College of the Redwoods CREDIT COURSE OUTLINE

advertisement

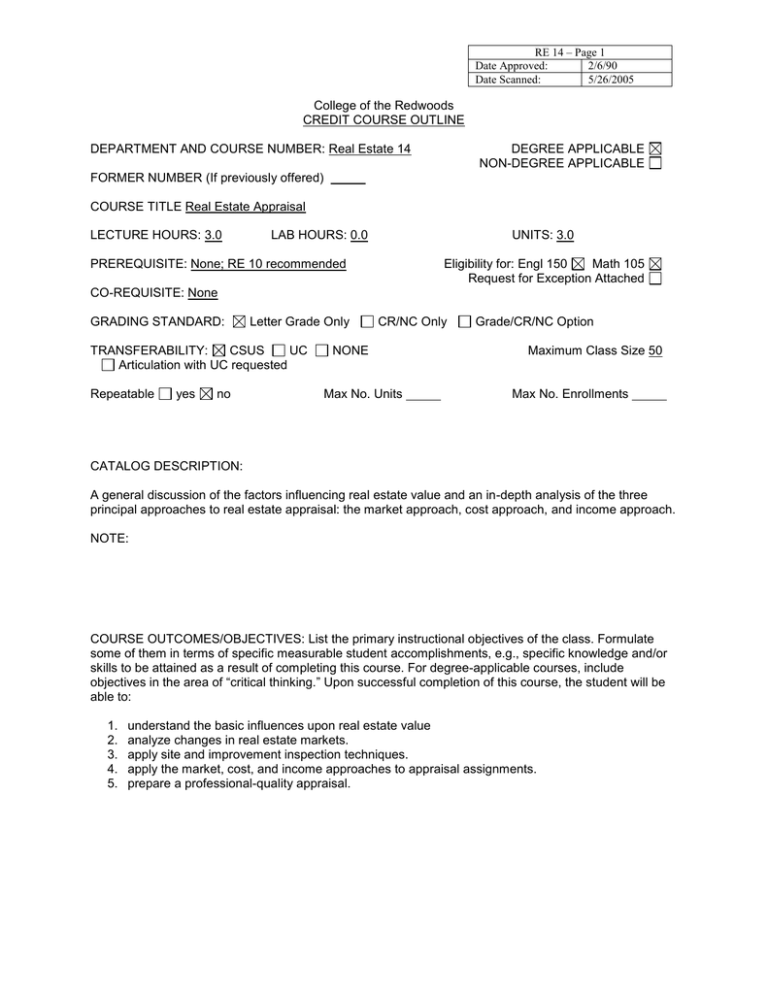

RE 14 – Page 1 Date Approved: 2/6/90 Date Scanned: 5/26/2005 College of the Redwoods CREDIT COURSE OUTLINE DEPARTMENT AND COURSE NUMBER: Real Estate 14 DEGREE APPLICABLE NON-DEGREE APPLICABLE FORMER NUMBER (If previously offered) COURSE TITLE Real Estate Appraisal LECTURE HOURS: 3.0 LAB HOURS: 0.0 UNITS: 3.0 PREREQUISITE: None; RE 10 recommended Eligibility for: Engl 150 Math 105 Request for Exception Attached CO-REQUISITE: None GRADING STANDARD: Letter Grade Only TRANSFERABILITY: CSUS UC Articulation with UC requested Repeatable yes no CR/NC Only NONE Max No. Units Grade/CR/NC Option Maximum Class Size 50 Max No. Enrollments CATALOG DESCRIPTION: A general discussion of the factors influencing real estate value and an in-depth analysis of the three principal approaches to real estate appraisal: the market approach, cost approach, and income approach. NOTE: COURSE OUTCOMES/OBJECTIVES: List the primary instructional objectives of the class. Formulate some of them in terms of specific measurable student accomplishments, e.g., specific knowledge and/or skills to be attained as a result of completing this course. For degree-applicable courses, include objectives in the area of “critical thinking.” Upon successful completion of this course, the student will be able to: 1. 2. 3. 4. 5. understand the basic influences upon real estate value analyze changes in real estate markets. apply site and improvement inspection techniques. apply the market, cost, and income approaches to appraisal assignments. prepare a professional-quality appraisal. RE 14 – Page 2 Date Approved: 2/6/90 Date Scanned: 5/26/2005 COURSE OUTLINE: Introduction to Appraisal Legal Descriptions Formal Appraisal Process Community and Neighborhood Analysis Principles of’ Valuation Site Inspection Area and Volume Calculations Property Inspection Understanding Construction Details Functional Utility and Architectural Styles Introduction to Market Approach Analyzing and Adjusting Comparables Site Valuation Estimating Cost of Construction Accrued Depreciation Applying the Cost Approach Introduction to Income Approach Gross Income Annual Expenses Capitalization Theory Reconciling Value Estimates Letter Reports Form Reports Narrative Reports % of Classroom Hours Spent on Each Topic 2% 5% 2% 7% 5% 2% 2% 5% 5% 2% 5% 5% 5% 5% 5% 2% 2% 5% 5% 5% 5% 2% 5% 7% RE 14 – Page 3 Date Approved: 2/6/90 Date Scanned: 5/26/2005 APPROPRIATE TEXTS AND MATERIALS: (Indicate textbooks that may be required or recommended; including alternate texts that may be used.) Text(s) Title Fundamentals of Real Estate Appraisal Required Alternate Edition Current Recommended Author Williams Publisher RE Estate Education Co. Date Published 1988 (Additional required, alternate, or recommended texts should be listed on a separate sheet and attached.) For degree applicable courses the adopted texts have been certified to be college-level: Yes. Basis for determination: is used by two or more four-year colleges or universities (certified by the