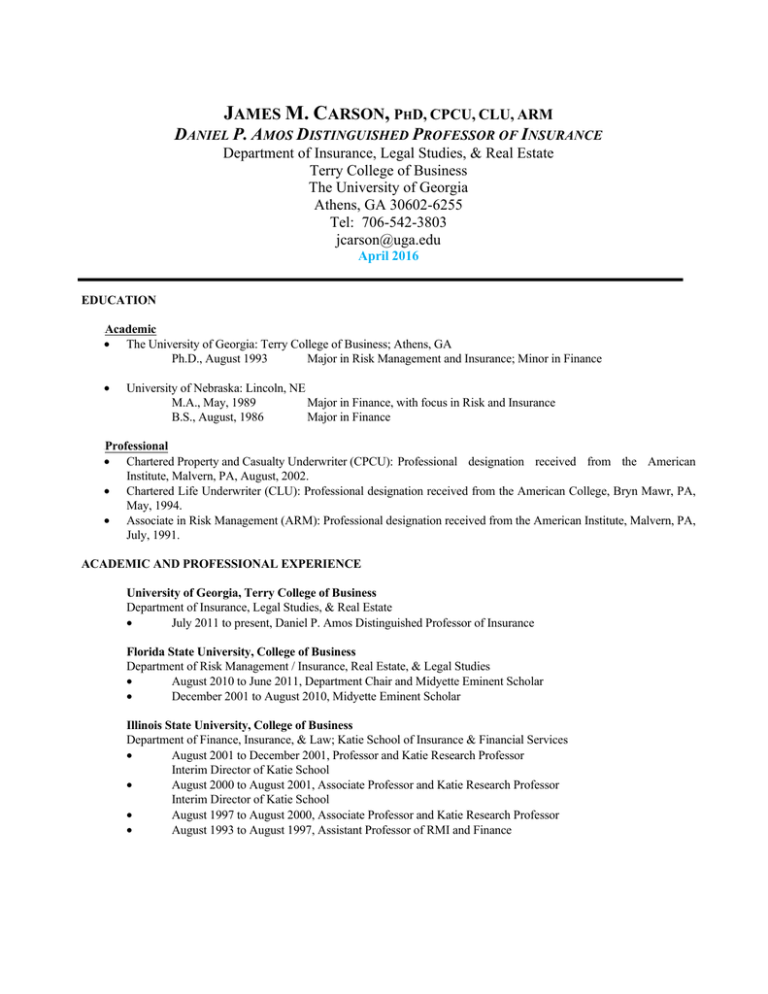

J M. C ,

advertisement