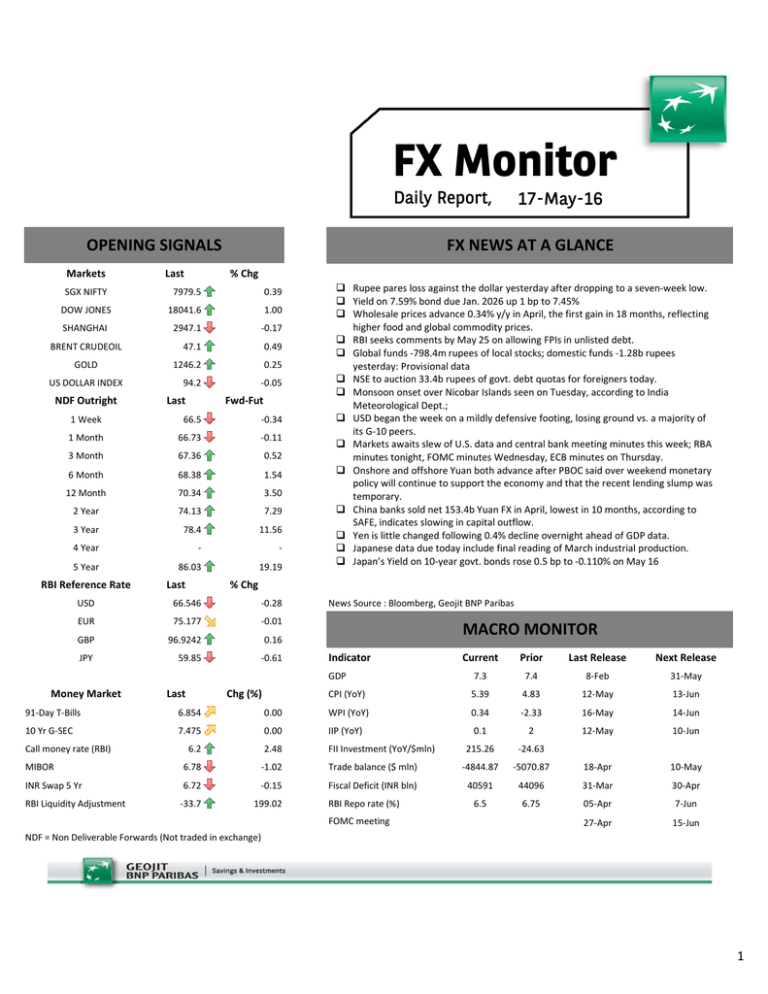

Markets Last % Chg

advertisement

FX Monitor Daily Report, OPENING SIGNALS Markets Last FX NEWS AT A GLANCE % Chg SGX NIFTY 7979.5 0.39 DOW JONES 18041.6 1.00 SHANGHAI 2947.1 -0.17 47.1 0.49 BRENT CRUDEOIL GOLD US DOLLAR INDEX NDF Outright 1246.2 0.25 94.2 -0.05 Last Fwd-Fut 1 Week 66.5 -0.34 1 Month 66.73 -0.11 3 Month 67.36 0.52 6 Month 68.38 1.54 12 Month 70.34 3.50 2 Year 74.13 7.29 3 Year 78.4 11.56 4 Year - - 5 Year 86.03 19.19 RBI Reference Rate Last Rupee pares loss against the dollar yesterday after dropping to a seven-week low. Yield on 7.59% bond due Jan. 2026 up 1 bp to 7.45% Wholesale prices advance 0.34% y/y in April, the first gain in 18 months, reflecting higher food and global commodity prices. RBI seeks comments by May 25 on allowing FPIs in unlisted debt. Global funds -798.4m rupees of local stocks; domestic funds -1.28b rupees yesterday: Provisional data NSE to auction 33.4b rupees of govt. debt quotas for foreigners today. Monsoon onset over Nicobar Islands seen on Tuesday, according to India Meteorological Dept.; USD began the week on a mildly defensive footing, losing ground vs. a majority of its G-10 peers. Markets awaits slew of U.S. data and central bank meeting minutes this week; RBA minutes tonight, FOMC minutes Wednesday, ECB minutes on Thursday. Onshore and offshore Yuan both advance after PBOC said over weekend monetary policy will continue to support the economy and that the recent lending slump was temporary. China banks sold net 153.4b Yuan FX in April, lowest in 10 months, according to SAFE, indicates slowing in capital outflow. Yen is little changed following 0.4% decline overnight ahead of GDP data. Japanese data due today include final reading of March industrial production. Japan’s Yield on 10-year govt. bonds rose 0.5 bp to -0.110% on May 16 % Chg USD 66.546 -0.28 EUR 75.177 -0.01 GBP 96.9242 0.16 JPY 59.85 -0.61 News Source : Bloomberg, Geojit BNP Paribas MACRO MONITOR Indicator GDP Money Market Last Chg (%) 31-May 13-Jun 16-May 14-Jun 12-May 10-Jun IIP (YoY) FII Investment (YoY/$mln) 6.78 -1.02 -0.15 8-Feb 12-May 0.00 199.02 7.4 4.83 2.48 6.72 7.3 -2.33 6.2 -33.7 Next Release 5.39 7.475 RBI Liquidity Adjustment Last Release 0.34 10 Yr G-SEC INR Swap 5 Yr Prior CPI (YoY) 6.854 MIBOR 0.00 Current WPI (YoY) 91-Day T-Bills Call money rate (RBI) 17-May-16 0.1 2 215.26 -24.63 Trade balance ($ mln) -4844.87 -5070.87 18-Apr 10-May Fiscal Deficit (INR bln) 40591 44096 31-Mar 30-Apr 6.5 6.75 05-Apr 7-Jun 27-Apr 15-Jun RBI Repo rate (%) FOMC meeting NDF = Non Deliverable Forwards (Not traded in exchange) 1 FUTURES MONITOR (NSE - Near Month) USDINR 66.84 1d % Chg 5d % Chg 1m % Chg 1Yr % Chg -0.1 -0.07 0.18 5.5 70 PIVOTS 65 60 17-Feb 17-Mar 17-Apr EURINR S3 S2 S1 PV R1 R2 R3 66.50 66.69 66.76 66.87 66.94 67.05 67.23 RSI 55 Neutral 17-May 75.6 1d % Chg 5d % Chg 1m % Chg 1Yr % Chg 0.1 -0.6 -0.3 -2.7 PIVOTS 80 75 70 17-Feb 17-Mar 17-Apr GBPINR S3 S2 S1 PV R1 R2 R3 75.12 75.37 75.49 75.63 75.74 75.88 76.13 RSI 48 Neutral 17-May 97.5475 1d % Chg 5d % Chg 1m % Chg 1Yr % Chg 0.2 1.1 2.9 -1.4 PIVOTS 100 95 S3 S2 S1 PV R1 R2 R3 96.42 96.95 97.25 97.48 97.78 98.01 98.55 RSI 48 Neutral 90 17-Feb 17-Mar 17-Apr JPYINR 17-May 60.015 1d % Chg 5d % Chg 1m % Chg 1Yr % Chg -0.4 -2.1 -0.7 13.5 70 PIVOTS 60 50 17-Feb 17-Mar 17-Apr S3 S2 S1 PV R1 R2 R3 59.43 59.76 59.89 60.09 60.22 60.42 60.75 RSI 51 Neutral 17-May RSI < 30 = oversold and RSI > 70 = overbought 2 OPTIONS MONITOR - USDINR MOST ACTIVE CALL OPTIONS Strike Expiry Last % Chg Vol OI IV Moneyness Time Value 69 MAY 16 0.0375 -6.25 39988 73434 8.33 Out-of-the-money 0.0375 66.5 MAY 16 0.59 -6.72 29717 34558 4.39 In-the-money 0.1225 66 MAY 16 0.93 -7.23 29302 46198 5.25 In-the-money 0.0375 66.75 MAY 16 0.455 -7.14 14293 8223 4.62 In-the-money 0.2375 68 JUN 16 0.3575 5.15 11244 9701 6.02 Out-of-the-money 0.3575 67.75 MAY 16 0.1375 -5.17 7665 10341 6.19 Out-of-the-money 0.1375 67.25 MAY 16 0.2575 -6.36 5974 5211 5.23 Out-of-the-money 0.2575 68.25 MAY 16 0.075 3.45 5823 23410 7.14 Out-of-the-money 0.075 65.5 MAY 16 1.3925 -4.13 2001 2993 5.37 In-the-money 0.075 67.5 JUN 16 0.5 -12.28 1507 1501 5.76 Out-of-the-money 0.5 65 MAY 16 1.84 -4.17 350 904 7.38 In-the-money 0.1275 Strike Expiry Last % Chg Vol OI IV Moneyness Time Value 66.25 MAY 16 0.1675 34.00 11112 10368 4.91 Out-of-the-money 0.1675 MOST ACTIVE PUT OPTIONS 66.75 MAY 16 0.37 19.35 10960 8915 4.76 Out-of-the-money 0.37 65.5 MAY 16 0.0375 36.36 8832 23334 6.01 Out-of-the-money 0.0375 65.75 MAY 16 0.0575 43.75 4426 21348 5.71 Out-of-the-money 0.0575 68 MAY 16 1.2675 6.74 3362 42386 6.54 In-the-money 0.235 65 MAY 16 0.0125 0.00 1352 3203 7.37 Out-of-the-money 0.0125 67.25 MAY 16 0.6825 13.75 548 1298 5.93 In-the-money 0.4 70.25 MAY 16 3.385 4.96 200 791 13.08 In-the-money 0.1025 69 MAY 16 2.1725 0.00 151 1872 8.99 In-the-money 0.14 68.5 MAY 16 1.6 0.00 115 921 7.81 In-the-money 0.0675 3 DISCLOSURES & DISCLAIMERS: CERTIFICATION We, Anand James, Tency N. Kurien and Veena Vasanth, authors of this Report, hereby certify that all the views expressed in this research report reflect our personal views about any or all of the subject issuer or securities. This report has been prepared by the Research Team of Geojit BNP Paribas Financial Services Limited, hereinafter referred to as GBNPP. COMPANY OVERVIEW Geojit BNP Paribas Financial Services Limited (hereinafter GBNPP), a publically listed company, is engaged in services of retail broking, depository services, portfolio management and marketing investment products including mutual funds, insurance and properties. GBNPP is a SEBI registered Research Entity and as such prepares and shares research data and reports periodically with clients, investors, stake holders and general public in compliance with Securities and Exchange Board of India Act, 1992, Securities And Exchange Board Of India (Research Analysts) Regulations, 2014 and/or any other applicable directives, instructions or guidelines issued by the Regulators from time to time. DISTRIBUTION OF REPORTS This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. GBNPP will not treat the recipients of this report as clients by virtue of their receiving this report. GENERAL REPRESENTATION The research reports do not constitute an offer or solicitation for the purchase or sale of any financial instruments, inducements, promise, guarantee, warranty, or as an official confirmation of any transaction or contractual obligations of any kind. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The information contained herein is from publicly available data or other sources believed to be reliable, but we do not represent that it is accurate or complete and it should not be relied on as such. We have also reviewed the research report for any untrue statements of material facts or any false or misleading information. