Micro Theory Exam Summer 2014 Instructions

advertisement

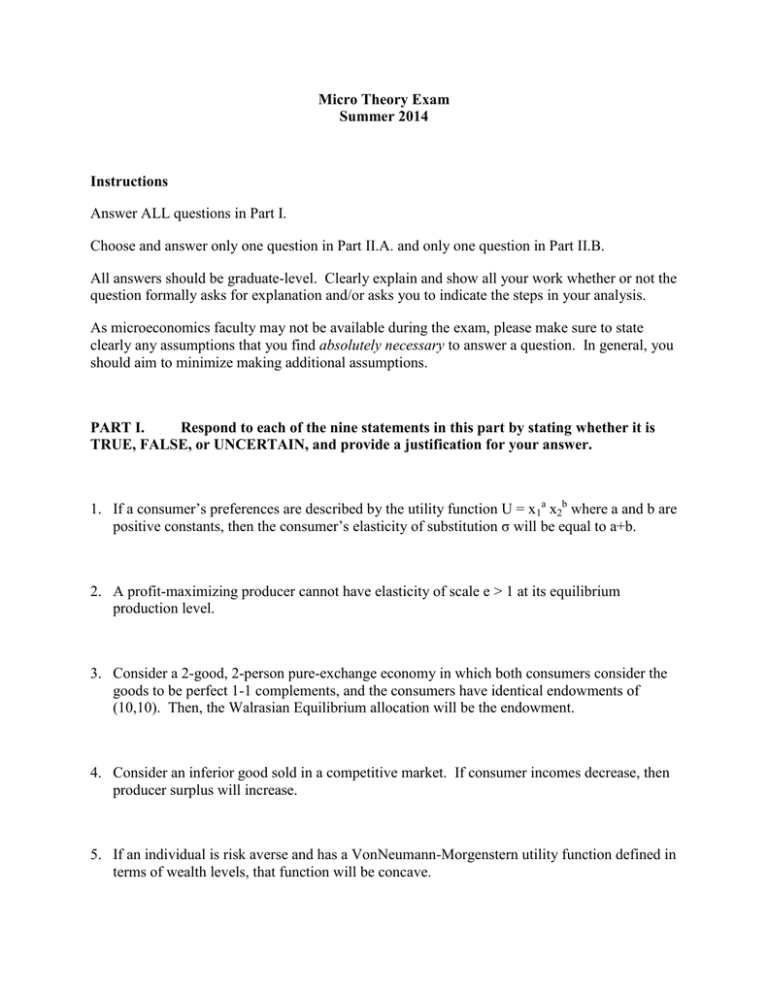

Micro Theory Exam Summer 2014 Instructions Answer ALL questions in Part I. Choose and answer only one question in Part II.A. and only one question in Part II.B. All answers should be graduate-level. Clearly explain and show all your work whether or not the question formally asks for explanation and/or asks you to indicate the steps in your analysis. As microeconomics faculty may not be available during the exam, please make sure to state clearly any assumptions that you find absolutely necessary to answer a question. In general, you should aim to minimize making additional assumptions. PART I. Respond to each of the nine statements in this part by stating whether it is TRUE, FALSE, or UNCERTAIN, and provide a justification for your answer. 1. If a consumer’s preferences are described by the utility function U = x1a x2b where a and b are positive constants, then the consumer’s elasticity of substitution σ will be equal to a+b. 2. A profit-maximizing producer cannot have elasticity of scale e > 1 at its equilibrium production level. 3. Consider a 2-good, 2-person pure-exchange economy in which both consumers consider the goods to be perfect 1-1 complements, and the consumers have identical endowments of (10,10). Then, the Walrasian Equilibrium allocation will be the endowment. 4. Consider an inferior good sold in a competitive market. If consumer incomes decrease, then producer surplus will increase. 5. If an individual is risk averse and has a VonNeumann-Morgenstern utility function defined in terms of wealth levels, that function will be concave. 6. In a finitely repeated Prisoner’s Dilemma (with common knowledge about payoffs, types and length of games), discount rates exist so that cooperation, at least for some periods, is part of a subgame-perfect Nash equilibrium. 7. Because of the Revenue Equivalence Theorem, auction design is irrelevant—each auction with private values yields ex ante the same predicted outcome. 8. Consider the following game where Nature chooses a sender type t1 or t2 with equal probability. (The sender knows her type, but the receiver does not know the sender’s type.) Then, the sender chooses a signal L or R, followed by the receiver choosing an action U or D. Seeing a signal L, the receiver believes with probability p that the sender is of type t1. Seeing a signal R, the receiver believes with probability q that the sender is of type t1. The first number in each payoff combination in the diagram below refers to the sender’s payoff, and the second number to the receiver’s payoff. 1,3 U p L R q U 2,1 Sender type t1 4,0 2,4 0,1 D 0.5 Nature Receiver U D Sender type t2 0,0 U 1,0 D 1,2 Receiver 0.5 L 1-p D R 1-q In pure strategies, there is only one pooling Perfect Bayesian Equilibrium in this game where both sender types send out the same signal. 9. In the second-price sealed-bid auction with independent values, it is optimal for each bidder to bid his/her own value. Part II Section A Answer ONE of the following two questions. 10. Consider a consumer in a 2-good world whose preferences are described by the utility function U(x1,x2) = 4x1 + ln x2. a. Derive this consumer’s ordinary (Marshallian) demand functions for the two goods. Under what conditions will there be an interior solution? b. Derive the consumer’s compensated (Hicksian) demand functions for the two goods. Under what conditions will there be an interior solution? c. For the case when p1 = 2, p2 = 8, and income is 20, what will be the consumer’s resulting utility level? d. For those levels of prices, income and utility (as in the previous part), use the Slutsky equation to give a specific interpretation of the good 1 own-price effect. e. Do the same for good 2, and compare the two cases. f. The effect on the consumer’s welfare of an increase in p1 can be measured by the change in Marshallian consumer surplus, by compensating variation, and by equivalent variation. For this consumer, which measure would indicate the greatest impact? g. What about the welfare effect of an increase in p2? Explain the difference between the two goods, relating your answer to part f above. 