Cash or Coupons? Testing the Impacts of Cash versus Republic of Congo

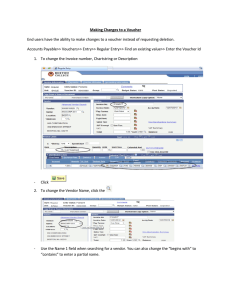

advertisement