WESTPAC GROUP WESTPAC SUBORDINATED NOTES II For personal use only

advertisement

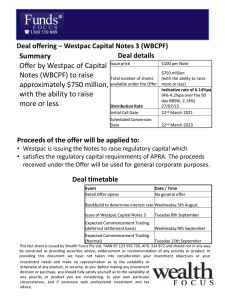

For personal use only WESTPAC GROUP WESTPAC SUBORDINATED NOTES II July 2013 Westpac Banking Corporation ABN 33 007 457 141. For personal use only Disclaimer THIS PRESENTATION IS NOT FOR DISTRIBUTION TO ANY U.S. PERSON OR ADDRESS IN THE UNITED STATES This presentation has been prepared and authorised by Westpac Banking Corporation (ABN 33 007 457 141, AFSL 233714) in connection with a proposed offer of Westpac Subordinated Notes II (“Offer”). The Offer is being made under a prospectus which was lodged with the Australian Securities and Investments Commission (“ASIC”) on 10 July 2013 and a replacement prospectus, which will include the Margin and Application Form, expected to be lodged with ASIC on or about 18 July 2013. Deutsche Bank AG, Sydney Branch, Goldman Sachs Australia Pty Limited, Macquarie Capital (Australia) Limited, Morgan Stanley Australia Securities Limited, UBS AG, Australia Branch and Westpac Banking Corporation (via Westpac Institutional Bank) are the Joint Lead Managers to the Offer (“Joint Lead Managers”). The information in this presentation is an overview and does not contain all information necessary to make an investment decision in relation to Westpac Subordinated Notes II. It is intended to constitute a summary of certain information relating to Westpac and does not purport to be a complete description of Westpac or the Offer. This presentation also includes information derived from publicly available sources that have not been independently verified. The information in this presentation is subject to change without notice and Westpac is not obliged to update or correct it. Certain statements contained in this presentation may constitute statements about “future matters” for the purposes of section 728(2) of the Corporations Act 2001 (Cth). The forward-looking statements include statements regarding our intent, belief or current expectations with respect to our business and operations, market conditions, results of operations and financial condition, including, without limitation, future loan loss provisions, indicative drivers and performance metric outcomes. All statements as to future matters are not guaranteed to be accurate and any statements as to past performance do not represent future performance. This presentation is not intended as an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security. Prospective investors should make their own independent evaluation of an investment in Westpac Subordinated Notes II. If you have any questions, you should seek advice from your financial adviser or other professional adviser before deciding to invest in Westpac Subordinated Notes II. Nothing in this presentation constitutes investment, legal, tax, financial product or other advice. The information in this presentation does not take into account your investment objectives, financial situation or particular needs and so you should consider its appropriateness having regard to these factors before acting upon it. No representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates or opinions or other information contained in this presentation. To the maximum extent permitted by law, Westpac, the Joint Lead Managers and their related bodies corporate, affiliates and each of their respective directors, officers, employees and agents disclaim all liability and responsibility (including without limitation any liability arising from fault or negligence on the part of Westpac, the Joint Lead Managers and their related bodies corporate, affiliates and each of their respective directors, officers, employees and agents) for any direct or indirect loss or damage which may be suffered by any recipient through use of or reliance on anything contained in or omitted from this presentation. In making an investment decision, investors must rely on their own examination of Westpac and the Offer including the merits and risks involved. Investors should consult with their own legal, tax, business and/or financial advisors in connection with any acquisition of securities. Westpac Subordinated Notes II are not deposit liabilities of Westpac, nor protected accounts for the purposes of the Banking Act or the Financial Claims Scheme and are not guaranteed or insured by any government agency, by any member of the Westpac Group or any other person. You should consider and read the prospectus in full before deciding whether to invest in Westpac Subordinated Notes II. A copy of the prospectus is available at www.westpac.com.au/investorcentre. Applications for Westpac