ENVIRONMENT, ENERGY & SAFETY Industry Progress Report:

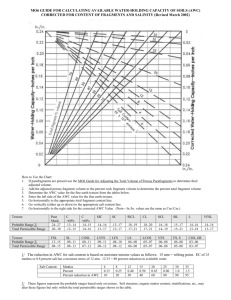

advertisement

Industry Progress Report: ENVIRONMENT, ENERGY & SAFETY INTRODUCTION The American Wood Council (AWC) is the voice of North American wood products manufacturing, representing over 75 percent of an industry that provides approximately 400,000 men and women with family-wage jobs. AWC members make products that are essential to everyday life from a renewable resource that absorbs and sequesters carbon. Staff experts develop state-of-the-art engineering data, technology, and standards for wood products to assure their safe and efficient design, as well as provide information on wood design, green building, and environmental regulations. AWC also advocates for balanced government policies that affect wood products. AWC members are very proud of their record of mill safety, energy management and efficiency, and protection of the environment while producing products that are central to the lives and homes of all Americans. This is the first published AWC Environment, Energy, and Safety Report. Based on 2010 and 2012 data collected from the industry in 2011 and 2013, it shows that despite the economic downturn from 2007 to mid-2009 causing a drop in wood products manufacturing, manufacturers have made considerable environment, energy and safety improvements. Many factors influence individual parameters so it is important to look at longer term trends rather than changes between years. The Report also provides some economic and employment data for the last decade. KEY FINDINGS n The Greenhouse Gas reduction benefits of using biomass manufacturing residuals for energy by the wood products industry are equivalent to removing about 4.6 million cars from the road per year. n Among the entire manufacturing sector, the wood products industry is the largest user of biomass energy in terms of its percentage share of total energy use. n Emission releases of formaldehyde and methanol have been reduced by more than half and a third respectively in the last several years due to resin reformulations and millions of dollars in investments in pollution controls. n Safety at mills as measured by Reportable Cases has improved by 40 percent over the last decade. n Energy intensity has improved significantly coming out of the recession returning to pre-recession levels with carbon-neutral, renewable biomass representing about 75 percent of total energy use. ENVIRONMENTAL PROFILE Chemical Releases Formaldehyde - Formaldehyde emissions intensity of reporting AWC members, expressed in pounds per thousand cubic feet of products produced, has been declining continuously since 2006. Between 2003 and 2012, release intensity has decreased 56 percent. The more recent declines are probably due to a combination of required air pollution controls and product reformulation efforts to reduce formaldehyde in resins. CHART 1: Formaldehyde Release Intensity Pounds per 1,000 cubic feet of production 3 2 1 0 2003 2006 2008 2010 2012 Source: EPA (for facilities reporting to AWC/AF&PA Surveys) Methanol - Methanol emissions intensity of AWC member companies, expressed in pounds per thousand cubic feet of wood products produced, remained essentially flat during 2003-2008. Since 2008, intensity has declined from 4.2 pounds/MCF to 2.8 pounds/MCF in 2012, a reduction of 33 percent. Improvements in methanol emissions are associated with Clean Air Act requirements to capture and destroy methanol from various presses, dryers and other process equipment that went into effect in 2008. CHART 2: Methanol Release Intensity 5 Pounds per 1,000 cubic feet of production 4 LIFE CYCLE PERFORMANCE 3 2 1 0 2003 2006 2008 2010 2012 Source: EPA (for facilities reporting to AWC/AF&PA Surveys) Toxic Release Inventory - The following chart tracks total Toxic Release Inventory (TRI) releases per MCF (thousand cubic feet) of wood products production for AWC member companies that reported to the AWC survey. The data were obtained from EPA’s TRI. Total TRI release intensity has been trending downward since 2003. Between 2003 and 2012, intensity decreased 44 percent. CHART 3: Total TRI Release Intensity 6 Pounds per 1,000 cubic feet of production 5 4 3 2 1 0 2003 2006 2008 2010 2012 Source: EPA (for facilities reporting to AWC/AF&PA Surveys) The North American wood products industry is committed to sustainability in its products and their use. In support of this commitment, and as a way to stimulate product improvement, the industry undertook to prepare and publish third-party verified Environmental Product