Document 12586103

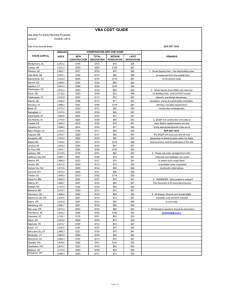

advertisement

August 2014 FY2013 ROPA Presentation Board of Trustees William Rainey Harper College Presented by: Jonathan King Virginia State University Wagner College Washburn University Wellesley College Wesleyan University West Chester University of Pennsylvania West Virginia Health Sciences Center West Virginia University Western Connecticut State University Western Oregon University Westfield State University Wheaton College (MA) Whitworth University Widener University Williams College Williston Northampton School Worcester State College Xavier University Yeshiva University Youngstown State University Interrelations of Strategic Facilities Management Space Impact • Planned targeted renovations will lower the age of campus • High density factor & technical complexity impact operational demands Space Operating Impact • Planned Maintenance has seen growth in recent years. Further investment into PM will be essential as newly renovated buildings come online 2 Capital Operations Capital Impact • Planned renovations will alleviate some of the growth in Backlog but will also create greater need for Stewardship reserves in coming years • As campus has aged and funding levels have not met Target (though close), the Backlog of need has seen continual growth The Age Profile Shifts with Time A balanced age distribution alleviates risk Campus Age Profile 100% 5% 90% 26% 80% 53% 70% 55% 55% Buildings 25 to 50 % of Space 60% 36% 50% 40% 17% 23% 30% 20% 20% 30% 10% 38% 22% 20% FY06 FY13 Less than 10 10 to 25 FY13 Peer Avg. 25 to 50 Campus space includes 1.31M GSF *Assumes completed renovations to M, F, A, D and H Major envelope and mechanical life cycles come due. Higher Risk Buildings 10 to 25 Short life-cycle needs; primarily space renewal. Medium Risk Buildings Under 10 0% 3 Buildings over 50 Life cycles of major building components are past due. Failures are possible. Highest risk FY18* Over 50 years Little work .“Honeymoon” period. Low Risk Defining Stewardship Investment Targets Replacement Value: $699M* $30.00 Life Cycle Need - Determined by: - Campus GSF - Campus Age - Function of Space - Technical Complexity $ in Millions $25.00 $20.00 $15.00 $12.2 Target Need: Discounts for campus modernization, and replacement of components before life cycles come due $21.0 $10.00 $4.3 $5.00 $8.4 $6.3 $0.00 3% Replacement Value Equilibrum Need Target Need $21.0 $20.6 $10.6 Envelope/Mechanical Depreciation Model 4 Space/Program Sightlines Recommendation *Replacement Value is unique from the institutional insurance value; it is calculated using the Sightlines model, based off the age, complexity and function of space. Does not include building content values. Chasing a Moving Target As the campus profile changes, the Target will continue to grow Project Spending to Target $12 FY09-FY13 Funding Distribution: Harper Stabilizing Backlog 10% Master Plan Infrastructure Projects Target Need P Chiller Plant Project Spending (Millions) $10 $8 $6 $4 90% FY09-FY13 Funding Distribution: Peers $2 46% 54% $0 2006 2007 2008 Annual Stewardship 5 2009 2010 2011 Asset Reinvestment 2012 2013 Target Need The Impact of Renovations on Deferred Maintenance Theory, demonstrating Sightlines IFP estimated backlog & impact of renovating space Estimated Backlog With Planned Renovations $180 $160 $140 $8.15 $10.31 Millions $120 $6.04 $17.45 $11.32 $100 $80 $152 $141 $60 $105 $105 $40 $20 $0 Total Existing Post-Building Building H Needs D Renovation Renovation $119/GSF 6 Building M Renovation Building F Building A Estimated 5 Year Add'l Renovation Renovation Backlog 2018 Deferred $108/GSF *5 Year Add’l Deferred: estimated using FY09-13 average deferral rate x projected target FY14-18 $80/GSF Operational Performance A Young, Complex Campus Requires Strong PM Best practice institutions invest 10-12% of their budget on PM; Harper investing 5% Total Planned Maintenance $0.45 Peer Average Harper $0.40 Harper 5% $0.35 Peer Avg. 4% Best Practice $0.30 $/GSF PM as % of Total Operating Costs: 10-12% $0.25 $0.20 $1 in PM today $0.15 $0.10 $0.05 Saves $3 in Daily Service tomorrow $0.00 Average 8 ROI: Systems and Utility Investments Result in Major Savings 19% reduction in BTU/GSF consumption from FY10 levels FY10-13 Utility Initiatives & Savings Millions $3.50 Utility Initiatives FY10-13 $3.00 $2.50 FY10-13 Utility projects: L building chiller work, D building chiller tank expansion, occupancy sensors, lighting controls, A&W chilled water loop Energy Savings* FY10-13 $2.00 $1.50 • $3.24M • $2.12M cumulative; $708K annually (FY11-13) $3.24 $2.12 $1.00 65% of investment costs recovered in 3 years alone $0.50 $0.00 Utility Initiatives Energy Savings *Savings calculated using normalized consumption (BTU/GSF) to each years unit price 9 Moving Forward Recent Successes • Savings in energy cost and consumption due to conservation efforts • Strategic project selection has resulted in high ROI investments that extend Life Cycles • Ongoing renovations target high-need buildings Ongoing Strategies • While newly renovated buildings are reset, others are aging. Secure additional funds to keep up with the ongoing renewal needs of these spaces • Commit to growing the Planned Maintenance program over the “run to fail” method 10 Discussion & Questions