July 17, 2008 File No. R-3662-2008 Page 1 of 8

advertisement

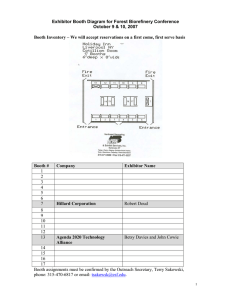

July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 1 of 8 INFORMATION REQUEST 1 FROM GAZ MÉTRO TO IGUA CONCERNING IGUA’S EVIDENCE 1. Documents: Testimony of IGUA analyst Jean-Benoit Trahan, Q5 Preamble: “Q.5 What is IGUA’s position on the downtrend in volumes? A.5 IGUA considers the decline in volume per consumer to be positive. It shows that energy efficiency efforts are paying off in all customer categories, producing more effective use of natural gas and making natural gas more competitive with other forms of energy.” Requests: 1.1 Is the reduction in consumption per customer due solely to energy efficiency efforts or is it also related to loss of load? 1.2 What portion of the reduction in consumption per customer is due to reduced natural gas loads for existing customers and new customers? Answers: See Jean-Benoît Trahan’s answers 1.1 and 1.2 to Gaz Métro. 2. Documents: Testimony of IGUA analyst Jean-Benoit Trahan, Q5 Preamble: “Regarding migration to electric power, Hydro-Québec Distribution’s pricing structure has not changed significantly since last year. Modifications to the rates continue to tie pricing more closely to marginal supply costs, notably through larger increases in the second bracket of Rate D and the energy portion of Rates M and L.” Requests: 2.1 Please provide Hydro-Québec’s marginal supply cost, the second bracket of Rate D and the energy portion of Rates M and L for every year since October 1, 2006. Please provide the price of natural gas (supply rate) for the same period. Answer: See Jean-Benoît Trahan’s answer 2.1 to Gaz Métro. July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 2 of 8 3. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, Commercial Paper Spread chart, page 6 Requests: 3.1 Please update this chart with the latest available data. 3.2 Please indicate exactly what data was used to produce this chart and provide the source. In addition, please provide this data in Excel format. Data series are Cansim V1221812 and V121778, three month prime commercial paper and Treasury Bill yields. Chart is below and data is booth cp.pdf (Appendix 3.1A hereof) Commercial Paper Spread 7/4/2008 5/4/2008 3/4/2008 1/4/2008 11/4/2007 9/4/2007 7/4/2007 5/4/2007 3/4/2007 1/4/2007 11/4/2006 9/4/2006 7/4/2006 5/4/2006 3/4/2006 1/4/2006 2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 4. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, Leading Indicators: US and Canada chart, page 6 Requests: 4.1 Please indicate exactly what data was used to produce this chart and provide the source. In addition, please provide this data in Excel format. Data is cansim series v7671 and v7688. Updated chart is below and data is in booth leading.pdf. (Appendix 4,1A hereof) July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 3 of 8 Leading Indicators: US and Canada 2.00 1.50 1.00 0.50 Ja n0 M 0 ay -0 Se 0 p00 Ja n0 M 1 ay -0 Se 1 p01 Ja n0 M 2 ay -0 Se 2 p02 Ja n0 M 3 ay -0 Se 3 p03 Ja n0 M 4 ay -0 Se 4 p04 Ja n0 M 5 ay -0 Se 5 p05 Ja n0 M 6 ay -0 Se 6 p06 Ja n0 M 7 ay -0 Se 7 p07 Ja n0 M 8 ay -0 8 0.00 -0.50 -1.00 -1.50 Canada % US % 5. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, Interest Rates and Inflation chart, page 7 Requests: 5.1 Please indicate exactly what data was used to produce this chart and provide the source. In addition, please provide this data in Excel format. 5.2 Please confirm that “T-Bills” have 90-day maturities and “Canadas” have 30-year maturities. 5.1 Data and Cansim pneumonics provided in booth interest rates.pdf. (Appendix 5.1A hereof) 5.2 No. 3 month Treasury Bill yields in Canada are based on 91 days as Canadian rates are quoted on a 365 day count basis. US T Bills are 90 days since they are quoted on 30/360 day count basis. Canadas are over ten as 30 year Canada bonds do not exist back to 1961. 6. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, Corporate ROE and BBB Spread chart, page 10 July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 4 of 8 Requests: 6.1 Please confirm that the ROE shown on this chart is the rate of return on equity, i.e. an accounting measure consisting in net income divided by the book value of shareholders’ equity. 6.2 Please add to this chart the evolution of the risk premium expected by investors on shares of the corporations under consideration. The risk premium is defined as the difference between the yield expected by investors on shares of the corporations under consideration and the yield on Government of Canada long-term (30-year) bonds. 6.3 Please add to this chart the evolution of the rate of return yielded by the NEB formula, since 1994. 6.4 Please indicate exactly what data was used to produce this chart and provide the source. In addition, please provide this data in Excel format. 6.5 Please provide the list of companies included in the data. 6.1 Correct 6.2 This can not be done since the ROE data is composite data for Corporate Canada provided by Statistics Canada and includes all Canadian corporations. 