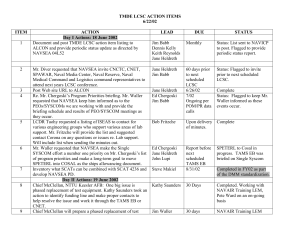

TECHNICAL APPENDIX

advertisement