EEVA MAURING UNIVERSITY COLLEGE LONDON

advertisement

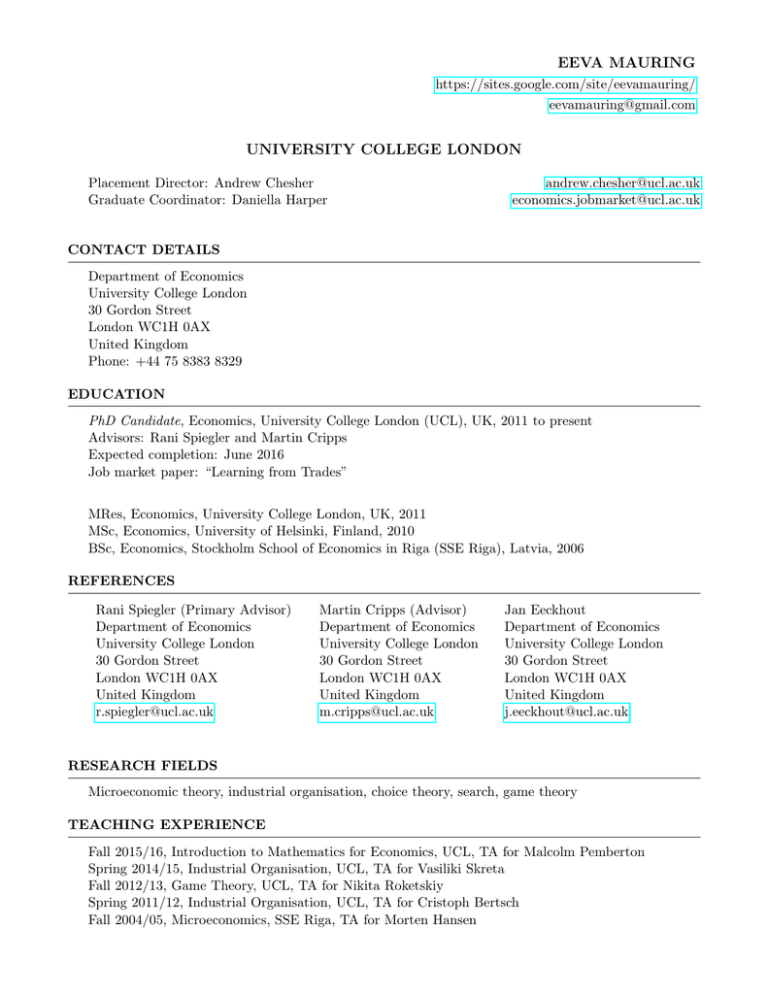

EEVA MAURING https://sites.google.com/site/eevamauring/ eevamauring@gmail.com UNIVERSITY COLLEGE LONDON Placement Director: Andrew Chesher Graduate Coordinator: Daniella Harper andrew.chesher@ucl.ac.uk economics.jobmarket@ucl.ac.uk CONTACT DETAILS Department of Economics University College London 30 Gordon Street London WC1H 0AX United Kingdom Phone: +44 75 8383 8329 EDUCATION PhD Candidate, Economics, University College London (UCL), UK, 2011 to present Advisors: Rani Spiegler and Martin Cripps Expected completion: June 2016 Job market paper: “Learning from Trades” MRes, Economics, University College London, UK, 2011 MSc, Economics, University of Helsinki, Finland, 2010 BSc, Economics, Stockholm School of Economics in Riga (SSE Riga), Latvia, 2006 REFERENCES Rani Spiegler (Primary Advisor) Department of Economics University College London 30 Gordon Street London WC1H 0AX United Kingdom r.spiegler@ucl.ac.uk Martin Cripps (Advisor) Department of Economics University College London 30 Gordon Street London WC1H 0AX United Kingdom m.cripps@ucl.ac.uk Jan Eeckhout Department of Economics University College London 30 Gordon Street London WC1H 0AX United Kingdom j.eeckhout@ucl.ac.uk RESEARCH FIELDS Microeconomic theory, industrial organisation, choice theory, search, game theory TEACHING EXPERIENCE Fall 2015/16, Introduction to Mathematics for Economics, UCL, TA for Malcolm Pemberton Spring 2014/15, Industrial Organisation, UCL, TA for Vasiliki Skreta Fall 2012/13, Game Theory, UCL, TA for Nikita Roketskiy Spring 2011/12, Industrial Organisation, UCL, TA for Cristoph Bertsch Fall 2004/05, Microeconomics, SSE Riga, TA for Morten Hansen RESEARCH EXPERIENCE AND OTHER EMPLOYMENT July 2013 - Nov 2014, Research Assistant to Rani Spiegler, UCL Oct 2011 - July 2012, Research Assistant to Rani Spiegler, UCL June 2010 - Aug 2010, Research Assistant to Klaus Kultti, University of Helsinki June 2009 - Aug 2009, Research Assistant to Klaus Kultti, University of Helsinki April 2007 - Aug 2008, Financial Analyst, AS Hansapank (now AS Swedbank), Estonia CONFERENCE & SEMINAR PRESENTATIONS May 2015, SaM Conference, Aix-en-Provence, France April 2015, Royal Economic Society Junior Symposium, Manchester, UK Nov 2014, ENTER seminar, Tilburg, Netherlands Aug 2011, European Economics Association Conference, Oslo, Norway Aug 2011, Irish Society of New Economists Conference, Dublin, Ireland OTHER PROFESSIONAL ACTIVITIES Refereeing: Economic Journal Conference organisation: Frontiers in Economics and Psychology, UCL, 5-6 June 2014 Summer schools: Decision Theory, Jerusalem, 2013; Incomplete Contracts, Bronnbach, 2012 SCHOLARSHIPS 