RPP Infra Projects Ltd. Relative Valuations

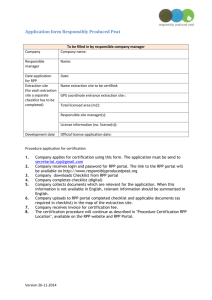

advertisement

Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria RPP Infra Projects Ltd. (BOM – 533284) (NSE – RPPINFRA) Last Price (11/5) 151 INR Market Cap 337 INR Crore Industry Infrastructure & Irrigation Relative Valuations Dividend Yield (%) 0.34 Return on Equity 12.7% Price Target (FY17) INR 243 (60%) RPP Infra’s Focus on Boosting Order Book, Niche Projects Adjusted P/E Forward P/E EV/ EBITDA RPP 19x 14x 8.6x Sector 23x 20x 9.8x Country 20x 17x 11x P/CF 14.5x 12.6x 9.5x Source: Medici Estimates, Bloomberg RPP’s Order Book Distribution Government spending, Niche Projects to Drive Margins Incorporated in 1988, RPP Infra Projects Ltd. is engaged in civil construction, infrastructure, construction of roads, water pipeline projects, industrial structures and irrigation projects. The company is headquartered in Erode, Tamil Nadu and executes projects primarily in the states of Karnataka, Andhra Pradesh, Tamil Nadu and the Union Territory of Andaman Nicobar Islands. As of April 2016, RPP Infra has an order book of approximately Rs.780 crores (2.4x of TTM consolidated revenue). Buy-side: Targeting of niche segments will continue to boost bottomline. Partnerships with Siemens and other international giants will help in a bidding of bigger projects, augmentation of order book. Government spending to push infra and construction growth Government spending in the infrastructure, construction, and irrigation space continues to be a major driver for growth in the sector. RPP Infra’s model relies primarily on state spending on construction as well as infrastructure projects. The company is targeting new states like Madhya Pradesh as well as strategic partnerships with local and international players like Siemens for boosting its order book. Sell-side: Long term trajectory High competition in the sector can push pressure on margins. RPP Infra has seen steady growth across its execution trajectory over the past few quarters. The company is relying on its core strength of executing projects at a fast pace on EPC basis in order to manage large book at relatively less amount of liquidity. The model has helped the company to maintain strong margins. An elongated working capital cycle will increase need of short term capital. Entry into already competitive states like Madhya Pradesh. In FY16, RPP Infra is expected to expand its topline by approximately 20%-22% with 50 basis to 75 basis points dent in operating margins on lower execution in the last two quarters. However, the trend is expected to improve over the next few quarter with higher margins in FY17. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Joint ventures inked, focus on diversified partnerships Smaller projects and quick execution key to RPP’s higher margins. RPP Infra bids for projects between Rs.50 to Rs.100 crores. The company is in a better position to bid for smaller projects as it can control onsite operations, raise milestone bills faster and hence enhance liquidity. However, in order to bid for bigger projects the company has entered into a memorandum of understanding with Hunan Construction Engineering Group Corporation of China and Delamore & Owl Group of Companies of Canada. A joint venture with Chinese construction giant will enhance technical skills, expertise in project execution and will also help in supply of equipment, design and engineering. Joint Ventures will enable the company to bid for bigger projects as well as tie up funding at a faster pace. RPP’s push in Central Indian States will lead to further diversification RPP Infra will participate in a tendering process, project management and allocation of resources. Canadian giant Delamore & Owl Group would act as a co-sponsor and funding partner. It will also provide assistance in finance and cost management. Existing status and projects Hunan Construction is keen on executing projects on EPC basis however Canada’s Delamore is looking to fund projects