6.3 Graph is below, note NEB Allowed ROE for the TransCanada Mainline is only available since 1990. Corporate And NEB Allowed ROE and BBB Spread 400 16.00 350 14.00 300 12.00 250 10.00 200 8.00 150 6.00 100 4.00 50 2.00 0 0.00 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 BBB Spread ROE NEB ROE July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 5 of 8 6.4 Spread data is from Scotia Capital and is described in answer to 7.0, the ROE data is from Statistics Canada cansim series D86221for the earlier data using SIC codes and V 498077 using NAICs. Data is in booth ROE.pdf. (Appendix 6.4A hereof) 6.5 The companies are all of Corporate Canada as surveyed by Statistics Canada and the list of all companies is too exhaustive to be provided even were it available. 7. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, A and BBB Spreads chart, page 11 Requests: 7.1 Please indicate exactly what data was used to produce this chart and provide the source. In addition, please provide this data in Excel format. 7.2 Please provide the list of companies included in the data. 7.3 What is the largest spread for the A-rated bonds shown on this chart? On what date did this peak occur? 7.1 The data was from Datastream for the series SCM2ALG, SCM1ALG, SCM3BLG and SCMCLG. SCM refers to ScotiaCapital, 3 for triple, 2 for double and 1 for single for A and B type bonds and C for Canada. Data is in booth spreads.pdf. (Appendix 7.1A hereof) 7.2 The composition of Scotia Capital indexes has varied over time and there is no way to provide this. 7.3 Maximum for A was on April 23, 2008 at 161.4 basis points, the maximum for BBB was February 1994 at 456 basis points. 8. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, page 9 July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 6 of 8 Preamble: “Since the National Energy Board started using its ROE formula in 1994 we have been through this process at least once, if not twice, before and the NEB has not changed its formula and repeatedly found the results to be fair and reasonable. Further, the Regie’s formula ROE as well as that of the Ontario Energy Board both went through the period 2001-3 when yield spreads were similarly large without any adjustment. Consequently, I see nothing unusual in what has happened over the last year that might cause the ROE formula to become unfair or unreasonable.” Requests: 8.1 Please file a list of the rates you have recommended before Canadian regulatory agencies for each year since 1994 and the rate that was eventually granted by the regulatory agency in each case. Prior to 2004 Dr. Booth did not file independent testimony as he worked for Berkowitz and Associates, who maintained all records. Dr Booth does not have the requested data prior to that period. Further Dr. Booth does not keep a record of board decisions. Since 2004 to the best of Dr. Booth’s recollections he has made the following recommendations: 2008 TQM and Ontario Power Generation 7.75% not decided yet 2007 Ontario Hydro: 7.5% and Gaz Metro 8.0% 2006 None 2005 Terasen Gas: 7.75% 2004 None 2003 Alberta Generic: 8.12% Many of the recent cases have been business risk cases, such as Enbridge and Union Gas 2006, the TransCanada Mainline in 2004, Fortis BC and the Mackenzie Valley pipeline in 2005. 9. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, page 8 Preamble: “As a result, I am currently using a forecast long Canada rate of 4.75% for my fair ROE estimates compared with the 5.0% I was using last year.” July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 7 of 8 Requests: 9.1 Please file all the data and analyses that led you to use a 4.75% rate this year and 5.0% last year. Dr. Booth’s interest rate forecasts are based on Schedule 1 to his testimony this year and Schedule 5 of his testimony last year, plus his analysis of current economic events which was in Section 2 of his testimony last year, but which is not part of his testimony this year. 10. Documents: Rate of return for Gaz Métro, Evidence of Laurence D. Booth, Bond Betas chart, page 13 Requests: 10.1 Please update this chart with the latest available data. 10.2 Please indicate exactly what data was used to produce this chart and provide the source. In addition, please provide this data in Excel format. 10.3 Please provide the betas for Canadian corporate bonds (rated A and BBB) during the same period. 10.1 Current graph follows Bond Betas 0.8 0.6 0.4 US 0.2 Canada -0.4 07 20 01 04 20 98 20 19 92 95 19 89 19 19 83 86 19 80 19 19 74 77 19 19 68 71 19 19 62 65 19 59 19 19 53 56 19 50 19 19 44 47 19 41 19 19 19 -0.2 19 35 38 0 July 17, 2008 File No. R-3662-2008 Information request 1 from Gaz Métro to IGUA Page 8 of 8 10.2 Data is provided as booth Can and US returns (Appendix 10.2A hereof). The Canadian returns are from the Canadian Institute of Actuaries Report on Canadian Economic Statistics. US returns are from the Federal Reserve Economic Data bank (FRED) for the S&P500 and the long US Treasury bond. 10.3 Not possible as Dr. Booth does not have access to holding period return data for corporate bonds. Holding period return data can not be created from yield data since indexes never default. HBdocs - 4672257v1