11. Consider a general equilibrium economy with two identical households, and two identical firms. There are two commodities, L and C. Suppose the following: • The firms’ technology allows them to produce C using L, according to a production function C = L1/2. • The households have identical utility functions, U = C L. They own identical shares of the firms. They have identical endowments of C = 0 and L = 100 (each). • Let L be the numeraire, so its price is 1, and the price ratio will be pc/1 = pc. Assume price-taking by all parties. a. For the typical firm, describe its technology set, its profit-maximization problem, its demand function for L as an input, and its supply function for C as an output. b. Describe the economy’s production possibilities curve (boundary of the feasible set). c. For the typical household, describe its budget constraint, and its gross and net demands for C and L. d. Derive the general equilibrium price pc*, and describe the resulting allocation of the commodities including input and output levels at each firm, and consumption levels at each household. Part II Section B Answer ONE of the following two questions. 12. There are two main roads connecting San Francisco and San Jose, a northern road via Mountain View and a southern road via Cupertino. Travel time on each of the roads depends on the number x of cars using the road per minute, as indicated in the following diagram: Mountain View 1+x San Francisco 51 + 0.1x 51 + 0.1x San Jose 1+x Cupertino For example, the travel time between San Francisco and Mountain View is 1 + x, where x is the number of cars per minute using the road connecting these cities. Each driver chooses which road to take in going from San Francisco to San Jose, with the goal of reducing to a minimum the amount of travel time. Early in the morning, 60 cars per minute get on the road from San Francisco to San Jose (where assume these travelers leave early enough in the morning so that they are the only ones on the road at that hour). a. What are the Nash equilibria of this game? b. At these equilibria, how much time does the trip take at an early morning hour? c. Suppose that the California Department of Transportation constructs a new road between Mountain View and Cupertino, with travel time between these cities 10 + 0.1x (see the figure below). This road is one way, enabling travel solely from Mountain View to Cupertino. Find a Nash equilibrium in the new game. Mountain View 1+x San Francisco 51 + 0.1x 10 + 0.1x 51 + 0.1x San Jose 1+x Cupertino d. Under this equilibrium how much time does it take to get from San Francisco to San Jose at an early morning hour? Does the construction of the additional road improve travel time? e. Explain the intuition behind the difference between your results in parts b and d. 13. Consider the static Bertrand duopoly model with homogeneous products. The two firms name prices simultaneously; demand for firm i's product is: a - pi if pi < pj 0 if pi > pj (a - pi)/2 if pi = pj Marginal costs are c < a. a. Consider the infinitely repeated game based on this stage game. Show that the firms can use trigger strategies (that switch forever to the stage-game Nash equilibrium after any deviation) to sustain the monopoly price level in a subgame-perfect Nash equilibrium if and only if 1/2. b. Suppose that demand fluctuates randomly in the infinitely repeated Bertrand game. In each period, the demand intercept is aH with probability p and aL (< aH) with probability 1 – p. Demands in different periods are independent. Suppose that in each period the level of demand is revealed to both firms before they choose their prices for that period. What are the monopoly price levels (pH and pL) for the two levels of demand? c. Solve for *, the lowest value of such that the firms can use trigger strategies to sustain these monopoly price levels (i.e., to play pi when demand is ai, for i = H,L) in a subgameperfect Nash equilibrium. For each value of between 1/2 and *, find the highest price p() such that the firms can use trigger strategies to sustain the price p() when demand is high and the price pL when demand is low in a subgame-perfect Nash equilibrium.