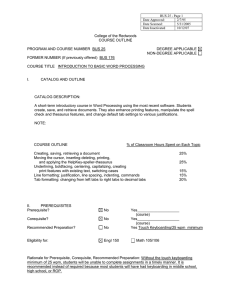

Business BUS 82 Current Income Tax Preparation

advertisement

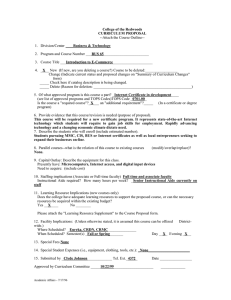

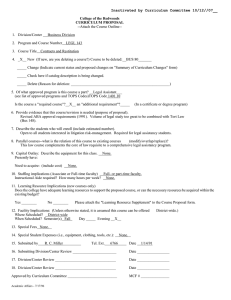

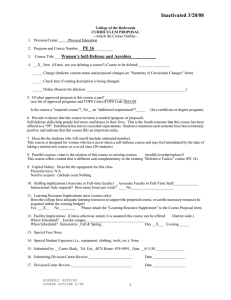

College of the Redwoods CURRICULUM PROPOSAL --Attach the Course Outline-- Business 1. Division/Center: 2. Program and Course Number: 3. Course Title: 4. BUS 82 Current Income Tax Preparation New (If new, are you deleting a course?) Course to be deleted Change (Indicate current status and proposed changes on "Summary of Curriculum Changes" form) Check here if catalog description is being changed. Delete (Reason for deletion: ) 5. Of what approved program is this course a part? 01802 (see list of approved programs and TOPS Codes)TOPS Code 0502.00 Is the course a "required course"? an "additional requirement" (In a certificate or degree program) 6. Provide evidence that this course/revision is needed (purpose of proposal).This course in conjunction with the one unit law practicum to prepare actual returns for clients will provide experience that can be included on a resume to enhance employability. 7. Describe the students who will enroll (include estimated number). Transfer students, AS degree students (general business and legal students), and students interested in tax as a vocation. Enrollment estimate is 25-30 students. 8. Parallel courses--what is the relation of this course to existing courses (modify/overlap/replace)? none 9. Capital Outlay: Describe the equipment for this class. Presently have: whiteboard/overhead projector Need to acquire: (include cost) none 10. Staffing implications (Associate or Full-time faculty) full or parttime faculty Instructional Aide required? no How many hours per week? 11. Learning Resource Implications (new courses only) Does the college have adequate learning resources to support the proposed course, or can the necessary resources be acquired within the existing budget? Yes No Please attach the "Learning Resource Supplement" to the Course Proposal form. 12. Facility Implications: (Unless otherwise stated, it is assumed this course can be offered District-wide.) Where Scheduled? Arcata Foodworks site When Scheduled? Semester(s) winter Day Evening 13. Special Fees none 14. Special Student Expenses (i.e., equipment, clothing, tools, etc.): 15. Submitted by ___Helen Edwards_________________ Tel. Ext.4367 Date 2/6/03 16. Submitting Division/Center Review _______________________ Date 17. Division/Center Review ________________________________ Date 18. Division/Center Review ________________________________ Date Approved by Curriculum Committee __ ACADEMIC AFFAIRS COURSE OUTLINE 1/01 3/14/03 1 College of the Redwoods COURSE OUTLINE DATE 2/6/03 PROGRAM AND COURSE NUMBER: BUS 82 FORMER NUMBER (If previously offered) BUS 199 COURSE TITLE: Current Income Tax Preparation I. CATALOG AND OUTLINE 1. CATALOG DESCRIPTION: Students will learn how to prepare basic IRS and California State income tax forms for students and others in the community with low to limited income, individuals with disabilities, non-English-speaking and elderly taxpayers. NOTE: Repeatable to a maximum of 2 enrollments. 2. COURSE OUTLINE: Topic 1. Interview techniques, filing status, who should file 2. Income determination 3. Adjustments to income 4. Itemized deductions 5. Miscellaneous credits 6. Finishing the return 7. Child Care Credit 8. Education Credits 9. Earned Income Credit 10. Child Tax Credit % of Classroom Hours Spent on Each 10% 10 10 10 10 10 10 10 10 10 II. PREREQUISITES Prerequisite? No Yes Corequisite? No Yes Recommended Preparation? No Yes (course) (course) Rationale for Prerequisite, Corequisite, Recommended Preparation ACADEMIC AFFAIRS COURSE OUTLINE 1/01 2 PROGRAM AND COURSE NUMBER BUS 82 III. OUTCOMES AND ASSESSMENTS 1. COURSE OUTCOMES/OBJECTIVES: List the primary instructional objectives of the class. Formulate some of them in terms of specific measurable student accomplishments, e.g., specific knowledge and/or skills to be attained as a result of completing this course. For degree-applicable courses, include objectives in the area of "critical thinking." Upon successful completion of this course, the students will be able to: Upon successful completion of this course, the student will be able to: Catagorize the basic income types and identify appropriate taxability Identify and classify deductions Identify and calculate various tax credits Complete required federal and California state income tax forms 2. COLLEGE LEVEL CRITICAL THINKING TASKS/ASSIGNMENTS: Degree applicable courses must include critical thinking tasks/assignments. This section need not be completed for non-credit courses. Describe how the course requires students to independently analyze, synthesize, explain, assess, anticipate and/or define problems, formulate and assess solutions, apply principles to new situations, etc. Income tax students are required to: Analyze filing requirments Determine filing status Identify various types of income, deductions and credits Demonstrate ability to complete federal and California state income tax forms 3. ASSESSMENT Degree applicable courses must have a minimum of one response