Subordinated Notes II can only be made in the relevant Application Form in or accompanying the replacement prospectus, or as otherwise described in the replacement prospectus. The distribution of this presentation or the prospectus in jurisdictions outside of Australia may be restricted by law. Any person who comes into possession of this presentation or the prospectus should seek advice on and observe any of these restrictions. Failure to comply with these restrictions may constitute a violation of applicable securities laws. In particular, Westpac Subordinated Notes II have not been, and will not be, registered under the United States Securities Act of 1933, as amended, (“US Securities Act”) and may not be offered, sold, delivered or transferred within the United States or to, or for the account or benefit of, US Persons (as defined in Regulation S under the US Securities Act). All amounts are in Australian dollars unless otherwise indicated. Certain financial information in this presentation is presented on a cash earnings basis. Cash earnings is a non-GAAP measure. Refer to Westpac’s Interim 2013 Results (incorporating the requirements of Appendix 4D) for the half year ended 31 March 2013 available at www.westpac.com.au for details of the basis of preparation of cash earnings. Capitalised terms used in this presentation but not otherwise defined have the meanings given in the prospectus. Westpac Subordinated Notes II | July 2013 2 For personal use only Westpac Subordinated Notes II summary Issuer Offer Westpac Subordinated Notes II (“Notes”) Maturity1 • Westpac Banking Corporation ("Westpac") • A$750 million with the ability to raise more or less • The proceeds will be used for general business purposes • The Offer includes a Reinvestment Offer to Eligible Westpac SPS Holders (WBCPA.ASX) • Fully paid, redeemable, subordinated, unsecured debt obligations of Westpac • Face Value of A$100 each • Must pay Interest quarterly in arrear, at a floating rate, unless Westpac is not, or will not be, Solvent • Must be redeemed by Westpac on the Maturity Date, unless Westpac is not, or will not be, Solvent (or unless redeemed, converted or written-off earlier) • Are subordinated to claims of all depositors and most other creditors of Westpac • 10 years (22 August 2023) • Westpac may redeem Westpac Subordinated Notes II earlier than the Maturity Date: – All or some on 22 August 2018 or any Interest Payment Date after that date – All (but not some) before the Maturity Date for certain tax or regulatory reasons Early Redemption Quotation • Any early Redemption is subject to APRA’s prior written approval2 • Holders have no right to request Redemption • Westpac will apply for quotation on ASX and expect Westpac Subordinated Notes II to trade under the code WBCHB • If ASX does not grant permission for Westpac Subordinated Notes II to be quoted, the Notes will not be issued 1 This date assumes the Issue Date will be 22 August 2013. 2 There can be no certainty that APRA would provide its approval in respect of any such Redemption. Westpac Subordinated Notes II | July 2013 3 For personal use only Westpac Subordinated Notes II summary (cont.) Interest Rate Interest Payment Regulatory Capital Treatment • Floating Interest Rate (Interest Rate = 90 day Bank Bill Rate + Margin) • Fixed Margin to be determined under the Bookbuild and expected to be in the range of 2.30% to 2.45% p.a. • The 90 day Bank Bill Rate is set on the first Business Day of each Interest Period • Pay Interest quarterly in arrear, wholly in cash (gross pay) • Interest is payable on 22 February, 22 May, 22 August and 22 November of each year, commencing on 22 November 20131 • Interest payments are not deferrable or discretionary (unless Westpac is not Solvent or would not be Solvent immediately after payment) • Any unpaid Interest will accumulate with compounding (unless Conversion occurs, in which case, accrued but unpaid Interest will not be paid) • APRA has confirmed that Westpac Subordinated Notes II will qualify as Tier 2 Capital under APRA’s Basel III capital adequacy standards • A Non-Viability Trigger Event will occur if APRA notifies Westpac in writing that it believes Conversion of some or all Westpac Subordinated Notes II (or conversion or write-down of other capital instruments of the Westpac Group) or a public sector injection of capital (or equivalent support), is necessary because, without it, Westpac would become non-viable • Upon a Non-Viability Trigger Event occurring, Westpac may be required to Convert some or all of the Westpac Subordinated Notes II into Ordinary Shares. If Conversion is not possible, the Notes