primarily on Built Operate Transfer or BOT basis. RPP Infra prefers to execute projects on EPC basis. The company is in dialogue with Hunan Construction for establishing a company in India with investments being deployed by the Chinese giant and both the entities getting engaged in an execution of various projects. Proposed partnerships RPP Infra is also in dialogue with few other international players to strike out similar structure with latter entities deploying capital and/or execution skills whereas RPP Infra engages in management as well as an execution of the projects. The company is jointly bidding for Rs.1,500 crore project in Bangladesh with Siemens for an order of Rs.75 – Rs.100 crore falling in net of RPP Infra. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Power, Water Management and Construction Crowds RPP’s Order Book In 2016, RPP Infra has bagged major order from Neyveli Lignite Corporation for Rs.56.5 crore which includes construction of 154 residential quarters general civil works phase II roads and drains package. The company also received two orders for construction works at the proposed ITBP Complex from Engineering Projects India for Rs.58.5 crore. Overall, RPP Infra has bagged orders totaling Rs.360 crores, or 47% of the total order book, in the first three months of 2016 reflecting strong built up and impact of joint ventures. Civil construction and management dominate company’s order book water the Book diversified among major South Indian states RPP Looking to bid for projects in Central India for further diversification RPP’s orders include mainly projects in construction, power and water management with the expected EBITDA margins in the range of 12%-15%. The company’s major projects include construction of integrated storm water drain in Coovum water shed of Coovum basin, rehabilitation of Bhadrawathi canal and construction of scientific godown of 40,000 metric tonne capacity at Nagapattinam. What is expected to augment RPP’s order book? As of April 2016, RPP Infra has participated into various tenders of Rs.850 crores on a standalone basis as well as along with joint ventures entities. These projects are in the areas of lift irrigation, roads construction, civil construction and prefab structures. The company is bidding for these projects in Madhya Pradesh, Karnataka, Tamil Nadu and internationally in Sri Lanka and Bangladesh. Awarding of new projects in Tamil Nadu and Kerala has slowed due to run up to state elections. However, state governments in Karnataka, Madhya Pradesh, Telangana have consistently invited bids for irrigation and construction projects. The orders in the bidding process are in a range of Rs.50 crore to as high as Rs.350 crore. RPP’s management expects operating margins of 10%-14% on these projects. If the company successfully receives even 30%-40% of the total projects its order book is expected to cross Rs.1,000 crores. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria How RPP is Benefiting from Niche Projects and Execution Skills Niche Segments The construction space is highly competitive and is expected to grow at 6% in 2016 backed by government spending, easing monetary policy, housing for all and other reforms for accelerating growth. As a result of competition and higher working capital cycle, margins in the industry tend to be lower. However, RPP Infra reported higher operating margins of 12.2% in FY15 and 12.6% in 9MFY16. The company is generating higher margins due to an execution of niche and complex projects like building reinforced concrete roads and water pipeline projects. Quicker turnaround, focus on projects where all bases are covered results in higher operating margins. Protection of escalation and penalty clauses, benefit of mobilization advance helps in augmenting of margins. The niche areas like pipeline projects have higher entry barriers with execution cycle being as high as five years with first billing generated in 14-18 months. RPP Infra sub contracts 25%-35% of its total work, which