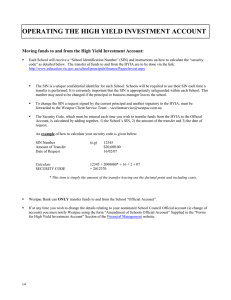

Thank you for requesting this Product Disclosure Statement from Funds Focus.

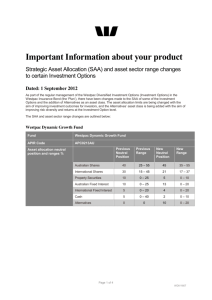

advertisement