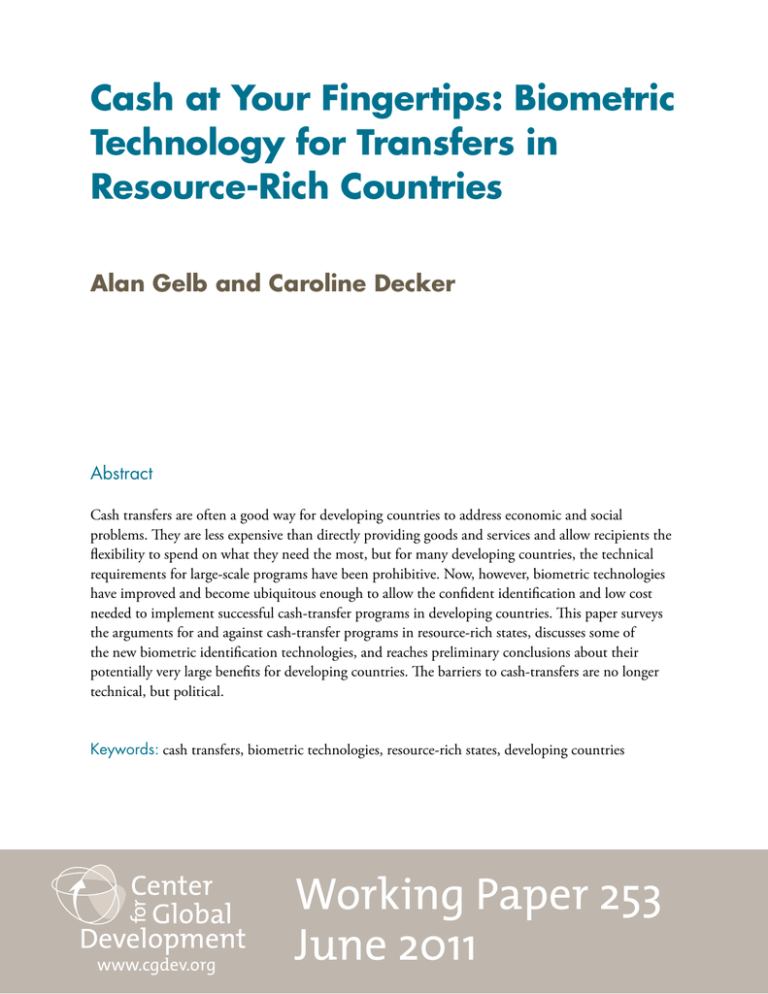

Cash at Your Fingertips: Biometric Technology for Transfers in Resource-Rich Countries

advertisement