will be Written-off and the rights of Holders will be terminated • If Westpac is required to convert only an amount of Relevant Capital Securities, Westpac will first convert or write off all Relevant Tier 1 Capital Securities before Conversion of Westpac Subordinated Notes II Non-Viability Trigger Event Conversion following a Non-Viability Trigger Event 1 This date assumes the Issue Date will be 22 August 2013. Westpac Subordinated Notes II | July 2013 4 For personal use only Subordination and ranking of Westpac Subordinated Notes II • In a Winding-Up of Westpac, Westpac Subordinated Notes II (if they are on issue at the time) rank: – ahead of Ordinary Shares; – ahead of Tier 1 Capital Instruments, such as Westpac SPS and Westpac Capital Notes; and – behind Senior Creditors and certain other securities (including Westpac Subordinated Notes 2012), as illustrated below Higher ranking Illustrative examples Preferred and secured debt Liabilities in Australia in relation to protected accounts (generally, savings accounts and term deposits) and other liabilities preferred by law including employee entitlements and secured creditors Unsubordinated unsecured debt Trade and general creditors, bonds, notes and debentures (including covered bonds) and other unsubordinated unsecured debt obligations Lower Tier 2 Capital Securities (issued prior to 1 January 2013) Westpac Subordinated Notes 2012, other subordinated bonds, notes and debentures and other subordinated unsecured debt obligations with a fixed maturity date Tier 2 Capital Securities (issued on or after 1 January 2013) and Upper Tier 2 Capital Securities (issued prior to 1 January 2013) Westpac Subordinated Notes II, Westpac Perpetual Capital Notes Tier 1 Capital hybrid securities Notes or preference shares in respect of TPS 2003, TPS 2004, Westpac TPS, Westpac SPS, Westpac SPS II, Westpac CPS and Westpac Capital Notes Ordinary shares Westpac Ordinary Shares Lower ranking Westpac Subordinated Notes II | July 2013 5 For personal use only Offer summary • The Offer is for the issue of Westpac Subordinated Notes II at a Face Value of A$100 each to raise approximately A$750 million (with the ability to raise more or less) • The Offer includes a Reinvestment Offer, being a priority offer to Eligible Westpac SPS Holders • The Offer consists of: Offer size – The Reinvestment Offer – a priority offer to registered holders of Westpac SPS at 7.00pm (Sydney time) on 1 July 2013 and shown on the Register as having an address in Australia – The Securityholder Offer – an offer to registered holders of Ordinary Shares, Westpac TPS, Westpac SPS II, Westpac CPS, Westpac Subordinated Notes 2012 or Westpac Capital Notes at 7.00pm (Sydney time) on 1 July 2013 and shown on the Register as having an address in Australia Who can apply Applications – The Broker Firm Offer – an offer to clients of the Syndicate Brokers – The Institutional Offer – an offer to Institutional Investors through Westpac Institutional Bank • Applications may be scaled back if there is excess demand • Priority will be given to Applications received under the Reinvestment Offer when allocating the Notes • Applications must be for a minimum of 50 Notes (A$5,000) and thereafter in multiples of 10 Notes (A$1,000) (these requirements do not necessarily apply to Eligible Westpac SPS Holders) • There is no general public offer of Westpac Subordinated Notes II. However, Westpac reserves the right to accept Applications from other persons at its discretion (subject to selling restrictions) Westpac Subordinated Notes II | July 2013 6 For personal use only Comparing Westpac Subordinated Notes II Westpac Term Deposit Westpac Subordinated Notes 2012 Westpac Subordinated Notes II Westpac Capital Notes Westpac SPS ASX code Not quoted on ASX WBCHA WBCHB1 WBCPD WBCPA Legal form Deposit Note; Unsecured subordinated debt obligation Note; Unsecured subordinated debt obligation Note; Unsecured subordinated debt obligation Stapled security; One preference share and one note issued by Westpac Yes2 No No No No 1 month to 5 years (usually) 10 years3 10 years3 Perpetual with the first possible scheduled conversion after 8 years4 Perpetual with the Initial Mandatory Conversion Date on 26 September 2013 Yes, on 8 March 2019, subject to APRA’s prior written approval Yes, in certain limited circumstances Protection under the Banking Act or Financial Claims Scheme Term Issuer early redemption option No Yes, 5 years after issue, Yes, 5 years after issue, on 23 August 2017 and on 22 August 2018 and each interest payment date each Interest Payment Date after that date, subject to after that date, subject to APRA’s prior written APRA’s prior written approval approval Interest / distribution / dividend rate Fixed (usually) Floating Floating Floating Floating Interest / distribution / dividend payment Cumulative, unfranked Cumulative, unfranked Cumulative, unfranked Non-cumulative, franked Non-cumulative, franked Interest / distribution / dividend payment frequency End of term or per annum or monthly Quarterly Quarterly Quarterly Quarterly 1 Westpac will apply to have Notes quoted on ASX and they are expected to trade under this code. 2 For deposits made from 1 February 2012, up to an amount per account holder per ADI of A$250,000. 