2014, Kristjan Jaak Scholarship, Estonian Ministry of Education and Research 2010-2012, WM Gorman Scholarship, UCL 2010-2012, ESRC Scholarship, Economic & Social Research Council, UK 2010, Rein Otsason Scholarship, Rein Otsason Foundation 2009, Kristjan Jaak Scholarship, Estonian Ministry of Education and Research 2008-2009, International Student Grant, University of Helsinki 2008, Staffan Burenstam Linder Scholarship, Staffan Burenstam Linder Memorial Foundation RESEARCH PAPERS IN PROGRESS Job Market Paper: “Learning from Trades” Buyers learn about the distribution of options on the market from many types of information. This paper analyses the efficiency of various information regimes in a dynamic market model with pairwise meetings where buyers face an unknown distribution of options. I show that, contrary to the intuition that more information leads to greater market efficiency, a market where buyers learn about the unknown distribution from a private signal with an equilibrium-determined precision (“trade signal”) may be less efficient than a market where buyers do not receive this signal. The trade signal reveals to a buyer whether a randomly chosen seller traded in the previous period. In equilibrium, observing that the seller traded is good news about the unknown distribution. In contrast to the trade signal, a market where buyers learn from a private signal with a suitable exogenously given precision is more efficient than both a market where buyers do not receive a signal and a market where buyers know the distribution of options. “Two-Person Search” This paper extends the standard sequential search model by allowing the agent who compiles the choice set via search (the “searcher”) to differ from the agent who chooses from the set (the “chooser”). I show for a general joint distribution of the agents’ preferences that the searcher’s optimal policy is a threshold rule. I characterise the optimal threshold and show that it features a “discouragement effect”: if the searcher is unlikely to find an item that is better for the chooser than the best item found so far, the searcher stops searching. “Search with Mistakes” PRE-DOCTORAL WORK Kultti, K., E. Mauring, J. Vanhala and T. Vesala (2015): “Adverse Selection in Dynamic Matching Markets”, Bulletin of Economic Research, Vol. 67, pp. 115-133. Kultti, K. and E. Mauring (2014): “Low Price Signals High Capacity”, Journal of Economics, Vol. 112, pp. 165-181. Kultti, K. and E. Mauring (2010): “Search with Homogeneous and Heterogeneous Agents”, Finnish Economic Papers, Vol. 23, No. 2. PERSONAL INFORMATION Citizenship: Estonia Languages: Estonian (mother tongue), English (fluent), Finnish (advanced), German (intermediate), Russian (beginner)