Declarations (EPDs) and Transparency Briefs that capture and describe the environmental performance of many of the products we produce. As noted, all North American wood industry EPDs have been independently third-party verified by UL Environment (ULE), a business unit of Underwriters Laboratories. ULE verifies that EPDs conform to the requirements of ISO 14025, the global standard governing EPDs. ULE’s review looks at both the underlying life-cycle assessments as well as the data reported in the EPDs. EPDs for the wood products industry can be found on www.awc.org. The next two largest energy source categories for 2012 were Purchased Electricity at 13.5 percent and Natural Gas at 9.9 percent. Natural gas share of total energy consumption increased from 6.6 percent in 2010 to 9.9 percent in 2012. The 2012 biomass-use data maintained the decade-long trend, shown in the chart below, in which wood products facilities have typically derived about 75 percent of their energy needs from carbon neutral biomass. As noted above, this use of biomass also replaces the use of fossil fuels and reduces landfilling of residues, conserving landfill space and avoiding methane emissions. In terms of percentage share of total energy use, the wood products industry is the largest user of biomass energy among all manufacturing sectors, making it a leader in renewable energy use. ENERGY PROFILE CHART 5: Biomass share of total energy consumption Wood products facilities use all parts of the raw material not only to manufacture products used every day, but also to generate most of the energy needed for production. Data submitted to AWC’s Survey indicate that member companies met almost 75 percent of their energy needs from renewable, carbon neutral biomass energy in 2012. 90 CHART 4: 2012 Wood Product Facility Energy Sources 50 Percentage Percentage 100 80 70 60 40 2004 2006 2008 2010 2012 Source: 2010, 2012 data from AWC Environment, Energy and Safety Survey; AF&PA EH&S Survey for previous years Biomass Fuels Chart 6 shows energy use trends for the wood products sector since 2004. Though total energy use has trended downward since 2004 due to a drop in production, the intensities have remained within a narrow range during the 2004-2012 period. Small variations likely result from energy use not being directly proportional to production and inefficiencies occurring when facilities operate at lower production rates than normal. Purchased Electricity Natural Gas Purchased Steam Other Fossil Fuels 0 10 20 30 40 50 60 70 CHART 6: Energy Use Intensity 80 Source: AWC Environment, Energy and Safety Survey 0.12 By using its biomass manufacturing residuals, the wood products industry is harnessing the energy value of the CO2 before it is lost to the atmosphere through other means or in form of methane, a much more potent greenhouse gas. Additionally, by using biomass, the industry displaces fossil fuel use and its associated emissions. 0.10 A recent study by the National Council for Air and Stream Improvement (NCASI) shows that the greenhouse gas reduction benefits of using biomass manufacturing residuals for energy by the wood products industry are equivalent to about 24 million tons of carbon dioxide. This is equivalent to removing approximately 4.6 million cars from the road each year. 0.04 Million BTUs/ MCF Production 0.08 0.06 0.02 0.00 2004 2006 2008 2010 2012 Source: 2010, 2012 data from AWC Environment, Energy and Safety Survey; AF&PA EH&S Survey for previous years Chart 8 provides a comparison of the safety performance of AWC members with that of the entire manufacturing sector. Data reported to the AWC survey indicates a 2012 recordable incidence rate of 2.5. This compares with a 2012 rate of 4.3 for all manufacturing as reported by the Bureau of Labor Statistics (BLS). The 2012 lost-work-day case rate for reporting AWC companies was 0.61, a small decrease compared to 2010. The lost-work-day case rate was 1.1 for all manufacturing as reported by the BLS. CHART 8: 2012 Safety Rates Comparison 5 SAFETY PROFILE Over the last decade, safety at wood products manufacturing mills, as measured by the Occupational Safety and Health Administration (OSHA) Recordable Case Incidence Rate, has improved by 40 percent. The OSHA recordable incidence rate is calculated as the number of recordable injuries and illness cases occurring among 100 full-time employees over a period of one year. The recordable incidence rate dropped from 3.4 in 2004 to 2.0 in 2008. While still lower than the high in 2004, it has been edging up during the past two reporting cycles - 2.3 in 2010 and 