3 Subject to possible early redemption by Westpac in certain circumstances with APRA’s prior written approval. 4 Subject to possible early redemption by Westpac (with APRA’s prior written approval), transfer or conversion in certain circumstances. Westpac Subordinated Notes II | July 2013 7 For personal use only Comparing Westpac Subordinated Notes II (cont.) Westpac Term Deposit Westpac Subordinated Notes 2012 Westpac Subordinated Notes II Westpac Capital Notes Westpac SPS Are Interest / distribution / dividend payments discretionary? No No, subject to a solvency condition No, subject to the Solvency Condition Yes Yes Transferable No Yes – quoted on ASX Yes – quoted on ASX Yes – quoted on ASX Yes – quoted on ASX Yes, subject to conditions No No No No Investor's ability to withdraw or redeem Ranking (in a winding up of Westpac) • Senior to Westpac Subordinated Notes II and other Equal and Junior Ranking Capital Instruments • Senior to Westpac Subordinated Notes II • • Senior to Ordinary • Shares and other Junior Ranking Capital • Instruments, such as Westpac Capital Notes and Westpac SPS No No No Conversion into Ordinary Shares on a Non-Viability Trigger Event No No Yes 8 • Senior to Westpac Ordinary Shares Subordinated to Westpac Subordinated Notes II • Subordinated to Westpac Subordinated Notes II Subordinated to Senior Creditors, such as depositors and holders of Westpac Subordinated Notes 2012 Potential Conversion to Ordinary Shares (other than on a NonViability Trigger Event) Westpac Subordinated Notes II | July 2013 Senior to Westpac Ordinary Shares Scheduled conversion on Mandatory conversion on 8 March 2021 (subject to 26 September 2013 (subject certain conditions) or in to certain conditions) or in other specific circumstances other specific circumstances Yes No For personal use only Key dates for the Offer Key dates for the Offer Record date for determining Eligible Securityholders (7.00pm Sydney time) 1 July 2013 Announcement of Offer and lodgement of Prospectus with ASIC 10 July 2013 Bookbuild 17 July 2013 Announcement of Margin 17 July 2013 Lodgement of replacement Prospectus with ASIC 18 July 2013 Opening Date for the Offer 18 July 2013 Closing Date for the Reinvestment Offer (5.00pm Sydney time) 9 August 2013 Closing Date for the Securityholder Offer and the Broker Firm Offer (5.00pm Sydney time) 13 August 2013 Issue Date of Notes 22 August 2013 Commencement of deferred settlement trading 23 August 2013 Holding Statements despatched by 28 August 2013 Commencement of normal settlement trading 29 August 2013 Key dates for Westpac Subordinated Notes II Record Date for first Interest payment 14 November 2013 First Interest Payment Date1 22 November 2013 First Optional Redemption Date (at Westpac's discretion) 2 22 August 2018 Maturity Date 22 August 2023 1 Interest is payable quarterly in arrear, subject to the Solvency Condition. 2 APRA must provide its prior written approval for any such Redemption. There can be no certainty that APRA will provide its approval. Westpac Subordinated Notes II | July 2013 9 For personal use only WESTPAC GROUP Westpac Banking Corporation ABN 33 007 457 141. Cash earnings1 ($m) 2H11 1H12 16.4 15.8 16.5 15.6 15.1 15.9 16.1 1H13 1H11 3,525 2H12 2H10 3,403 1H12 1H10 3,195 2H11 2,930 3,133 1H11 2,949 3,168 2H10 Return on equity (cash basis, %) 1H10 For personal use only Westpac – consistent, strong financial performance 2,605 2,442 1H08 2H08 2,295 2,332 1H09 2H09 1H13 Impairment charges to average gross loans1,2 (bps) Net interest margin1 (cash basis, %) 2.6 2H12 NIM 80 NIM excl. Treasury and Markets 70 Common equity Tier 1 ratio3 (%) 11.4 60 2.4 2.19 7.1 50 7.3 7.4 7.7 8.2 8.7 40 2.2 30 2.0 2.06 17 20 10 0 2002 2003 2004 2005 2006 2007 2008 2009 1H10 2H10 1H11 2H11 1H12 2H12 1H13 1H13 2H12 1H12 2H11 1H11 2H10 1H10 2H09 1H09 2H08 1H08 1.8 2H10 1H11 2H11 1H12 2H12 1H13 1H13 APRA Basel III BIII 1 1H08, 2H08 and 1H09 presented on a pro-forma basis as if the St.George merger was completed on 1 October 2007 to assist comparison. 