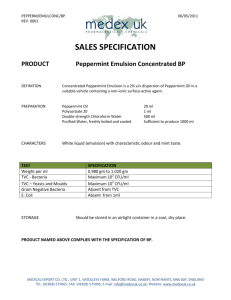

advertisement