Man Series 4 EXPLANATORY MEMORANDUM New Capital Guarantee by

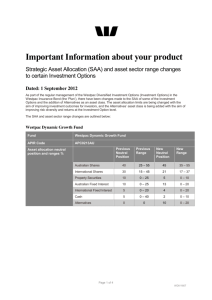

advertisement