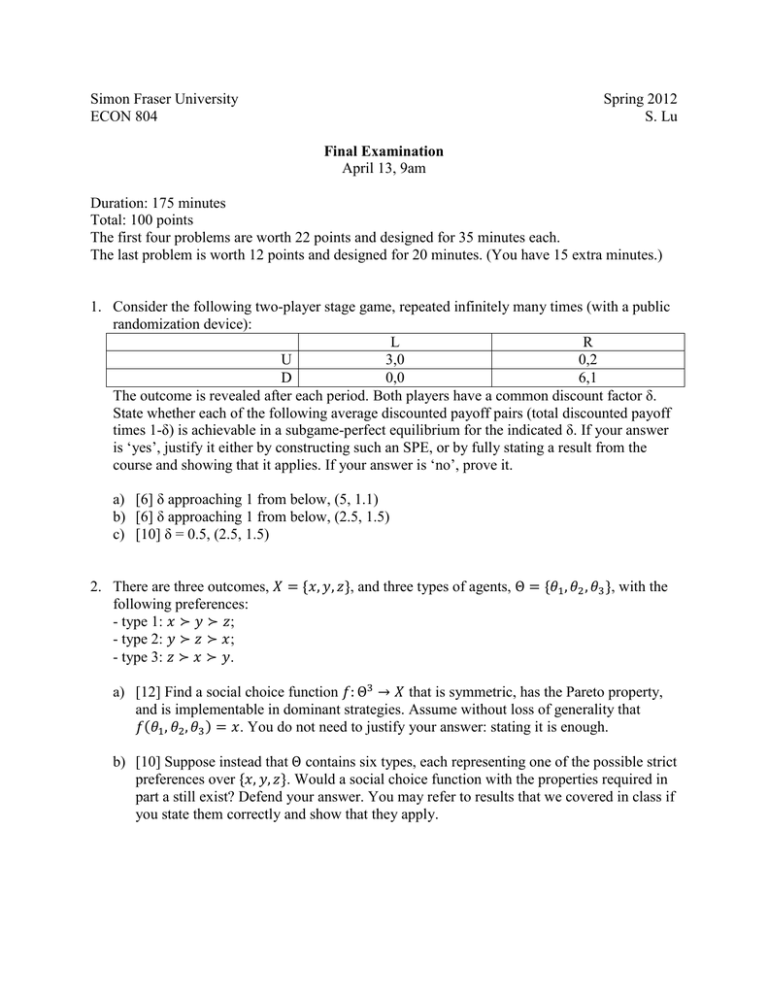

Simon Fraser University Spring 2012 ECON 804 S. Lu

advertisement

Simon Fraser University

ECON 804

Spring 2012

S. Lu

Final Examination

April 13, 9am

Duration: 175 minutes

Total: 100 points

The first four problems are worth 22 points and designed for 35 minutes each.

The last problem is worth 12 points and designed for 20 minutes. (You have 15 extra minutes.)

1. Consider the following two-player stage game, repeated infinitely many times (with a public

randomization device):

L

R

U

3,0

0,2

D

0,0

6,1

The outcome is revealed after each period. Both players have a common discount factor δ.

State whether each of the following average discounted payoff pairs (total discounted payoff

times 1-δ) is achievable in a subgame-perfect equilibrium for the indicated δ. If your answer

is ‘yes’, justify it either by constructing such an SPE, or by fully stating a result from the

course and showing that it applies. If your answer is ‘no’, prove it.

a) [6] δ approaching 1 from below, (5, 1.1)

b) [6] δ approaching 1 from below, (2.5, 1.5)

c) [10] δ = 0.5, (2.5, 1.5)

2. There are three outcomes, 𝑋 = {𝑥, 𝑦, 𝑧}, and three types of agents, Θ = {𝜃1 , 𝜃2 , 𝜃3 }, with the

following preferences:

- type 1: 𝑥 ≻ 𝑦 ≻ 𝑧;

- type 2: 𝑦 ≻ 𝑧 ≻ 𝑥;

- type 3: 𝑧 ≻ 𝑥 ≻ 𝑦.

a) [12] Find a social choice function 𝑓: Θ3 → 𝑋 that is symmetric, has the Pareto property,

and is implementable in dominant strategies. Assume without loss of generality that

𝑓(𝜃1 , 𝜃2 , 𝜃3 ) = 𝑥. You do not need to justify your answer: stating it is enough.

b) [10] Suppose instead that Θ contains six types, each representing one of the possible strict

preferences over {𝑥, 𝑦, 𝑧}. Would a social choice function with the properties required in

part a still exist? Defend your answer. You may refer to results that we covered in class if

you state them correctly and show that they apply.

3. Consider an auction setting where the auctioneer has two identical goods that have no value

to him (except, of course, the fact that he can sell them for money). There are n bidders,

whose private and independent valuations are drawn from U[0,1]. These are the valuations

for one unit of the good; having a second unit is worth zero to each bidder.

a) [8] Propose an auction where each bidder’s weakly dominant strategy is to bid their value,

and prove your answer.

b) [14] Your friend, an MA student, says, “It seems like all auctions that allocate the objects

to the bidders with the two highest values would generate the same revenue for the seller.”

Is your friend correct? If so, show it. If not, provide a counterexample. If you can easily

fix the statement so that it is correct, please do so and show that your version is right.

[Hint: Does the fact that there are two objects make a difference for the Revenue

Equivalence Theorem?]

4. Consider a bilateral trade setting where:

- the buyer’s valuation is 0 with probability p and 2 with probability 1-p;

- the seller’s valuation is 1 with probability q and 3 with probability 1-q;

- both the buyer and the seller are risk-neutral;

- the valuations are independent and private.

a) [10] State the Myerson-Satterthwaite Theorem. Does it apply to the setting described

above? Why or why not?

b) [12] For what values of p and q, if any, does the conclusion of the Myerson-Satterthwaite

Theorem hold? Prove your answer.

5. Consider second-degree price discrimination by a monopolist facing three types 𝜃𝐻 > 𝜃𝑀 >

𝜃𝐿 > 0. Type i has utility function 𝜃𝑖 𝑣(𝑥) − 𝑇, where 𝑥 is the amount of the good consumed

and 𝑇 is the total amount paid. Assume that 𝑣(0) = 0, 𝑣 ′ (𝑥) > 0.

[12] Prove that the incentive compatibility (IC) constraint of type 𝜃𝐻 with respect to type

𝜃𝐿 ’s bundle can be replaced by a simple monotonicity constraint, assuming that all the other

IC constraints are satisfied.