2 2002-2005 reported under AGAAP; 2006 onwards reported on A-IFRS basis. 2002-2007 does not include St.George. 3. All numbers prior to Mar-13 on a pro forma basis. Westpac Subordinated Notes II | July 2013 11 For personal use only Westpac’s clear strategic priorities 1 2 A strong company Reorient to higher growth/higher return sectors and segments A strengthened balance sheet • Basel III fully harmonised Common equity Tier 1 ratio 11.4% • Stable funding ratio1 83%, up 390bps on 1H12 Maintain ROE above 15% • Cash ROE 16.1%, up 102bps on 1H12 • Above system growth in deposits2 and wealth3 • Wealth penetration sector leading at 18.6%4 up 95bps on 1H12 A$86bn market cap The world’s 13th largest bank by market cap7 AA-/Aa2/AA- 3 Continue building deeper customer relationships Grow customer returns on credit RWA5 • Customer return on credit risk weighted assets 4.0%, up 8bps on 1H12 One of only 11 banks rated AAor higher by S&P and Aa2 or higher by Moody's8 4 Materially simplify products and processes Maintain lowest expense to income ratio of peers • Expense to income 40.6%, down 51bps on 1H12 5 One team approach Focus on leadership, diversity and flexibility • Employee engagement 84%, up 300bps6 Strong franchise >20% market share in core segments2,3,9 12m customers 1 Stable funding ratio calculated as customer deposits + wholesale funding with a residual maturity greater than 12 months + equity + securitisation, as a proportion of total funding. 2 APRA Banking Statistics March 2013 3. Plan for Life December 2012 All Master Funds Admin. 4 For Wealth penetration metrics provider details refer to slide 111 of Westpac’s Interim Results 2013 Presentation and Investor Discussion Pack available at www.westpac.com.au/investorcentre. 5 Customer return calculated as operating income, less Treasury and Markets income, less operating expenses, divided by average credit risk weighted assets. 6. Employee engagement measured annually. Results represent FY12 compared to FY11. 7. Source: IRESS, CapitalIQ and www.xe.com based in US dollars. As at 1 July 2013 8. As at 1 July 2013 9. RBNZ March 2013. Westpac Subordinated Notes II | July 2013 12 For personal use only Setting Westpac apart – Domestic focus, balance sheet strength and efficiency Leader in efficiency Clear focus on home markets of Australia and New Zealand 1 9 Total income by geography1 (%) 15 7 8 16 Asia, Pacific, Europe & Americas Expense to income ratio2 (%) 4 16 44.4 45.1 Peer 1 Peer 2 43.0 40.6 New Zealand 90 89 78 68 Australia Westpac Peer 1 Strong asset quality Peer 2 Peer 3 Westpac Capital levels ahead of peers Lowest short term funding of peers Impairment losses on loans to average gross loans2 (bps) Peer 3 Short term funding to total funding including equity2,3 (%) Common equity Tier 1 ratio2 (APRA Basel III) (%) 8.7 24 44 21 20 Peer 1 Peer 2 8.2 8.1 8.2 Peer 1 Peer 2 Peer 3 17 27 17 Westpac Peer 1 22 Peer 2 Peer 3 Westpac Peer 3 Westpac 1 Source: Company Annual Reports. Westpac, Peer 1 and Peer 3 as at 30 September 2012. Peer 2 as at 30 June 2012. 2 Source: Company reports. Westpac, Peer 1 and Peer 3 as at 31 March 2013, Peer 2 as at 31 December 2012. 3 Short term funding includes Central Bank deposits and long term wholesale funding with a residual maturity less than 1 year. Westpac Subordinated Notes II | July 2013 13 For personal use only Strong Common equity Tier 1 ratio against global peers Global peer comparison of Basel III pro-forma Common equity Tier 1 ratios1 (%) 15.0 14.4 14.0 13.5 13.0 11.8 12.0 11.6 11.4 10.8 11.0 10.6 10.5 10.3 10.1 10.0 10.0 9.6 9.5 9.4 9.3 9.3 9.3 9.3 9.0 Basel III minimum 7.0% 9.0 8.9 8.8 8.7 8.7 8.5 8.3 8.2 8.2 8.2 8.1 8.0 8.0 7.0 6.0 1. Source: Company data, Credit Suisse estimates (based on latest reporting data as at 16 April 2013). Westpac, ANZ and NAB as reported as at 31 March 2013. Westpac Subordinated Notes II | July 2013 14 BEN BOQ Wells Fargo HSBC Bk of Nova Scotia US Bancorp Intesa Sanpaolo Citigroup ING TD Bank JPMorgan Chase BKIR Bank of America Raiffeisen Bk RBC Nordea Bk of Montreal Morgan Stanley Canada Imperial NAB DnB ANZ Standard Chartered CBA Danske Bank Westpac DBS SEB Svenska Swedbank 5.0 For personal use only Strong capital position, up across all measures in 1H13 • Westpac operates under APRA Basel III regulations from 1 January 2013 • Preferred range for Common equity Tier 1 ratio of 8.0% to 8.5%, comfortably above regulatory minimum (4.5%) and capital conservation buffer (2.5%) • Key capital ratios (%) 1H12 2H12 1H13 APRA Basel 2.5 Strong rise in capital ratios over the year APRA Basel III Common equity Tier 1 ratio 8.0 8.4 8.7 Additional Tier 1 capital 1.8 1.9 2.1 Tier 2 capital 1.0 1.4 1.7 10.8 11.7 12.5 $300bn $298bn $308bn 1H12 2H12 1H13 10.3 10.6 11.4 Total regulatory capital ratio Risk weighted assets Common equity Tier 1 ratio (BCBS1 Basel III) 70 8.74 1 Basel Committee on Banking Supervision. 