is altered in order to decrease the turnaround time. The company has designed processes in order to enhance quality, ensure quick deliverables and corresponding reporting to the top management. Out of its total book, only two projects of construction and formation of flood carrier canal totaling Rs.30 crores, forming 4% of the total order book, have faced delays mainly due to non-availability of land from the respective government entities. Mobilization, escalation, and penalty clauses RPP Infra engages in projects covered by escalation clause in order to hedge against wild swings in commodity prices. The billing is revised based on wholesale price index released by the central government agencies. The company also benefits from 10%-15% mobilization advance, which is interest-free, provided at the time of rewarding of a contract. RPP Infra mobilization advance for its existing book stood at Rs.48 crore. Strong advances facilitate in an easing of working capital cycle as well as benefits in an overall profitability of the company. RPP Infra can also claim for penalty interest amount in case of delayed payment from select government entities and projects. The penalty interest rate of 15% can be recovered in case of delayed payments, this arrangement facilitates recovery of any costs on blocked capital. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria RPP Infra – One of the Most Profitable Construction and Infra Entity Higher Operating Margins RPP Infra Projects went public in 2010 and its stock has almost doubled since its listing. The company’s EBITDA margin has improved to 17.3% in FY15 as compared to 14.8% in FY12. The company’s book has expanded by 50% over the past four years. RPP’s extended working capital cycle is getting funded primarily by Rs.58 crore of cash credit limits, which if improved or any reduction in interest rates will lead to a higher bottom line. Its net profit margin improved to 6.6% in FY15 as compared to 5.7% in FY12. Commodity prices benefit players RPP’s operating expenses have shown steady growth with material costs declining in FY15 mainly due to lower commodity prices internationally. The trend is expected to continue for the next few quarters as manufacturing activity in China decline on a shift towards services. Bigger projects mean lower profits? RPP Projects derives higher margin from niche and complex projects like construction of RCC roads and water pipeline projects. The company intends to focus on the niche and diversified areas across the offerings as well as regions in order to hedge itself against traditional slowdowns in the construction space. RPP Projects has managed its operations on asset light basis i.e. the company leases equipment in order to reduce shifting time as well as deploy lesser capital on acquiring as well as maintenance of assets. The trend is expected to continue although we might see a majority of the equipment leased from Hunan Construction. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria RPP Infra Targeting Lower Rates, Improving of Capital Structure RPP Infra’s total debt as on March 31, 2015 stood at Rs.81 crore consisting of Rs.73 crore in cash credit facilities primarily from Indian Overseas Bank and Axis Bank. As on March 31, 2016, utilization levels are expected to be in line with the prior year. The financial costs for FY16 is estimated at Rs.18- Rs.19 crore with an effective rate of interest of 14%. The company is in negotiations with its bankers for reduction of interest rates by 75 bps to 100 bps which would result in savings of Rs.1-Rs.1.25 crore per annum. These initiatives would boost net margin by 1% on an absolute basis. In talks with bankers for reduction of existing rates by atleast 75-100 basis points. Rated as an investment grade entity (Brickworks BBB-). Any improvement in the ratings will help easing of interest rates. Elongated working capital cycle RPP has been witnessing some delays in repayment from select government entities, especially in pipeline projects. The