Division Chair or Branch Coordinator, or Center Dean) OR has been certified by the LAC as being of college level using the Coleman and Dale-Chall Readability Index Scale. No. Request for Exception Attached If no text or a below college level text is used in a degree applicable course must have a minimum of one response in category 1, 2, or 3. If category 1 is not checked, the department must explain why substantial writing assignments are an inappropriate basis for at least part of the grade. 1. Substantial writing assignments, including: essay exam(s) term or other paper(s) written homework reading report(s) laboratory report(s) other (specify) _____ If the course is degree applicable, substantial writing assignments in this course are inappropriate because: The course is primarily computational in nature. The course primarily involves skill demonstrations or problem solving. Other rationale (explain) __________________________________________ 2. Computational or Non-computational problem-solving demonstrations, including: exam(s) quizzes homework problems laboratory report(s) field work other (specify)_______ 3. Skill demonstrations, including: class performance(s) other (specify)____ 4. Objective examinations, including: multiple choice completion field work performance exam(s) true/false other (specify) matching items 5. Other (specify) Professional quality FNMA Residential Appraisal NOTE: A course grade may not be based solely on attendance. RE 14 – Page 4 Date Approved: 2/6/90 Date Scanned: 5/26/2005 REQUIRED READING, WRITING, AND OTHER OUTSIDE OF CLASS ASSIGNMENTS: Over an 18-week presentation of the course, 3 hours per week are required for each unit of credit. ALL Degree Applicable Credit classes must treat subject matter with a scope and intensity which require the student to study outside of class. Two hours of independent work done out of class are required for each hour of lecture. Lab and activity classes must also require some outside of class work. Outside of the regular class time the students in this class will be doing the following: Study Answer questions Skill practice Required reading Problem solving activity or exercise Written work (essays/compositions/report/analysis/research) Journal (reaction and evaluation of class, done on a continuing basis throughout the semester) Observation of or participation in an activity related to course content (e.g., play, museum, concert, debate, meeting, etc.) Field trips Other (specify) ____________________________ COLLEGE LEVEL CRITICAL THINKING TASKS/ASSIGNMENTS: Degree applicable courses must include critical thinking tasks/assignments. This section need not be completed for non-degree applicable courses. Describe how the course requires students to independently analyze, synthesize, explain, assess, anticipate and/or define problems, formulate and assess solutions, apply principles to new situations, etc. Analyze market trends and forces affecting value; analyze, synthesize and verify data collected in the evaluation process; and apply the market, income, and cost approaches to a subject property.