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. RISK DISCLOSURE GBNPP and/or its Affiliates and its officers, directors and employees including the analyst/authors shall not be in any way be responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Investors may lose his/her entire investment under certain market conditions so before acting on any advice or recommendation in these material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. This report does not take into account the specific investment objectives, financial situation/circumstances and the particular needs of any specific person who may receive this document. The user assumes the entire risk of any use made of this information. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this report (including the merits and risks involved). The price, volume and income of the investments referred to in this report may fluctuate and investors may realize losses that may exceed their original capital. TECHNICAL DISCLAIMER The securities described herein may not be eligible to all categories of investors. Reports based on technical analysis is focused on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We may have issued or may issue on the companies covered herein, reports, recommendations or information which is contrary to those contained in this report. Opinions expressed herein are our current opinions as of the date appearing on this report only. JUSRISDICTION The securities described herein may not be eligible for sale in all jurisdictions or to all categories of investors. The countries in which the companies mentioned in this report are organized may have restrictions on investments, voting rights or dealings in securities by nationals of other countries. Distributing/taking/sending/dispatching/transmitting this document in certain foreign jurisdictions may be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe any such restrictions. Failure to comply with this restriction may constitute a violation of any foreign jurisdiction laws. Foreign currencies denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of or income derived from the investment. Investors in securities such as ADRs, the value of which are influenced by foreign currencies effectively assume currency risk. REGULATORY DISCLOSURES: GBNPP’s Associates consists of companies such as Geojit Technologies Private Limited (GTPL- Software Solutions provider), Geojit Credits Private Limited (GCPL- NBFC Services provider), Geojit Investment Services Limited (GISL- Corporate Agent for Insurance products), Geojit Financial Management Services Private Limited (GFMSL) & Geojit Financial Distribution Private Limited (GFDPL), (Distributors of Insurance and MF Units).In the context of the SEBI Regulations on Research Analysts (2014), GBNPP affirms that we are a SEBI registered Research Entity and in the course of our business as a stock market intermediary, we issue research reports /research analysis etc that are prepared by our Research Analysts. We also affirm and undertake that no disciplinary action has been taken against us or our Analysts in connection with our business activities. SEBI REGISTRATION NUMBERS: NSE: INE/INF/INB231337230 | BSE (Cash): INB011337236 | BSE (F&O): INF011337237 NSDL:IN-DP-NSDL-24-97 | CDSL Regn no: IN-DP-CDSL-648-2012 | Portfolio Manager: INP000003203 | Investment Adviser: INA200002817 | Research Entity SEBI Registration Number: INH200000345 | ARN Regn. no: 0098 CORPORATE OFFICE: Geojit BNP Paribas,34/659Paribas,34/659- P, Civil Line Road, Padivattom, Kochi – 682024 Toll-Free Number : 1800-425-5501 / 1800-103-5501, Paid Number : 91 - 484 - 2901000 Email id : customercare@geojit.com, Web: www.geojitbnpparibas.com 4 5