company prefers projects backed by World Bank or Nabard in order to ensure timely payments on billings. The delays resulted in a substantial increase of debtors to Rs.170 crores as compared to Rs.79 crore in the previous year, which has been subsequently transferred to sub-contractors resulting in an increase of creditors to Rs.118 crore as compared to Rs.34 crore in the previous year. The company has received a substantial portion of its outstanding in FY16 and has applied for interest recovery at 15% from the respective entities. The working capital cycle is estimated to improve in FY16 with debtors declining to Rs.100-Rs.110 crore and creditors towards Rs.80-Rs.90 crore. Any improvement in the cycle should help the company in free capital for undertaking more projects. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Competition The construction space is market by intense competition, however, projects requiring specialization as well as having higher turnaround time like a pipeline, irrigation and concrete roads has less competition. RPP’s major book comes from Karnataka, Tamil Nadu and Andhra Pradesh. The company faces competition from local as well as regional contractors like Ramalingam Construction, IVRCL, Madhucon, Marg Infrastructure, JMC Projects and other private contractors. Competitive Landscape 1 RPP Infra Projects Pvt. Ltd. Mkt Cap (Rs. Crores) 336 2 Simplex Infrastructures Ltd 1,375 4,611 3 Hindustan Construction Co 1,671 5,873 4 NCC Ltd 4,106 6,026 5 Punj Lloyd Ltd 779 5,295 -40.01 6 Supreme Infrastructure India 277 2,004 -30.12 7 J.Kumar Infraprojects Ltd 2,165 2,489 0.70 8 KNR Constructions Ltd 1,549 1,577 9 IL&FS Transportation Network 2,628 11,219 Sl. No. Company (As on April 22, 2016) 0.34 Revenue Growth (Y-o-Y) (%) 12.97 EPS Growth (Y-o-Y) (%) 47.78 Return on Equity (%) 13.50 Total Debt (Rs. Crore) 110 0.18 1.24 3.02 4.40 2.28 -4.51 35.63 164.72 EV (Rs. Crores) Dividend Yield (%) 397 0.54 Debt / Equity Debt / EBITDA 0.6 3.1 3,369 2.3 5.0 6.16 11,899 16.0 9.5 3.4 3.91 3,390 0.9 -14.57 7,141 7.7 -84.16 2.46 4,184 4.5 11.6 13.18 4.90 13.84 515 0.7 2.1 0.36 4.95 19.74 13.49 768 0.9 6.0 4.88 3.48 -21.42 7.70 23,513 3.9 10.9 Source: Medici Estimates, Bloomberg Estimates How increasing competition can Impact Margins? RPP Infra is focusing on new states like Madhya Pradesh, Uttar Pradesh for diversification as well as an expansion of its existing book. Madhya Pradesh is witnessing all round a development in the infrastructure space. The state has seen investments and projects across the development of airports, dams, water management, irrigation, pipeline and roads construction. Major companies like Dilip Builders, SEW Constructions, Som Projects, Prakash Asphalting, Emerald Industries, PNC Constructions, Chetak Enterprises, Shree Construction and many other private contractors are involved in a tendering process. The state has attracted major interest from west and south India-based construction companies looking to expand beyond their states. As a result, initially these companies attract tenders based on an attractive price quotation translating into lower operating margins. Shift towards bigger projects, construction and states with higher competition can put some pressure on margins. RPP Infra will also look for projects in the state of Uttar Pradesh, however, these would start finding traction in the order book post state elections which are due in 2017. However, that is necessary for next growth phase in order to ramp up qualifications. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria How Government Spending and Global Factors can Impact the Industry GoI has earmarked Rs.50,000 crore for development of 100 smart cities. The current government has clearly prioritized spending in the infrastructure space in the budget as well as through other measures like an easing of norms and limits in foreign direct investment. The government is pushing for manufacturing locally in order to push for employment as well as support rural growth. In the Budget 2016, the central government has earmarked Rs.86,500 crore for irrigation in order to give a boost to agriculture production. There is a huge gap in irrigation facilities as more than 60% of the total 142 million hectares of farm land in the country is not covered under irrigation. Budget 2016 – Rs.2.2 lakh crore allocated for infrastructure spending. Roads sector getting boost of Rs.97,000 crore. GoI has unveiled plans to invest $137 billion in railways over the next five years. The infrastructure sector on a whole got a record allocation of Rs.2.21 lakh crore in order to revive investments in the sector with the participation of private players. The road sector has received highest allocation of Rs.97,000 crore including Rs.19,000 earmarked for rural roads. The construction space is expected to benefit from tax exemptions for developers as well as individuals on affordable housing. Low-interest rates, commodity prices Commodity prices for steel, oil have rebounded almost 50% from their lows in 2016. However, they the prices are still low when compared with the 2014 peaks. Any substantial increase in commodity prices will make a dent on allocation as well as an execution of projects as interim margins tend to get impacted. Prices for steel, cement and other major input raw materials for construction space are expected to be weak as manufacturing activity slows in other major nations including China. If we head southwards The world economy hasn’t recovered completely from the 2007 financial crisis. Countries are using monetary and fiscal measures to push for exports and hence growth. If there is a pullback in any major economy like the US, China or Japan, it can have major negative impact on global growth and hence infrastructure spending. China’s economy is in a midst of becoming more service driven than the exiting growth model driven by exports. The US has raised interest rates for the first time in six years, the economy has improved but runs very high debt on per capita basis. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Valuations RPP is currently trading at 14x on a one-year forward price to earning basis as compared to the industry average of 19x. Traditionally, the company and overall sector have traded at a discount to the broad market as entities deal with lower margins, higher debt composition and delays in execution primarily from the government front and lower budgetary allocations. However, the current government is focusing on increasing infrastructure spending and smoothening execution process. These changes combined with lower interest rates and lower commodity prices are expected to provide a boost to the overall sector. RPP is asset light company, deploys strategy of leasing assets. On price to earning basis, the company is marginally undervalued. Medici as well as management estimates reflect high teens growth. One of the strongest in the space. On a one year forward basis, the company’s peers are trading at an EV to EBITDA multiple of 9.8x, considering increased visibility in revenues, joint ventures for bidding of bigger projects, revaluation of stock to that of the industry and a bottomline growth of around 20%-22%, the stock can garner a valuation of Rs.243 on one year forward basis and Rs.288 by the end of FY18. As the company is asset light and deploys a strategy of leasing assets, valuation on the basis of price-to-earnings would reflect fair valuation. RPP’s order book has expanded at a good pace in 2016 reflecting a pickup in the overall industry. RPP can garner higher valuations as its increases its networth, rationalizes its elongated working capital cycle and further diversifies its order book. On the basis of Price-to-earnings Sl. No. Parameter A Price Per share Multiple (x) PAT Mkt Cap Exit in 2017 18.0x 30 545 241 B Exit in 2018 18.0x 37 676 299 C Exit in 2019 18.0x 50 905 401 D Exit in 2020 18.0x 63 1,143 506 Source: Medici Estimates, Bloomberg Estimates © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria RPP’s Performance in the Recent Quarters Floods in the South India led to lower execution in the December 2015 and March 2016 quarter. In 9MFY16, RPP Infra posted revenues of Rs.249 crore, forming 95% of FY15 revenues, as compared to Rs.180 crore in the prior year period. The higher execution was mainly due to a strong book, quicker execution and retrospective billing in the first two-quarters. In the December quarter, RPP Infra posted revenues of Rs.72 crore as compared to Rs.92 crore in the previous quarter mainly due to floods in Southern India and building up of state elections which resulted in lower execution. For the March quarter, revenues are estimated at Rs.70 - 75 crore bringing the FY16 total to Rs.320 crore, reflecting 22% growth on a year over year basis. The management expects some slowdown due to state elections in the June quarter. Estimates turnover of Rs.90-95 crore. In FY17, RPP’s management estimates revenue of Rs.90 – Rs.95 crore in the June quarter and ramping up of execution with yearly estimates of Rs.380 – Rs.400 crore. Subdued profitability The company posted a profit before extraordinary items of Rs.17 crore as compared to Rs.15 crore in the prior year period. The net margins excluding tax and extraordinary items stood at 7% as compared to 6% in FY15. The rise in margins can be attributed partially to decline in commodity prices over the past few quarters. In the first nine months of FY16, RPP Infra reported Rs.34 crore as compared to Rs.26 crore in the prior year period. The company reported diluted earnings per share Rs.5.51 as compared to Rs.5.11 in the prior year period. RPP Infra executed projects in a pipeline, water management and there has been a strong foray into construction projects in order to boost book as well as execution. © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria 2016 Projects Dominating Order Book Date Principal Party (Rs. Crore) Warehouse Godown in Chennai Apr-16 Container Corp. 11.6 Construction of 160 Nos. PC Quarters Mar-16 Karnataka Police Housing 30.9 Construction of combined admin blocks at Kalikiri Chittoor. Mar-16 EPI-ITBP 34.2 Construction of Type II,III,IV quarters at Kalikiri, Chittoor Mar-16 EPI-ITBP 24.3 Rehabilitation of Bhadravathi canal Feb-16 KNNL Construction of 154 Nos. of various types of Resindential Quarters Feb-16 NLC 31.7 Road and Storm water drain in NTPL campus at Tuticorin Feb-16 NLC 21.0 Pipeline work at Kulithalai, Karur Feb-16 TWAD 42.0 Construction of quarters in 2 places - Dharwad, Karnataka Jan-16 Karnataka Police Housing 30.5 Chainpura Charanpura Bhaura Road-Madhya pradesh Jan-16 MP PWD 29.2 Construction of Quarters at Bhel Trichy Dec-15 BHEL 2.7 Periodical renewal, New Mangalore Port Trust, Road construction Dec-15 NHAI 26.3 Development work at Mudhaliar Kuppam,Chennai Oct-15 Tourism Develop Nagapatinam Aug-15 TNCSC Construction of 51 tenants at Ramnadu- staff quarters Aug-15 TANGEDCO 4.1 Construction of Integrated storm water drains in Coovum Jun-15 Chennai Corp 118.0 Proposed Gauge conversion work between Tiruvarur-Karaikudi May-15 Southern Railway Construction of Pipeline Corridor in Reach III for MSEZ Mar-15 MSEZ WSIS to Tindivanam municipality in Vilipuram District Feb-15 TWAD, Tamilnadu 46.0 Construction of Scientific godown of 29,000 MT capacity at Tanjavur Dec-14 TNCSC 25.0 Udumalaipettai Dec-14 TWAD ,Tamilnadu 27.0 Road and Drain improvement works in City Municipal council Nov-14 Gadag 21.9 Coimbatore Nov-14 TNCSC 9.1 Providing CWSS to 212 rural Habitation May-14 TWAD 13.1 Providing CWSS to 327 Rurual habitation in Salem District Apr-14 TWAD 6.7 Creek. Feb-14 Chennai Rivers 6.3 Formation of Flood Carrier Canal Mar-12 PWD 12.6 Construction of Sea Wall/ Shore Protection Work at Mus, Car Nicobar Dec-11 CPWD 17.1 117.0 1.5 Construction of Scientific godown of 40,000 MT capacity at 28.4 32.6 8.4 Providing CWSS to 158 habitations in Gudimangalam and Construction of Scientific godown of 22,000 MT capacity at Implementation of Eco restoration in 300 acres of Adyar Estuary