Minds and markets: Some frontiers of behavioral finance by Colin Camerer

advertisement

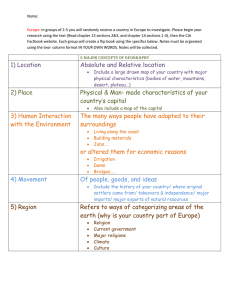

BeFi Web Seminar for May 30, 2007 Minds and markets: Some frontiers of behavioral finance © BeFi Forum 2007 by Colin Camerer Caltech Minds and markets: Some frontiers of behavioral finance Colin Camerer, Caltech camerer@hss.caltech.edu • See opportunities others don’t see – Psychology: Attention + curiosity • Understand the fears and hopes of investors – Psychology: Prospect theory – Neuroscience: Fear of the economic unknown New GAIM 2007 Monaco 1. See opportunities others don’t see • Conscious attention is limited – “Flicker” paradigm – Top-down encoding: “I’ll believe it when I see it” • Visual and cognitive illusions New GAIM 2007 Monaco How many F’s are there? FINISHED FILES ARE THE RESULT OF YEARS OF SCIENTIFIC STUDY COMBINED WITH THE EXPERIENCE OF YEARS New GAIM 2007 Monaco How many F’s are there? Answer: 6! FINISHED FILES ARE THE RESULT OF YEARS OF SCIENTIFIC STUDY COMBINED WITH THE EXPERIENCE OF YEARS • The brain ‘sees sounds’ and automatically encodes “of” as “ov” New GAIM 2007 Monaco How far can attention go? • Attention can be stretched but memory suffers • E.g. “I Love Lucy” chocolate factory episode New GAIM 2007 Monaco Do markets have ADD? • A. Earnings announcements – Friday reaction is slower • B. Distant demographic effects are underpriced – Bicycles and drugs • C. Attention-grabbing events drive volume – Barber-Odean • D. ENMD (reading the market’s reading) – Nature vs New York Times • E. Paying attention makes you smarter: Curiosity New GAIM 2007 Monaco A. Earning reports: (dark blue) Fridays react more slowly (Della Vigna-Pollet 06) New GAIM 2007 Monaco B. Demographic profiles for bicycles (red) & drugs (blue): Investors look only 5 (…years!) ahead New GAIM 2007 Monaco C. Attention-grabbing events volume • High-volume or high-volatility stocks get 20% more individual investor trade (BarberOdean 06) New GAIM 2007 Monaco D. news (Nature) vs. NEWS (NYTimes) New GAIM 2007 Monaco E: Paying attention makes you happy and smart(er): Curiosity is the hunger pang of an info-vore • Einstein: “I have no special talents. I am merely passionately curious” • The wick in the candle of learning New GAIM 2007 Monaco Curiosity-piquing question • What animal excrement is eaten as a delicacy? New GAIM 2007 Monaco Curiosity-piquing question • What animal excrement is eaten as a delicacy? • A: Bat guano New GAIM 2007 Monaco Curiosity activates reward areas… • “Striatum” activated by: – Cocaine – Money – Expected return – Faces of cooperators – “warm glow” charity – information… when you are curious New GAIM 2007 Monaco …and curiosity enhances memory: highly curious remember wrong answers twice as often New GAIM 2007 Monaco 2. The fears and hopes of investors • Prospect theory: – Hate to lose compared to a reference point – Overweight or ignore rare “black swan” events – Fama: “morbid fear of a recession” • Preference for the familiar – “Home bias” (countries, Baby Bells, local firms) – Aversion to unfamiliar activates fear areas New GAIM 2007 Monaco Prospect theory value Function A special role for losses • Kahneman & Tversky (1979) most-cited empirical paper in economics post-1970 Gains = x(ρ) Losses = -λ*(-x)(ρ) New GAIM 2007 Monaco Nonlinear weighting of probabiltiy in choices↓ and in the brain ↓ New GAIM 2007 Monaco Overweighting low probability is severe– a quantum of possibility? – π(p) α (ln(1/p)) =1/e (α=1 linear) – Typical measured value (α=.77) • • • • π(.10)=.15 π(.01)=.04 π(.001)=.012 π(.000001)=.000515 (x1.5) (x4) (x12) (x 515) New GAIM 2007 Monaco Increased gain/reduced loss activates striatum…. brain (x) correlates with behavior (y) (Tom et. al. 07 Sci) New GAIM 2007 Monaco Can investors be immunized against loss-aversion? Maybe… 140 choices gamble vs. guaranteed p=0.5 Risky Gamble Guaranteed p=0.5 New GAIM 2007 Monaco Accept the gamble? Emotional down-regulation: Instructed to ‘think like a trader’… One way to think of this instruction is to imagine yourself a trader. You take risks with money every day, for a living. Imagine that this is your job, and that the money at stake is not yours – it’s someone else’s. Of course, you still want to do well (your job depends on it). You’ve done this for a long time, though, and will continue to. All that matters is that you come out on top in the end – a loss here or there won’t matter. In other words, you win some and you lose some. New GAIM 2007 Monaco Down-regulation decreases biological response to actual loss • Decreases skin conductance (not shown) Decreases activity in right amygdala (crosshair location) 217 voxels tmax= 72.78 p < .006 New GAIM 2007 Monaco Down-regulation of loss-aversion lowers measured λ (λ”Attend” - λ”Regulate”) as percent of λ”Attend” % DECREASE IN LAMBDA 0.6 0.5 The down-regulation strategy decreases loss aversion (t=5.40 p<.000003 N=45, Paired t- 0.4 test) 0.3 0.2 0.1 0 -0.1 -0.2 INDIVIDUAL SUBJECTS New GAIM 2007 Monaco (caveat re: ρ) Fear of the economic unknown (e.g. home bias in investing) New GAIM 2007 Monaco fMRI shows brain areas New GAIM 2007 Monaco Activation when fearing the economic unknown New GAIM 2007 Monaco In the news April 20, 2006 ECONOMIC SCENE Enter the Neuro-Economists: Why Do Investors Do What They Do? By TYLER COWEN A neuro-economics laboratory at Cal Tech, led by Colin F. Camerer…has assembled the foremost group of interdisciplinary researchers…. …. New GAIM 2007 Monaco Conclusions & the future • 1. Missing attention profits • 2. Fears and hopes of investors • Science fiction: – – – – – Predicting bubble crashes from brain signals Collective attention (herding…) Measuring risk propensity neurally Changing reactions to loss (down-regulation) Identifying great traders, rogue traders, and burnout. New GAIM 2007 Monaco PRESENTED BY Shlomo Benartzi Co-Founder, BeFi Associate Professor Co-chair of the Behavioral Decision Making Group The Anderson School at UCLA Warren Cormier © BeFi Forum 2007 Co-Founder, BeFi President, Boston Research Group