C-7-5 UMQ RESPONSE TO IR No. 1 from La Régie (E

advertisement

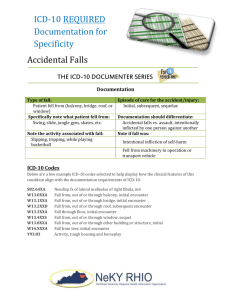

C-7-5 UMQ RESPONSE TO IR No. 1 from La Régie (ENGLISH TRANSLATION) October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 1 of 15 REQUEST FOR INFORMATION NO. 1 FROM GAZ METRO PARTNERSHIP ("GAZ METRO") TO THE UNION OF MUNICIPALITIES OF QUEBEC ("THE UMQ") 1. References : (i) Memo from the UMQ, page 8 – section Costs of category "B" ‐ Costs of existing distribution network (ii) Memo from the UMQ, page 9 – section Costs of category "C" ‐ Distribution costs not related to the gas network (iii) Memo from the UMQ, page 9 – section Costs of category "C" ‐ Distribution costs not related to the gas network (iv) Memo from the UMQ, page 9 – section Costs of category "C" ‐ Distribution costs not related to the gas network (v) Memo from the UMQ, page 9 – section Costs of category "C" ‐ Distribution costs not related to the gas network Preamble: (i) "Based on these observations, the UMQ accepts the proposals of Gaz Metro.” (ii) "[...] these producers will benefit from access to an established distribution network and the expertise of Gaz Metro.” (emphasis added) October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 2 of 15 (iii) "Even if the quantification of these benefits is subject to debate and ultimately based on a subjective assessment, it is not envisaged in the request.” (iv) "The percentage of distribution costs not related to the gas network could provide a "proxy” for both the costs identified by Gaz Metro for these benefits.” (emphasis added) (v) "The UMQ submits that beyond the costs identified by Gaz Metro, there are benefits from access to an established network that must be taken into account in determining the portion to be attributed to producers.” (emphasis added) Request: 1.1 Please define the term "benefits from access to an established network. Specifically, what are the benefits derived from access to an established network that should be taken into account in determining the portion to be allocated to producers? Answer: 1.1 The concept of "benefits from access to an established network" refers to all non‐quantified elements, difficult to quantify but nevertheless identifiable. We could regroup these profits under the name of “goodwill”. For example, the reputation and influence of Gaz Metro in the community, patents that Gaz Metro can hold. Request: 1.2 Please specify whether this benefit of "access to a network" is already included in the category B costs and not in the category C costs, as seems to be suggested by the UMQ. October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 3 of 15 Answer: 1.2 If the understanding of the UMQ is correct, the costs of category B (costs of the existing distribution network) are not charged to producers when natural gas injected by producers is consumed within the territory. These costs, at least those of the transport function of the distribution network, are charged to them only if the natural gas is used outside the territory. So the benefit of "access to a network" is not included in the category B costs. Request: 1.3 Please elaborate on this notion of "benefit of access to a network" based on the principle of cost causality in terms of cost allocation. Please also elaborate according to the recovery of these costs through the reception rate. Answer: 1.3 The UMQ does not reject the attempt of Gaz Metro to determine these costs according to some form of causality. The position of the UMQ differs from that of Gaz Metro as to the quantum. On the one hand, the position of Gaz Metro is based on scenarios which "deliver" various options. On the other hand, Gaz Metro considers only the costs identified. These costs should be recovered through the reception rate. Request: 1.4 According to the UMQ, what value do we give access to an established gas network and the expertise of Gaz Metro? Answer: October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 4 of 15 1.4 According to the UMQ, the value must match the difference between the rate recommended by the UMQ (5%) and that proposed by Gaz Metro (4%): i.e. 1% of the value of the producer's investment. 2. References: (i) Gaz Metro ‐ 1, Document 1, page 12, lines 6 and 7 (ii) Memo from the UMQ, page 13 (iii) APGQ/QOGA Evidence, page 11 Preamble: (i) "The facilities of producers joining the existing gas network via the connecting pipes.” (ii) "Distribution pipes to be constructed to transport natural gas from the facilities of producers to those of Gaz Metro can be assimilated to a collection network. Pricing points reflect the "collection" element.” (emphasis added). (iii) [See source page 3] Request: October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 5 of 15 2.1 Please confirm that the terms "collection network" and "item collection" correspond to the connecting pipes and not the producers' facilities which include the collection network (Gathering Infrastructure). Answer: 2.2 The UMQ confirms. 