and Total Book 779.3 © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria DIRECTOR PROFILE Directors Mr. P Arulsundaram Mrs. A Nithya Mr. P Muralidasan Mr. A P C Krisshnamoorthy Position Chairman, Managing Director Director Director Independent Director Mr. S Swaminathan Independent Director Mr. K Natarajan Independent Director Description Has an experience of more than two decades in the industry of civil works in the field of transportation, power, commercial buildings, and irrigation. He holds Bachelors in Civil Engineering. As a Whole Time Director he is involved in strategic affair, business development, and overall management of operations. Has an experience of more than 15 years with RPP Infra. She looks after finance, accounts and treasury functions. She is involved into strategic affairs as well as looks after fund raising and other important financial decisions of the company. Has wide experience of project execution and management. He acts as a project head for various projects and has three to four project managers reporting to him. Has been associated with RPP Infra since three decades and acts as a legal advisor to the company. Has a rich experience of managing power and related projects with BHEL. He has worked in Indonesia towards various power projects. He is involved in business development activities for RPP Infra. Has vast experience in power and related projects and is currently involved with RPP Infra for business development activities. Beneficial Ownership/ (% O/S) 9788443 43% 6579898 29% 156 - - - - © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Projected Financials RPP Infra’s Income Statement (All figures in INR Crores unless stated otherwise) FY11A FY12A FY13A FY14A FY15A FY16E FY17P FY18P FY19P FY20P 214 265 260 240 266 324 422 519 628 753 2 3 3 7 5 5 5 5 6 6 216 269 263 247 270 329 427 524 633 759 51 65 72 68 54 82 105 131 155 190 Works Contract 73 101 83 67 89 101 130 165 196 235 Labour Wages 38 33 39 41 66 67 93 112 140 163 5 4 1 7 5 5 7 8 10 12 6 8 9 7 5 6 6 7 7 8 11 14 17 15 13 19 23 28 35 42 184 224 220 204 231 279 364 451 543 650 33 45 43 43 40 50 62 73 91 110 4 8 10 8 7 8 9 9 10 12 29 38 33 35 32 42 54 63 80 98 5 10 17 17 17 16 15 16 16 17 24 27 16 18 15 26 39 48 64 81 - 1 (0) - 6 - - - - - 24 28 16 18 21 26 39 48 64 81 5 6 5 5 5 6 8 10 14 18 19 23 11 14 17 21 30 37 50 63 Shares in issue (Lakhs) 226 226 226 226 226 226 226 226 226 226 Earnings per share (Rs.) 8.27 10.00 5.03 6.02 7.34 9.08 13.37 16.59 22.20 28.03 Revenue from operations Other income Total Revenues Operating Expenses Raw Material Cost Direct Operating Costs Freight, Power and Other Charges Total Employee Benefit Expenses Other manufacturing expenses [-] Total Operating Expenses EBITDA [-] Depreciation EBIT [-] Interest PBT and exceptional, extraordinary items Extraordinary item PBT [-] Taxes PAT © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria RPP Infra’s Balance Sheet (All figures in INR Crores unless stated otherwise) FY11A FY12A FY13A FY14A FY15A FY16E FY17P FY18P FY19P FY20P Cash Credit / Overdraft Utilization 23 65 75 71 78 75 78 82 86 90 [+] Accounts payable 37 45 40 22 107 70 90 113 135 163 [+] Other Current Liabilities 38 55 32 36 47 48 49 50 51 52 Liabilities & Equity Current Liabilities & Provisions [+] Short Term Provisions 8 7 6 7 7 7 7 7 7 7 105 173 152 136 239 200 224 252 279 312 Long term borrowings 9 13 15 15 7 4 1 0 0 0 Deferred tax liabilities 0 1 1 1 - 1 1 1 1 1 Long term provisions 0 0 - - 0 0 0 0 0 0 [+] Total Non Current Liabilities 9 14 16 16 8 6 3 2 2 2 Share Capital 23 23 23 23 23 23 23 23 23 23 Reserves and surplus 64 86 97 133 148 167 196 232 281 343 [+] Total Networth 86 109 120 155 171 190 219 255 304 366 201 296 289 306 418 396 446 509 584 680 30 27 14 12 14 27 50 40 56 74 Total Current Liab. & Prov. Non Current Liabilities Networth Total Liabilities & Equity Assets Current Assets Cash & Cash Equivalent [+] Inventory 1 1 1 1 2 1 2 3 4 4 [+] Account Receivables 63 106 107 94 188 146 160 220 263 322 [+] Loans & Advances 