Simon Fraser University Fall 2015 Econ 383 D100 Auction Theory Midterm Exam

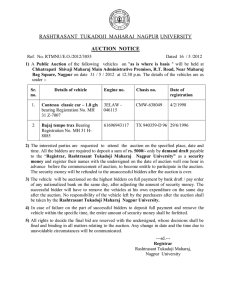

advertisement

Simon Fraser University

Fall 2015

Econ 383 D100 Auction Theory Midterm Exam

Instructor: Songzi Du

Thursday October 29, 2015, 12:30 – 2:20 PM

Write your name, SFU ID number, and tutorial section number both on the exam

booklets and on the questionnaire. Hand in both the exam booklets and this

questionnaire. But note that only the exam booklets are graded.

• Name:

• SFU ID number:

• Tutorial section number:

General instructions

1. This is a closed-book exam: no books, notes, computer, cellphone, internet, or other

aids. A scientific, non-graphing calculator is allowed.

2. If you use decimals in calculation, keep two decimal places.

3. Write clearly. Illegible answers will receive no credit.

4. Show your work! Partial credits are given. Answers without proper explanation/calculation

will be penalized.

5. A request for regrade can be accepted only if the exam is written with a pen.

1

1. (15 points) There are three buyers {x, y, z} and three houses {a, b, c}. The buyers’

valuations are given below (assume each buyer wants only one house).

Buyer

x

y

z

value for house a value for house b value for house c

3

1

2

3

2

1

4

3

1

For this problem, assume integer prices.

a. Do prices pa = 2, pb = 0, pc = 0 clear the market? Explain.

b. There are six possible matchings of buyers to houses (x − a means buyer x is matched

to house a). Calculate the total value (i.e., social welfare) for each matching. Which one

maximizes the total value?

Matching

Total value

x − a, y − b, z − c

x − a, y − c, z − b

x − b, y − a, z − c

x − b, y − c, z − a

x − c, y − a, z − b

x − c, y − b, z − a

c. Run the ascending price auction on these values. What are the (market-clearing) prices

and matching given by the auction?

2. (10 points) There is one object for sale, and three bidders, whose values for the object

are independently and uniformly distributed over [0, 1]. Consider a second price auction with

a reserve price r.

(a) Calculate the seller’s expected revenue as a function of r, Rev(r), when bidders play

their dominant strategy. Hint: consider the following cases: (i) all three values are below r;

(ii) all three values are above r; (iii) one value is above r, and the other two values are below

r (there are three ways for this to happen); (iv) two values are above r, and the other value

is below r (there are three ways for this to happen).

2

(b) Calculate the derivative of the expected revenue with respect to r, Rev0 (r), and show

that Rev0 (r) = 3(1 − 2r)r2 . Show ALL steps in your derivation.

(c) What is the r that maximizes the expected revenue?

3. (10 points) There is one object for sale, and four bidders, whose values for the object

are independently and uniformly distributed over [0, 1]. Consider an average price auction

where the highest bidder wins the object and pays the average of all bids (all other bidders

do no pay). The equilibrium bidding strategy is si (vi ) = Avi for a constant A. Derive this

constant A.

4. (5 points) Consider an average price auction of a single object, with three bidders.

Is truthful bidding a dominant strategy? Explain.

3