When do Firms Go Green? Regulations in India WORKING PAPER

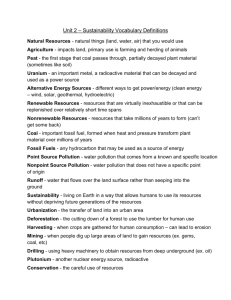

advertisement