15 IRRBB RWA Mortgage 20% LGD floor Concessional thresholds 266bps Mar-13 APRA Basel III Dividends paid out Cash earnings 30 Sept 12 APRA Basel III Accrued dividend 58bps Equity investments 50/50 deductions risk weighted RWA changes 2 (9) 22bps Westpac Subordinated Notes II | July 2013 8 Other (1) 1 8.16 St.George tax adjustments (31) 11.40 132 (67) RWA movement (51) 25 Mar-13 Basel III Fully harmonised 114 50/50 deductions now 100% 30 Sept 12 APRA Basel 2.5 8.38 40 69 Other Common equity Tier 1 capital ratio (% and bps) For personal use only Strong funding profile supported by customer deposit growth Westpac deposit growth funding loan growth Funding composition by residual maturity (%) Customer deposit growth ($bn) SFR1 64% SFR1 83% SFR1 7 83% Net loan growth ($bn) 63.2 16 10 10 Wholesale Offshore <1Yr 20 57.2 58.7 59.6 5 11 10 Wholesale Offshore >1Yr 9.8 9.5 6.6 11.9 8.3 6.7 40 2H10 1H11 2H11 1H12 2H12 1H13 7 7 Securitisation Liquid assets ($bn) 1 Equity 5 up 123bps 58 3 Cash, government and semi-government bonds Private securities4 and government guaranteed paper Customer deposits Self securitisation 2 2H12 110 111 43 45 45 25 30 38 7 2 FY08 42 36 2H12 1H13 59 44 1H13 103 Short term outstanding debt 1H13 5 1 SFR is the stable funding ratio calculated on the basis of customer deposits + wholesale funding with residual maturity greater than 12 months + equity + securitisation, as a proportion of total funding. 2 2008 does not include St.George. 3. Equity excludes FX translation, Available for Sale Securities and Cash Flow Hedging Reserves. 4 Private securities include Bank paper, RMBS, and Supra-nationals. 5 Includes long term wholesale funding with a residual maturity less than 1 year. Westpac Subordinated Notes II | July 2013 16 50 3 1H10 10 FY08 8.6 0 2 2 4 4.3 Wholesale Onshore >1Yr 60 12.4 8.6 10 5 21.3 70 67.6 62.5 11.2 20 69.0 27.8 Customer deposit to loans ratio (%) 30 Wholesale Onshore <1Yr 7 For personal use only Term funding focused on flexibility and diversity New term issuance by type1 (%) New term issuance by original tenor1,2 (%) 4 9 15 8 8 18 9 11 17 47 48 40 33 24 20 45 27 6 12 Senior unsecured Covered bonds Hybrid Subordinated debt RMBS & ABS 1 Year Australian covered bond issuance3 Covered Bond 27 25 11% 18 38% 37% 35% 8% 1 Year ANZ 5 Years >5 years Hybrid Senior 24 50% Govt Guaranteed Sub Debt $7.3bn remaining maturities 23 23 19 19 FY16 FY17 25% 15 2 Years 4 Years Issuance Maturities 17 38% 24% 11 3 Years 25 75% 24 30% 15 33 100% 18% 30 2 Years Term debt issuance and maturity profile1,4,5 ($bn) Remaining capacity (8% cap & OC) ($bn) Issued ($bn) % of capacity utilised (%) 1% 45 0 2013 1H13 year to date5 FY12 FY12 2013 year to date5 1H13 FY12 3 Years CBA 15 10 4 Years NAB 5 Years >5 years 0% FY11 Westpac FY12 Year to 2H13 FY14 date5 (remaining) FY15 >FY17 1 Based on residual maturity and FX spot currency translation. Includes all debt issuance with contractual maturity greater than 13 months, excluding US Commercial Paper. Contractual maturity date for hybrids and callable subordinated instruments is the first scheduled conversion date or call date for the purposes of this disclosure. 2 Excludes securitisation. 3 Sources: Westpac, Bloomberg, Company reports as 24 June 2013 4 Maturities exclude securitisation amortisation. Perpetual sub-debt has been included in >FY17 maturity bucket. 5 As at 21 June 2013. Westpac Subordinated Notes II | July 2013 17 Stressed exposures as a % of TCE1 (%) and provisions ($m) 3.0 $m 4,000 3,500 90+ Investor 30+ Past Due Loss Rates 1.0 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 Sep-11 Jun-11 Mar-11 Dec 10 Sep-10 Jun 10 Mar-10 Dec 09 - 3,000 Sep-09 2,771 2,694 90+ First Home Buyer 90+ Low Doc Jun 09 2,909 3.0 90+ Past Due Total 2.0 Mar-09 4.0 4.0 Sep-08 % Watchlist & substandard (%, lhs) 90+ days past due well secured (%, lhs) Impaired (%, lhs) IAP ($m, rhs) CAP (inc. Econ Overlay) ($m, rhs) Australian mortgages delinquencies and loss rates (%) Dec 08 For personal use only Significant improvement in asset quality in 1H13 2,500 2.26 1.26 2.0 2.17 1.24 1.94 1H13 Change 1H13 – 1H12 Net write-offs to average loans annualised 21bps (8bps) Total impaired assets to gross loans 82bps (6bps) Total provisions to gross loans 80bps (6bps) Collectively assessed provisions to CRWA 106bps (10bps)2 40.2% 240bps 2,000 1.03 1,482 1,470 1,505 1.0 Asset Quality 1,500 1,000 0.40 0.60 0.35 0.35 0.58 0.56 0.0 500 0 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 1H13 Impairment provisions to impaired assets 1 TCE is Total Committed Exposures. 