Financing Experimentation March 2013

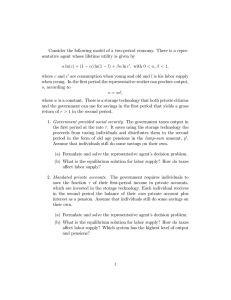

advertisement