A couple of notes on the Midterm exam.

advertisement

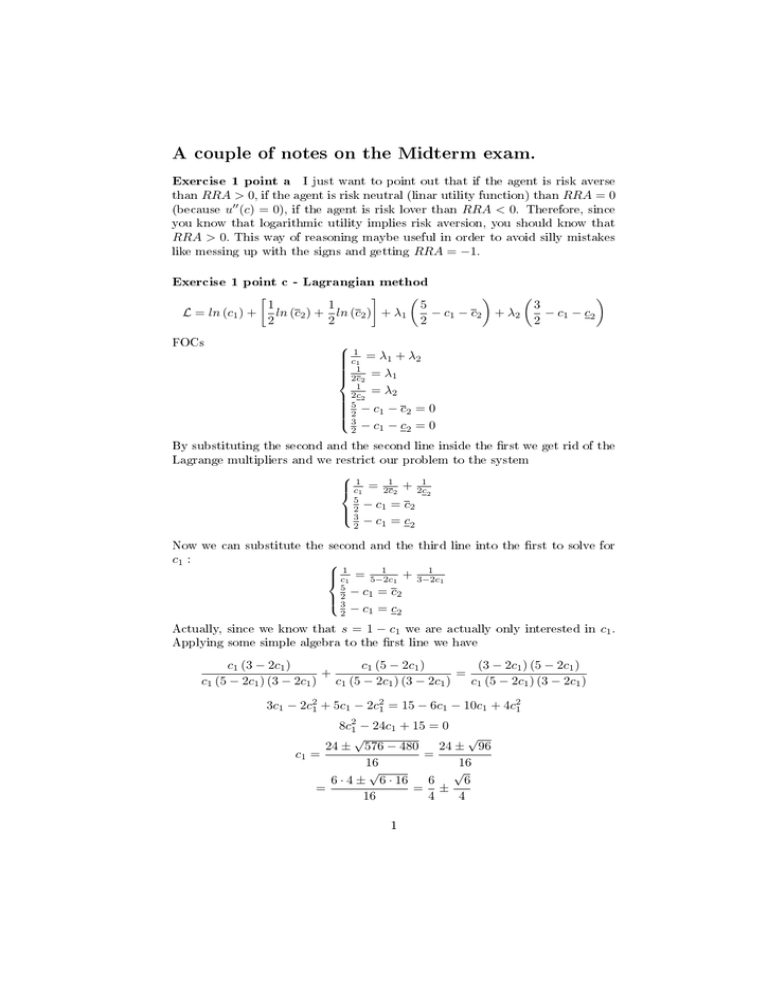

A couple of notes on the Midterm exam. I just want to point out that if the agent is risk averse than RRA > 0, if the agent is risk neutral (linar utility function) than RRA = 0 (because u00 (c) = 0), if the agent is risk lover than RRA < 0. Therefore, since you know that logarithmic utility implies risk aversion, you should know that RRA > 0. This way of reasoning maybe useful in order to avoid silly mistakes like messing up with the signs and getting RRA = −1. Exercise 1 point a Exercise 1 point c - Lagrangian method L = ln (c1 ) + FOCs 1 5 3 1 ln (c2 ) + ln (c2 ) + λ1 − c1 − c2 + λ2 − c1 − c2 2 2 2 2 1 c1 = λ1 + λ2 1 2c2 = λ1 1 2c2 = λ2 5 2 − c1 − c2 = 0 3 2 − c1 − c2 = 0 By substituting the second and the second line inside the rst we get rid of the Lagrange multipliers and we restrict our problem to the system 1 1 1 c1 = 2c2 + 2c2 5 2 − c1 = c2 3 2 − c1 = c2 Now we can substitute the second and the third line into the rst to solve for c1 : 1 1 c1 = 5−2c1 + 5 2 − c1 = c2 3 2 − c1 = c2 1 3−2c1 Actually, since we know that s = 1 − c1 we are actually only interested in c1 . Applying some simple algebra to the rst line we have c1 (3 − 2c1 ) c1 (5 − 2c1 ) (3 − 2c1 ) (5 − 2c1 ) + = c1 (5 − 2c1 ) (3 − 2c1 ) c1 (5 − 2c1 ) (3 − 2c1 ) c1 (5 − 2c1 ) (3 − 2c1 ) 3c1 − 2c21 + 5c1 − 2c21 = 15 − 6c1 − 10c1 + 4c21 8c21 − 24c1 + 15 = 0 √ √ 24 ± 96 24 ± 576 − 480 = c1 = 16 16 √ √ 6 · 4 ± 6 · 16 6 6 = = ± 16 4 4 1 Therefore we have √ 1 6 s1,2 = − ± 2 4 which is exactly the solution that we get by substituting directly the budget constraints in the expected utility function and solving the unconstrained maximization problem. Now remember, why we may rule out the negative solution in this case? The √ negative solution implies that the agent today borrows 12 + 26 from the bank. If the realization of√income today is 23 than the agent will be able to payback the debt in full 12 + 26 (the interest rate is zero); if the realization of his income is 1 2 than he will not have enough money to payback the debt and he will default at least partially on his debt. Assume that the bank is risk neutral, than it will not be willing to lend money to the agent in the rst place because it expects to receive less than the amount it lends out. Furthermore, notice that the function ln (c)is not dened for c = 0 and tends to −∞ as c → 0. 2