Simon Fraser University Spring 2015 Econ 302 (D200) Quiz Instructor: Songzi Du

advertisement

Simon Fraser University

Spring 2015

Econ 302 (D200) Quiz

Instructor: Songzi Du

Thursday February 5 2015, 8:30 – 9:20 AM

Write your name, SFU ID number, and tutorial section number both on the exam

booklets and on the questionnaire. Hand in both the exam booklets and this

questionnaire. But note that only the exam booklets are graded.

• Name:

• SFU ID number:

• Tutorial section number:

General instructions

1. This is a closed-book exam: no books, notes, computer, cellphone, internet, or other

aids. A scientific, non-graphing calculator is allowed.

2. If you use decimals in calculation, keep two decimal places.

3. Write clearly. Illegible answers will receive no credit.

4. Show your work! Partial credits are given. Answers without proper explanation/calculation

will be penalized.

5. A request for regrade can be accepted only if the exam is written with a pen.

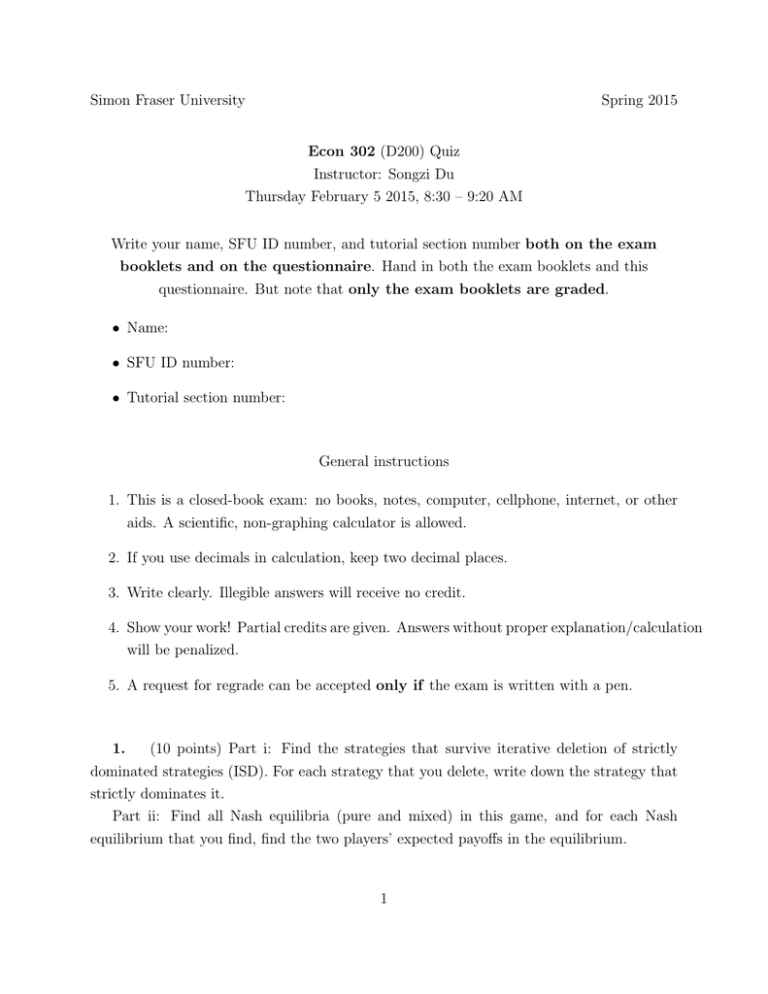

1.

(10 points) Part i: Find the strategies that survive iterative deletion of strictly

dominated strategies (ISD). For each strategy that you delete, write down the strategy that

strictly dominates it.

Part ii: Find all Nash equilibria (pure and mixed) in this game, and for each Nash

equilibrium that you find, find the two players’ expected payoffs in the equilibrium.

1

W

X

Y

Z

A

10, 1

3, 9

3, 5

5, 2

B

4, 4

10, 4

1, 6

1, 5

C

4, 1

2, 0

5, 11

4, 2

D

5, 1

5, 1

2, 3

8, 4

2. (10 points) The market demand function for a homogeneous good is Q(P ) = 10−2P .

There are two firms: firm 1 has a constant marginal cost of 2 for producing/selling each unit

of the good, and firm 2 has a constant marginal cost of 4.

Suppose that the two firms compete by simultaneously setting their quantities (q1 and

q2 ), and the price of the good is determined by the market demand function given the total

quantity. Calculate the Nash equilibrium (q1 , q2 ) in this game, and calculate the price in this

equilibrium.

3.

(10 points) Suppose that there are n airlines (n ≥ 2). Each airline i chooses a

number si from the set {1, 2, 3, 4, 5, 6, 7}, where each number represents a level of security

expenditure by an airline. Airline i’s payoff is 50 + 20 × min(s1 , s2 , . . . , sn ) − 10si (10 is the

cost for each level of security, and 20 is the benefit; security is as strong as the weakest link).

(For example, if n = 3, and s1 = 1, s2 = 5, and s3 = 2, then min(s1 , s2 , s3 ) = 1, so airline 1

gets 50 + 20 − 10 = 60, airline 2 gets 50 + 20 − 50 = 20 and airline 3 gets 50 + 20 − 20 = 50.)

Consider only pure strategy in this game. Can a non-symmetric strategy profile be a Nash

equilibrium? Find all pure-strategy Nash equilibria. Explain your answers.

2