2. Prior periods restated on a pro forma Basel III basis. Westpac Subordinated Notes II | July 2013 18 For personal use only Joint Lead Managers Westpac Institutional Bank • Allan O’Sullivan (02) 8254 1425 • Robbie Moulton (02) 8253 4584 Deutsche Bank • Rupert Daly (02) 8258 1408 • Mozammel Ali (02) 8258 1845 Goldman Sachs • Michael Cluskey (03) 9679 1138 • Andrew Edwards Parton (02) 9320 1296 Macquarie • Kate Herfort (02) 8232 5956 • Andrew Batmanian (02) 8232 6501 Morgan Stanley • Bob Herbert (03) 9256 8937 • Andrew Brown (02) 9770 1509 UBS • Andrew Buchanan (02) 9324 2617 • Joe Hunt (02) 9324 3718 Westpac Subordinated Notes II | July 2013 19 For personal use only Contacts For further information on Westpac, please visit our investor website: For further information contact Group Treasury www.westpac.com.au/investorcentre Joanne Dawson Deputy Treasurer, Westpac Banking Corporation +61 2 8204 2777 jdawson@westpac.com.au Go to ‘Latest news’ to access information on Westpac Subordinated Notes II Guy Volpicella Executive Director, Structured Funding and Capital +61 2 8254 9261 gvolpicella@westpac.com.au Investor Relations Andrew Bowden Head of Investor Relations +61 2 8253 4008 andrewbowden@westpac.com.au or email: investorrelations@westpac.com.au Jacqueline Boddy Senior Manager, Debt Investor Relations +61 2 8253 3133 jboddy@westpac.com.au Westpac Subordinated Notes II | July 2013 20 For personal use only Reinvestment Offer – Options for Eligible SPS Holders 1 Apply to reinvest all of your Westpac SPS 2 Apply to reinvest some of your Westpac SPS 3 Apply to reinvest all of your Westpac SPS and apply for additional Notes 4 5 Sell your Westpac SPS on market and do not participate Do nothing • Eligible Westpac SPS Holders may apply to have all of their Westpac SPS held on the Reinvestment Offer Record Date reinvested in Westpac Subordinated Notes II • Eligible Westpac SPS Holders who choose this option will receive a Pro-Rata Distribution of $0.5293 per Westpac SPS on 29 August 20131, but will not receive a Final Distribution • Eligible Westpac SPS Holders may apply to have only some of their Westpac SPS held on the Reinvestment Offer Record Date reinvested in Westpac Subordinated Notes II • Eligible Westpac SPS Holders who choose this option will receive a Pro-Rata Distribution of $0.5293 per Westpac SPS on 29 August 20131, but will not receive a Final Distribution in respect of their Reinvested Westpac SPS. They will receive a Final Distribution in respect of the Non-Participating Westpac SPS that they still hold when trading in Westpac SPS ends 1 • Eligible Westpac SPS Holders that apply to reinvest all of their Westpac SPS may also apply for more Westpac Subordinated Notes II than the number of Westpac SPS they held on the Reinvestment Offer Record Date • Eligible Westpac SPS Holders may sell or dispose of their Westpac SPS on ASX at the prevailing market price, which may be higher or lower than the price holders receive if they reinvest Westpac SPS in Westpac Subordinated Notes II through the Reinvestment Offer (which is expected to be $100 per Westpac SPS) • Under this option, holders may have to pay brokerage and may receive a price greater or less than the Face Value of $100 per Westpac SPS • If holders choose this option, they will not be entitled to receive the Pro-Rata Distribution on any Westpac SPS sold before the ex-date for the Pro-Rata Distribution of 15 August 2013, or the Final Distribution on any Westpac SPS sold before the exdate for the Final Distribution of 12 September 2013 • Westpac SPS Holders are not required to participate in the Reinvestment Offer and therefore can choose to do nothing • Westpac intends that Non-Participating Westpac SPS will be transferred from holders to the Nominated Party on 26 September 2013. On that date, holders will receive $100 per Non-Participating Westpac SPS, plus the Final Distribution of $0.3495 per Westpac SPS1. Holders will also receive a Pro-Rata Distribution of $0.5293 per Westpac SPS on 29 August 20131 1 Subject to satisfaction of the distribution payment test in the Westpac SPS terms. Westpac Subordinated Notes II | July 2013 21 For personal use only Key dates for the Reinvestment Offer Key dates for the Reinvestment Offer Reinvestment Offer Record Date for determining Eligible Westpac SPS Holders (7.00pm Sydney time) Opening Date for the Reinvestment Offer 1 July 2013 18 July 2013 Closing Date for the Reinvestment Offer (5.00pm Sydney time) 9 August 2013 Ex-Date for Pro-Rata Distribution 15 August 2013 