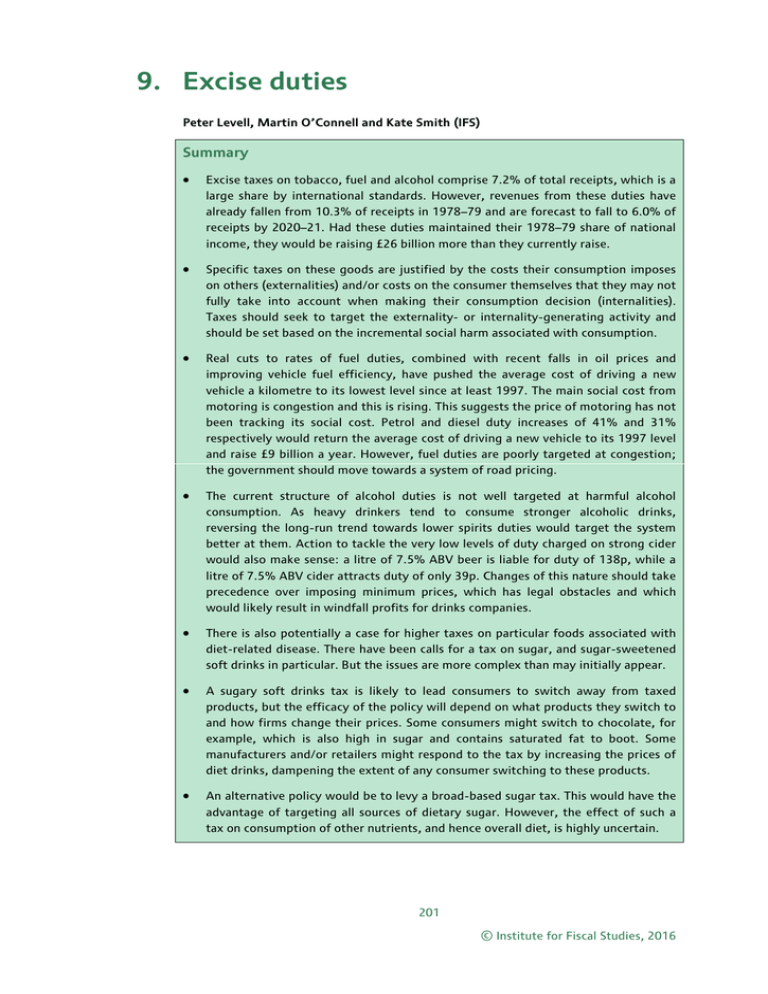

9. Excise duties Summary •

advertisement