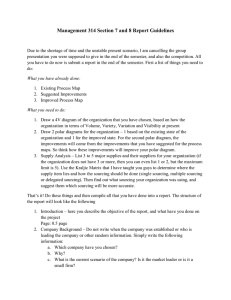

STRATEGIC SOURCING IN THE AIR FORCE

advertisement