3. References: (i) Memo from the UMQ, page 15, section Rates applicable to reception points (ii) Memo from the UMQ, page 16, section Rates applicable to reception points (iii) Memo from the UMQ, page 16, section Rates applicable to reception points Preamble: (i) "The UMQ submits that it is premature to set the ratio on such bases.” (ii) "However, if we consider the ratio as a "right of entry", both residential customers and the IRA should be considered.” October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 6 of 15 (iii) "The UMQ submits that the ratio should be set at 5%, which corresponds to an equal distribution between producers and consumer customers of the ratio of annual distribution costs not related to the gas network to be shared (between producers and consumer customers ) on all assets of Gaz Metro.” Request: 3.1 What does the expression "right of entry" in the context of the evidence of the UMQ mean? More precisely, how does the ratio represent a "right of entry"? Answer: 3.1 The term "right of entry" in the context of the evidence of the UMQ would be the counterpart of the "exit fee". The UMQ has referred to the "right of entry" in order to argue that the causality of costs should only serve as a general guide in determining the costs not related to the gas network. The quantum, if the scenarios leave open the possibility of different rates, should take account of qualitative elements. Request 3.2 Gaz Metro understands that the ratio of 5% is the result of the division into two percentages of 10% calculated on the total of the rate base of Gaz Metro. Please confirm our understanding. If not, please explain how UMQ sets the percentage of annual distribution costs not related to the gas network at 5%? Provide all documents supporting this position. Answer: 3.2 The understanding of Gaz Metro is correct. October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 7 of 15 References: (i) Memo from the UMQ, page 20, section Unit rate of volumes delivered outside territory. (ii) Memo from the UMQ, page 20, section Unit rate of volumes delivered outside territory. Preamble: "The UMQ submits that it is premature to determine, from the present file, a specific rate applicable to the volumes to be delivered outside the territory. Unlike the rate for distribution costs not related to the gas network (Category C costs), this rate is not essential for processing requests for approval of subsequent investments.” (Ii) "Finally, offer this case a specific rate could leave the impression that natural gas produced within the territory of Gaz Metro is primarily intended for consumption outside the territory, especially since there no fixed rate for consumption in the territory.” Request: 4.1 The UMQ mentions in the preamble (i) that the unit rate applicable to the volumes supplied outside the territory is not required for processing requests for approval of subsequent investments. According to the UMQ, what would happen if Gaz Metro had to file an investment request to connect the facilities of a producer customer to its existing network if the customer wanted to deliver natural as outside the territory of Gaz Metro, while the rate was not sent in the context of this case? October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 8 of 15 Answer: 4.1 The issue of the unit rate applicable to volumes supplied outside the territory would be considered as part of the request of investment in question upon request at 4.1. Request: 4.2 Please explain how the setting of a specific rate in the context of this case could leave the impression that natural gas produced in the territory of Gaz Metro is primarily intended for consumption outside the territory. Answer: 4.2 Since only the general principles applicable to the pricing at the reception point and the delivery point in the territory have been established in this case, setting a specific rate applicable to volumes supplied outside the territory as part of this same case could leave the impression that this specific data is required because the natural gas is primarily destined for outside consumption. 5. References: (i) Memo from the UMQ, page 24 (ii) Gaz Metro‐ 1, Document 1, pages 31 and 32 and Gaz Metro‐1 , Document 1.10 in response to question 10.2 of the Regie of energy, Excel file attached entitled Tableaux III et IV October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 9 of 15 Preamble: (i) "The UMQ submits that the initial contract term should be equivalent to the period of depreciation. It follows that the breakeven rate point should be attained at the end of the contract initial minimizing risks to all customers. “ (ii) Project Assumptions Annual Volume (m3) 500 000 000 Total investment in capital ($) 45 000 000 Distribution costs non related to the Gaz network (4.0 % of investment) 1 800 000 ($) Regulated Parameters Useful life of assets (years) 20 Royalty rate to the Board of Energy ($ / 103m3) 0.311486 Royalty rate to the Building Authority ($ / 103m3) 0.411000 Rate of the tax on public services 1.50% Tax rate 26.90% Debt Rate (Weighted cost) 6.91% Rate of the equity (weighted cost of common equity and Privileged) 8.55% Debt Percentage October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 10 of 15 54% Percentage of assets of shareholders (regular and privileged) 46% Weighted rate of the capital 7.67% Breakeven rate (years) 20 Service Cost 0 1 2009 in 2010 $ in $ 2 3 4 5 10 20 