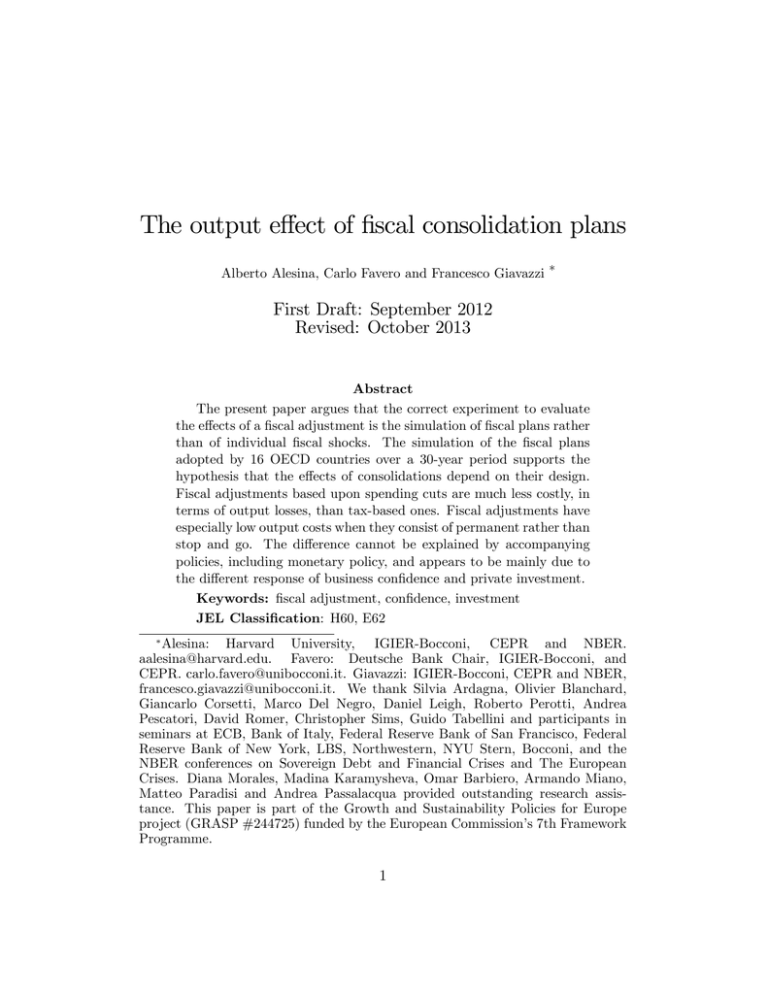

The output e¤ect of …scal consolidation plans First Draft: September 2012

advertisement