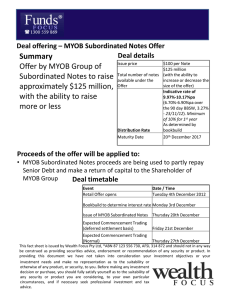

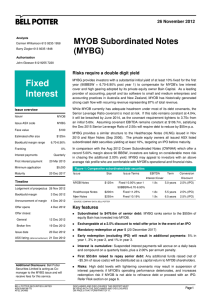

MYOB Subordinated Notes

advertisement

MYOB Subordinated Notes MYOB Group has just announced the launch of a new income offer: MYOB Subordinated Notes. The first round of access is through a broker firm allocation, prior to the general offer and listing in December. The Notes will pay a quarterly coupon of 5.0%-5.5% (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 3.27% as of 23rd December, with an initial indicative rate of 9.97%-10.27%pa (The first pricing is due to be set on date of issue). The Notes are expected to redeem on the 13th December 2017*. The Notes will be tradable on the ASX. MYOB Group SUBORDINATED NOTES Offer Details Issuer Security Name Maturity Date MYOB Group MYOB Group Subordinated Notes (MYBG) 13th December 2017 (unless redeemed earlier) Margin Size Minimum Parcel 90 day BBSW + 6.7%-6.9% (rate to be determined by bookbuild) $125m+ $5,000 (Wealth Focus minimum is $10,000) Source: MYOB Group SUBORDINATED NOTES prospectus Background to MYOB Group MYOB is a leading provider of accounting, payroll and tax software with an estimated 60%70% market share (by revenue). Its dominance in the Accounting market has arguably allowed it to build a strong relationship further down the chain with SMEs as they look to integrate with their accountant offering. This in turn has provided MYOB with strong, growing, recurring revenues (87% of revenue in the 12 months to September 2012) and a loyal customer base. * Includes maintenance/cover, recurring software, transactional and other services revenues. ** New software sales. Past performance is not a reliable indicator of future performance. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 26/11/12 Basel III and historically high debt issuance leading to equity like returns from fixed income It’s easy to point the finger towards investor appetite for fixed income products as the reason why we have seen a surge this year’s Basel Post GFC, investors have re-priced risk in the marketplace. These Notes provide investors with the opportunity to receive equity like returns with enhanced security and highlights the increased cost of funding post GFC, the recent increase in hybrid issuance and the reluctance of banks to provide unsecured financing in light of the Basel III requirements. Key Features 1. A relatively small offering of just $125 Million. 2. Indicative floating yield of 9.97%-10.17% provides investors the opportunity to take advantage of a historically high margin and arguably equity like returns from fixed income. 3. Distributions are cumulative - Suspended interest payments will accrue on a daily basis and compound on a quarterly basis, plus a 2.00% per annum penalty. 4. No optional suspension of interest - Issuer may not elect to suspend interest payments at its discretion if a Suspension Condition does not apply on the relevant interest payment date. 5. Minimum income level of 10%pa for the first four payment periods. 6. Unfranked income - Fixed income etiquette dictates that the rate disclosed is inclusive of franking credits, therefore unfranked payments are more attractive as the full payment is received rather than having to claim the franking back at the end of each year. 7. 5 year investment term – MYOB Group has a maturity date of December 2017. Risks: High debt levels with tightening covenants may result in suspension of interest payments if MYOB’s operating performance deteriorates, and increases redemption risk if MYOB is not able to refinance debt or proceed with an IPO. Our View This issue has many of the hallmarks of an attractive hybrid, a fixed term of 5 years, a relatively small offering of only $125 Million, unfranked income, cumulative distributions with a 2%pa penalty in the event of suspending payments, a well known brand with a strong market share and a large proportion of income from recurring revenues. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 26/11/12 However, investors should note that equity type returns come with equity type risk. MYOB Group is unlisted and as has been the case with Healthscope Notes (ASX code: HLNG), investors don’t have the benefit of ASX reporting on the Group. Investors should also note the added risk of investing in software company where there are little, if any, hard assets. Furthermore, by MYOB’s own accounts, their current liabilities exceed their assets, which in itself is not unusual for private equity companies, but nevertheless adds to the risk of this issue. We view the largest risk as the high debt levels which in turn may result in suspension of interest payments if MYOB’s operating performance deteriorates. Advocates may point to MYOB Group’s stable income, long client relationships and recurring revenues. We agree, but don’t like the lack of hard assets. Our view is that although this is a hybrid, we would add this to our equity basket and feel the equity type returns are a fair reflection of that. Note: MYOB Group Subordinated Notes will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. Investors looking for an allocation can contact us on 1300 559 869 We encourage you to view our online presentation An Introduction to Fixed Income www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 26/11/12