On-Market Buy-Back Date 19 August 2013 Record date for Pro-Rata Distribution (7.00pm Sydney time) 21 August 2013 Issue Date of Notes 22 August 2013 Payment date for Pro-Rata Distribution¹ 29 August 2013 Key dates for Non-Participating Westpac SPS Holders Ex-Date for Pro-Rata Distribution 15 August 2013 Record date for Pro-Rata Distribution (7.00pm Sydney time) 21 August 2013 Payment date for Pro-Rata Distribution (payable to all holders of Westpac SPS) 1 29 August 2013 Last day of trading in Westpac SPS 11 September 2013 Ex-Date for Final Distribution 12 September 2013 Record date for Final Distribution (7.00pm Sydney time) (payable to Non-Participating Westpac SPS Holders) 18 September 2013 Payment date for Final Distribution (payable to Non-Participating Westpac SPS Holders)1 26 September 2013 Expected transfer date 26 September 2013 Initial Mandatory Conversion Date for Westpac SPS2 26 September 2013 1 Subject to satisfaction of the distribution payment test in the Westpac SPS terms. 2. Subject to satisfaction of certain conditions set out in the Westpac SPS terms. Westpac Subordinated Notes II | July 2013 22 For personal use only Key risks of Westpac Subordinated Notes II • It is possible that the Notes may trade at a market price below their Face Value. • Circumstances in which the market price of the Notes may decline include general financial market conditions, changes in investor perception and sentiment in relation to Westpac, the availability of better rates of return on other securities issued by Westpac or other issuers and the occurrence of a Non-Viability Trigger Event. • The market for the Notes may be volatile and less liquid than the market for Ordinary Shares. • Holders who wish to sell their Notes may be unable to do so at an acceptable price, or at all, if insufficient liquidity exists in the market for the Notes. • There is a risk that Interest will not be paid and that the Face Value will not be repaid because all payments in respect of Notes are subject to the Solvency Condition being satisfied. However, any unpaid Interest will accumulate with compounding (unless Conversion occurs, in which case, accrued but unpaid Interest will not be paid). • The Interest Rate will fluctuate (increase and/or decrease) over time with movements in the 90 day Bank Bill Rate. • There is a risk that the Interest Rate may become less attractive compared to returns available on comparable securities or investments. • The value of Ordinary Shares received for each Note that is Converted upon the occurrence of a Non-Viability Trigger Event may be significantly less than the Face Value of each Note. • If for any reason Conversion of Notes is not possible following the occurrence of a Non-Viability Trigger Event (for example, due to applicable law, order of a court or action of any government authority), those Notes will be Written-off and all rights of Holders (including to interest payments and repayment of Face Value) in respect of those Notes will be terminated. Your investment will lose its value and you will not receive any compensation. • The price used to calculate the number of Ordinary Shares to be issued on Conversion may be different to the market price of Ordinary Shares at the time of Conversion because the price used is based on the VWAP during the 5 Business days immediately preceding the Conversion Date. Also, the Conversion Number is subject to the Maximum Conversion Number. The value of Ordinary Shares you receive may therefore be significantly less than the value of those Ordinary Shares based on the Ordinary Share price on the Conversion Date. • Redemption, Conversion or Write-off may occur in certain circumstances before the Maturity Date, which may be disadvantageous in light of market conditions or your individual circumstances. • In the unlikely event of a Winding Up, if the Notes are still on issue, they will rank ahead of Ordinary Shares, equally among themselves and with other Equal Ranking Capital Instruments but behind Senior Creditors, including depositors and all holders of Westpac’s senior or less subordinated debt. • If there is a shortfall of funds on a Winding-Up to pay the claims of Senior Creditors and holders of other Equal Ranking Capital Instruments, Holders will lose all or some of their investment. • Westpac may issue further securities which rank equally with, or ahead of, the Notes. This is a summary of the key risks only. You should read Section 6 “Investment risks” of the Westpac Subordinated Notes II Prospectus in full before deciding to invest (including “Investment Risks Relating to Westpac”). Westpac Subordinated Notes II | July 2013 23