Société en commandite Gaz Métro Cause tarifaire 2008, R-3630-2007 R

Société en commandite Gaz Métro

Cause tarifaire 2008, R-3630-2007

R ÉPONSE DE G AZ M ÉTRO À UNE DEMANDE DE RENSEIGNEMENTS

Origine : Demande de renseignements n o

1 en date du 7 juin 2007

Demandeur : Association des consommateurs industriels de gaz

Référence : Dr. Paul Carpenter’s Evidence

Préambule :

With reference to Dr. Carpenter’s discussion of assurance that the utility will be allowed to earn a fair ROE on page 13.

Questions :

6.1. a) Please provide the allowed and earned ROE for Gaz Metro from 1997, b) Please also provide the allowed and actual ROE for Union Gas and Enbridge Gas

Distribution for whom Dr. Carpenter testified in 2006 for the same period. c) On the basis of this ability to earn their allowed ROE since 1997 please rank Gaz

Metro relative to the two Ontario gas LDCs.

Réponses :

6.1.a)

Gaz Métro Allowed ROE

(without incentive)

Gaz Métro Allowed ROE

(including incentive)

Gaz Métro Earned ROE

(including incentive)

1997 11.50%

1998 10.75%

1999 9.64%

11.90%

11.09%

10.22%

2000 9.72% 10.06%

2001 9.60% 10.38% 10.38%

2002 9.67% 9.69% 10.67%

2003 9.89% 10.34% 10.82%

2004 9.45% 10.96% 11.47%

2005 9.69% 11.64% 10.52%

Original : 2007.06.19

Révisé : 2007.08.03

Gaz Métro – 7, Document 9.6

Page 1 de 4

Société en commandite Gaz Métro

Cause tarifaire 2008, R-3630-2007

6.1.b) Dr. Booth appears to possess this information for 1997 – 2005 for EGDI and for 1997 –

2004 for Union. See Schedule 2 of “Business Risk and Capital Structure for Enbridge

Gas Distribution Inc. (EGDI), Evidence of Dr. Laurence D. Booth Before the Ontario

Energy Board, November 2006, On Behalf of The Consumers Council of Canada (CCC),

Industrial Gas Users Association (IGUA), and the Vulnerable Energy Consumers

Coalition (VECC)” from OEB Docket No. EB-2006-0034.

6.1.c) Dr. Carpenter would not use this information to rank relative risk, because business risk is a forward-looking market concept, and these data represent historical accountingbased returns.

Original : 2007.06.19

Révisé : 2007.08.03

Gaz Métro – 7, Document 9.6

Page 2 de 4

Société en commandite Gaz Métro

Cause tarifaire 2008, R-3630-2007

1

2

3

L-27

BUSINESS RISK AND CAPITAL STUCTURE

4

FOR

5

ENBRIDGE GAS DISTRIBUTION INC (EGDI)

6

7

8

9

Evidence of

Dr. Laurence D. Booth

10

11

12

13

14

Before The

Ontario Energy Board

November 2006

On Behalf

15 of

16

17

The Consumers Council of Canada (CCC), Industrial Gas Users Association

(IGUA), and the Vulnerable Energy Consumers Coalition (VECC)

Original : 2007.08.03

Gaz Métro - 7, Document 9.6

Page 3 de 4

Société en commandite Gaz Métro

Cause tarifaire 2008, R-3630-2007

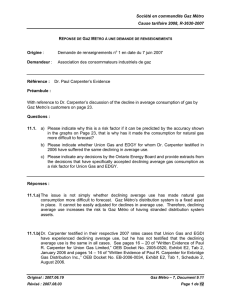

Schedule 2

Earned vs Allowed ROEs

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Allowed

13.25

13.13

13.13

12.30

11.60

11.65

11.88

11.50

10.30

9.51

9.73

9.54

9.66

9.69

9.69

9.57

11.01

EGDI

Actual

13.60

13.29

13.40

14.43

12.49

12.66

13.14

13.00

11.97

10.77

10.83

10.03

11.81

13.14

10.66

9.46

12.17

1.16

Allowed

13.50

13.50

13.00

12.50

11.75

11.75

11.75

11.00

10.44

9.61

9.95

9.95

9.95

9.95

9.62

UNION

Actual

13.40

12.50

13.70

14.30

12.14

12.12

12.52

12.26

11.14

10.10

10.11

11.45

12.36

12.08

10.45

Allowed

12.25

na

10.65

12.00

11.00

10.25

10.00

9.25

9.50

9.25

9.13

9.42

9.15

Terasen

Actual

9.06

11.91

9.73

12.03

11.80

11.27

9.41

10.70

10.75

9.38

10.03

10.23

9.46

Over

11.21

12.04

0.83

10.15

10.44

0.29

Terasen data is from the company’s response to the BCUC information request #1 in the BCUC review of its adjustment mechanism. The data for EGDI is from VECC #45 and that for Union from Appendix B Schedule 10 of the pre-filed testimony of Dr. William Cannon in RP-2002-0158 updated with interrogatory answer J2-31.

2

Original : 2007.08.03

Gaz Métro - 7, Document 9.6

Page 4 de 4