Vehicle to Grid Power Delaware Public Service Commission Willett Kempton, Director

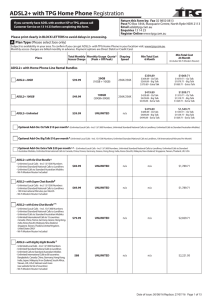

advertisement

Vehicle to Grid Power Presented to Delaware Public Service Commission 7 July 2009 by Willett Kempton, Director Center for Carbon-free Power Integration College of Earth, Ocean, and Environment University of Delaware Overview • Vehicle-to-Grid (V2G) • Car as underutilized resource • How much power available? • Vehicles as A/S providers • Control of car by ISO • Software for aggregation of vehicles • Car production, Fleet Expansion vehicle-to-grid Power Plug-in for charging V2G with ISO Control V2G taps an underutilized resource • US car used 1 hour/day, parked 23 h/d • Daily travel = 35 mi, battery 100-200 mi • Thus, most storage unused most days • Drive train output = 100 kW • Practical power through grid = 10 - 20 kW • Cars as significant power? Compare: • Vehicle fleet at 15 kW each car, with • Total load for country (GW) How Much Power in cars? Denmark UK USA Light vehicles 6 (10 ) 1.9 28.5 191 Vehicle GW (@ 15 kW each) 29 427 2,865 Avg. Electric Load (GW) 3.6 40 417 Initial Market -- Ancillary services • First Market: Ancillary Services (A/S) • Higher revenue, especially regulation • ISO control via Automatic Generation Control (AGC) • Revenue sufficient for business launch Energy Markets North American RTO/ISOs PJM as Part of the US Eastern Interconnection Key Statistics PJM member companies 470+ Millions of people served 51 Peak load in megawatts 144,796 MWs of generating capacity 165,303 Miles of transmission lines 56,070 GWh of annual energy 728,000 Generation sources 1,271 Square miles of territory 164,260 Area served 13 states + DC 6,038 substations 26% of generation in Eastern Interconnection 23% of load in Eastern Interconnection 19% of transmission assets in Eastern Interconnection 19% of U.S. GDP produced in PJM www.pjm.com 11 ©2006 PJM Value of regulation Average Annual Market Clearing Price ($/MW-h) 2004 2005 2006 PJM $42.75 $49.73 $32.69 RTO-NE $28.92 $30.22 $24.02 NY ISO $22.59 $39.21 $51.26 ERCOT $22.66 $38.07 n/a CA ISO $29.00 n/a $36.04 Value per Vehicle 10 –Year Present Value V2G Revenue Potential Assumptions: 80% availability, Reg. $40/MW-h, Spin. $10/MW-h, 7% discount rate, example calculations Sequence of Markets • Initial, high-value markets, are ancillary services (A/S) • Regulating power (“Regulation”) • Spinning reserves (synchronous reserves) Sequence of Markets • Later -- larger markets, lower value per kW • Defer upgrades to distribution feeders, transformers • Peak load reduction, valley filling • Power factor correction • Balancing wind, reducing ramp rate • Shifting solar peak to load peak Control of car by ISO (Grid operator) AGC from PJM to Vehicle via PLC What the ISO sees What the ISO sees EVs providing regulation Regulation, drive, regulation, drive Permitted by Load-Serving Entity (local utility) Permitted by Load-Serving Entity (local utility) “meets IEEE 1547 standards” Bill to codify interconnect Permits Define: Aggregator Grid-integrated electric vehicle Bill to codify interconnect Permits Continued... Net metering Net can be at rate at time of use (not in this case) Interconnection requirements, etc same as distributed renewables Changed to ISO coalition - vehicle smart link ISO link now on server Vehicle Smart link (VSL) in Car • No moving parts, fits under dash • Receives signal from coalition server • Reports capacity and current state back to coalition • Working to predict next use of car (time, distance) • Automotive-grade Linux computer From car-as-generator to fleet as generator • AGC signal to a server used by aggregator • Server runs an agent-based coalition manager, dispatches individual vehicles • Vehicle Smart Link (VSL) on each vehicle learns pattern of use of that vehicle, predicts ability to dispatch • Vehicle module acts reasonably when communication lost (e.g. night charge) V2G Aggregator Leveling Wind with V2G Simple model of V2G for wind leveling • 220 MW offshore wind power (modelled from buoy 44009) • Leveling target at 88 MW (40% of nameplate or 14% of average DE load over 8760 hours) • EV storage of 1000 MWh (1 GWh) to level • Storage from just under 30,000 EVs (28571 eBoxes), about 4% of DE fleet • Simplifying assumptions: no other end use storage, no distribution power limits, driving compromised during a few long wind lulls/year • Equivalent proportion: 3,250 MW capacity (100% of DE electricity) and 58% of fleet July Wind July wind + V2G January Wind January wind + V2G V2G as wind leveling • Good to reduce ramp rate, fill short gaps (up to 6 hours? one day?) • Simple model: Not suitable for multi-day wind lulls • Still need fossil or some other backup for long wind lulls • Half of fleet serves very roughly 100% wind electric -- needs model with load, etc Experimental Fleet Current Fleet • AC Propulsion eBox • Fuel Cell Bus Fleet expansion • Now building 5 vehicles • Market test requires enough vehicles, at 15 kW/vehicle that is • V2G market test in PJM: 200 cars = 1 MW • V2G test in ISO-NE: 20 cars = 100 kW • OEMs not building grid-oriented cars, so we work with medium-volume (300/year) manufacturers medium-volume manufacturing AutoPort, Inc. converts vehicles, will do EVs with V2G Fleet expansion Summary • Electricity has “won” as next car fuel • Plug-in cars will be a grid resource • A/S as initial high-value markets • Completed or in process • 1-6 vehicle dispatch under AGC • Software for aggregator & vehicle • Interconnect; law for net metering • Next: Fleet for A/S contract (~200+) END More information: www.magicconsortium.org www.carbonfree.udel.edu