in category A, B, or C. If category A is not checked, the department must explain why substantial writing assignments are an inappropriate basis for at least part of the grade. A. This course requires a minimum of two substantial (500 words each) written assignments which demonstrate standard English usage (grammar, punctuation, and vocabulary) and proper paragraph and essay development. In grading these assignments, instructors shall use, whenever possible, the English Department’s rubric for grading the ENGL 150 exit essay. Substantial writing assignments, including: essay exam(s) term or other paper(s) laboratory report(s) written homework reading report(s) other (specify) If the course is degree applicable, substantial writing assignments in this course are inappropriate because: The course is primarily computational in nature. The course primarily involves skill demonstrations or problem solving. Other rationale (explain) B. Computational or Non-computational problem-solving demonstrations, including: exam(s) quizzes homework problems laboratory report(s) field work other (specify) C. Skill demonstrations, including: class performance(s) field work other (specify) complete income tax forms ACADEMIC AFFAIRS COURSE OUTLINE 1/01 performance exam(s) 3 PROGRAM AND COURSE NUMBER BUS 82 D. Objective examinations, including: multiple choice true/false completion other (specify) matching items E. Other (specify) NOTE: A course grade may not be based solely on attendance. IV. TEXTS AND MATERIALS APPROPRIATE TEXTS AND MATERIALS: (Indicate textbooks that may be required or recommended, including alternate texts that may be used.) Text(s) Title: Volunteer Assistor's Guide Required Edition: most current Alternate Author: IRS Recommended Publisher: IRS Date Published: most current (Additional required, alternate, or recommended texts should be listed on a separate sheet and attached.) For degree applicable courses the adopted texts have been certified to be college-level: Yes. Basis for determination: is used by two or more four-year colleges or universities (certified by the Division Dean or Center Dean) OR has been certified by the LAC as being of college level using a Readability Index Scale. No Request for Exception Attached. REQUIRED READING, WRITING, AND OTHER OUTSIDE OF CLASS ASSIGNMENTS: Over a 16-week presentation of the course, 3 hours per week are required for each unit of credit. ALL Degree Applicable Credit classes must treat subject matter with a scope and intensity, which require the student to study outside of class. Two hours of independent work done out of class are required for each hour of lecture. Lab and activity classes must also require some outside of class work. Outside of the regular class time the students in this class do the following: Study Answer questions Skill practice Required reading Problem solving activity or exercise Written work (essays/compositions/report/analysis/research) Journal (reaction and evaluation of class, done on a continuing basis throughout the semester) Observation of or participation in an activity related to course content (e.g., play, museum, concert, debate, meeting, etc.) Other (specify) ACADEMIC AFFAIRS COURSE OUTLINE 1/01 4 PROGRAM AND COURSE NUMBER BUS 82 V. TECHNICAL INFORMATION 1. Contact Hours: (Indicate "TOTAL" hours if less than semester length) Lecture: 1.5 TOTAL HOURS 27 Lab: TOTAL HOURS (Use Request for Exception sheet to justify more-thanminimum required hours.) 5. Recommended Maximum Class Size 30 6. Transferability CSU UC List two UC/CSU campuses with similar courses (include course #s) ; Articulation with UC requested Lecture Units 1.5 Lab Units Variable Unit Range Total Units 1.5 2. TLUs 3. 7. Grading Standard Letter Grade Only CR/NC Only Grade-CR/NC Option Grade-CR/NC Option Criteria: Introductory 1st course in sequence Exploratory 2.25 Does course fulfill a General Education requirement? For existing courses only; for new courses, use GE Application Form) Yes No 8. Is course repeatable Yes No If so, repeatable to a maximum of: 2 Total Enrollments 3.0 Total Units (Use Request for Exception sheet to justify repeatability.) If yes, in what G.E. area? AA/AS Area CSU/GE Area IGETC Area 9. SAM Classification C Course Classification I 4. Method of Instruction: Lecture Lab Lecture/Lab Independent Study ACADEMIC AFFAIRS COURSE OUTLINE 1/01 5 PROGRAM AND COURSE NUMBER BUS 82 REQUEST FOR EXCEPTION This form may be used to provide justification for 1. making a course repeatable 2. requiring more than the minimum number of contact hours 3. utilizing non-college level texts for degree applicable course To request an exception, provide the following information: BUS 82 Federal Income Tax Preparation Course Title Department and Course No NATURE OF THE EXCEPTION REQUESTED AND RATIONALE: Because this course is the preparatory course for actual tax form filling assistance, it is necessary that each year that the student engages in the assistance program that familiarity with the tax law and form changes be current. Each year the Internal Revenue Service makes modifications to tax forms and current law is either modified or updated. ACADEMIC AFFAIRS COURSE OUTLINE 1/01 6