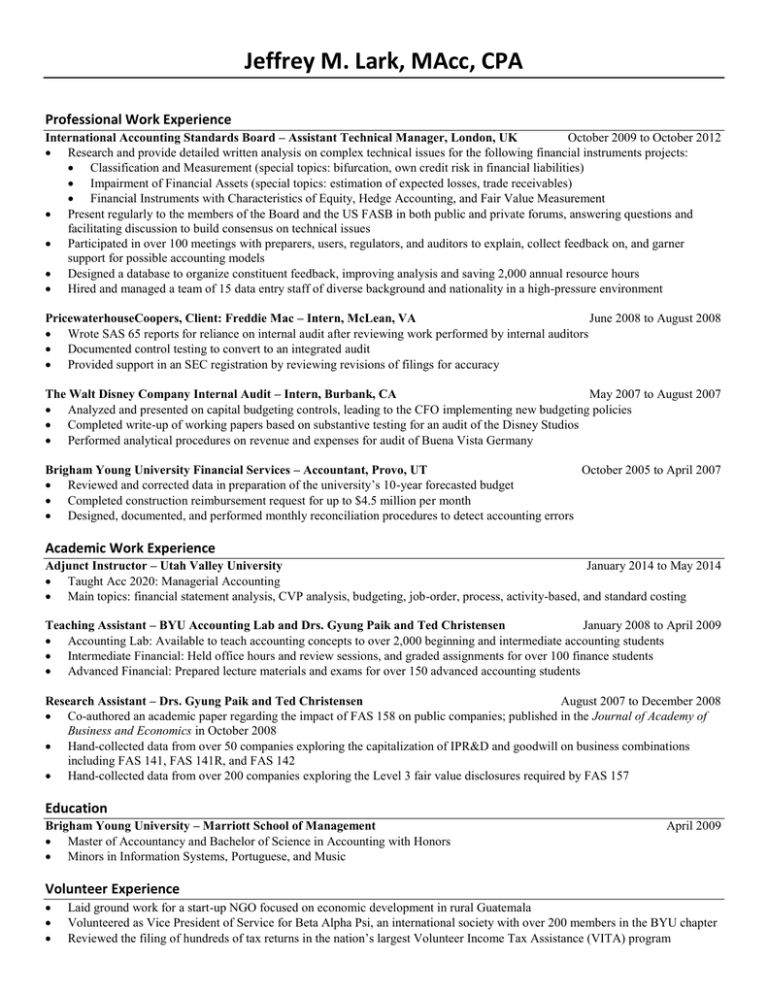

Jeffrey M. Lark, MAcc, CPA Professional Work Experience

advertisement

Jeffrey M. Lark, MAcc, CPA Professional Work Experience International Accounting Standards Board – Assistant Technical Manager, London, UK October 2009 to October 2012 Research and provide detailed written analysis on complex technical issues for the following financial instruments projects: Classification and Measurement (special topics: bifurcation, own credit risk in financial liabilities) Impairment of Financial Assets (special topics: estimation of expected losses, trade receivables) Financial Instruments with Characteristics of Equity, Hedge Accounting, and Fair Value Measurement Present regularly to the members of the Board and the US FASB in both public and private forums, answering questions and facilitating discussion to build consensus on technical issues Participated in over 100 meetings with preparers, users, regulators, and auditors to explain, collect feedback on, and garner support for possible accounting models Designed a database to organize constituent feedback, improving analysis and saving 2,000 annual resource hours Hired and managed a team of 15 data entry staff of diverse background and nationality in a high-pressure environment PricewaterhouseCoopers, Client: Freddie Mac – Intern, McLean, VA June 2008 to August 2008 Wrote SAS 65 reports for reliance on internal audit after reviewing work performed by internal auditors Documented control testing to convert to an integrated audit Provided support in an SEC registration by reviewing revisions of filings for accuracy The Walt Disney Company Internal Audit – Intern, Burbank, CA May 2007 to August 2007 Analyzed and presented on capital budgeting controls, leading to the CFO implementing new budgeting policies Completed write-up of working papers based on substantive testing for an audit of the Disney Studios Performed analytical procedures on revenue and expenses for audit of Buena Vista Germany Brigham Young University Financial Services – Accountant, Provo, UT October 2005 to April 2007 Reviewed and corrected data in preparation of the university’s 10-year forecasted budget Completed construction reimbursement request for up to $4.5 million per month Designed, documented, and performed monthly reconciliation procedures to detect accounting errors Academic Work Experience Adjunct Instructor – Utah Valley University January 2014 to May 2014 Taught Acc 2020: Managerial Accounting Main topics: financial statement analysis, CVP analysis, budgeting, job-order, process, activity-based, and standard costing Teaching Assistant – BYU Accounting Lab and Drs. Gyung Paik and Ted Christensen January 2008 to April 2009 Accounting Lab: Available to teach accounting concepts to over 2,000 beginning and intermediate accounting students Intermediate Financial: Held office hours and review sessions, and graded assignments for over 100 finance students Advanced Financial: Prepared lecture materials and exams for over 150 advanced accounting students Research Assistant – Drs. Gyung Paik and Ted Christensen August 2007 to December 2008 Co-authored an academic paper regarding the impact of FAS 158 on public companies; published in the Journal of Academy of Business and Economics in October 2008 Hand-collected data from over 50 companies exploring the capitalization of IPR&D and goodwill on business combinations including FAS 141, FAS 141R, and FAS 142 Hand-collected data from over 200 companies exploring the Level 3 fair value disclosures required by FAS 157 Education Brigham Young University – Marriott School of Management Master of Accountancy and Bachelor of Science in Accounting with Honors Minors in Information Systems, Portuguese, and Music April 2009 Volunteer Experience Laid ground work for a start-up NGO focused on economic development in rural Guatemala Volunteered as Vice President of Service for Beta Alpha Psi, an international society with over 200 members in the BYU chapter Reviewed the filing of hundreds of tax returns in the nation’s largest Volunteer Income Tax Assistance (VITA) program