2011 2012 2013 2014 2019 2029 In $ In $ In $ In $ In $ In $ Distribution costs non related to the Gaz network (1 800 (1 800 (1 800 (1 800 (1 800 (1 800 (1 800 000) 000) 000) 000) 000) 000) 000) Rate of the tax on public services (641 250) (607 500) (573 750) (540 000) (506 250) (337 500) ‐ Royalties (361 243) (361 243) (361 243) (361 243) (361 243) (361 243) (361 243) Depreciation (2 250 (2 250 (2 250 (2 250 (2 250 (2 250 (2 250 000) 000) October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 11 of 15 000) 000) 000) 000) 000) Interest cost (1 636 (1 552 (1 468 (1 384 (1 300 (881 288) 678) 746) 814) 881) 949) (41 966) Tax (966 141) (527 830) Cost of equity (1 725 (1 636 (1 548 (1 460 (1 371 (929 094) 461) 976) 491) 006) 520) Total service cost (9 380 (8 675 (8 494 (8 309 (8 122 (7 141 (5 025 773) 066) 163) 790) 156) 517) 282) Pricing Base Equity (20 700 (20 182 (19 147 (18 112 (17 077 (16 042 (10 867 (517 500) 000) 500) 500) 500) 500) 500) 500) Debt (24 300 (23 692 (22 477 (21 262 (20 047 (18 832 (12 757 (607 500) 000) 500) 500) 500) 500) 500) 500) Costs and prices Service Costs 9 380 8 675 8 494 8 309 790 773 066 163 8 122 7 141 517 156 5 025 282 Price Revenue 7 528 7 528 7 528 7 528 718 718 718 718 7 528 7 528 718 718 7 528 718 (466 601) (491 865) (513 660) (532 193) (582 392) (44 243) October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 12 of 15 Difference between cost and revenue 1 852 1 146 965 445 055 348 781 072 593 438 (387 201) (2 503 436) VAN of the difference 1 720 988 842 122 581 182 410 111 (184 922) (571 008) VAN cumulative of various differences 1 720 2 708 3 482 4 063 615 122 964 433 773 470 4 473 4 583 478 727 0 Request: 5.1 The tables below show the tables in the reference (ii) allowing the establishment of the rate applicable at the point of reception, deducting distribution costs not related to the gas network (cost C in gray in the table). This is a business case analyzed with the same methodology as the one used by Gaz Metro in investment projects. It is a profitability analysis including only the marginal costs. Project Assumptions Annual Volume (m3) 500 000 000 Total investment in capital ($) 45 000 000 Distribution costs non related to the Gaz network (4.0 % of investment) ($) 0 Regulated Parameters Useful life of assets (years) 20 Royalty rate to the Board of Energy ($ / 103m3) 0.311486 October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 13 of 15 0.411000 Royalty rate to the Building Authority ($ / 103m3) Rate of the tax on public services 1.50% Tax rate 26.90% Debt Rate (Weighted cost) 6.91% Rate of the equity (weighted cost of common equity and Privileged) 8.55% Debt Percentage 54% Percentage of assets of shareholders (regular and privileged) 46% Weighted rate of the capital 7.67% Breakeven rate (years) 1 Service Cost 0 1 2009 in 2010 $ in $ 2 3 4 5 10 20 2011 2012 2013 2014 2019 2029 In $ In $ In $ In $ In $ In $ ‐ ‐ ‐ ‐ ‐ Distribution costs non related to the ‐ Gaz network ‐ ‐ Rate of the tax on public services (641 250) (607 500) (573 750) (540 000) (506 250) (337 500) ‐ October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 14 of 15 (361 243) (361 243) (361 243) (361 243) (361 243) (361 243) Royalties (361 243) Depreciation (2 250 (2 250 (2 250 (2 250 (2 250 (2 250 (2 250 000) 000) 000) 000) 000) 000) 000) Interest cost (1 636 (1 552 (1 468 (1 384 (1 300 (881 288) 678) 746) 814) 881) 949) (41 966) Tax (966 141) (527 830) Cost of equity (1 725 (1 636 (1 548 (1 460 (1 371 (929 094) 461) 976) 491) 006) 520) Total service cost (7 580 (6 875 (6 694 (6 509 (6 322 (5 341 (3 225 773) 066) 163) 790) 156) 517) 282) Pricing Base Equity (20 700 (20 182 (19 147 (18 112 (17 077 (16 042 (10 867 (517 500) 000) 500) 500) 500) 500) 500) 500) Debt (24 300 (23 692 (22 477 (21 262 (20 047 (18 832 (12 757 (607 500) 000) 500) 500) 500) 500) 500) 500) Costs and prices Service Costs 7 580 6 875 6 694 6 509 790 773 066 163 (466 601) (491 865) (513 660) (532 193) (582 392) 6 322 5 341 517 156 (44 243) 3 225 282 October 21, 2010 File No.: R‐3732‐2010 Response to request for information no. 1 from Gaz Metro to the UMQ Page 15 of 15 7 528 7 528 7 528 7 528 718 7 528 7 528 718 7 528 718 718 718 718 718 Price Revenue Difference between cost and revenue 52 055 (653 652) (834 555) (1 018 (1 206 (2 187 (4 303 928) 562) 201) 436) VAN of the difference 48 347 (563 842) (668 607) (758 167) VAN cumulative of various differences 48 347 (515 495) (1 184 (1 942 (2 776 (7 676 (18 115 102) 269) 096) 531) 234) (833 827) (1 044 (981 570) 580) Please confirm that once the rate is established at the point of reception based on A and C cost categories, the breakeven rate according to the analysis of profitability based on marginal costs is one (1) year. If not, please explain. Response: 5.1 See response 5.2 Request: 5.2 Please confirm that the breakeven rate is reached before the end of the initial contract. Response: 5.2 The UMQ confirms. However it has been demonstrated that, in the case of producers, it would have been difficult to establish a rate based on the "postage stamp" principle. This principle applies when connecting a new customer at Gaz Metro who has a choice among the existing distribution schedules. # 366411