2.5 in 2012. This may be a result of increased hiring of new employees and temporary workers as mills expanded production in recent years, with these workers having less experience with mill safety programs. CHART 7: AWC Members Recordable Case Rate 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 2004 2006 2008 2010 2012 Source: 2010, 2012 data from AWC Environment, Energy and Safety Survey; AF&PA EH&S Survey for previous years 4 3 2 1 0 Recordable Incident Rate Days Away From Work Case Rate AWC Reporters All Manufacturing Source: AWC Environment, Energy and Safety Survey; U.S. Department of Labor Capital Spending As shown in Chart 10, the wood products industry spent $2.7 billion on plant and equipment in 2012, according to Census Bureau data. That level of spending represented a 67 percent increase relative to a recession-period spending low of $1.6 billion in 2009. Only $0.5 billion of the industry’s 2012 capital expenditures went for structures, while $2.2 billion was used for equipment. CHART 10: Wood Products Industry Capital Spending Billions of Dollars 5 4 ECONOMIC PROFILE Production 3 2 1 After peaking in late 2005, production of wood products had dropped nearly 45 percent by mid-2009 due to declines in housing starts resulting from the financial crisis. The subsequent recovery in new home construction has lifted demand for solid wood products. U.S. production of wood products rebounded by 30 percent between its mid-2009 cyclical low point and the third quarter of 2014, according to Federal Reserve Board data. However, as can be seen from Chart 9 below, wood products production still remains significantly below its pre-recession levels. Sales from wood products companies recently have also been on the rise, from a low of $58 billion in 2009 to $71 billion in 2013, according to U.S. government data. The wood products industry accounted for 1.2 percent of U.S. manufacturing GDP in 2012, according to data compiled by the Bureau of Economic Analysis (BEA). CHART 9: Wood Products Industry Production and Housing Starts 120 110 100 90 60 50 40 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Industry Production (Index: 2007 = 100) Housing Starts (Thousands) Source: Federal Reserve Board, seasonally adjusted monthly data 2008 2009 2010 2011 2012 Employment According to U.S. Bureau of Labor Statistics data, wood products employment bottomed out at 337,100 workers in 2012 and has been trending higher during recent years as housing starts and industry production recover. Wood products industry employment rose 0.6 percent in 2012 and 3.8 percent in 2013, to 351,900. By mid-2014, it had increased to 370,000. CHART 11: Wood Products Industry Employment Thousands of Workers 600 500 2,000 400 1,500 300 1,000 200 500 100 0 2007 Source: Annual Capital Expenditures Survey, U.S. Census Bureau 2,500 80 70 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Source: Bureau of Labor Statistics REPORT METHODOLOGY 2015 AWC MEMBERS Almond Bros. Lumber Anthony Forest Products Boise Cascade Canadian Wood Council Canfor USA/New South Charles Ingram Lumber Collum’s Lumber Columbia Vista Deltic Timber Georgia-Pacific Gilman Building Products Green Bay Packaging Hampton Resources Harrigan Lumber High Cascade/WKO Hood Industries Hull-Oakes Lumber Humboldt Redwood Company H.W. Culp Lumber Idaho Forest Group Idaho Timber Interfor U.S., Inc. Interstate Resources Kapstone Paper & Packaging Lampe & Malphrus LP Masonite McShan Lumber Mendocino Forest Products Mt. Hood Forest Products MWV Norbord Plum Creek Potlatch Rex/North Florida Roseburg Forest Products Scotch Gulf Lumber Seneca Sawmill Company Shuqualak Lumber Sierra Pacific Simpson Lumber Stimson Lumber Swift Lumber T.R. Miller Mill Company Vaagen Brothers West Fraser Westervelt Weyerhaeuser The American Wood Council (AWC) is both one of the youngest and one of the oldest major trade groups in the nation. AWC was re-chartered as a separate corporation in June 2010, evolving from a number of predecessor groups. Immediately prior to the founding of AWC, the wood products industry was represented by the American Forest & Paper Association (AF&PA). AWC member data for 2010 and 2012 are from survey responses to AWC’s Environment and Energy Survey. For years prior to 2010, data is from a similar survey conducted by AF&PA for its members with wood products operations. Note that the sample set of respondents varies from one survey year to another. 222 Catoctin Circle SE | Suite 201 | Leesburg, VA 20175 1101 K Street NW | Suite 700 | Washington, DC 20005 Phone: (202) 463-2766 | Fax: (202) 463-2791 www.awc.org