35 39 40 60 60 64 69 74 79 84 [+] Other Current Assets 30 64 72 85 93 101 110 119 130 141 Total Current Assets 160 236 234 251 358 340 391 456 531 626 [+] Net Fixed Assets 27 53 48 47 39 37 35 33 32 32 [+] CWIP 1 0 1 3 3 - - - - - [+] Non-current investments 0 0 0 0 0 0 0 0 0 0 [+] Long term loans and advances 4 2 2 1 1 1 1 1 1 1 [+] Other non current assets 8 4 3 4 16 17 18 18 19 20 201 296 289 306 418 396 445 509 584 680 Total Assets © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Ratio Analysis (All figures are dimensionless unless stated otherwise) FY11A FY12A FY13A FY14A FY15A FY16E FY17P FY18P FY19P FY20P EBITDA Margin 15.3% 17.0% 16.6% 17.7% 14.9% 15.5% 14.8% 14.1% 14.4% 14.5% EBIT Margin 13.5% 14.1% 12.8% 14.5% 12.1% 13.0% 12.7% 12.2% 12.8% 13.0% PBT and extraordinary Margin 11.1% 10.3% 6.2% 7.6% 5.6% 8.1% 9.2% 9.2% 10.2% 10.8% 8.7% 8.5% 4.4% 5.7% 6.2% 6.3% 7.2% 7.2% 8.0% 8.4% Revenue 23.9% -2.1% -7.6% 10.7% 22.0% 30.0% 23.0% 21.0% 20.0% EBITDA 38.1% -4.4% -1.4% -7.0% 26.5% 24.5% 16.8% 24.4% 20.8% EBIT 29.9% -11.3% 4.3% -7.3% 30.7% 27.7% 18.1% 26.5% 22.1% PBT 15.0% -41.5% 13.6% -18.7% 76.9% 47.2% 24.1% 33.8% 26.3% PAT 20.9% -49.7% 19.7% 21.9% 23.8% 47.2% 24.1% 33.8% 26.3% Profit Margins PAT Margin Growth Rates As a % of Sales Raw Material Cost 23.6% 24.5% 27.7% 28.5% 20.2% 25.4% 24.9% 25.3% 24.7% 25.2% Power Cost 34.1% 37.9% 31.7% 28.0% 33.4% 31.0% 30.8% 31.7% 31.2% 31.2% Employee Cost 17.7% 12.2% 15.1% 17.0% 24.6% 20.5% 22.2% 21.7% 22.2% 21.7% Other manufacturing business 2.5% 1.4% 0.2% 2.8% 1.7% 1.6% 1.6% 1.6% 1.6% 1.6% Admin & Misc Expenses 3.0% 2.9% 3.4% 2.8% 2.0% 1.8% 1.5% 1.3% 1.1% 1.0% Current Ratio 1.52x 1.37x 1.53x 1.85x 1.50x 1.70x 1.75x 1.81x 1.91x 2.00x Quick Ratio 1.51x 1.36x 1.53x 1.85x 1.49x 1.69x 1.74x 1.79x 1.89x 1.99x ROAE 23.1% 9.9% 9.9% 10.2% 11.4% 14.8% 15.8% 18.0% 18.9% Pre Tax ROACE 34.3% 25.7% 22.7% 18.4% 22.5% 25.8% 26.5% 28.6% 29.1% Post Tax ROACE 26.9% 20.1% 17.7% 14.4% 17.6% 20.2% 20.8% 22.3% 22.8% 9.1% 3.9% 4.6% 4.6% 5.0% 7.2% 7.9% 9.2% 10.0% Liquidity Ratio Return Ratio ROAA Leverage Ratio Debt/ Equity 0.5x 0.6x 0.4x 0.3x 0.3x 0.3x 0.2x 0.2x 0.2x 0.1x Debt/ EBITDA 1.4x 1.5x 1.1x 1.2x 1.4x 1.0x 0.8x 0.7x 0.6x 0.5x Interest Coverage 5.8x 3.7x 1.9x 2.1x 1.9x 2.7x 3.5x 4.1x 5.0x 5.8x © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Valuation and Peers EXIT VALUATION ON CURRENT MULTIPLES On the basis of EV/ EBITDA Sl. No. Parameter A [+] Cash & Cash equivalent [-] Working Capital Loan Equity Value Multiple (x) EBITDA EV Price Per share Exit in 2017 8.5x 62 528 50 78 495 219 B Exit in 2018 8.5x 73 616 40 82 573 254 C Exit in 2019 8.5x 91 766 56 86 736 326 D Exit in 2020 8.5x 110 926 74 90 909 402 Trading Comparables Sl. No. Company (As on April 22, 2016) Mkt Cap (Rs. Crores) EV (Rs. Crores) FY2 EPS Growth (%) Return on Equity (%) Total Debt (Rs. Crore) TTM FY1 FY2 TTM FY1 Debt / Equity 6.67 6.30 22.03 17.93 11.91 3.02 4.40 3,369 2.3 16.89 24.38 23.32 -4.51 6.16 11,899 16.0 28.85 20.96 16.32 164.72 3.91 3,390 0.9 -14.57 7,141 7.7 -84.16 2.46 4,184 4.5 EV/ EBITDA (x) P/ E (x) 1 Simplex Infrastructures Ltd 1,375 4,611 8.08 2 Hindustan Construction Co 1,671 5,873 7.08 3 NCC Ltd 4,106 6,026 8.45 4 Punj Lloyd Ltd 779 5,295 5 Supreme Infrastructure India 277 2,004 8.05 13.50 6 J.Kumar Infraprojects Ltd 2,165 2,489 9.85 18.04 19.81 15.27 4.90 13.84 515 0.7 7 KNR Constructions Ltd 1,549 1,577 10.88 10.28 21.22 15.46 15.36 19.74 13.49 768 0.9 8 IL&FS Transportation Network 2,628 11,219 -21.42 7.70 23,513 3.9 5.85 5.24 45.92 7.27 16.02 4.56 3.92 8.90 Mean 9.8x 6.8x 13.7x 18.5x 19.7x 16.4x Median 8.5x 6.3x 6.3x 18.0x 19.8x 15.4x © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures. Medici Firma | Buy Side Coverage as of May 12, 2016 | Ravi Kataria Credits: Ravi Kataria Vice President – Medici Firma www.medicifirma.com rkataria@medicifirma.com +919726061617 © 2016 Medici Firma. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +919726061617. To license the research, call +919726061617. See last page for important disclosures.